Child Tax Credit Third Installment Payment

The third round of the advance monthly payment for the child tax credit was deposited into millions of bank accounts on Sept. 15. The child tax credit is a benefit available to all families regardless of how little money they make even if they do not ordinarily file taxes. Since July, payments have been coming in the form of monthly $300 or $250 per eligible child and will continue through December amounting to half of the total benefit amount.

For a family eligible for the full benefit amount of $3,600 per child, they will receive a total of $1,800 by the end of December. This means even if you have not yet signed up for the credit, there is still time. You will receive the full $1,800 per eligible child, just in one or two full payments instead of the six that families who signed up earlier are receiving.

If you requested to file an extension on your 2020 tax return, you still might be eligible to receive child tax credit payment money. In the most recent press release, the IRS stated that those who file and have their 2020 return processed on or before Nov. 1 may be eligible for the next two monthly advance payments for the child tax credit. These payments would amount to half of the total benefit to be received, depending on the number of eligible dependents you have.

In order to register for the next child tax credit installment payment, you can click here.

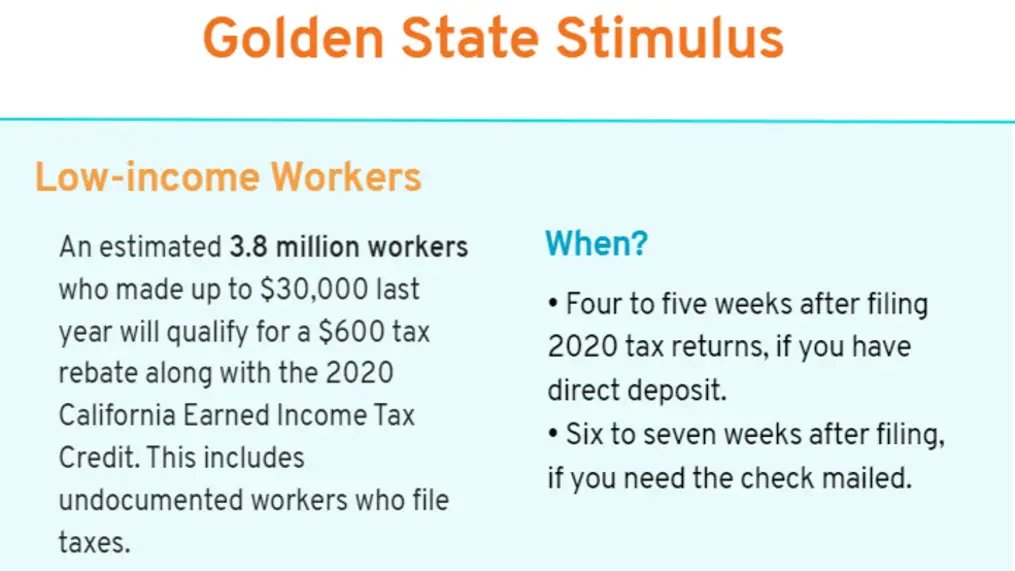

The California Comeback Plan Which Approved A New Round Of Stimulus Checks For More Residents Will Also See Some Californians Getting A Second Payment

The California Legislature approved a second round of Golden State Stimulus checks after the state ended up with a record budget surplus. The new round of economic aid to Californians raised the eligibility ceiling based on income from $30,000 to $75,000 giving around two thirds of the states residents access to the tax rebate scheme.

Some lucky residents who received a payment in the first round will get an additional payment in the latest round. Those with dependents and those who file taxes with an ITIN and didnt qualify for the federal Economic Impact Payments.

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income that’s on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Read Also: Are Gold’s Gym Treadmills Any Good

Direct Deposit Vs Paper Check

The FTB is sending out Golden State Stimulus payments in two ways; direct deposit and paper checks sent in the mail. In general, you can expect to get the payment using the same refund option you selected when filing taxes.

Typically, youll receive this payment using the refund option you selected on your tax return.

- Direct deposit: If you selected direct deposit as your refund option on your tax return

- Paper check in the mail:

- If you selected paper check as your refund option on your tax return

- If you received an advanced refund through your tax service provider or paid your tax preparation fees using your refund

Do I Qualify For The New Stimulus Payments

In the second round, people who made up to $75,000 could receive one-time $600 direct payments.

If you werent eligible for the first check and did not claim one or more dependent, youll receive $600. If you did not qualify earlier and also claimed one or more dependents, you will receive an extra $500.

If you received a check in the first round of payments and claimed one or more dependents, you will receive $500 this time around.

Undocumented immigrants, who have been left out of federal stimulus bills, may also receive payments in the second round. Those who filed taxes with an individual taxpayer identification number, or ITIN, and qualified for the first round will receive $1,000 if they claimed one or more dependents.

ITIN filers who qualified for the first round and did not claim a dependent credit will not receive payments.

Recommended Reading: How Much Is 24 Karat Gold Per Gram

Golden State Stimulus : New Payment Information

The state of California is in the process of sending Golden State Stimulus payments to about 9 million eligible people. So far, the states Franchise Tax Board has sent two rounds of payments to about 2.6 million people.

