How To Convert Gold Into Cash

The process is fairly simple, but to get the best price for your gold, you need to take some specific steps to protect your interests.

If youre a complete newbie to the process, you may want to visit the end of this article first. Weve put together a Glossary of Gold Terms;that well be referring to throughout this article and you might find it helpful to know exactly what Im talking about if youre not sure.

First, you need to decide when you want to sell your gold. You may be financially strapped after a divorce, or the divorce itself may be forcing you to sell as part of the agreed-upon settlement.

You may also simply want to redistribute and allocate your investments, pay for college tuition, buy a car, or a house, or if the gold market appears to have topped out, perhaps youll shift your funds to trading in other types of metals.

If you can afford to wait so that you can find the right time, that may be your smartest move. Youll want to start following the spot price for gold which changes daily. Listen to gold market and futures experts on where gold is going to go and be prudent in your timing.

Next, youll need to find a trusted place to sell your gold. A local pawn shop or coin dealer will give you the opportunity to talk to someone in person and walk away with money in your hand that same day.

But some dealers, such as APMEX, offer a 1-day guarantee, meaning youll be paid within 24 hours from the time your products are validated .

Cash For Gold Calculator

| $1,787.27 |

This is the original Cash for Gold Calculator.

This software was developed by the National Gold Market Corporation to educate the public, providing the most accurate market price for Gold, Silver and Platinum at 100% of the current New York Spot Price and the Asia Stock Market. The Live Price chart gives you a breakdown per gram, DWT and Troy Ounce. What is the right amount to receive for your gold? If you’re selling Gold Jewelry, a reasonable settlement would be 70% to 80% of the market value. If you’re selling Gold Coins a reasonable settlement would be 90% of the market value. If you are near The Los Angeles area, National Gold Market is located in Pasadena, California. They pay 75% to 80% for Gold Jewelry and 90% for Gold Coins. You can walk in and get your items tested for free to determine the Karat metal purity and the gram weight. The company will give you a quote based off the current Live Prices on the LA Cash for Gold website. Payments are made in CASH.VISIT THE LOCAL SITE BY CLICKING HERE: You can also send your gold using our Prepaid, insured FEDEX Package by following the simple instructions on National Gold Market.com website.VISIT THE NATIONAL SITE BY CLICKING HERE: National Gold Market

What to avoid when selling Gold?

How to sell your Gold Properly:

Richard Wants To Know Can I Sell My Gold To A Bank

Richard: You know I have 20 gold bullions and scrap gold here. The scrap gold is a mixture of some rings, a necklace, some thin chains, cufflinks, a wristwatch band, earrings and a brooch. I know that gold sells by the weight and thats why I weighed it. All the scrap gold has a weight of 51.74 pennyweights. Can I sell my gold to a bank? And if yes, do you think they are willing to accept the scrap gold too?

Alan: I know some banks are buying gold coins. But just bullions like yours and no other coins and especially no scrap gold. But I dont know nationwide operating banks that are buying coins. Banks that buy gold coins are mostly smaller banks with just a couple of branches or even only one branch. There is another drawback that they only buy your gold coins back if you are banking with them. So, you would need to open a bank account in order to make the deal and consider, some banks take up to 20 days to close the selling deal. Why? It is because most banks are not able to determine the authenticity of your coins. They send your gold coins away to get proof of authenticity. Im not sure if this procedure is hassle-free. Thats very questionable.

Richard: I understand. But wouldnt it be a good idea for banks to buy gold in any condition?

Richard: Maybe not but it would be very convenient for me as a consumer.

Alan: I agree with you.

Alan: Thank you.

Read Also: How Much Is 39 Grams Of Gold Worth

What Are Irs Reporting Rules About Sale Of Gold Coins

How you report the sale of your gold coins for taxes depends on many factors.

There is no one standard way of reporting the sale of gold coins on your tax return. How you report the sale and any possible tax owed depends on your specific circumstances. The tax rules are different for people who regularly sell gold coins with the intent of earning profits, for those who collect coins as a hobby and for taxpayers who hold onto their gold coins as an investment.

Selling Gold & Silver Bullion Online

Selling precious metals to an online dealer may fetch the best price because theyre operating expenses are much lower than a local coin shop that has to maintain a physical storefront.

Selling your gold or silver online to GoldSilver.com is easy. Just follow this process:

Recommended Reading: What Was The Price Of Gold 20 Years Ago

Problems With Storing More Than A Small Number Of Coins At Home

For a small number of coins, of limited value, often the most convenient and confidential storage solution is at home, in an insurance rated safe. This definitely works best when you do not need to itemise your gold coins nor extend your household insurance.

This will require that both:-

- Your coins do not cause your safes valuables to exceed your safes rating

- Your coins do not cause your high value, or high risk items to exceed your household insurances limit for these.

