Inflation A Process Not An Eventbut History Shows Runaway Inflation Can Come Suddenly And Without Warning

Image courtesy of Visual Capitalist Click to enlarge

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Romes silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. A change of fortune, Ben Franklin tells us, hurts a wise Man no more than a change of the Moon._________________________________________________________________

Looking to prepare your portfolio for whatever uncertainty lies aheadDISCOVER THE USAGOLD DIFFERENCE

Repost from 9-16-2021

Gold stays in tight range ahead of FedMyrmikan Capital thinks new liquidity crisis could evoke policy response, power gold

Charts of the Day

European Central Bank Balance Sheet

Bank of Japan Balance Sheet

Peoples Bank of China Balance Sheet

Gold Price Forecast: Hawkish Fed Weighs On Market

TagsFor tradersNews and featuresAnalysis

The gold price has fallen sharply in the past week, recording its largest drop in five months after the US Federal Reserve indicated that it could increase interest rates earlier than expected.;

The economic recovery from the COVID-19 pandemic continues, increasing inflation expectations that had supported a gold rally in April and May, but also raising the prospect of the Fed tightening monetary policy.

Where will the precious metal price move next? Should investors still allocate a portion of their portfolio to the safe-haven asset? In this article we look at the latest gold price news and long-term forecasts.

Evaluating A Gold Trade Into 2021

As 2021 is just around the corner, lets take a look at the 2020 gold chart to see if it offers any clues on how to approach a gold trade.

The chart does show a run higher towards the August highs and then a loss of momentum as gold traded near the $1,760 level in November. But the resilient commodity started to stage a rebound from its multi-month low and recovered around $100 an ounce to trade near the $1,860 level.

The near-term picture does show several instances of weakness since the summer months so perhaps keeping the support levels in mind before entering a trade is a good idea.

Investors should expect the first support level of $1,760 could fail to hold if gold moves sharply lower due to some unforeseen reason. However, the next support level of $1,670 has worked as expected from April to June as gold prices bounced back higher after hitting these levels.

This begs the question: will the price of gold go up? No market moves in a straight line higher for ever so near-term drops are far from unusual. Expectations for gold to retest it’s all-time highs in 2021 could be a base-line scenario for many investors and could be realised if a strong break above the $1,900 level is seen.

If you would like to have a clear vision of how to make a trade on the gold market right now, take a closer look at our detailed gold price analysis in a short video by Capital.com market strategist David Jones.

Also Check: How Much Is 14k Italy Gold Worth Per Gram

Gold Stocks Gold Price Hinge On Fiscal Fed Policy

The gold price charged back to $1,950 in early January. The surge came amid rising odds that Democrats would take control of the Senate in Georgia’s runoff elections. and unleash a new flood of fiscal support.

Yet Democratic victories in Georgia, rather than fueling new highs for gold and gold stocks, sparked a sell-off. The problem: The additional trillions in anticipated federal spending boosted growth expectations and Treasury yields.

Gold stocks aren’t a play on a booming economy, but are driven by interest rates and inflation. Industrial metals such as copper have surged since last summer as gold has wavered. Silver, which offers both precious metal and industrial metal characteristics and has a key role in 5G, also has outperformed gold.

Gold and gold stocks powered higher in the weeks after the coronavirus lockdown as the Federal Reserve and Congress uncorked a gush of liquidity and fiscal support. The yellow metal took off again as hopes for a V-shape recovery were splashed by a summer coronavirus wave. Wall Street began to imagine an extended era of ultralow interest rates, multi-trillion-dollar deficits, a weak dollar. And eventually a rekindling of inflation pressures.

What It Means To You

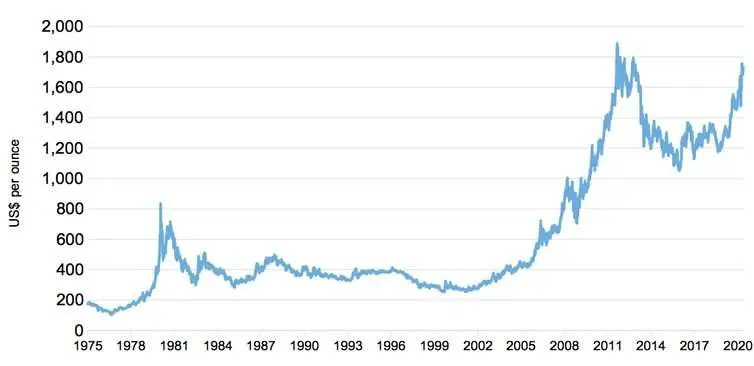

Between 1979 and 2004, gold prices rarely rose above $500 per ounce. The rise to record highs in 2011 was a result of the worst recession since the Great Depression, and the 2020 records were due to the COVID-19 pandemic.

Most financial planners advise that gold comprise 10% or less of a;well-diversified portfolio. If you’re holding more than that, talk to your financial advisor before gold falls again.

