Points Per $1 At Us Supermarkets

Amex Golds dining rewards cover every day eating at home, too. But people tend to spend more at the supermarket than at restaurants over the course of a year. So Amex limits your bonus earning rate of 4 points per $1 at U.S. supermarkets to $25,000 spent on groceries per year. After that, youll get 1 point per $1. Purchases at superstores and warehouse clubs also earn you just 1 point per $1 spent.

Bonuses & Rewards Explained

The American Express Gold Card is designed to help you earn at least one point for every dollar you spent on eligible purchases. Additionally, it offers lucrative rewards and bonuses.

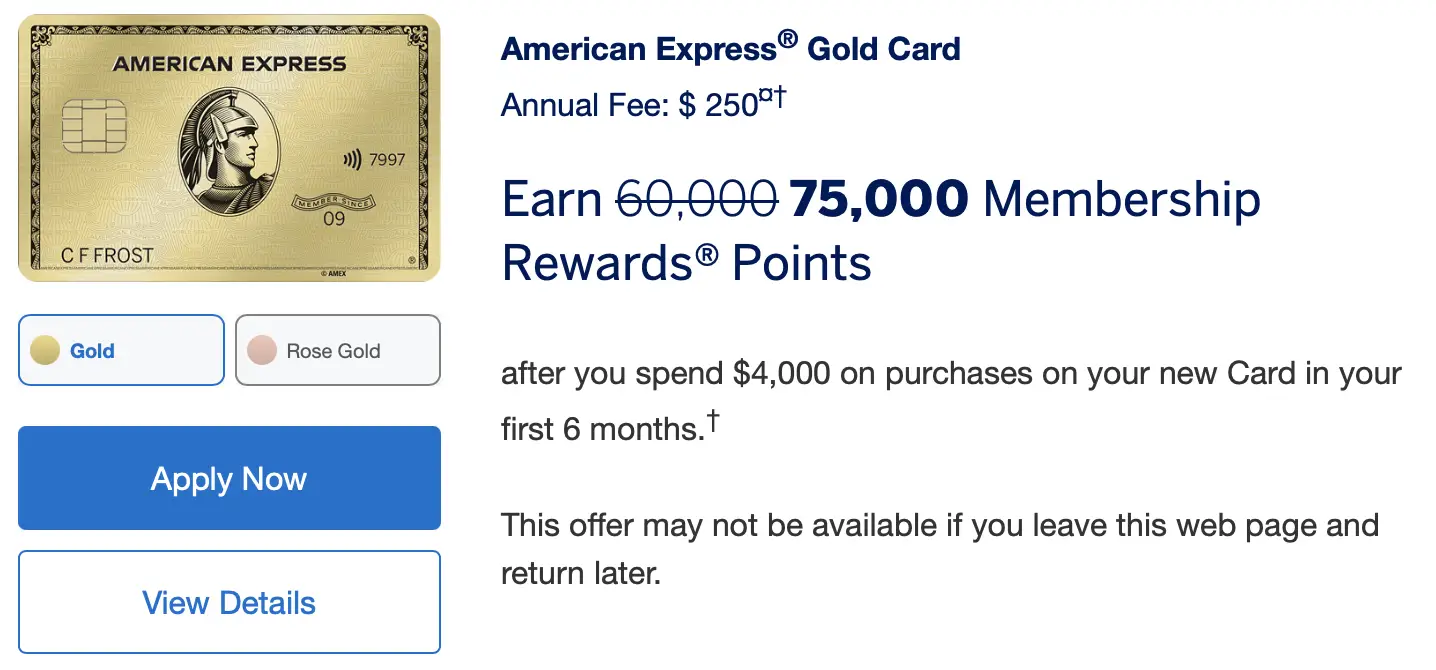

Welcome Bonus for New Cardholders

Your American Express Gold Card will be credited with 75,000 points if you make eligible purchases of at least $4,000 in the first six months of holding the membership.

Earning Rewards

All purchases made using the card can get you at least one reward point per dollar. Flight bookings can fetch you three points per dollar, while restaurant and supermarket bills can reward you with four points per dollar.

Easy Rewards Redemption and Transfer

You can redeem the points through American Express Travel or at retailers like Amazon and Best Buy. Its also possible to use them to buy gift cards or certificates. You will also be rewarded for each dollar spent while redeeming. Additionally, you can transfer the points to participating airline and hotel loyalty programs at a fee. Each Amex partner offers at least the same value for the points transferred.

$10 Monthly Dining Statement Credit

Earn up to $10 in statement credits each month when you pay with the Gold Card at participating partners. You must enroll in the benefit to receive the credits.

