Trade Gold Cfds With Capitalcom

What do you think, will the gold price rise or fall? You can start trading the precious metal with contracts for difference on Capital.com.

CFD trading gives you the opportunity to try to profit from both positive and negative price fluctuations. You can either take a long position, speculating that the gold price will rise, or a short position, speculating that the price will fall.;

Historical Gold Rate Trend In India

The below chart represents the historical movement of gold prices in India:

| This chart contains the average annual price for gold from 1964 present. |

YearPrice YearPrice Rs.63.25Rs.4,334.00Rs.71.75Rs.4,140.00Rs.83.75Rs.4,598.00Rs.102.50Rs.4,680.00Rs.162.00Rs.5,160.00Rs.176.00Rs.4,725.00Rs.184.00Rs.4,045.00Rs.193.00Rs.4,234.00Rs.202.00Rs.4,400.00Rs.278.50Rs.4,300.00Rs.506.00Rs.4,990.00Rs.540.00Rs.5,600.00Rs.432.00Rs.5,850.00Rs.486.00Rs.7,000.00Rs.685.00Rs.8,400.00Rs.937.00Rs.10,800.00Rs.1,330.00Rs.12,500.00Rs.1,800.00Rs.14,500.00Rs.1,645.00Rs.18,500.00Rs.1,800.00Rs.26,400.00Rs.1,970.00Rs.31,050.00Rs.2,130.00Rs.29,600.00Rs.2,140.00Rs.28,006.50Rs.2,570.00Rs.26,343.50Rs.3,130.00Rs.28,623.50Rs.3,140.00Rs.29,667.50Rs.3,200.00Rs.31,438.00Rs.3,466.00Rs.35,220.00Rs.48,651.00

*The price of gold showed a fluctuating trend through the year of 2020 after opening the year on a positive note due to the COVID-19 pandemic. With the precious metal serving as a safe-haven for investors, the demand for gold increased and so did its price. The equities market suffered during the pandemic but showed signs of recovery at the end of 2020 when the price of gold declined marginally.

Its important to note that the gold prices would fluctuate during the year and the amount mentioned below is a representation of the average price for that year.

Also check :;Today’s Gold Rate in India

Gold Price Technical Outlook Warns Of Looming Death Cross Formation

The price of gold trades back below the 50-Day SMA as it gives back the advance following the Federal Reserve interest rate decision, and the precious metal may face a further decline ahead of the US Non-Farm Payrolls report as a death cross looks poised to take shape over the coming days.

The negative slope in both the 50-Day and 200-Day SMAs warns of a looming crossover in the moving averages as bullion extends the decline from the start of the week, and it remains to be seen if fresh US data prints will influence the price of gold as the economy is now expected to add 880K jobs in July.

An upbeat NFP report may dampen the appeal of gold as it puts pressure on the Federal Open Market Committee to draw up an exit strategy, while a lackluster development may encourage the central bank to retain the current course for monetary policy as Governor Lael Brainard insists that employment has some distance to go.

As a result, the price of gold may move to the beat of its own drum ahead of the NFP report as the FOMC remains reluctant to switch gears, but the technical outlook casts a bearish forecast for bullion as a death cross looks poised to take shape over the coming days.

You May Like: How Much Is 12 Grams Of Gold Worth

Analysts Surveyed By The Lbma Predict Average Gold Price Of Us$ 1974 For 2021

The London Bullion Market Association published its annual precious metals forecast survey. On average, the 38 surveyed analysts forecast a price of US$ 1,973.8 per troy ounce in 2021. This would imply a gain of 4.6% versus the average price level in January 2021 and an increase of about 11.5% over the average price seen in 2020.

