E*trade Customer Service And Security

We performed extensive customer service testing by phone, email and text and found E*TRADEs customer service has longer wait times and more frequent no answer responses than several of their larger investment firm competitors.

None of the calls made after 7:00 pm were answered within 10 minutes. In our seven email contacts, the responses were evenly split between a one-day response and two- or three-day responses. Text chat was unresponsive.

While their customer service left much to be desired, the companys security and insurance are top notch. E*TRADEs security features include:

- Firewalls

E*trade Makes Money In 9 Ways

1. Interest on Money Markets

When investors fund their accounts, the money goes into a money market fund. E*Trade generates interest income off of these deposits. In 2019, interest income exceeded $1.9 billion. This is passive income with the company generating it exclusively by the deposits of consumers. This is why E*Trades advertising emphasizes funding an account rather than conducting a free trade.

2. Broker-Assisted Trades

When conducting a transaction, most consumers can do the trades themselves online for no fee. If a consumer needs assistance with the transaction, there is a $25 fee to have a broker assist you in the purchase or sale.

3. Over-the-Counter Stock Trades

Not all stocks trade for free on the platform. Those trading penny or over-the-counter stocks will pay $6.95 per transaction. This commission drops to $4.95 for those who execute at least 30 trades per quarter.

4. Options Contract Fees

Options trades are also free, however, there is an options contract fee that consumers must pay. The fee is $0.65 per contract for up to 29 trades per quarter. The fee goes down to $0.50 for those with 30 or more contracts per quarter.

5. Bond Trades

Investors dont pay a commission on U.S Treasury auctions or secondary U.S. Treasury trades. However, all other online secondary trades pay $1 per bond with a minimum of $10 and a maximum of $250.

6. Futures Contracts

7. Mutual Funds

8. Margin Rates

9. Managed Portfolios

Goldco Our Top Choice

Pros: Substantial variety of silver and gold coins/bars for Individual retirement accounts Easy to rollover your existing individual retirement account and also arrange a gold/silver individual retirement account Gotten greatest score of A+ from the BBB

Cons:Does not use palladium or platinum steels

The high rankings Goldco has actually obtained from the BCA and also BBB establish the dependability of the firm. If you want to enhance your wide range with silver or gold, go with this trusted company, which concentrates on self-directed IRAs with precious metals with the help of assets like silver and gold.

Own Gold In Etrade Ira

You can diversify your profile with rare-earth elements like silver and also gold. The financial guard this develops, stops you from experiencing the effects of a fall in the stock market. Properties like silver and also gold attraction clients, as a result of their historical stable worth. In addition, when the economy or stock market falls, the worth of rare-earth elements tends to enhance.

As there is a consistent need for silver and gold, you can easily market your financial investments in them in the future as well as obtain money in exchange. This is not the instance with property.

Goldco supplies an uncomplicated treatment for organizing your gold Individual retirement accounts immediately. With it, you can maintain your other precious metals, including gold, in a self-directed individual retirement account, rather than stocks and bonds.

Don’t Miss: 18 K Gold Price

Gold Has Been A More Powerful Diversifier Than Silver

Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds, and commodities. However, gold is considered a more powerful diversifier. It has been consistently uncorrelated to stocks and has had very low correlations with other major asset classesand with good reason: Unlike silver and industrial base metals, gold is less affected by economic declines because its industrial uses are fairly limited.

E*trade Commissions And Fees

E*TRADEs commissions and fees are within the average range for the online brokers we surveyed. They offer commission-free trading of stocks and exchange-traded funds , which has become the industry standard, while their $0.65 per contract charge for options is reasonable, albeit not the cheapest rate out there.

Mutual fund investors will greatly appreciate E*TRADEs 4,400 no-load, no-transaction fee funds. Just note that the firm charges an early redemption fee of $49.99 when you sell no-load, no transaction fee funds within 90 days of purchase. All other mutual funds incur a standard $19.99 transaction fee.

E*TRADE charges an average of 7.79%, ranging from a high of 8.95% for account balances under $10,000 to a low of 5.45% for accounts of more than $1 million. Price-conscious margin traders seeking the lowest rates should check out Interactive Brokers or Zacks Trade.

Additionally, active traders need to understand that E*TRADE may be paid for order flow. While this is a disadvantage for day traders, the company maintains that it is committed to the best possible trade execution.

E*TRADEs account fees for infrequent extra services are about average for most things, such as $25 for outgoing wire transfers. One fee to watch out for is the higher-than-average $75 fee for full account transfers out.

