Sell Scrap Gold With Redollar

reDollar.com is designed to provide a great selling experience, and weve worked hard to create the best way possible to sell scrap gold online. Scrap gold has a decent value, and shipping requires a well-thought-out process. While many sellers are not prepared to ship valuables, we offer you free gold-shipping supplies. You can either order a selling kit for your scrap gold or;start the process right now. If you order a selling kit, well mail you a solid bubbled envelope or a box, sorting pouches, a gold-selling confirmation sheet, and selling instructions. If you sell your gold online, well provide you with a free and fully insured shipping label by email right away. Selling is easy, safe, and hassle-free.

I’ve Heard That Gold Traded 24/7 Is That True Is There An Open And A Close

Gold, actually trades 23 hours a day Sunday through Friday. Most OTC markets overlap each other; there is a one-hour period between 5 p.m. and 6 p.m. eastern time where no market is actively trading. However, despite this one hour close, because spot is traded on OTC markets, there are no official opening or closing prices.

For larger transactions, most precious metals traders will use a benchmark price that is taken at specific periods during the trading day.

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value; however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Recommended Reading: What Was The Price Of Gold 20 Years Ago

E Fia Le Totogi O Teuga Auro Mo Auro

Afai o loo e latalata i le itu o Los Angeles, o loo iai le National Gold Market i Pasadena, Kalefonia. Latou te totogia 75% i le 80% mo Auro Auro ma le 90% mo tupe auro. E mafai ona e savali i totonu ma faataitaia au aitema e leai se tau e fuafua ai le mama o le uamea Karat ma le mamafa o le kalama. …

| $58.08 |

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Don’t Miss: Will Gold Rate Decrease In Coming Days

What Is Paper Gold

âPaper goldâ is the nickname for investment products that track the price of gold. This primarily means gold ETFs and futures.

The distinction between physical gold and paper gold is the latter is only âon paper.â By contrast, physical gold is a tangible asset.

Physical precious metals change hands in over-the-counter markets. The best example is the London Bullion Market, the UK gold hub.

Whats The Difference Between London And Dubai Gold Prices

Reasons include: The LBMA Gold Price is a benchmark. Timing differences. Dubai is four hours ahead of London. When Dubai opens for business the most recent LBMA Gold Price will have been set the previous day. The Dubai rate quoted is a retail rate and includes a small premium to cover bullion delivery charges and customs duties.

Don’t Miss: What To Mix With Bacardi Gold

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

Commonly Used Gold Gram Karats In Canada

Note: Do not be confused between the two terms of “Karat” and “Carat”. Carat is a unit of weight for diamonds where 1 carat= 0.2 grams. While a karat is a unit of purity of gold where gold 18 karat means gold which is 18/24 pure i.e. the absolutely pure gold should be karat 24.

The following are commonly used Gram karats in Canada as well as other countries:

Recommended Reading: What Is The Toll For The Golden Gate Bridge

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high; however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

You May Like: Does Kay Jewelers Sell Real Gold

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

E Fia Le 150 Kalama Auro

E fia le 150 kalama o le auro e aoga?

| 150 Grams o Auro e Taua |

|---|

| US tala |

| 6,307 |

Faapea foi, faafefea ona fuafuaina le auro tau?

Afai la, afai e te manao e faatau se filifili auro o le 9.6 kalama, ona faatatauina lea o le tau o le: Tau o 1 kalama auro = Rs 27,350 vaevaeina i le 10 = Rs. 2,735. Tau o le 9.60 kalama ‘filifili auro = Rs 2,735 taimi 9.60 kalama = Rs 26,256. …

| Auro mama i mea teuteu | Numera Atoatoa |

|---|

E tusa ai, E fia nei auro?

MONEX Ola Auro Spot Tau

| Tau auro nofoaga |

|---|

E fia le auro e 100oz? Tau auro i le aunese i le US Dollar

| Aunese |

|---|

E fia le 1g o le 18K auro e aoga?

18K Auro Tau i Aofaiga Aotelega

| Iunite o 18K Auro |

|---|

17 Fesili Fesoasoani Tali Maua

Lisi o Mataupu

You May Like: Will Gold Price Go Down

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Recommended Reading: Who Buys Gold Filled Jewelry

How To Calculate The Scrap Gold Price

First, its important to know that scrap gold comes in different alloys. 10K gold is worth less than 14K gold, and 14K gold is worth less than 18K gold. Besides 14K gold, 18K gold is most common for jewelry and scrap gold in the US and is therefore one of the most important gold alloys. 14K gold is a gold alloy containing 58.3% pure gold. Therefore, 14K gold is worth 58.3% of the price of 100% pure gold, and 18K is worth 75% of the price of 100% pure gold. Check our current scrap gold prices in the table above if your items are marked as 10K gold, 14K gold, or 18K gold. If you know the weight of your pieces, you can easily calculate your total payout amount by using this formula:

WEIGHT OF YOUR ITEMS x CURRENT SCRAP GOLD PRICE = YOUR TOTAL PAYOUT AMOUNT

Is Gold Traded 24 Hours A Day

Yes. Gold trades on exchanges located around the world. Even when one exchange is closed for the night, there is another somewhere else that is active.