The LBMA cites declining interest rates in the United States, as well as the monetary and fiscal policy and a weak US dollar as key reasons mentioned by the surveyed analysts. The range of this years predictions is wide due to uncertainties around geopolitics, the COVID-19 pandemic and economic growth expectations.

| Time Frame |

|---|

Goldman Sachs Lowers Forecasts For Gold In 2013 And Predicts Turn In Gold Price Cycle

According to Reuters, Goldman Sachs considers a turn in the current gold bull cycle in 2013 as likely. Goldman Sachs cut its gold price forecasts for the coming three, six, and twelve months to US$1,825, US$1,805, and US$1,800 an ounce respectively. Currently, the gold price is slightly below US$ 1,700 an ounce.

The bank also predicts for 2014 a gold price of US$1,750 an ounce.

Goldman Sachs expects the gold price to be driven by the opposing forces of more Fed easing and a gradual increase in real rates on better U.S. economic growth. According to their expanded modelling, the improving U.S. growth outlook will likely outweigh further Fed balance sheet expansion. The bank added it was difficult to call a price peak due to the elevated risks to its growth outlook, particularly with regard to the fiscal cliff.

The bank said, their forecast for limited upside to gold prices accounted for their economists expectation for further Fed easing later in 2013. It expects that an improving U.S. growth outlook would more than offset the potential for further Fed balance sheet expansion.

In case of absent additional easing in late 2013, Goldman Sachs predicts gold prices to decline at a faster pace in 2013 and to reach $1,625 an ounce by the end of that year. In case of a weaker U.S. growth outlook, gold prices are predicted to trend higher, reaching $1,900 an ounce by the end of 2013.

You can find the full Reuters article here.

| Time Frame |

|---|

You May Like: How Much Does Xbox Gold Cost

Gold Prices Crash Today Plunge To 4

2 min read.Livemint

- Gold rates in India have plunged 1,600 per 10 gram in just two days, tracking global selloff in precious metals

Gold and silver prices continued to skid in India, tracking a global selloff in precious metals. On MCX, gold futures fell 1.3% or 600 to a four-month low of 46,029 per 10 gram while silver shed 1.6% or 1,000 to 63,983 per kg. In the previous session, gold and silver had plunged about 1,000 and 2,000 respectively.

In global markets, gold rates slumped as much as 4.4% today as better-than-expected US jobs data fueled fears that the Federal Reserve would raises rates quicker than expected. Spot gold were down 2.3% to $1,722.06 per ounce after touched $1,684.37 earlier in the session. Silver was down down 2.6% at $23.70 after slumping much as 7.5% earlier in the session.

Evergrande or not, steel firms are standing strong

“Weak bias for gold is likely to continue while prices stay below $1,788. Next major support is seen at $1,665 a direct drop of which is a short term bearish signal. Likewise, it required to break above $1,835 to trigger recovery rallies in the counter,” domestic brokerage Geojit said in a note.

Data released on Friday showed, US employers hired the most workers in nearly a year in July and continued to raise wages. The data boosted the dollar and benchmark US. 10-year Treasury yields, hurting gold’s appeal as an inflation hedge.

Evergrande or not, steel firms are standing strong

Abn Amro Predicts Lower Gold Prices In 2017 But Recovery In 2018

While gold prices have fallen below 1,200.- U.S. dollars, ABN AMRO expects the price of gold to weaken to 1,100,- USD in 2017 before recovering to 1,300.- U.S. dollars at the end of 2018.

After the short-lived gold price rally triggered by;Trumps election victory, according to the bank, investor sentiment made a dramatic U-turn. ABN AMRO states that;the rise in U.S. Treasury yields and the rally in U.S. equity markets in combination with an environment of positive investor sentiment substantially strengthened the U.S. dollar and caused the decline in gold prices.

The bank expects the current negative environment for gold prices to stay in place for 2017. As the key driver for the gold price they identify investor demand which they expect not to be compensated by rising;jewellery and industrial demand due to lower prices.

According to the bank, rising inflation expectations are more than offset by the rise in U.S. Treasury yields and expectations about;upcoming rate hikes by the Fed. A rise in U.S. real yields and the absence of major inflation fears would push the gold price lower.