Read Also: How To Watch Gold Rush Without Cable

The Bottom Line On Investing In Silver Funds

Generally, the best way to invest in silver is through ETFs or ETNs, not mutual funds. The reason for this is that most investors want exposure to the price of silver, rather than stocks of companies associated with silver mining and manufacturing. ETFs and ETNs often track the price of silver. However, most precious metals mutual funds do not.

As always, you should use caution when investing in securities, especially those that you do not completely understand. Dont try to time the market. Due to the speculative nature of silver and other precious metals funds in the market, its best to avoid short-term market timing strategies. You can use precious metals funds as long-term diversification tools. Allocate small percentages, such as 5-10% of the portfolio, to such securities.

You May Like: Does Kay Jewelers Sell Real Gold

The Sorts Of Investments

You need to evaluate the numerous investment instruments used by gold IRA companies. As an instance, certain firms permit the usage of precious metals for personal financial investments as well, whilst others only supply rare-earth elements for IRAs.

Hereafter, inspect what sorts of rare-earth elements the firm supplies. Is the choice restricted to silver as well as gold, or does the firm likewise supply palladium and platinum? The number of various bars and also coins can you utilize for individual investments as well as IRAs?

You may find that certain firms offer financial investments in cryptocurrency such as Ethreum and also Bitcoin. If it is something you have taken into consideration recently, you might try to look for companies that focus on this area, along with Gold IRAs.

Own Gold In Etrade Ira

Recommended Reading: Get Tinder Gold Free

The Reviews Mention It All

A provider may point out everything they intend to create themselves appear good. But it is what the customers mention that actually matters. After exploring Goldco carefully, our company have actually discovered that they have the most effective ranks amongst gold IRA providers, time period. Goldco has thousands of favorable assessments about its product or services. They have actually also been supported by past governmental candidate Ron Paul as well as actor/martial crafts grasp Chuck Norris.

Goldco has high rankings with spots like the Better Business Bureau as well as comparable bodies that check companies for performance. The firm has repeatedly been actually called as a top-performing company through various financial institutions as well as by Inc. Magazine.Of training program, just like any business that has been in business for this duration of your time, there were a number of poor evaluations. These poor evaluations generally concentrated on customers being actually confused concerning gold coin worths as well as gold coin financial investment opportunities.What our team performed find out, nonetheless, is that many of these negative testimonials were actually upgraded along with a favorable keep in mind considering that Goldco had the capacity to help them understand the issues or even troubles they were actually having.

Customer Advisory: Beware Of Gold And Silver Schemes

: You need to only handle a company that has all the suitable and necessary licenses, registrations, insurance, and bonds to secure your investment. Request for confirmation of those licenses and other info. Special Costs Owning gold in a gold Individual Retirement Account does feature some special expenditures. The charges that a financier will deal with consist of::Although gold has a going rate, there are markups depending upon whether you desire gold bullion, coins, proofs, and so on, states Sentell.

Similarly, each form of gold presents its own set of requirements when an investor has to sell, he adds.: This one-time charge is charged to develop your brand-new IRA account . This also differs by institution, but it might be more than the usual setup fee, as not all monetary services firms deal with gold IRAs.

: The gold needs to be held by a qualified storage center for which storage fees are charged. Invest In Gold On Etrade.: If you wish to close out a gold IRA by selling your gold to a third-party dealer, said dealership will wish to pay less than what it opts for on the open market.

4 Steps To Start Investing In A Gold Ira Lendedu

Should You Consider Investing In Gold? Morgan Stanley

Golds Unique Threats All financial investments come with threats and rewards, gold consisted of. In many ways, gold Individual retirement accounts have the very same risks that any investment has, says Moy.

, says Moy.

Is A Gold Ira Right For You? The Motley Fool

Don’t Miss: War Thunder Earn Golden Eagles

Individual Retirement Account Gold Ira Silver Ira

!? You are actually turning part of your retirement nest egg into gold. That stated, is putting a gold Individual Retirement Account in your portfolio the ideal move for you?

A gold IRA frequently features higher fees than a conventional or Roth Individual Retirement Account that invests solely in stocks, bonds, and shared funds. A gold IRA can act as an excellent hedge versus inflation but is likewise focused in a single possession class Invest In Gold On Etrade. The Shifting Cost of Gold Gold rates per ounce have ranged from $255 in September 1999 to a high of $1,937 in August 2020.

