What To Lookout For Todays Scrap Gold Price

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

How Often Do Gold Spot Prices Change

Spot prices for gold are constantly changing, as can be seen on any gold price chart. The price floats freely on the market and responds to real-time trading behavior.

U.S. markets close at 5:15 pm in New York, but gold continues to trade âovernightâ in Asian and Australian markets. Today’s gold price is rarely the same as yesterday or tomorrow. Therefore the spot price can change at virtually any time.

Historical charts before about 1950 don’t reflect this. Reliable data about the historical gold price is harder to find. Gold prices today are more dynamic and well-documented.

Read Also: Does Kay Jewelers Sell Real Gold

Price Of Silver Today

Keep up-to-date with silver price changes on our live silver price chart. Scroll through 30 years of data to see where the price of silver has gone in the past, and where it is going next. This long-term silver price perspective is vital in precious metal investing. Grab the left and right sliders to select any particular time period for specific information on silver prices. Hover over the chart to get the exact price of silver from a daily, weekly, monthly, and yearly price perspective, and start enjoying the benefit of accurate silver price insight from the precious metals experts at SilverGoldBull.ca.

What Happened In 2011 To Increase Gold And Silver Prices

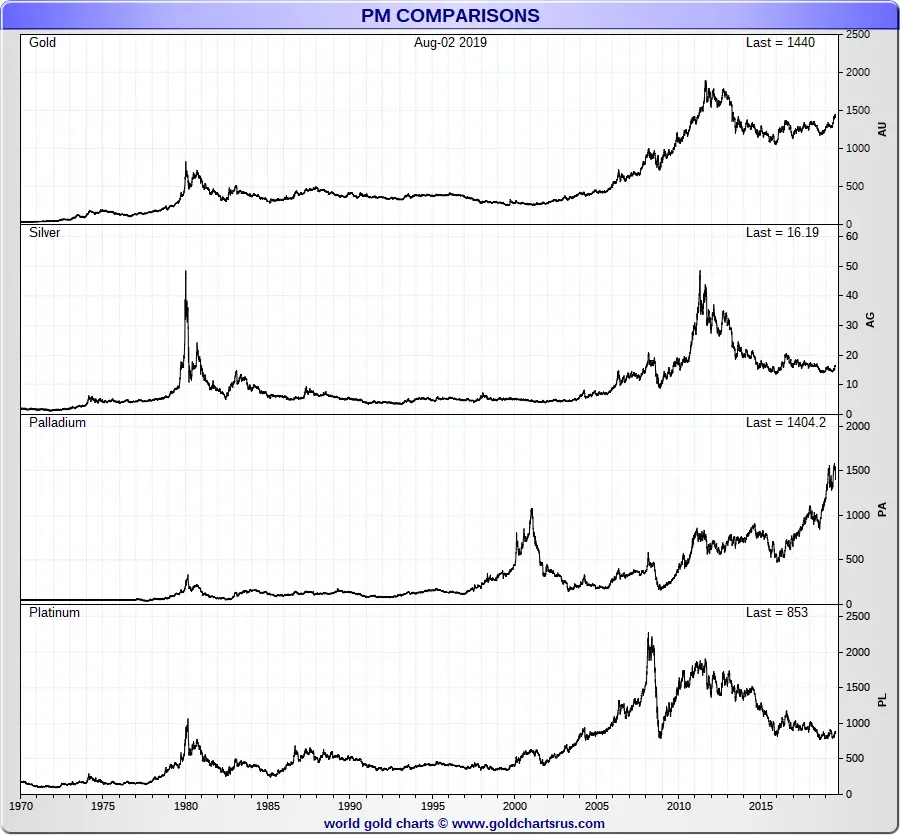

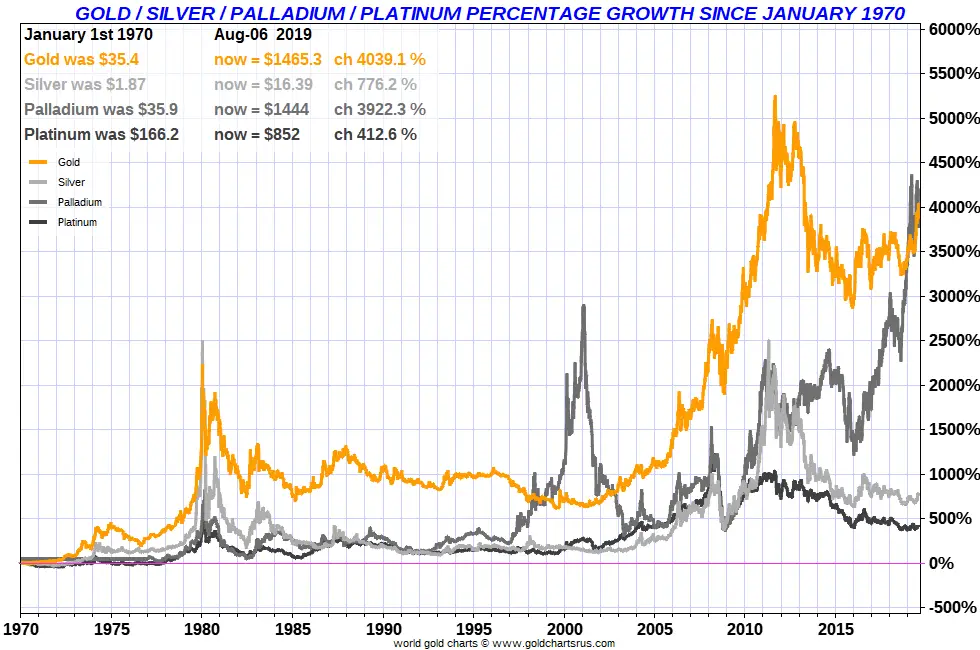

Gold prices hit an all-time high of $1,900/oz. in August 2011. Earlier that year, silver ran up to just shy of $50/oz. The precious metals surged as a consequence of Federal Reserve Quantitative Easing programs, rising inflation fears, and a spike in investment demand for physical bullion.

However, those nominal 2011 highs werent actually new highs in real terms. The January 1980 peaks of $850/oz gold and $50/oz silver still havent been surpassed when adjusted for inflation.

According to the governments own inflation calculator, $850 in 1980 dollars translates to $2,475 in 2011 dollarsand $2,805 in 2019 dollars.

Don’t Miss: How To Get Free Golden Eagles In War Thunder

What Can Cause The Spot Gold Price To Change

Any change or disruption to either the supply or demand for gold will move the spot price.

If a large gold deposit is discovered, the increased supply will cause the spot price to fall. The reverse is true if the gold supply decreases.

An increase in gold demand will also drive the spot price higher. Perhaps the demand is due to accelerating inflation or extreme economic uncertainty.

Supply and demand are affected on a daily basis, meaning the gold spot price is constantly in flux.

What Is The Gold Spot Price