If these conditions are met, and no other terms in your insurance contract are breached, then keeping a small number of gold coins at home is a reasonably safe and economic storage solution.

When the above conditions are not met home storage becomes difficult.

If your safes rating is exceeded it is likely your insurance of its entire contents will be voided. Our advice is never to exceed your safes rating.

If you have to elevate your household cover to include a larger high value items figure it is likely the insurance company will both raise your premium and place a string of onerous responsibilities on you. This will include:-

- installing a regularly serviced and permanently monitored intruder alarm

- maintaining and undertaking to use every night high specification key-operated locks on all windows and doors, and

- ensuring windows are never left open in unoccupied rooms.

One: High Uncertainty In The Us And Global Economy

Gold is often revered as the ultimate store of value in times of uncertainty with the global and US economy.; Predicting the next big moment of uncertainty could potentially yield significant gains on gold purchases.

In recent history, we have witnessed two particularly high spikes in the value of gold.; The first between 2009 and 2011, at the height of the financial crisis and the second surrounding the Brexit vote of 2016 – both times of extreme economic uncertainty. In these moments of economic downturn, investors flocked to gold, and in the process, increased demand which in turn, increased prices and ultimately increased the value for gold.

Currently, amidst some economic uncertainty amidst China and the US as well as global growth slowdown, stock markets have seen their prices peak and begin to stagnate or drop.; These events, though not great for the world economy, tend to all be very good things for the value of gold. It may not be a perfect time, but it is definitely something worth keeping an eye on.; There are more indicators below to help aid in pinpointing the right moment to cash in on your gold.

Recommended Reading: Do Diamonds Look Better In White Or Yellow Gold

Can I Sell Gold Jewelry

Yes, its possible to sell gold jewelry. If you do choose to sell gold jewelry, youll need to decide whether youre trying to sell it as jewelry or as gold, as this will impact your options when looking for a buyer.

If you want to sell your jewelry as jewelry, youll want to look to jewelers, pawn shops, or a way to sell to other consumers, such as through eBay or Craigslist.

If the jewelry is old, you might also have luck selling it to a person or shop that focuses on antique goods.

Selling jewelry as jewelry is usually best if it has some historical or artistic value. A plain gold necklace will be worth less than a well-preserved, hundred-year-old necklace that contains the same quantity of gold because the old necklace has historical significance.

If you want to sell your jewelry for the value of the gold it consists of, youll want to focus on selling to gold dealers or other companies that specialize in dealing with precious metals.;

With these buyers, the value of your jewelry will be tied to the amount of gold it contains. Jewelry with higher purity gold will be worth more by weight than jewelry with lower purity gold.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Recommended Reading: Can Rose Gold Be Resized

Online Gold Bullion Dealers

You can find many established gold bullion buyers online, usually offering a fixed, exact price per unit for specific gold coins such as Buffalo gold coins and American Eagle gold coins.

Online gold bullion dealers often have low operating expenses, allowing them to offer competitive prices for gold coins. Once you sell your coins, youll need to ship them with a delivery service that provides insurance and tracking.

How Do Gold Buyers Make Money

Gold buyers are often gold dealers who can make money in a couple of different ways. They can buy gold from consumers at a discounted price and then sell that gold to wholesalers and refiners in their supply chain.

Other gold buyers stock an inventory of gold that they have pre-purchased in bulk at a discount. They will sell individual and smaller amounts of gold to consumers, taking a mark-up in the process. Other dealers are brokers who are strictly middlemen who take orders from one entity and drop-ship orders from larger wholesalers.

You May Like: What Dentist Does Gold Teeth

How Much Is Rose Gold Worth

As with regular gold, how much your rose gold is worth will depend on its karat.

18k rose gold contains 75% gold. To determine how much your 18k rose gold is worth, just find its weight in grams and multiply that by 0.75. Then, multiply that number by the current spot price of gold.

14k rose gold contains 58.3% gold. To figure out how much your 14k rose gold is worth, find its weight in grams and multiply that weight by 0.583. Then multiply that number by the current spot price of gold.;

Can I Sell My Gold To A Bank Asked Richard

Can I sell gold to a bank?

Many consumers consider selling gold to a bank. The bad news is that most banks do NOT accept gold due to missing evaluation possibilities. During the last 10 years many counterfeit coins and bars appeared because the gold price raised so rapidly. The risk of buying gold with a tungsten core is serious and most banks are not willing to bear buying-risks.

Large banks such as Wells Fargo, Chase Manhattan Bank or the Bank of America operate too many branches and it is almost impossible to get thousands of bankers educated on testing gold. Moreover the equipment for testing gold is extremely expensive. Our company for example owns testing equipment worth tens of thousands of dollars and using high-tech equipment is mandatory in doing a precise evaluation.