There has been significant growth, yet likewise some retrenching. The possibility of using gold and other products as securities in an Individual Retirement Account was produced by Congress in 1997, says Edmund C.

Gold IRAs: A Growing Trend Gold IRAs appeal to investors who financiers a diversified retirement portfolio. During his tenure as director of the Mint, Moy states there was little demand for gold IRAs due to the fact that they involve a really complex deal that just the most persistent investor was willing to pursue.

The Virtual Trading Floor

âSocial media has become hugely important in stock trading,â says Mihir Dange, a former gold trader at the New York Mercantile Exchange, who now works with a company that integrates social media and markets. Twitter in particular, he says, was a game changer for both institutional investors and small-time traders alike.

âBefore, you really needed to be someone to get news as it was happening,â he says. âBloomberg terminals werenât available for common people. If big changes happened in the marketplace you had no way to know what had happened until Bloomberg, the Wall Street Journal or any of the other big outlets wrote about it.â

But today, as CEOs circumvent traditional corporate communications to broadcast their views directly to the Twittersphere and studies that suggest that online popularityâfrom Twitter mentions to Facebook fansâcorrelates positively with stock performance, social media offers todayâs investors a new and powerful barometer of a stockâs future.

Unfortunately, with newfound power comes newfound responsibility, and the vast and opaque social media landscape is riddled with as many new dangers as opportunities.

And while people deposit half a billion tweets per day into the Twittersphere, todayâs investors suffer from an overabundance of informationâadding the challenge of finding the needle in the haystack to the already daunting task of knowing which of those needles can be trusted.

Also Check: Spectrum Triple Play Gold Channels

Should You Acquire Rare

There are lots of benefits of investing in precious metals. It is specifically helpful if you are planning a portfolio diversification. History reveals that rare-earth elements have constantly carried out better in the long term compared to the flat currencies. The erratic stock exchange remains vulnerable to accidents as well as other threats. Rare-earth elements have been a reliable financial investment alternative. The materials of these steels are limited and they will remain extremely valued in the future.

Rare-earth elements are utilized extensively not only for fashion jewelry however also for other applications. They have some unique buildings as well as top qualities that make them extremely suitable for electronic items. Digital product producers require processed as well as raw rare-earth elements for use in these products. These needs will certainly continue to remain solid and so the demand for rare-earth elements will certainly also continue to be high. Investments in these metals enable you to distribute your financial investment danger. Protect your financial investments in the retirement funds by buying these trusted investment instruments. Your income throughout retirement will be secured.

The popularity of rare-earth element financial investment has enhanced over the last few years since lots of investors have shed their savings in stock market crashes. You can not depend solely on stock financial investments to safeguard your retired life savings.

Get Up To $3000 1 Learn How

Take charge of your finances with a new E*TRADE brokerage or retirement account by December 31and start with a generous cash bonus.

Check the background of E*TRADE Securities LLC on FINRA’s BrokerCheck and seeE*TRADE Securities LLC and E*TRADE Capital Management, LLC Relationship Summary.

| Investment Products: Not FDIC Insured No Bank Guarantee May Lose Value |

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

This Thematic Investing screener is an educational tool and should not be relied upon as the primary basis for investment, financial, tax-planning, or retirement decisions. This tool provides a sample of exchange-traded funds that may be of interest to investors and is provided to customers as a resource to learn more about different categories of ETFs and the use of screeners. This educational information neither is, nor should be construed as, investment advice, financial guidance, or an offer or a solicitation or recommendation to buy, sell, or hold any security, or to engage in any specific investment strategy. Additional ETFs available through E*TRADE Securities LLC may be found by using the ETF screener at .

How ETFs are selected for a theme:

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors.

Don’t Miss: Banned For Buying Gold Classic Wow

Buying Commodities Through Etfs Or Mutual Funds

What Is An Online Stock Broker

An online broker is a financial institution that allows you to purchase securities, including stocks, through an online platform. Online brokers are sometimes referred to as discount brokers because they offer a considerable discount to what the typical full-service brokerage firm charges.

With an online broker, you wont get the same financial advice or investment recommendations that full-service brokers typically provide, but you will get commission-free trading and access to a number of other services and products depending on which broker you choose. Choosing an online broker makes sense for most investors.