Higher U.S. equities, expectations of more rate hikes by the Fed and expectations of a strong uplift in the U.S. economy would drive the U.S. dollar. According to the bank, investors will find zero-income paying asset gold and other;precious metals unattractive because of higher income in equities and bonds.

| Time Frame |

|---|

You May Like: How Much Is 14k Italy Gold Worth Per Gram

Coronavirus Pandemic: Sbp Governor Says Inflation Expected To Decrease In Coming Days

Saturday Apr 11, 2020

Governor State Bank of Pakistan, Reza Baqir, said on Friday that inflation was expected to decrease further in the coming days and that the central bank was ready to “take action” in the coming days regarding the interest rate if the situation required so.

Baqir was speaking to anchor Shahzeb Khanzada on Geo News’ programme ‘Aj Shahzeb Khanzada Ke Sath’ when he said that the central bank takes decisions about the interest rate by taking into account the inflationary situation in the days to come.;

“The statistics that we have with us clearly show that inflation is expected to decrease further in the coming days,” he said. “As we keep receiving information about the country’s economy, the State Bank will be ready to take action in future about the interest rate,” he added.

He said that it was extremely important for the government to focus its energies on employment and economic growth. The SBP governor said that Pakistan had cut its basis points by 255 which was the second-highest decline in the world.

Speaking further about the SBP’s new scheme, Baqir said that businesses who do not lay off employees will be able to avail loans on a 5% rate. “Businessmen who are on the active tax list will be able to avail loans on 1% interest rate as well,” he said.

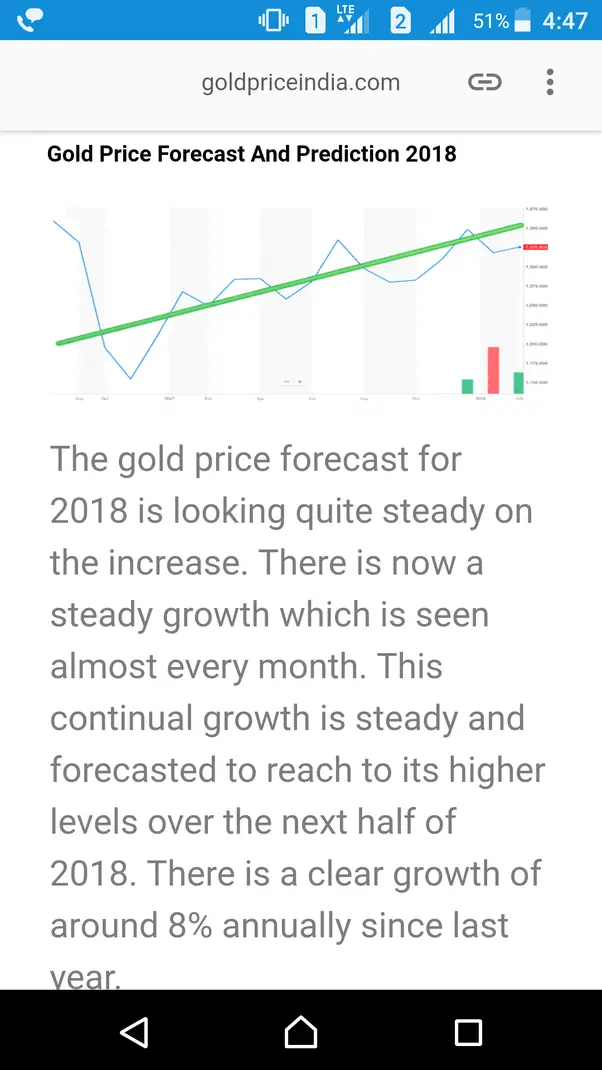

Gold Price Forecast By Day

| Date | |

| 46121 | 45439 |

In 1 week Gold price forecast on Wednesday, September, 29: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price in India on Thursday, September, 30: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Friday, October, 1: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price in India on Monday, October, 4: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Tuesday, October, 5: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs.