Spot prices represent what a commodity is trading for at any given moment. It is the live gold price in real time.

This price is used by gold refiners, miners, financial institutions, and gold dealers. It’s how they determine pricing for gold bullion.

In other words, the gold spot price is a benchmark for wholesale transactions. It’s the amount a wholesaler will charge for a unit of physical gold per ounce before any markups or premiums.

Gold derivatives often track with the spot price.

Also Check: How To Get Free Gold Bars On Candy Crush

Gold Bullion Coin Mints

As mentioned above, gold bullion coins are preferred by many investors because they have the backing of central banks and federal governments. Additionally, these coins are issued by national sovereign mints and other state-owned facilities. The following are some of the most prolific issuers of gold coins:

Silver Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The silver price in CAD is updated every minute. The data comes from the silver price in US Dollars converted at the exchange rate of the USD/CAD pair.

Recommended Reading: Who Makes Gold Peak Tea

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Lady Liberty Gold Round

One of the most affordable ways to get gold is the Lady Liberty round, made of .9999 pure gold in one-tenth troy ounce. They are not legal tender and the goal is to provide the buyer with more gold for the money versus fractional coin bullion. Lady Liberty is featured on the obverse with the image of a descending bald eagle on the reverse.

Also Check: Where Can I Sell Gold Bars Rdr2

Precious Metals Securities And Share Prices

The New York Stock Exchange, the NASDAQ and other stock exchanges are the home ofsecurities trading. Securities are paper certificates representing exposure to, but notnecessarily control of, an underlying asset. For metals investors this can include ExchangeTraded Funds such as $GLD or $SLV as well as shares of mining companiessuch as Barrick Gold.

Invest In Gold Right Now

Gold is a timeless investment to protect your wealth. A time capsule from any century is sure to include gold coins or bullion. Discover the security and pride in ownership for yourself. Pool your resources and make an important decision about your financial future. Talk to a knowledgeable professional at Money Metals Exchange by calling 1-800-800-1865 today to learn how to buy gold bullion for greater financial security. We take pride in offering outstanding service, great pricing, and fast delivery times to everyone from novice buyers to sophisticated investors.

Precious Metals

Also Check: Where To Sell Gold Rdr2

Why Do Gold And Silver Prices Fluctuate

Like other investment assets, gold and silver are prone to price swings based on investor sentiment. They can also fluctuate due to trends in underlying supply and demand fundamentals.

