What Drives The Price Of Gold

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

Today, gold is sought after, not just for investment purposes and to make jewelry, but it is also used in the manufacturing of certain electronic and medical devices. Gold was over $1,700 per ounce, and while down more than $300 from September 2020, still up considerably from levels under $100 seen 50 years ago. What factors drive the price of this precious metal higher over time?

How Can Savers Protect Against Inflation

Fortunately for savers, all is not lost if prices spike higher. Treasury Inflation Protected Securities are US Treasury bonds that are indexed to the consumer price index. If CPI goes up, the principal of that bond increases if CPI falls, the principal decreases. While experts say TIPS are expensiveoffering little yield by historical standardssavers can use them to hedge their investments if they are worried about near-term increases in consumer prices.

And while hedging against inflation is tricky, finding assets whose returns outpace rising prices may be more doable. Data compiled by Dimensional Fund Advisors suggest a wide range of assetsincluding bonds, stocks, and commoditieshave produced returns that exceeded inflation when held for longer timeframes.

Driver #: Supply Chain Risks

- Completely dependent on pervasive COVID/virus.

- Government policies and outbreaks in low vaccination regions causing bottlenecks & supply disruptions, unsynchronized COVID cycles with unpredictable demand trends, relentless V-shaped* US demand for goods.

*V-shaped demand is demand seeing a sharp decline, followed by a fast and strong rebound.

The global supply chain has been strained lately as a result of the Covid pandemic, making many physical gold investors worried about the possible implications for the global economy. And it looks like all this supply chain chaos could get worse if Covid risks persist.

A chaos that could further fuel the current rise in prices while slowing down the global economic recovery.

Recommended Reading: Buy Gold From Dubai Online

Miners Should Start Easing Off The Gas

The mining industry continues to pursue various long-term sustainability goals. In our view, the industrys biggest challenge is weening itself off the diesel fuel needed to power haul trucks, loaders, dozers and other large equipment. To that end, and according to company reports, Rio Tinto and Caterpillar are cooperating to advance the development of a zero emission, 220-tonne haul truck in Western Australia. Meanwhile in South Africa, Engie and Anglo American are tackling the 300 500 tonne trucks to develop prototypes powered by hydrogen fuel cells according to company reports. Perhaps net zero isnt just a dream…

What To Watch For

Milling-Stanley expects gold to exceed $2,000 by the end of the year and he is not convinced the Fed will raise rates even if inflation climbs in subsequent years. Adding that President Bidens multi-trillion-dollar infrastructure programs will lead to rising deficits, interest rates will have to remain low. Contrarily, Lloyd expects gold to finish the year at $1,700. Radomski, however, expects gold to keep declining over the next several months, sliding to as low as $1,500 or even lower and then recovering to the $1800 range by year end.

Don’t Miss: War Thunder 10000 Golden Eagles Code

What Your Dollars Are Buying More Of Now

The dollar is buying as much as it did before. Its just that many of the things it is buying are not things that consumers know about, or want. For example the dollar is buying lots of extra idle time for each container, and lots of extra handling. It is buying an above-market rent by union trucking shops, who secure this uneconomic rent by laws against nonunion truckers. It is buying extra salaries and fuel burned by ships who are not idle, they are burning fuel to remain in position too far offshore for their anchors to reach the bottom. It is buying all sorts of extra labor, tanker trucks, permits, road taxes, and administrative costs to move energy by whatever channel is least constrained at the moment, in a world where constraints are shifting around and growing.

It is paying for warehousing of chips and other critical components that used to arrive justin-time. It is paying for food and shelter and clothing and Xboxes for millions of people who once worked, but now find it convenient to get paid not to work.

The list goes on.

Driver #: Geopolitical Uncertainty

- The frequency of geopolitical events is rising after a chaotic Afghanistan withdrawal causing US humiliation.”

- US counted on to NOT intervene in potential future geopolitical skirmishes , driving the need for more tactical tail-risk hedging.

- The threat of social unrest is also on the rise especially in middle-income countries given vaccination disparities and a mishandling of COVID waves.

Geopolitical uncertainty and rising tensions can end up impacting the gold price and even push it up, as many investors prefer buying gold during uncertain times.

And it seems that the current instability in some regions could lead some gold investors to hedge their portfolios with safe-haven assets like physical gold.

Also Check: Do Diamonds Look Better In White Or Yellow Gold

The Precious Metal Is ‘stuck In A No

Gold is considered a store of value during troubled times, but its price has been stuck in the $1,725 to $1,830 range for the past four months despite rising concerns over inflation. Getty

Gold is seen as a key hedge against inflation and with prices accelerating, the precious metal should be shining right now. But it isnt.