If you maximize the $10 statement credit each month, youâll receive an annual savings of $120.

Participating partners:

- Participating Shake Shack locations. Excludes Shake Shack locations in ballparks, stadiums, airports and racetracks.

Don’t Miss: How To Buy Gold In World Of Warcraft

Plaza Premium Lounge Visits + Priority Pass Membership

The American Express Gold Rewards Card will also be adding airport lounge access to its list of travel benefits.

Every year, cardholders will be entitled to four visits to Plaza Premium lounges in Canada. Youll be able to use the Plaza Premium Lounges in Toronto, Vancouver, Winnipeg, and Edmonton .

Cardholders also receive a complimentary membership with Priority Pass. However, no free lounge visits are provided, and each admission to a Priority Pass lounge is subject to a $32 USD per visit fee.

This is a less attractive Priority Pass perk than the Platinum Card or Business Platinum Card, for instance, both of which grant you unlimited access to 1,200+ lounges throughout the world.

Considering that Priority Pass and Plaza Premium have parted ways, though, the Gold Rewards Cards greater lounge access benefits on the Plaza Premium side make sense, given Plaza Premiums large presence at Canadian airports.

The Rewards For Travel Seemed Perfect For The Average Traveler

There was a point when I had planned on frequent travel every year, but over time traveling became less of a priority to me. Sure, I still love weekend getaways within driving distance and maybe one or two domestic flights a year, but I now consider my interest in traveling to be on the “average” side.

That being said, I knew it wouldn’t make sense for me to pay a super high annual fee for a travel credit card that I won’t be able to take advantage of as much as I should. At the same time, though, I still wanted to receive rewards for the times when I do travel. The American Express Gold Card doesn’t totally prioritize travel rewards but it doesn’t ignore them, either.

Cardholders receive 3X points on flights . And, there are no foreign transaction fees when you use the card internationally. The card also provides some *travel protections, like baggage insurance of up to $1,250 for carry-ons and up to $500 for checked luggage. Please visit americanexpress.com/benefitsguide for more details.

These offers seem pretty reasonable and useful for someone who doesn’t plan to travel every single month.

Recommended Reading: Can You Buy Gold On The Stock Market

How To Apply For The American Express Gold Card

To apply for the American Express® Gold Card, you must be at least 18 years old and a US citizen or permanent resident.

Eligibility requirements

To apply for the card, you must be:

- At least 18 years old

- A US resident

What credit score do I need to apply?

American Express doesnt publish a minimum credit score, but your chances of approval increase if you apply with a good to an excellent score of 670 or higher. Several cardholders on Reddit note they were approved for the card with a Good credit score as low as 640, though at the time they had a strong salary or clean credit history.

Purchase And Extended Warranty Protection

Purchase and Extended Warranty Protection allow you to shop with more peace of mind. Here are the details.

Purchase Protection: Purchases are covered 90 days from the Covered Purchase Date for theft, loss, and damage . Enrollment is not required, but you must use your Amex Gold card to activate coverage. Exclusions on covered purchases apply, so I recommend reading the purchase plan documents before filing a claim.

Extended Warranty Protection: Covered purchases made with your Amex Gold card are eligible for an extra year of warranty covered after the manufacturers warranty expires. Here are a few important details.

- Protection only applies to warranties 5 years or less

- Coverage maxes out at $10,000 per item .

Exclusions apply and different states have different rules, so I recommend reading the extended warranty plan documents before filing a claim.

Read Also: Where Are The Golden Knights Playing Tonight

Online Shopping And Online Checkout

Redeeming your points for online shopping is another method I do not recommend. You can pay with your points at checkout at a variety of different stores for a value of 0.7 cents per point. You can also shop membershiprewards.com for a value of 0.5 cents per point. Here are a few examples.

- Pay at Checkout: Amazon, PayPal, Staples, etc $0.007 per point

- Shop at membershiprewards.com $0.005 per point

The 0.5 cents per point value is the lowest you can get. While still a poor method, you are better off taking a statement credit at 0.06 cents per point.

Monthly Restaurant Statement Credits

Speaking of takeout, you could get $10 toward your meal every month. Pay with your American Express® Gold Card, and youre entitled to up to a total of $10 in statement credits on takeout or delivery through Grubhub or Goldbelly, as well as on orders made with The Cheesecake Factory, Milkbar, Wine.com and participating Shake Shack locations. Terms apply.