Traders determine gold spot prices on futures exchanges. Metals contracts change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price.

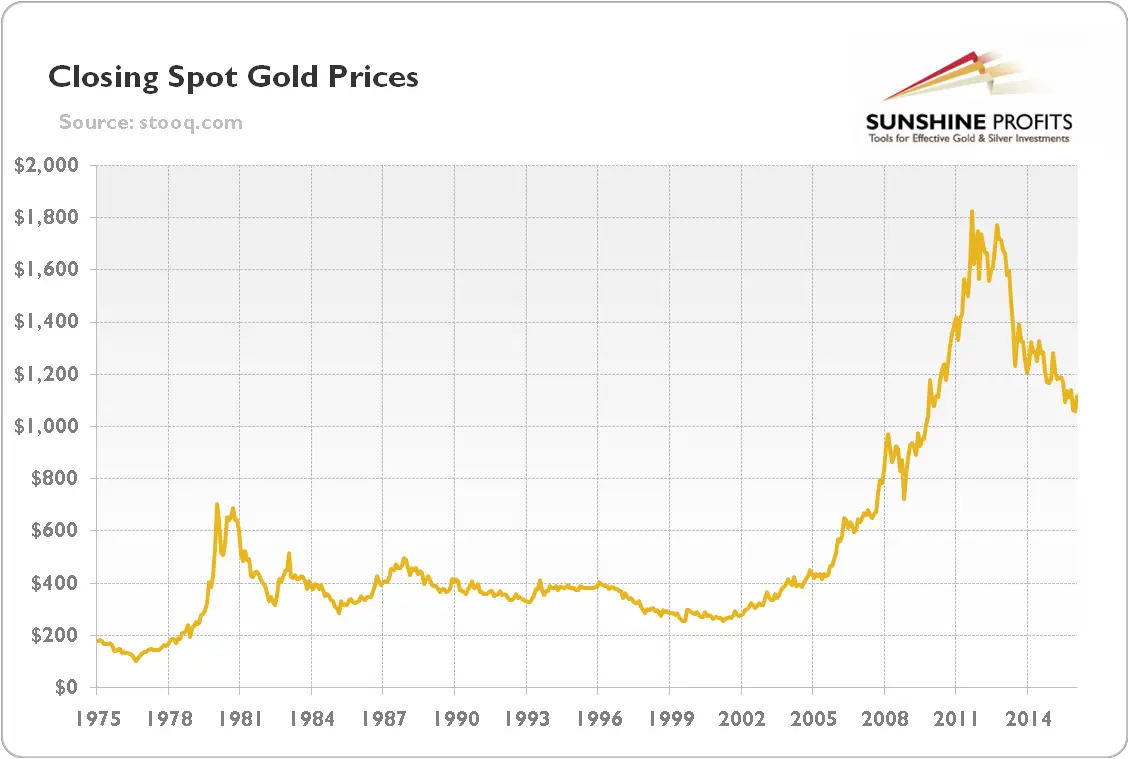

A hundred years ago, gold sold for just $20 per ounce. In recent years gold has traded between $1,200 and $1,900 per ounce. Thats a huge move up in nominal terms over the past century. Yet in real terms gold prices today arent much different from what they were when they were last quoted at $20 an ounce.

Its not that gold has become so much more expensive. Its that the currency in which gold prices are quoted has depreciated so much.

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2. Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

Read Also: How To Get Free Gold Bars In Candy Crush

What Is A Krugerrand

First minted in 1967, the Krugerrand is a South African coin. The South African Mint produced it to help market gold from South Africa. It was also used as a form of legal tender and as gold bullion. By 1980, it accounted for 90 percent of the gold coin market around the world. Paul Kruger, the President of the South African Republic from 1883 to 1900, is featured on the obverse. The South African unit of currency, or rand, is shown on the reverse of the coin.

Krugerands became politically controversial during the 1970s and 1980s because of the association with an apartheid government. As a result, production of the coins varied, with levels of production increasing since 1998. The Krugerrand weighs 1.0909 troy ounces and is made from 91.67 percent pure gold . As a result, the coin has one troy ounce of gold with the remaining weight in copper. Three sizes have been available since 1980 including ½ oz, ¼ oz, and 1/10 oz. Proof Krugerands are also available for collectors. They differ from bullion coins because the proofs have 220 serrations on the coin’s edge, rather than 160.

What Are Sovereign Silver Coins And Why Are Their Prices Different From The Amount Of Silver Per Ounce

Youll find several nations that mint their silver coins today. Some good examples of these types of silver coins include the Mexican Silver Libertad, the Silver Krugerrand, the Australian Silver Kangaroo, and many others, as well. The reason these coins have different pricing than what youll find in a silver price chart for the price of silver per ounce is that they are 1) coins, not rounds and 2) they are minted as both legal tender and carry some collectible value. While they take only minimal numismatic value when first created, that value increases over time as they become rarer and harder to find on the market.