Instead, the gold price has been stuck in what Matt Weller, global head of research at StoneX Financial, calls its well-trodden four-month range between $1,725 and $1,830.

At the time of writing, it is trading at around $1,800, more than 15 per cent below its all-time high of $2,084, which it hit in August 2020 at the height of Covid-19 uncertainty.

Gold has been a store of value in troubled times for 4,000 years, so why arent investors clamouring to buy it in these uncertain times?

Is current weakness a buying opportunity, or a sign that gold simply isnt as attractive as it was?

Gold should really be doing better amid slowing global growth, supply chain bottlenecks, rising energy prices and lingering pandemic fears, says Georgios Leontaris, chief investment officer of global private banking and wealth at HSBC.

However, there is enough good news out there to offset this.

The Covid-19 vaccination drive is keeping most economies open, which also reduces the demand for a safe haven. Investors are worried, but not worried enough to pile into gold.

What Makes The Price Of Gold Go Up Inflation

What makes the price of gold go up? Part 1: Inflation

There are so many factors in what makes the price gold up that it can be scary. Before researching this topic, my own opinion was “anything bad for the economy”. That may be the case, but while a bad economy is often sufficient, it is far from necessary. Get ready to delve into the financially complex and yet strangely common-sense world of how inflation makes the price of gold go up. In future articles, I’ll talk about other factors from human psychology to trade wars.

What Causes Inflation?

There are two main causes of inflation: “cost push inflation” and “demand pull inflation”.

The first type, cost pull, causes the dollar to lose value due to the fact that companies have to pay more for things so they pass those costs on consumers, thus making products more expensive.

The second, demand pull, happens when manufactures reach the maximum amount of production of goods and services in spite of exploding demands.

Why Bother with what Makes the Price of Gold Go Up?

To some of us gold investors it seems like a natural question. Obviously, we want to understand what makes gold go up so that we can get the better of the market, or at the very least understand long-term trends. In my opinion, nobody can accurately forecast gold prices in the short-term.

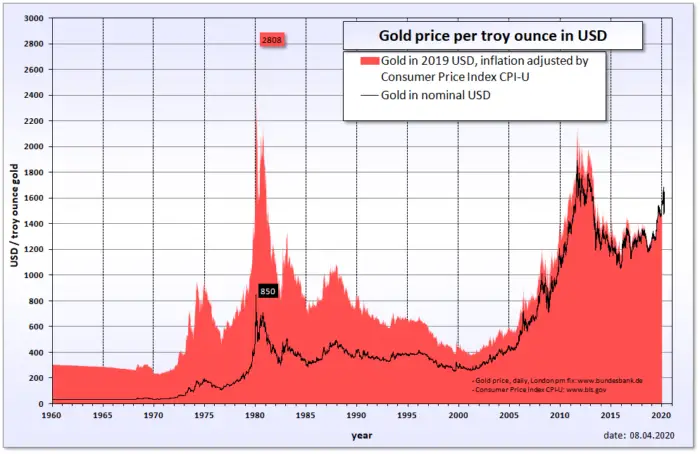

When you look to 6-months to 5-year gold market trends, there isn’t much there. On the other hand, longer periods can be revealing.

Why Does Gold Enter the Inflation Game?

