What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

Prediction #: Gold Prices Will Increase

Even though the price of gold is at an all-time high, many people think that the market will maintain its bullishness and that the price of gold will only go up from here. Some industry experts are predicting that gold could be worth anywhere from $3,000$5,000 per ounce in the next 510 years!

For those who think gold prices will increase, they cite that people are now recognizing the value of gold, which will increase the demand, therefore increasing the value. Others cite unstable economies, due in part to the coronavirus, as the reason for this potential increase, as the world will likely take years to overcome this recession.

So Many Questions About Gold Prices

What is the cost of gold jewelry? How does the cost of gold jewelry compare to the price per ounce of gold on the metals market?Are rings more expensive by weight than chains? What is retail markup? What makes one type of gold jewelry more expensive than another?

Here at we get asked and try to answer all kinds of jewelry questions. With help from my;mathematically;happening husband Jeremy, we take on these questions!

You May Like: Who Buys Gold Filled Jewelry

What Is The Price Of The Gold And Silver Ratio

The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold.

Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold.

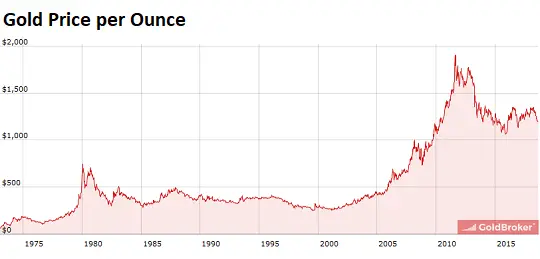

Gold Price Chart On 20 Years

The historic gold charts show the dominant trends for the gold price. There is no need to look at the longest timeframes because the gold price chart on 20 years shows the ongoing dominant trend which is sufficient for gold investors. The gold price chart on 20 years reveals 2 very specific price points which are the ones that are crucial in determining when the new secular gold bull market starts. Note that these price points were also discovered in our;gold price forecast 2019.

Most investors tend to forget the importance of long term charts. Some other investors tend to focus on charts that span over too long time periods. For instance the intraday or daily gold price chart do not caryy any relevant information on dominant patterns, and the 100 year gold chart;is way too long to see the current pattern at play.

Specifically for gold it is important to choose the right timeframe, and we make the point in this article that the gold price charton 20 years is the one to look at to determine the ongoing dominant trend.

Note that the 20 year gold chart may be combined with the;Gold Price Historic Chart on 40 Years;although it is a not a must to do so.

Recommended Reading: Where Is The Best Place To Buy Gold Jewelry

Dominant Trend On The 20 Years Gold Price Chart

Below is the gold price chart on 20 years.

The 2 dominant trends are clear:

- The grand gold bull market that started in 2001, and peaked at 2011, after a 10-fold rise of the gold price.

- The violent gold bear market that started in 2011, and is still ongoing.

Now here it becomes interesting. The million dollar question is which trend is now dominant?

Is it the bear market pattern is the dominant trend or the bull market is dominant? In other words is it the falling channel since 2011 that is dominant or is it the rising trendline since 2001?

This may seem a detail, but it really isnt. Its the most important question to sort out.

We firmly believe that the falling channel is the one that has the predictive value. A limited number of price points important to watch should be derived from the falling channel is what we are saying. As per Tsaklanos his 1/99 investing principles;it is a handful of price points we should derive from this bear market channel.

More specifically, we believe there are 2 price points which have predictive value.

The Cost Of Everyday Items In The 1970s Compared To Gold:

While the contrast isnt as significant as between the 50s and the 60s , from the 60s to the 70s inflation continues to rise. Steaks cost about a quarter more per pound and the average cost of a car goes up $850.

The breakdown:

Cost of steak : $1.30

Cost of a nice suit: $56.95

Cost of a car: $3450

Cost of an oz. of gold: $38.90

You May Like: How Much Is 10 Ounces Of Gold Worth

Golden Bull #: November 2015 May 2020

In the aftermath of the GFC, the Federal Reserve stoked an economic recovery with cheap money, seeing gold track to a low of $1,050 per ounce by December 2015. It was not until the election of a peculiar American president in 2016 that gold would rise again.

Pressure to increase interest rates, an aging debt-fueled economic recovery, a trade war with China, and the recent COVID-19 crisis has once again provoked economic uncertainty and a renewed interest in gold. With interest rates already at historic lows and quantitative easing as standard operating procedure, global economies are entering unprecedented territory.

There is still little insight into the direction of the economy but since November 2015 to May 2020, the price of gold has risen from $1,146 to $1,726 per ounce, 55% over 55 months.