In 2 weeks Gold price in India on Wednesday, October, 6: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Thursday, October, 7: exchange rate 45476 Rupees, maximum 46158 Rs, minimum 44794 Rs. Gold price in India on Friday, October, 8: exchange rate 45473 Rupees, maximum 46155 Rs, minimum 44791 Rs. Gold price forecast on Monday, October, 11: exchange rate 45476 Rupees, maximum 46158 Rs, minimum 44794 Rs. Gold price in India on Tuesday, October, 12: exchange rate 45548 Rupees, maximum 46231 Rs, minimum 44865 Rs.

In 4 weeks Gold price in India on Wednesday, October, 20: exchange rate 45278 Rupees, maximum 45957 Rs, minimum 44599 Rs. Gold price forecast on Thursday, October, 21: exchange rate 45015 Rupees, maximum 45690 Rs, minimum 44340 Rs. Gold price in India on Friday, October, 22: exchange rate 45437 Rupees, maximum 46119 Rs, minimum 44755 Rs.

Read Also: What Is There To Do In Golden Colorado

Gold Price Forecast: 2021 2022 And Long Term To 2030

;During the last year, the gold price;increased from $1,479.13 to $1,858.42, marking a 25.6% growth year-over-year. In the first month of 2021, gold prices averaged $1,866.98/oz, 0.46 percent up from December. The World Bank predicts the price of gold to decrease to $1,740/oz in 2021 from an average of $1,775/oz in 2020. In the next 10 years, the gold price is expected to decrease to $1,400/oz by 2030.

In 2020, the high level of;uncertainty;observed in the global economy due to the;outbreak of Coronavirus fueled demand for the yellow metal. In 2021, the gold price is predicted to gradually fall as uncertainty has decreased, but;volatility;is still high.

Investors’ expectations for an economic recovery due to;vaccinations;cautiously suggest a decline in gold prices, however, any event in 2021 that could increase volatility and uncertainty may put upward pressure on gold prices as;low-to-negative interest rate;conditions and loose monetary policies persist.

Goldman Sachs Increases Gold Price Forecasts Based On Stronger Net Speculative Positioning And A Weaker Us Dollar

May 11, 2016

The bank raised its gold price forecasts for the three, six and twelve months periods to US$ 1,200 , 1,180 and 1,150 per ounce, respectively. It justified the higher forecasts with a weaker U.S. dollar and stronger net speculative positioning.

As the price of one ounce of gold is currently above US$ 1,260, the increased forecasts still mean a decrease of its price.

However, the bank said it would not see much room for further increases in the price of gold;as there was not much room for the U.S. dollar to depreciate as the Fed had not much room left to lower interest rates. Moreover, the Chinese economy would have only limited room to contribute to the U.S. dollars weakness by driving emerging market currency strength which, in turn, would weaken the U.S. dollar.

| Time Frame |

|---|

Don’t Miss: Does Kay Jewelers Sell Real Gold

Gold Big Picture Update

GOLD MONTHLY TREND CHART: I like to turn to the monthly gold chart for a big picture perspective. Looking at the top indicator, you will see this is the first Monthly Stochastics dip below 80 in a new bull market. We had a similar setup in 2003 when gold dropped to $320, which turned out to be a superb buying opportunity. I believe the same is true now.

The 20-Month Average : In bull markets, gold prices should hold above the rising 20-month average . The only exception is when prices dip into an 8-year low . Note- The next 8-year low is not due until 2024.

GOLD PRICES AFTER SEPTEMBER 2001: After the initial shock of the 911 attack, gold prices fell back to pre-9/11 levels a few months later. That turned out to be one heck of an opportunity. I see the same setup now as gold approaches pre-Covid levels.

GOLD NOW: I believe we could be close to a bottom in gold. Prices could spike lower over the coming days if the stock market sells off, but I think that would be temporary. If we look back 5-years from now, I believe we will consider todays prices an amazing long-term opportunity.