Read Also: Price Of 18k Gold Today

Robinhood Vs E*trade: Mobile App And Trading Platforms

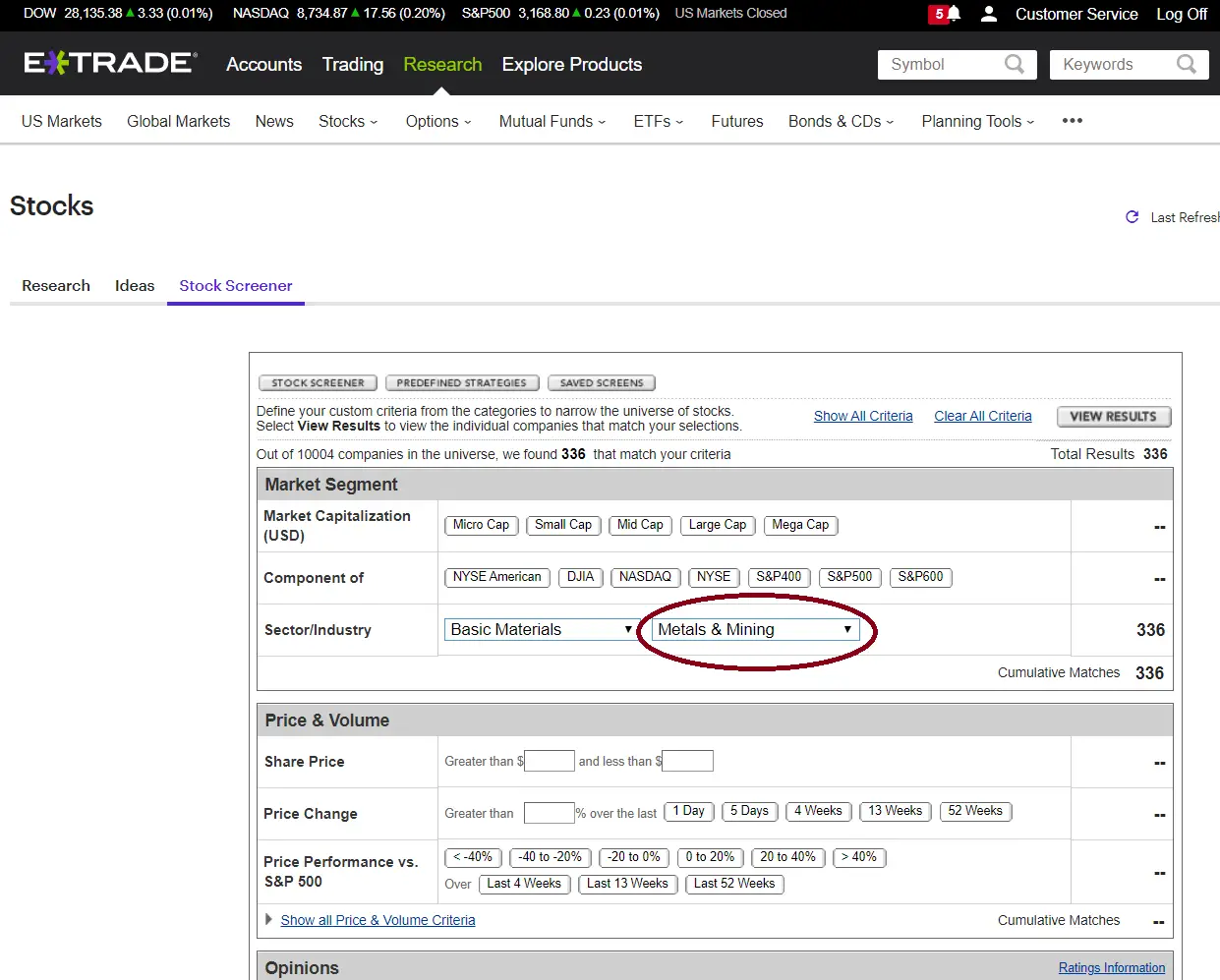

Investors evaluating Robinhood vs. E*TRADE will find key differences in mobile apps and trading platforms. For traders who value a sleek mobile app without bells and whistles, Robinhood may be a strong choice. E*TRADE offers a complex desktop suite best for active traders and options traders.

Robinhood was one of the pioneers of mobile trading, and still ranks as one of the best stock trading apps. A no-frills platform, Robinhood has made trading controversially easy. With little more than portfolio information and transaction tabs, the app is simple and visually appealing. Recently, Robinhood launched a desktop version of its trading platform, and it’s very similar to the mobile app.

E*TRADE offers a simple, easy-to-navigate mobile and desktop platform. With market data, commentary, research, and screeners, the basic platform is well suited to active traders. The Power E*TRADE platform sports a sleek dashboard and impressive tools for derivatives traders.