Travel might be on hold for the moment, but you can always get your dim sum delivered, bringing a little taste of your dream vacation to your dining room. Plus, youll get back $120 of value on the $250 annual fee. Terms apply.

Eligibility for this offer is limited. Enrollment is required in the Amex Offers section of your account before redeeming.

Recommended Reading: Where To Watch Fools Gold

The Hotel Collection Perks And Up To $100 Credit For 2

Amex Gold cardholders earn numerous benefits when booking two consecutive prepaid nights or more at The Hotel Collection. This is a group of handpicked hotels by American Express that consistently offer a premium guest experience. Here are some of the benefits you get.

- 2x points per dollar spent

- $100 credit per room for various activities

- Room upgrade

Available activities depend on the property. The maximum three-room limit per stay means you can get $300 in credits per stay by booking three rooms. To earn the benefits, the cardholder must complete the booking as well as be at the hotel for the stay.

While it may sound like all of the hotels are super fancy and expensive, there are reasonably priced options available.

X On Dining At Restaurants And Us Supermarkets

Even if youre spending less on airfare these days, youre likely still spending a decent amount on dining and groceries.

The Amex Gold earns 4x points on dining at restaurants and the first $25,000 spent at U.S. supermarkets each calendar year . Based on our experiences, this also includes grocery delivery services such as FreshDirect and FoodKick.

This bonus equates to an impressive 8% return according to TPG valuations, beating out most other cards on the market. For example, if you average about $400 per month on groceries and other dining expenses, youd be looking at about $380 in rewards value on those two spending categories alone. So, regardless of whether you prefer dining out or cooking at home, you really shouldnt have maximizing these bonus spend categories.

Recommended Reading: What Are Gold Dollar Coins Worth

Amex Gold Card Travel Benefits

The Amex Gold Card provides cardmembers with plenty of food and shopping perks, but that’s not all. With this card, you’ll also be able to take advantage of travel benefits. To utilize these perks, you’ll want to make sure that you charge your travel expenses to your Amex Gold Card. Here are some of the best Amex Gold Card travel benefits.

New Amex Delta Card Perks

- The Hilton Honors American Express Business Card is offering a $10 monthly wireless credit

For each of these offers:

- Registration is required through Amex Offers

- You must have had the card prior to January 1, 2021

- This is valid through December 31, 2021

On top of that, Hilton Honors personal cards are offering spending bonuses:

- Earn 10,000 bonus Hilton Honors points when you spend $5,000

- You can earn up to 100,000 bonus Hilton Honors points, which youd earn after $50,000 worth of spending

- Registration is required through Amex Offers

- This is valid through June 30, 2021

- You must have had the card prior to January 1, 2021

You May Like: Is It Worth It To Buy Gold

$240 Digital Entertainment Credit

What it is: Youll receive up to $20 in statement credits each month when you pay for eligible purchases with your Amex Platinum at one or more of the following providers :

- Audible.

- SiriusXM.

- The New York Times.

Tips for maximizing: Some of us can max out this perk without spending a dime more than usual. For example, a Peacock subscription and an Audible Premium Plus subscription will nearly account for the full $240 in statement credits each year.

Related: Best credit cards for streaming services in 2022

Does The American Express Gold Card Help Build Your Credit

Like any other card issuer, American Express will report your payments and other activity to the credit bureaus. This means that the American Express® Gold Card can help you build credit, but only if you use it responsibly and pay it off on time. Try to keep your balance relatively low and make sure to always make your monthly minimum payment on time.

Recommended Reading: How Much Is 100 Grams Of Gold Worth

Got Amex Gold You Will Receive A Priority Pass Airport Lounge Card Very Soon

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

As we suggested was likely last year, American Express has announced some good news for Preferred Rewards Gold credit and charge card holders.

Effectively immediately, your Lounge Club airport lounge access card is being replaced by a Priority Pass.

If you have an Amex Gold card, you will receive your Priority Pass within the next three weeks.

Amex Platinum Benefits Overview

- Earn 100,000 Amex Membership Rewards points after you spend $6,000 on purchases on the card in your first six months of card membership.

- Earn 5 points per dollar for flights booked directly with airlines or with American Express Travel .

- Earn 5 points per dollar on prepaid hotels booked with American Express Travel.

- Annual Uber Cash of up to $200 .*

- ShopRunner membership.*

*Enrollment required for select benefits, terms apply.

Lets focus on the benefits with the potential highest value and how you can maximize them year after year.