Recommended Reading: Can I Buy Gold Jewelry From Dubai Online

How To Sell Your Gold

Selling back to Money Metals Exchange is super easy. You can lock in prices on this website or over the phone. Successful sellers continually watch trends and prices to choose advantageous times to sell. Gold can be sold quickly at local pawn shops, but sellers are likely to take a lower price than what the bullion is actually worth. Jewelry and coin shops buy gold, but many of them do not offer top dollar like Money Metals Exchange does. It can also be sold in real-time online. The prices are locked in immediately, making it a great option. Plus, it is transferred in a safer way than bringing it around town to various shops, depending on where it is stored.

Get a firm price from a trusted buyer before agreeing to sell to ensure you get the best price for your gold, no matter how the market turns. Avoid listening to friends, co-workers or a sketchy telemarketers offering reduced prices for buyers and inflated ones for sellers. If it sounds too good to be true, it probably is.

Whats The Price Of Silver Per Ounce

The price of Silver can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Silver per ounce, they are referring to the spot price. The spot price of Silver is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Silver per ounce.

Read Also: Gold Peak Tea Commercial

What Taxes Can Get Added To Current Silver Prices

Sales taxes are generally only added to purchases of silver if you live in a state where local sales tax applies currently, not all states in the US tax precious metals. If you are buying silver online and live in a country that does require this, the sales tax will likely get added to your order at checkout. Note that fees on silver bullion purchases get generally based on your billing address, rather than your shipping address.

About The Kitco Gold And Precious Metals Fix

More than a century ago the first precious metals benchmarks were created. The fixing process involved a group of bankers sitting in a room haggling over the price of gold and silver. When demand matched with the supply the fixing price was set.

For a 100 years this was the process to establish the benchmark price for gold, silver, platinum and palladium. The room was eventually replaced with a telephone auction process. However, the financial marketplace has since become more and more digital.

The world is now in need of an inexpensive, reliable benchmark for gold, silver, platinum and palladium. Welcome to the Kitco Gold and Precious Metals Fix.

The worlds leader in precious metals information is establishing the new benchmark for all precious metals. Through the liquid and reliable over-the-counter cash market, Kitco Metals is able to calculate a reliable fixing price for gold, silver, platinum and palladium.

The fixing price will be released every day at 10 am and made available for free to Kitco users.

Read Also: How To Invest In Gold Robinhood

What Makes The Spot Price Move Up Or Down

At the most basic level, the spot price of gold depends on the balance between supply and demand within the international market. If many people are selling, or there is a large spike in mining and manufacturing, the supply of gold increases, and the spot price will go down. However, if many people are looking to invest in gold, this creates a high demand in the market, and the spot price of gold will go up.

Ordinary purchasing and liquidation activity, along with speculation, typically make for the minute-by-minutes changes to the spot price.

There are also big-picture forces that can influence buyers and sellers. These catalysts tend to have the greatest impact on the gold price.

Indian Spot Gold Rate And Silver Price On Monday Oct 25 2021

Gold Value and Silver Value Right this moment. Right heres the most recent replace on spot gold costs, forex alternate charges and different valuable metallic charges in India as on Monday, Oct 25, 2021

Right this moment Gold Price is larger than this weeks common of 47558.6 by 0.23%. The Gold Value was larger than yesterdays worth of 47660.

The Indian Gold Value Right this moment is 47670 which grew by 0.02% the speed was decrease than the worldwide Gold Value progress price of 0.18%. The worldwide Gold Value Right this moment is $1816.7.

Gold and different valuable metals on Monday, Oct 25, 2021

Following yesterdays development, the worldwide Gold Value continued its progress as we speak as nicely. It was clocked at $1816.7 per Troy ounce within the newest shut which famous a rise of 0.18% over yesterday. This worth degree is 4.24% larger than common Gold Value noticed up to now 30 days . Among the many different valuable metals, Silver Value Right this moment noticed a fall. The Silver Value plunged 0.06% to $25.2 per Troy ounce.

Additional, platinum worth has proven an uptick. The valuable metallic platinum rose 0.05% to $1078.0 per Troy ounce. In the meantime in India, gold was priced at 47990 per 10 gram on MCX, with a change of 326.3. Additionally, the worth of 24k gold within the Indian spot market was quoted at 47670 .

MCX Gold on Monday, Oct 25, 2021

Foreign money Trade Price on Monday, Oct 25, 2021

Get our Every day Information Capsule

Recommended Reading: Buy Gold In Dubai