The next round of GSS payments will go out on Tuesday, Oct. 5, according to Andrew LePage with the FTB. This round will include direct deposit payments as well as the first mailed checks to go out. LePage said direct deposits typically show up in accounts within a few business days. FTB advises people expecting mailed checks to allow up to three weeks for them to arrive.

At this point, the FTB is not sure how many payments it will be able to send on Oct. 5. Future payments will go out every two to three weeks after that, but those dates have not yet been determined. The state is also working on a new schedule for paper checks.

The hope is to get all Golden State Stimulus payments out by the end of the year.

In order to receive the payment, people need to file a 2020 tax return. The deadline to file is Friday, Oct. 15.

States Are Already Sending More Stimulus Checks To Families Here’s What It Means For You

Some governors are giving residents more stimulus money and teacher bonuses. Is your state on the list? Here’s what you should know.

Three stimulus checks helped many people pay for household expenses during the pandemic.;

So far, three stimulus checks have been sent to eligible families from the federal government, and advance child tax credit payments;are coming monthly through December . But with the rise in;delta variant;cases, the pandemic continues to make a huge impact on the economy and families. And even though some people may qualify for up to $1,400 in additional stimulus money if they had a baby this year, that money won’t come until next year.;

The big question is, will more money come this year? The answer is tricky. Some governors are giving their residents additional financial relief. California residents just got a second round of;Golden State Stimulus checks;for $600 . And other states are giving teachers bonuses . But as of now, Congress doesn’t plan to approve another federal stimulus check this year. Lawmakers are focused on the $1 trillion;infrastructure bill;and the $3.5 trillion federal budget package that could provide aid in other ways.;

Recommended Reading: Is Bryan Anthonys Real Gold

When You’ll Receive Your Payment

We anticipate that payments will begin in September 2021. If you received a payment by mistake or something may be wrong, review Received an erroneous payment. Visit Stimulus payments for more information.

Your stimulus payment will not be scheduled until your return is processed. Review our Wait Times dashboard for tax return and refund processing timeframes.

Golden State Stimulus Program: How To Contact Cftb

Californians can also track coronavirus stimulus checks by contacting the CFTB. You can contact the agency by three ways: phone, chat and mail.

Californians can call the CFTB representatives from 8 AM to 5 PM Pacific Time at 800-852-5711. Those who live outside the U.S. can reach the CFTB at 916-845-6500.

To reach CFTB through chat, you need to login into your MyFTB account. You can chat with a CFTB representative on weekdays between 8 AM to 5 PM.

You can also reach CFTB through the mail with your questions, documents or any other communications. The correspondence address to reach CFTB through the mail is: Franchise Tax Board, PO Box 942840, Sacramento CA 94240-0040.

Along with the support for tracking, the CFTB has updated its website with a tool that would give you an estimate of the amount you could expect under the Golden State Stimulus program.

- TAGS

Recommended Reading: What Is Vermeil Gold Plated

When To Expect Your Golden State Stimulus Payment

According to the FTB, these are the time periods in which you should expect to receive your Golden State Stimulus payment, depending on when you filed your tax return:

1. If you filed taxes between 1 Jan and 1 Mar

If you filed your taxes between 1 January and 1 March, your stimulus check will arrive after 15 April: within two weeks of that date for direct-deposit recipients and within four to six weeks for paper check recipients.

2. If you filed taxes between 2 Mar and 23 Apr

If you filed your tax return between 2 March and 23 April, your stimulus check will arrive after 1 May: within two weeks of that date for direct-deposit recipients and within four to six weeks for paper check recipients.

3. If you file taxes after 23 Apr

If you file after 23 April, direct-deposit recipients will get their check within 45 days of their return being processed and paper-check recipients will be paid theirs within 60 days of their return being processed.

The FTB has a useful wait time dashboard letting California taxpayers know how long it will take for their tax return to be processed after filing.

Individuals With An Ssn

- Qualified for GSS I and claimed a credit for at least one dependent: $500

- Didnt qualify for GSS I and did not claim a credit for any dependents: $600

- Didnt qualify for GSS I and claimed a credit for at least one dependent: $1,100

- Qualified for GSS I and didnt claim a credit for any dependents: $0

You May Like: Who Buys Gold Filled Jewelry

Latest Stimulus Payments: Qualifying California Residents Could Receive Up To $1100 This Month

The California Franchise Tax Board announced this week that the second round of state stimulus payments will be released tomorrow, Sept. 17. An estimated 2 million checks are set to hit bank accounts via direct deposit, the tax board stated. Qualifying recipients of the Golden State Stimulus II payment would have made $75,000 or less on their 2020 tax return.

Learn: Farm Workers and Meat Packers To Receive $600 Checks

The first round of payments dubbed Golden State Stimulus I released on August 27 and saw around 650,000 payments go out, which were aimed more toward low-income Californians. Governor Gavin Newsom has previously stated that the overwhelming majority, about two-thirds of Californians, will be eligible for the stimulus payments. The tax board has identified around 9 million tax returns that qualify for the state-sponsored stimulus payments, but expect to receive more returns by the Oct. 15 deadline that could in turn qualify even more people.