Recommended Reading: How To Share Xbox Live Gold With 2 Accounts

American Express Gold Card Vs The Platinum Card From American Express

With a hefty $695 annual fee and a slate of luxury travel benefits, The Platinum Card® from American Express is a good choice for high spenders who frequently fly. The card lets you earn 5X Membership Rewards® points on flights booked directly with airlines or with American Express Travel on up to $500,000 on these purchases per calendar year and 5X Membership Rewards® points on prepaid hotels booked with American Express Travel. Terms apply. That’s a higher rate on directly booked flights than the American Express® Gold Card, though you won’t get the elevated rate on dining and U.S. supermarkets that you get with the American Express® Gold Card. If you spend more on travel than dining and supermarkets, then The Platinum Card® from American Express is worth considering.

The decision to get The Platinum Card® from American Express also depends on whether you value luxury travel experiences. Consider that the card’s $695 annual fee goes toward a membership to Amex’s Global Lounge Collection this isnt a perk thats available on the American Express® Gold Card. You’ll also get elite hotel status and more extensive travel insurance.

For rates and fees of The Platinum Card® from American Express, please click here.

Earn Up To 400000 Membership Rewards Points

If you have the Amex Business Platinum Card, you can earn an additional 4 Amex Membership Rewards points per dollar for US purchases in the following categories through June 30, 2021:

- Wireless

- Gas

- Office supply stores

These are also Amex Offers, so activation through your account is required. You’ll earn the 4x bonus on up to $20,000 in spending per category , so if you hit the maximum across all categories, you’d earn 400,000 bonus Amex Membership Rewards points.

Again, these offers are only available to cardholders who had an open account as of November 1, 2020. However, Amex says to look out for offers targeted to new Amex Business Platinum Card members in the coming weeks.

Also Check: How Much Is Gold Per Ounce Now

Up To $120 In Uber Cash

American Express® Gold Card members also get up to $10 per month in Uber Cash that can be used to pay for U.S. Uber rides or U.S. Uber Eats purchases. Your Uber Cash will automatically show up in your Uber account each month once you add your American Express® Gold Card to the app. If you don’t use the full credit by the end of the month, you’ll lose it. However, if you’re able to maximize the American Express Gold Uber benefit, that’s up to another $120 in savings.

The American Express Gold Card Vs The Chase Sapphire Preferred Card

The Chase Sapphire Preferred card is a great alternative to the Amex Gold card for cardholders who dont want to spend more than $100 on their credit cards annual fee but still want a great travel card. Although the Sapphire Preferred doesnt earn as many points as the Amex Gold for purchases made at restaurants and U.S. supermarkets, it still has boosted rewards for travel purchases made in the Ultimate Rewards portal. Plus, youll have the added benefit of earning 3 points for every dollar spent on streaming services, at restaurants and for select online grocery purchases.

Travel redemptions through the Chase Ultimate Rewards portal receive a 25% boost for Sapphire Preferred cardholders. This perk can potentially outpace the redemption value of the Amex Gold: Chase rewards are worth 1.25 cents apiece redeemed in this way, while Amex points are worth just 1 cent apiece redeemed through the Amex travel portal. Youd need to find favorable transfer partners to beat that point value with the Amex Gold.

Don’t Miss: What Is Aol Desktop Gold

Points Earning Potential And Category Bonuses

The long-term earning potential is where the Amex Gold truly shines. The card features a monster 4X Membership Rewards points on dining, making it one of the best cards for dining purchases. You’ll also get 4X at U.S. supermarkets . These ensure a top return on your food spending.

- 4X points at U.S. supermarkets

- 3X points on flights booked directly with airlines or on amextravel.com

- 1X on all other purchases

The caveat to the high return on supermarket spend is that only purchases within the U.S. qualify. If you’re overseas or travel internationally, you’ll earn just one point per dollar at supermarkets. So, it’s worth finding another card that doesnt charge foreign transaction fees and has a better return. But, for U.S. supermarket purchases, youll be hard-pressed to find a better return than on the Amex Gold.

The Amex Gold earns 3X on airfare if purchased directly from the airline or via AmexTravel. However, you’ll want to use one of our top cards for travel purchases instead of the Amex Gold when purchasing airfare from an online travel agency like Expedia or Priceline.

No Foreign Transaction Fees

Many credit cards charge a foreign transaction fee of 3% on all purchases made overseas, which means that for every $1,000 you spend while traveling abroad, youd have to pay a $30 fee. However, the American Express® Gold Card doesn’t charge any foreign transaction fees, so you won’t have to worry about them eating into your travel budget.

For rates and fees of American Express® Gold Card, please click here.

Recommended Reading: How Much Is 10 Karat Gold Worth Per Gram