Read Also: Kay Jewelers Sale 19.99

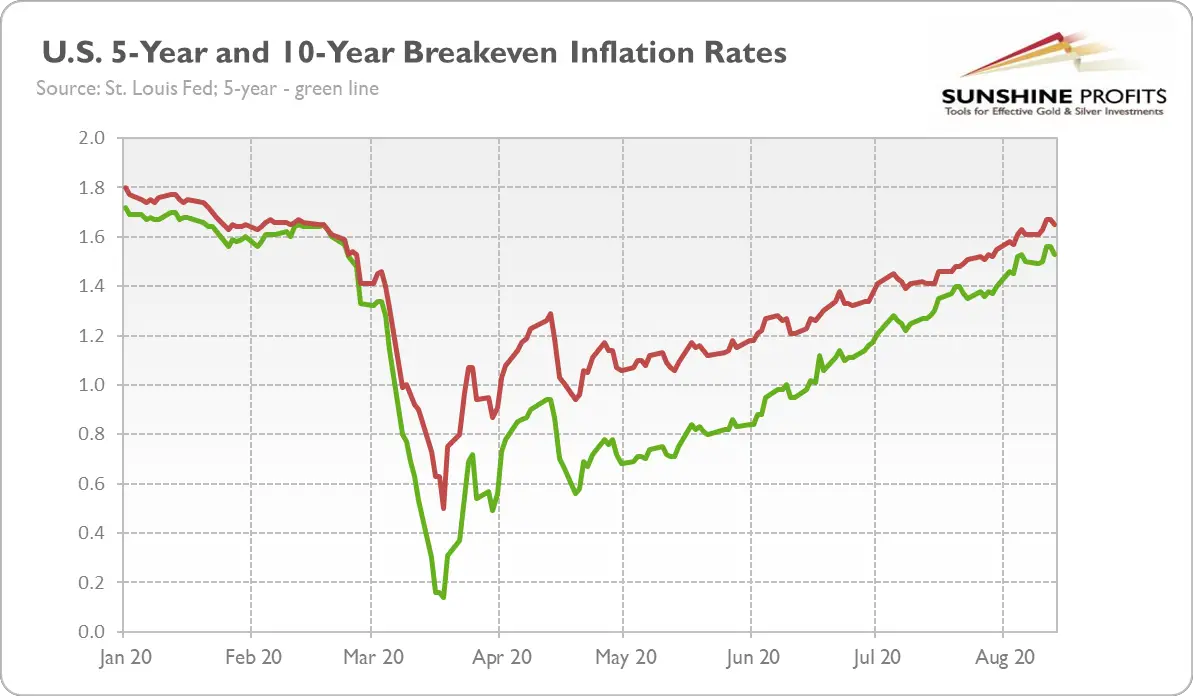

Driver #: High Inflation

- Inflation risks are rising and underappreciated, given the Fed’s stance stubbornly hinging on it being transitory.

- The markets have inflation because the Fed targeted inflation The Fed will more likely than not wrongfoot the exit.”

- Expansionary global fiscal policies, potential social unrest, unsustainable US debt path, continued protectionisttrade policies, rising transportation costs & increasing supply-chain riskall indicate structural & stickier inflation.

- The transitory inflation view will be tested by advanced economies’ Central Banks, especially as the Fed provided a hawkish greenlight at the June FOMC to begin tapering bond purchases this year.

To sum up her thinking, all signs suggest that inflation worries are up and mounting. Despite the Feds transitory inflation mantra, it looks like consumer prices will continue rising well into 2022.

To understand what an increase in consumer prices could mean for gold, read our SPOTLIGHT article on the subject.

Should The Gold Price Keep Up With Inflation

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true?

Most people define inflation as rising prices. Economists will quibble and say technically its the increase in the quantity of money, however Milton Friedman expressed the popular belief well. He said, Inflation is always and everywhere a monetary phenomenon.

There you have it. The Federal Reserve increases the money supply and that, in turn, causes an increase in the price of everything, including gold. Its as simple as that, right?

Except, it doesnt work that way. Just ask anyone who has been betting on rising commodities prices since 2011. Certainly the money supply has increased. M1 was $1.86T in January 2011, and in March it hit $3.15T. This is a 69 percent increase. However, commodities have gone the opposite way. For example, wheat peaked at $9.35 per bushel in July 2012, and so far its down to $4.64 or about 50 percent. And the price of gold fell from $1900 in 2011, to $1050 late last year, or 45 percent.

Would you say that inflation is +69%, or is it -45% or -50%?

Most people look at retail prices, not raw commodities or gold. Retail prices have not followed into the abyss. Love it or hate it, the Consumer Price Index registers a cumulative 8 percent gain from 2011 through 2015 inclusive.

Is this inflation?

You May Like: How Much Is 1 Block Of Gold Worth

How Inflation Affects Gold Price

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. The information in this content is not advice on financial, investment, tax or other matters. You should always consult your own financial, legal, tax, accounting, or similar advisors. You can trust the integrity of our unbiased, independent editorial staff. We may, however, receive compensation from the issuers of some products mentioned in this article. Our opinions are our own.

Table Of Content

To answer the question of how inflation affects gold prices, it is necessary to take another look at old fashioned economics as a way for discovering how cost valuations will likely unfold as time goes on. Among the very crucial economic powers in these regions is the power of market inflation.

Its powerful influence on the yellow metal could be important according to the underlying principles of the world economy. In these days, when inflation increase and uncertainty becomes more and more popular gold investment is something many people consider. So what is inflation and how can we deal with the consequences?

How Does Inflation Affect Gold

There is a correlation between inflation and goldgold can be lifted by high inflation. Gold prices might go up when asset holders flock to the precious metal and thus drive up demand amid fears of inflation going up. Yet inflation and gold dont move in a lockstep fashion, although you might see the inflation rate and the price of gold rise or fall at the same time.

All real assets will benefit from higher inflation, but gold is more than just a real asset it is the monetary asset of choice, Diego Parrilla, a managing partner with Spains Quadriga Asset Managers, toldThe Wall Street Journal in May 2020. In the battle of the currencies, gold will win.