View Historical Silver Prices At The No1 Silver Price Site

On this page you can explore silvers price history. The main chart can provide over four decades worth of silver price history. In addition, the interactive charts can be used to examine historical silver prices by the ounce or kilo and in numerous currencies besides dollars.

Although past performance is not necessarily indicative of future results, looking at a markets price history can potentially provide useful information. For example, looking at a silver price chart going back several months, if prices keep making higher highs and lower lows, then an uptrend may be present and prices could potentially continue higher.

In another example, looking at historical silver price data can also potentially help investors identify areas of support that could be solid buying opportunities. If silver has dipped down to $15 per ounce on numerous occasions but not gone lower, then buying interest may be strong at that level and it could potentially represent a good value for long-term buyers.

S Africa Court Shelves Black Mining Ownership Rule Changes

— Most Read from BloombergThe Global Housing Market Is Broken, and Its Dividing Entire CountriesIstanbul Turns Taps on Old Fountains, Joining Global Push for Free DrinksIn Paris, the Wrapped Arc de Triomphe Is a Polarizing PackageHow the Child Care Crisis Became a Global Economic FiascoMerkels Legacy Comes to Life on Berlins Arab StreetSouth Africas High Court struck down some changes to mining regulations that govern Black ownership targets, in a move that could potentially r

Today gold is 0.1% lower, as it is trading along $1,770 price level. What about the other precious metals?

What Affects Gold Prices

Like all markets, gold prices are subject to forces of supply and demand. When it comes to gold, supply is affected by trading trends as well as by mining companies digging up more gold that they can put into the market. One of the key factors impacting demand is the current market sentiment on inflation. When inflation rises, the value of the dollar goes down, and some investors flock to gold in hopes that it serves as a stable store of value.

What Is The Difference Between An Ounce And A Troy Ounce When Looking At A Gold Chart

A troy ounce is used specifically in the weighing and pricing of precious metals and its use dates back to the Roman Empire when currencies were valued in weight. The process was carried over to the British Empire where one pound sterling was worth one troy pound of silver. The U.S. Mint adopted the troy ounce system in 1828.

A troy ounce is about slightly heavier than an imperial ounce by about 10%. An imperial ounce equals 28.35 grams, while a troy ounce is equal to 31.1 grams.

Derivatives Cfds And Spread Betting

Derivatives, such as gold forwards, futures and options, currently trade on various exchanges around the world and over-the-counter directly in the private market. In the U.S., gold futures are primarily traded on the New York Commodities Exchange and Euronext.liffe. In India, gold futures are traded on the National Commodity and Derivatives Exchange and Multi Commodity Exchange .

As of 2009 holders of COMEX gold futures have experienced problems taking delivery of their metal. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. The delays cannot be easily explained by slow warehouse movements, as the daily reports of these movements show little activity. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts.

Outside the US, a number of firms provide trading on the price of gold via contracts for difference or allow spread bets on the price of gold.

The Cost Of Everyday Items In The 1950s Compared To Gold:

The 1950s, on the other hand, saw some serious inflation. The cost of steak nearly tripled, the cost of a car nearly doubled, and suits increased in price by almost 50%. Within a decade, the value of the dollar decreased significantly.

The breakdown:

Cost of steak : 93 cents

Cost of a nice suit: $36.95

Cost of a car: $1510

Cost of an oz. of gold: $40.25

Studying The Gold Rate Trend In India

Studying the gold rate trend in India could offer an insight into future fluctuations and investment plans can be made accordingly. The gold rate depends on a number of factors like the stability of the central bank, the supply and demand of gold in the market, quantitative easing, government reserves, the health of the jewellery industry and overall yearly production to name a few.

Gold prices in 2018 saw some significant fluctuations due to ongoing geopolitical tensions in the United States, which impacted the U.S. dollar rate and influenced global bullion demand. Local demand for the yellow metal was influenced by the fluctuating rupee rate, which continued to play second fiddle to the dollar. The ongoing Brexit crisis caused fluctuations across the Eurozone, which led to a surge in bullion demand towards the end of the year. The U.S government shutdown also served to pressure the U.S. dollar, though gold rates did not see much impact at the time.

The Price Of Gold Over The Past 20 Years

The price of gold got off to a slow start in the decade of the 2000s, but it had already begun its inevitable rise by 2002. Over the past two decades, the price of goldby the ounce, in bars or in investment coins, such as the Napoleonhas continued to climb. In fact, from 200 to 2020, we have witnessed a 400% increase in its euro worth! Lets take a look back at these two roaring decades for gold!