The Alternative to Selling to Banks: reDollar

If you are looking for a very reliable place to sell gold, reDollar.com is the perfect alternative to a bank. We are a FinTech Startup company offering the best buying service for gold in the United States. Selling is risk free and we pay the highest possible price for your gold. Even appraisers refer their clients to our company because they know that our work is exceptional, honest, and professional.

What about community banks or private banks? Can I sell my gold to those banks?

reDollar.com Needs Less Than 24 Hours for Testing

| Sell per gram |

| $32.64 |

Also Check: How To Buy Gold In Robinhood

Top Five Signs It Is Time To Sell Your Gold

Gold Investment Precious Metals

Are you holding onto gold?; Maybe you have recently inherited a collection of gold coins, or gained interest in diversifying your wealth into precious metals, and if so, do you need help determining exactly when the right time is to sell?; Do you even know what to look for to maximize your payout?

Before you start thinking about where to sell your gold, you need to decide whether its the best time to sell your gold. ;No one can be sure how the price of gold will move- the price fluctuates regularly depending on economic conditions and investor demand.; But there are several indicators you can identify to help determine if your gold has the most value now.

In this post, well be discussing FIVE Signs that will help ensure that you will receive the highest payout for your gold.

The Hidden Risk Of Coin Ownership

Many people buy gold coins as a form of ultimate protection from a future crisis.

- Some believe the next crisis will come in the form of a breakdown of social order. This sort of crisis is rare. Were it to happen gold owners would quickly learn the huge risks of using it as money. When the social order breaks down almost nobody pays with gold because they are sensibly frightened to be identified as a gold owner. The gold is unusable while at its most valuable.

- A breakdown of social order is uncommon, but would always be accompanied by a serious financial crisis. Crises in finance also happen independently of social breakdown, and with much higher frequency, making them a much more common style of problem we are likely to face. Most of us will experience local financial crisis in our lifetimes usually more than once.

When these cause a run on a rapidly depreciating currency governments tend to initiate capital controls, which are programs for preventing the flight of usable capital from their country.

It may well be possible to sell gold owned domestically during such a crisis. However formal channels under capital control environments will offer an official government-set price in local currency, which will be far below the true world-market price. Meanwhile informal channels extract the deep discounts of dealing in illegal contraband, and much of the value will be lost to middlemen.

Also Check: Who Buys Gold Filled Jewelry

When Is The Best Time To Sell Gold And Silver

Selling your gold and silver bullion is one of the quickest and easiest ways to get cash on hand. When you sell your old gold nuggets or old silver or gold jewellery, you dont have to deal with loans, banks, and interest rates. Its no fuss no muss ordeal to get cash for gold. While you could possibly take your gold and silver coins to a pawn shop to sell, theres a better way to get top dollar when you sell your precious metals. At Gold Buyers Melbourne, we specialise in buying gold and silver, offering competitive pricing you wont find an average pawnshop. A lot of people will speculate on when its the best time to sell their bullion coin. Heres what we believe as professional gold buyers.

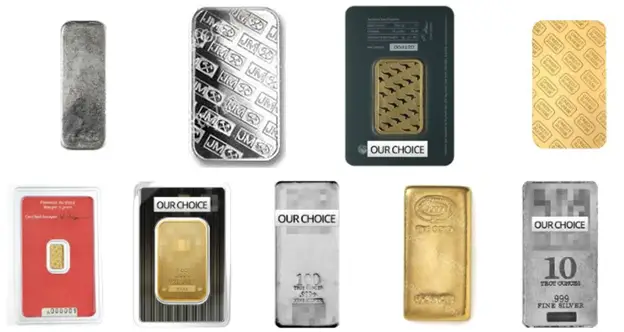

Selling Gold & Silver Bars

Gold and silver bars generally have high resale value, especially those bars that have been kept in professional vault storage.

Bullion bars produced by the most reputable mints and refineries have the strongest resale value. These bars come with a seal from the mint of origin, and sometimes include a serial number for easy identification and certification. With these bars there is low risk involved in buying or selling.

Browse our gold and silver bars

Don’t Miss: Where To Buy 24 Karat Gold

When The Us Dollar Is Strong

Wait a minute, we just stated that the best time to sell gold is when the U.S. dollar is weak. Now were suggesting the opposite. What gives?

The truth is that you can make an argument for either scenario! An important thing to remember in this case is that when gold is sold, what youre actually doing is making a trade: in exchange for the gold, you will get currency, usually in the form of U.S. dollars. Where you once owned gold, now you own dollars. When the U.S. dollar is strong, it can be more valuable as money than as gold.

The decision to sell gold should not be treated lightly. At the end of the day, the reason youve invested in gold is most likely for the security offered by a diversified portfolio. While the price of gold will periodically rise and fall, precious metals will always have value. Ultimately, the best time to sell gold may just be if a true financial emergency has arisen. If you cant count on the U.S. dollar, you can always count on gold.