In summary, Covid-19 was a pivotal turning point across the globe. There is a lot more money in circulation but the same amount of gold. Just like there was a brief opportunity to buy gold at pre-911 prices a few months after the event, investors are receiving a similar chance in gold now, in my opinion.

I believe now is the time to be greedy when others are fearful.

Gold Price Prediction For September 2021

The below gold price forecast article is based on one of our premium gold analyses.;Enjoy:

While golds rally on Sep. 3 allowed the yellow metal to retrace more than half of its 2021 decline, the music stopped at its July highs. Moreover, with mining stocks often leading during periods of sustained bullishness, the drastic underperformance of the HUI Index, the GDX ETF and the GDXJ ETF signal that golds relative strength is unlikely to hold over the medium term.

Moreover, with the recent event-driven rallies first underwritten by Powells dovish comments and then spearheaded by the Delta variants depression of U.S. nonfarm payrolls, progress on the health front will likely elicit the opposite reaction in the coming months. And once sentiment shifts, well likely witness a move to/below $1,700.

Please see below:

Just as the previous turning point triggered a reversal in gold, the same is likely to take place shortly.

Moreover, lets keep in mind that the yellow metal is also following the ominous roadmap from 2012. For example, if we break out the measuring tape and analyze the shape and the length of golds price action back then and compare it with today, its a tailored fit. Furthermore, the timeframe of the initial decline in 2012 approximately mirrored the length of the consolidation that followed. We see the same thing today gold has been consolidating for more or less as long as it had been declining.

To explain, I wrote previously:

Please see below:

Recommended Reading: What Is The Toll For The Golden Gate Bridge

Why Some Say The Dollar Could Collapse

Some say the euro could replace the dollar as an international currency. They point to the increase in euros held in foreign government reserves. Between the first quarter of 2008 and the first quarter of 2020, the holdings of euros almost doubled from $1.16 trillion to $2.19 trillion.

But the facts don’t support that theory. At the same time, U.S. dollar holdings more than doubled, from $2.7 trillion to $6.7;trillion. Dollar holdings are;61.99% of the $11 trillion of total measurable reserves. That’s only slightly less than the 62.94% held in;Q1 2008. The International Monetary Fund provides details about foreign exchange reserves for each quarter with the COFER Table.

China is the second-largest foreign investor in dollars. As of June 2020, it held $1.07 trillion in U.S. Treasury securities. China periodically hints it will reduce its holdings if the U.S. doesn’t reduce its debt. Instead, its holdings continue to increase. The U.S. debt to China;was 15% of America’s debt to foreign countries.;;

Japan is the largest investor with $1.26 trillion in holdings. It buys Treasurys to keep the value of the yen low, so it can export more cheaply. Its debt is 196% of its gross domestic product.

Factors That Influence The Gold Rate Forecast

In any traded commodity, demand and supply play a prominent role in defining its price. Gold is not a consumable product. All gold that ever mined is still available in the world. Also, every year, the amount of gold mined is not very up. And so, if demand for gold goes up, the price goes up since the supply is comparatively uncommon.

Gold prices have a converse relationship with interest rate. If interest rates fall, individuals dont get attractive returns on deposits. Hence, they break their deposits and buy gold instead to increase demand and it automatically increases price. And people sell their gold and invest in their deposits when interest rate goes high, it leads to a drop in demand and so the price.

When the inflation rates soar high, the value of the currency goes down. Also, most other investment avenues flop to deliver inflation-winning returns. Hence, most people start investing in gold. Even if high rates of inflation last for a longer period, gold acts as ideal privet since it is not influenced by fluctuations in the value of the currency.

India accounts for less than one percent of gold production globally. However, it is the second largest consumer of yellow metal. India imports large amounts of gold to meet the rising demand. Thus, import duty has important role in the gold price.

Don’t Miss: How To Invest In Gold Stocks