More: Pandemic Stimulus Checks Softened the Blow of Rising US Poverty Rates

Newsom signed the Golden State Stimulus in July, creating one of the nations first state stimulus plans. California operates under a progressive tax schedule, meaning the more you make, the more you pay in taxes. This, in conjunction with thrifty budgeting, left the state in an advantageous surplus that Newsom has used to fund the state stimulus checks, which are in addition to the federal payments that went out this year and last.

Estimate Your Stimulus Amount

The Golden State Stimulus has been expanded so more Californians are eligible. Now people may qualify for the new Golden State Stimulus II. Use this tool to find out what you may receive.

This payment is different than the Golden State Stimulus I .

If you qualify, you only need to file a complete 2020 tax return to receive the Golden State Stimulus II payment.

You May Like: What Is The Toll For The Golden Gate Bridge

Can We Expect A Fourth Stimulus Check

The short answer is, no.

Researchers have found;that the first three stimulus checks helped reduce hardships like food insufficiency and financial instability. So far, during the pandemic, eligible adults have received a max of $3,200 and children have received up to $2,500. For struggling families, that’s not enough to bounce back from lost wages and benefits.

Since the;American Rescue Plan, the White House has proposed several packages, including the American Jobs Plan and the;Build Back Better;agenda, but those don’t call for more direct aid. President Joe Biden is “open to a range of ideas” regarding stimulus aid, according to a June statement by;White House Press Secretary Jen Psaki, but he already put forward what would be “the most effective for the short term.”

The scaled-back compromise of the $1 trillion bipartisan infrastructure deal, which was;agreed to in the Senate on July 28, doesn’t include anything related to “human infrastructure” — it doesn’t address child care, improved wages or job training. Instead, those elements are to be included in the proposed $3.5 trillion reconciliation package. The White House has outlined its “Build Back Better Agenda,” incorporating lower health care costs, tax cuts and investments in teachers and schools. Senate Democrats are working on the economic plan, but the process of approving final versions of the bill in Congress could take a while.;

Second California Golden State Stimulus Payments Already Going Out

The Golden State Stimulus II or GSS II, is what the state is calling a second round of payments that range anywhere from $500 to $1,000 and which will be going out by mail or direct deposit through the end of the year.

“Yeah, I got the first check which was great and then I thought the second one is coming cool, but it just never came, said San Luis Obispo resident Phil Epstein.

If you are like Epstein, waiting for the second round, you likely won’t need to wait much longer.

Residents who’ve already filed their 2020 tax return in California should start seeing payments hitting their bank accounts.

“Some may have already seen that in their bank accounts. So if you have not, chances are you will be receiving it pretty soon, said Jose Ramirez Melgoza, employee at Emmanuel’s Tax & Bookkeeping in Santa Maria.

According to Ramirez, similar to the first payments, those who don’t have a Social Security number but have individual taxpayer-identification numbers also known as ITINs still qualify.

One difference now is the adjusted gross income has gone up from $30,000 to $75,000, giving more Californians an opportunity this time around.

Additionally, some people who received the first Golden State Stimulus payment earlier this year can also qualify for the additional payment.

These are the requirements according to the state of California Franchise Tax Boards Website:

Individuals with an SSN

Individuals with an ITIN

Recommended Reading: How Much Is 14k Italy Gold Worth Per Gram

Expanded Golden State Stimulus The Largest State Tax Rebate In American History To Start Reaching Californians Tomorrow

Two out of every three Californians eligible for Golden State Stimulus payments, providing $12 billion in total relief

SACRAMENTO Tomorrow, August 27, Californians will begin receiving the second round of Golden State Stimulus payments, the historic $12 billion state tax rebate program enacted by Governor Gavin Newsom to provide direct relief for Californians hit hardest by the pandemic and support the states economic recovery.

The Golden State Stimulus program was a key element of the Governors Immediate Action package in January to offset the worst economic effects of the pandemic, allocating $4 billion for low-income Californians, which included undocumented households that file taxes with an Individual Taxpayer Identification Number who were not eligible for the federal stimulus. In July, Governor Newsom expanded the program to include Californians making $75,000 or less. All told, the Golden State Stimulus package resulted in:

The Golden State Stimulus is key to lifting up those hit hardest by the pandemic and supporting Californias economic recovery, putting money directly in the hands of folks who will spend it on basic needs and within their local communities, said Governor Newsom.

Video message from;Luisa, a Golden State Stimulus recipient.

Heres what leading advocates said about Governor Newsoms historic Golden State Stimulus:

For The First Golden State Stimulus Payment

There are four bits of criteria that you will need to meet in order to receive the first Golden State Stimulus payment. These are:

- If you receive CalEITC or make less than 75,000 dollars per year and file with an ITIN. To qualify for CalEITC, you must earn at least 30,000 dollars in taxable income in 2020, be 18 years or older or have a qualifying child, and file as a status other than ‘married’ or ‘registered domestic partner filing separate.’

- You lived in California for more than half of 2020.

- You are a California resident on the date that checks are distributed.

- You aren’t eligible to be claimed as a dependent by someone else.

Don’t Miss: Can You Buy Gold On Etrade