The bottom line is that gold can be a hedge against inflation and diversify a portfolio during good and bad times.

My thesis for thinking that gold makes sense within a portfolio rests on this idea that the Federal Reserve will choose to overshoot, rather than risk deflation. The risk of inflation is far more palatable than any deflation, Tim Shaler, chief economist at iTrustCapital, claimed in June 2020. If somebody is concerned about future inflation, then gold is an appropriate part of somebodys portfolio.

According to Shaler, for people with a long-term outlook on their assets, holding 10% of their portfolio in gold makes a lot of sense in the current economic environment.

Also Check: How Much Is 18 Carat Gold

The Different Causes Of Inflation

Consumer prices are up due to the nonmonetary factors we mention above, most especially whiplash from the lockdown imposed in response to Covid. Every business from retail to repair has learned that they cannot rely on products delivered promptly. So naturally, prices go up to ration the limited supply.

When economists say that inflation is transitory, they mean that logistics problems will be worked out, and then inventories will be replenished.

Unfortunately, they do not distinguish between different causes. If prices go up due to monetary debauchery, that is inflation. If prices go up to due to temporary shipping snafus, that is inflation also. And if prices go up due to laws that make everyone use more-expensive natural gas and laws that prohibit domestic production of natural gas, then that, too, is called inflation.

We need different words for these phenomena. Though that is not our point today. We merely draw attention to the cause of the rise in consumer prices and note this one does not directly affect gold.

Gold Silver And The Future

Stable supply in the form of limited mining operations, as well as stable demand in the form of continued demand for decoration and coins, means that the price of gold will remain stable in the foreseeable future.

The value of silver generally fluctuates more than gold due to the many industrial applications that tie the white metal to the fortunes of numerous industries. Platinum and palladium, other rare metals that are often invested in as a hedge against inflation, are similarly prone to fluctuation.

Read Also: Gold Brick Cost

Consumer Price Index Useless Ingredients And The Gold Price

Another theory of what drives the gold price is changes to the consumer price index, also known as inflation. Consumer prices have been skyrocketing. But the price of gold has not. So is this a bullish signal?

We will leave aside the obvious contradiction. If rising consumer prices cause the price of gold to rise, and consumer prices rose but the gold price did not, then the theorys prediction has not come true. So there is no reason to expect it to become true in the future.

Whether rising prices are a signal for gold, depends on the cause of the rise in prices. If prices are going up due to nonmonetary forces such as tariffs, restrictions on energy production, and increasing number and cost of regulations , then why should that drive up the price of gold? There is no mechanical apparatus that connects the prices of consumer goods to the price of gold.

There are times when the prices of gold and consumer goods are rising together. But other times when one is moving up sharply, but not the other. For example, 2009-2011, the price of gold more than doubled. Or this year, consumer prices are up about 6.3% according to Bureau of Labor Statistics. The price of gold is down about 5%.

What To Expect From Gold In The Future

Ask yourself what the future holds for gold in regards to its value and whether it will continue to be expensive. Human psychology, as said earlier, has played a vital role in determining the value of gold in global standards.

Humans consider gold a go-to investment when facing uncertainty. It is a better bet than paper money when the economy faces recessions and depressions. Besides, there’s a high demand for gold in industries and financial markets today.

In short, the value of gold will hold steady in the future. It will also continue to be expensive as people have utilized most of the world’s gold deposits. The increasing demand for gold and reduced supply will see the prices for gold significantly rise in the global market.

Recommended Reading: How To Get Golden Eagles In War Thunder Free

Gold And Silver Lagging Inflation But For How Long

While the prices of food, housing, and staple goods continue to rise, other assets arent seeing nearly the same price increases. Two of those whose price movements are confounding are gold and silver.

Gold and silver have a reputation for gaining value during times of high inflation. During the 1970s stagflation, for instance, gold and silvers average annualized gains were over 30% over the course of the decade. So everyone is naturally expecting gold and silver to take off today in the face of high inflation, yet they havent yet. What gives?

In that respect, gold and silver arent completely unique. Stock markets are in much the same boat, trading in a relatively narrow range for weeks. Nothing seems to be moving outside of these narrow ranges, as if to see which way the wind is going to blow.

With the Fed in the middle of its tapering program and talking more and more about how it intends to raise interest rates this year, the pressure on markets will intensify. Its highly unlikely that the Fed will raise rates at its January meeting, but far more likely that it might decide on a first rate hike at its March meeting.

That isnt to say, however, that everything is going to remain the same in the meantime. Gold has seen some trading days with big gains recently, as fears of inflation and rate hikes combine to help drive the price up. And many soon-to-be-retirees are looking nervously at their 401 accounts as stock markets continue to slide this year.