Electronic trading of gold goes on continuously. This is reflected in the Globex gold price overseen by the CME Group. Globex prices are updated moment to moment based on futures trading.

24-hour gold trading means that gold product prices always fluctuate.

Also Check: How Much Is 10 Ounces Of Gold Worth

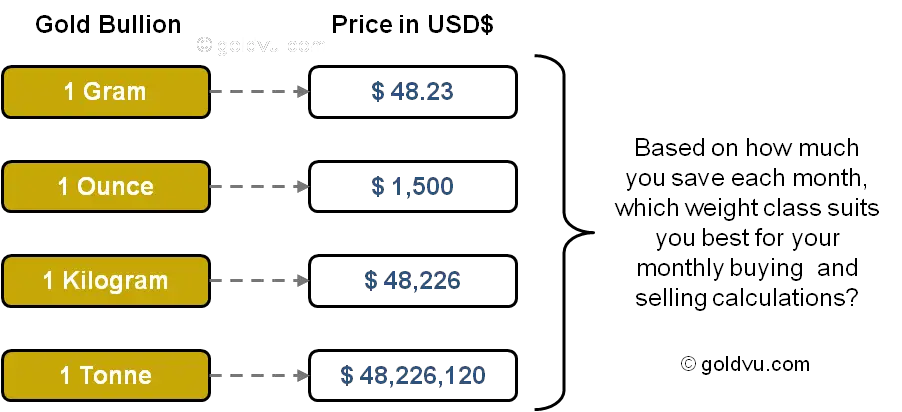

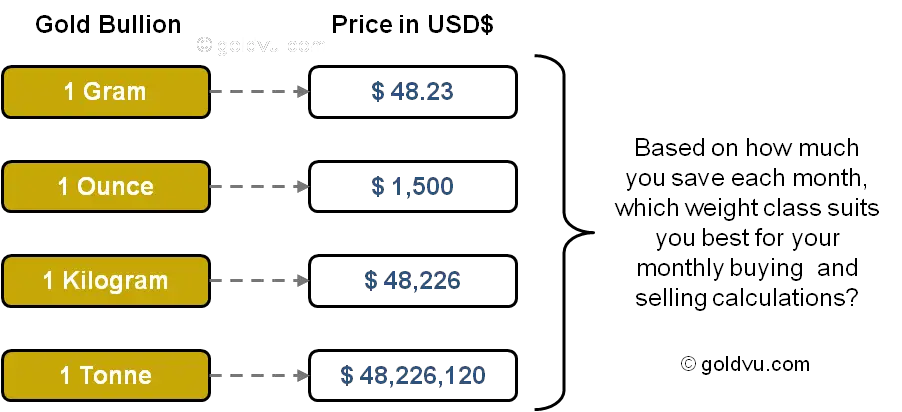

What Is Gold Price Per Gram

The gram is the entry level weight of a gold or silver bar. It is the smallest bar you can buy. Coins can also be bought in grams and are referred to as fractional because most coins are 1 troy ounce. The troy ounce is the standard unit of measurement for precious metals and one troy ounce is 31.1034807 grams. The standard ounce is 28.35 grams, a little bit less than the troy ounce. Even this slight difference demonstrates where grams can matter or might be worth noting. Buying in grams allows for versatility.

When Is The Gold Price The Strongest

It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement; however, historically, there have been high and low seasonal period in the gold market. Historically, September is golds strongest month. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year. The worst month has historically been March, April and then June.

Recommended Reading: How To Invest In Gold Stocks

Why Getpricetoday

You can easily find the latest and accurate price information from GetPriceToday.com

Most of the time, you need it to save your time!

How? When you are looking for how much is the price of gold per gram. There are too many unverified false price products on the Internet. How long does it take to find the true and reliable product prices?

But with us, you just type how much is the price of gold per gram and we have listed all the verified price charts pages with one click button to Access the price Page.

GetPriceToday allows users to share the latest prices of commodities such as Bitcoin, oil, and housing. Although we did not conduct any market research, we created 10,000 pages to clearly guide you in choosing the right price.

How To Buy Gold

First, decide what kind of Gold youre interested in buying. There are several types of Gold, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Gold bullion, choose between Gold coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Gold. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Gold in their own vaults or lockboxes at home, as well.

Also Check: What Is There To Do In Golden Colorado

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

You May Like: How Much Does Xbox Gold Cost

What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

Also Check: Where Is The Best Place To Buy Gold Jewelry

Mafai E Matou Ona Tapa Le Gst Ile Auro

le tagata faatau auro poo tagata faatau auro mafai ona tapaina Input Tax Credit totogiina i luga o mea masani na faaaogaina, ie, auro ma isi galuega galuega totogi na maua. Tusa lava pe totogiina e le faioloa auro le lafoga i luga o le faavae totogi mo le sapalai mai se le faigaluega tagata faigaluega, e mafai ona ia tapaina le ITC i sea lafoga.