This Is The Melt Price

This value is what is known as the melt price of this particular chain.; The melt price refers to the actual price that your jeweler would receive from a refiner if they chose to melt it down and just be paid for the value of the gold.

The melt price, like the gold price, changes on a daily basis, but as long as gold stays stable in price, it will pretty much remain the same for any given period of time.; Keep in mind that the melt price does not take into consideration any other factors, such as labor to create the piece, any stones that may be set into the piece, or any margin for profit that will be added on at the point of sale.; Well discuss these points below.

The Cost Of Everyday Items In The 1940s Compared To Gold:

There wasnt much of a jump in inflation from the 1930s to the 1940s. Suits cost pretty much the same and steak actually dropped a few cents per pound. Cars continued their upward trajectory in price. By this time the price of gold was no longer fixed, so it started going up as well.

The breakdown:

Cost of steak : 36 cents

Cost of a nice suit: $25

Cost of a car: $850

Cost of an oz. of gold: $34.50

How Do Designer Jewelry And Custom Jewelry Prices Get Figured Out

Custom Made Engagement Ring

If you have a one-of-a-kind custom-made ring created for you, your price to be paid will be greater, than a ring of similar weight and style that was factory made. The cost of a custom made ring includes the time of t he designer to create it, as well as the wax carving or CAD/CAM creation, casting, polishing, setting and adding the special finishes or textures plus any engraving that make your ring unique.

A custom wedding or engagement ring has no economy of scale because it is one of a kind. So expect to pay more for the singular care that goes into its making.

The Cost Of Everyday Items In The 2000s Compared To Gold:

The first decade of the 2000s werent that long ago, yet there are still some meaningful differences in the prices then and now. The price of steak went up considerably in comparison to the 90s, a suit nearly doubled in cost, and the average cost of buying a new car increased nearly $10,000. The value of the dollar just keeps diminishing at this point.

The breakdown:

Cost of steak : $4.81

Cost of a nice suit: $475

Cost of a car: $24,750

Cost of an oz. of gold: $272.65

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

What Is Oz Gram Kilo Tola

Gold and most precious metals prices are quoted in troy ounces; however, countries that have adopted the metric system price gold in grams, kilograms and tonnes.

Grams = 0.032151 troy ounces

Tael = 1.203370 troy ounces

Tola = 0.374878 troy ounce

Though not as popular as kilograms and grams, Tael is a weight measurement in China. The tola is a weight measurement in South Asia.

Highest Price For Gold: Historical Gold Price Action

Gold hit;US$2,067.15, the highest price for gold at the time of this writing, on August 7, 2020.

Golds breach of the significant US$2,000 price level in mid-2020 was undoubtedly due in large part to economic uncertainty caused by the sweeping COVID-19 pandemic.

To break through that barrier and reach that record high, the yellow metal added more than US$500, or 32 percent, to its value in the first eight months of 2020.

Despite this recent run up, the gold price has seen its share of both peaks and troughs over the last decade. Rising as high as US$1,920 per ounce in late 2011, the price of gold took a deep dive half way through 2013, dropping to about US$1,220. The gold price then remained between US$1,100 and US$1,300 from 2014 to early 2019 but in the second half of that year, a softer US dollar, rising geopolitical issues and a slowdown in economic growth pushed gold above US$1,500.

Gold price chart via Kitco.

Compared to 2020, golds price performance in 2021 has been a letdown for many market watchers who were hoping to see further gains. Golds failure to do so has surprised investors and commentators alike.

When will gold once again return to its upward trajectory? Only time will tell, but veteran investor Rick Rule, who recently retired from Sprott , views such downturns in the gold market as an opportunity, not a cause for concern, as conditions are ripe for the gold price to push higher.

Easy History Of Gold Ounce Price Comparison To A Loaf Of Bread

Over seven years ago in September 2010 I wrote this article about the history of Gold ounce price in comparison to a loaf of bread. But how did I get it so wrong? I have an agricultural background and as an investor thatshow I make my income. Now in March 2018 I updated this article with my new thoughts and experiences.

For historical authenticity I will not change the details of myoriginal article. It can be found at the very bottom of this article.

So why has my comparison comparing; a loaf of bread to the price of Gold been so far out? For centuries bread was the staple diet and an importantcommodity regarding the cost of living. But a loaf of bread for centuries was over a kilo in weight compared to400 grams today and some markets now sell 350-gram loaves. Obviously my size comparison is completely out wack asmajor supermarkets reduce price, quality and the size of our loaves!