You May Like: What To Mix With Bacardi Gold

Top 5 Factors That Affect Gold Rate In India

Gold is one of the most revered metals in the Indian culture. From festivals, to weddings to birthdays, no auspicious occasion goes by without making use of this metal. Indian temples are famous for their new as well as ancient gold idols which are guarded against any kind of theft or robbery. Most Indians look up to gold as a thing of investment which can be used in times of financial crisis. While gold has been living up to its standard for a very long time, lately the metal has started to lose its shine. The prices of gold have been tracing a downward spiral and as such customers have procured this metal in the hope of reaping substantial benefits when the price of the metal goes up again.

Also check :;Today’s Gold Rate in India

Let us look into some of the most important factors that determine the price of gold. One thing which is sure is that the prices of this metal are affected considerably by the international markets. India is one of the largest consumers of gold and as such any kind of movement in its prices internationally, has a huge impact on the prices here in India.

Read more on Gold

Should Those Who Invested In Gold At Levels Above Rs 50000/10 Gm Worry Now

While traders who entered to make quick gains may have reason to be worried, investors who see gold as a generational asset should not be too concerned. Over the last two decades, gold has risen by over 10 times, and the long-term steep rise has had its crests and troughs along the way. One must also remember that the supply of gold is limited, and since there is demand from both individuals and central banks of various countries, the price of gold in the long term is more likely to have an upward trajectory.

Historically, a rise in uncertainty and fear is the single biggest factor that leads to a spike in prices of gold as central banks increase the pace of gold purchase. If uncertainty around the pandemic propelled prices beyond Rs 57,000 per 10 grams in August , it should be remembered that it is not yet over, and is certainly not the last risk the world will see. Gold prices get impacted by several factors including geopolitical tensions, interest rate movements and change in value of the dollar with respect to other currencies.

Chirag Mehta, Senior Fund Manager-Alternative Investments at Quantum Mutual Fund, pointed out several risks that persist. If widespread access to a vaccine is months away, return to normalcy is still longer away and prone to setbacks as the pandemic-induced economic damage has been severe for businesses and individuals. He also pointed towards mounting government debts and real interest rates going deeper into the red amid rising inflation.

Recommended Reading: What Is The Toll For The Golden Gate Bridge

Though Gold Traders Have Become More Cautious They Havent Completely Thrown In The Towel

CHAPEL HILL, N.C. Notwithstanding golds $100 plunge over the last week, we still dont have a contrarian buy signal.

Thats because the prevailing mood in the gold market GC00, -0.58% is not yet sufficiently pessimistic. Though gold traders have become more cautious over the last week, they havent completely thrown in the towel. Only when they do will a contrarian buy signal be forthcoming.

These are the conclusions I draw from an analysis of gold market timers average recommended gold exposure level . This average currently stands at minus 4.8%, which means that the average timer is allocating a small portion of his gold trading portfolio to going short. Past contrarian gold signals have come when the HGNSI was even lower.

The HGNSI in late June did briefly dip down far enough to enter into the zone of extreme bearishness, which I define to be in the lowest 10% of all past readings. But the HGNSI dipped only barely into this zone and didnt stay there for long; at the first sign of strength in the gold market, the average gold timer quickly turned more bullish. This is why, as I warned in an early-July column, golds subsequent rally would be quite modest and range bound.

Gold Sinks As Us Central Bank Turns Hawkish

Gold climbed from $1,686 per ounce in late March to $1,909.90 on 2 June, reversing a decline seen in JanuaryMarch and recording a small gain from the $1,883 per ounce level at which it started the year. But the trend of gold price rises came to a halt in response to rising US employment figures and comments by Philadelphia Federal Reserve President Patrick Harker that policymakers should begin considering when to taper bond purchases.

The precious metal, which is considered a hedge against inflation and economic uncertainty, dropped by 4.7% to $1,774.80 per ounce on 16 June, its lowest level since late April. The pullback came after a statement from the Federal Open Market Committee sounded an optimistic note on the recovery of the US economy.;

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened, the statement said.;

Fed chairman Jerome Powell also indicated that the central bank would begin discussing tapering bond purchases.

Gold slipped further to $1,769 per ounce on 17 June and has since remained below $1,800 per ounce. There were further signs of economic recovery as data on US durable goods released on 24 June showed strong growth. New orders for manufactured durable goods increased by $5.7bn to $253.3bn, a 2.3% increase after a 0.8% decline in April.;

Recommended Reading: Who Buys Gold Filled Jewelry

Leading Indicator: Gold To Dollar Inverted Directional Correlation

The 2nd leading indicator for golds future price is the Dollar inverted correlation.

The next chart shows the Dollar in light grey, but it is inverted. The price of gold is reflected in black.

In the last 2 decades the gold price chart has tracked the inverted price of the Dollar with just 3 exceptions . Those exceptions only tended to last 6 to 15 months.

Now one may argue that the divergences are substantial, and it would question the validity of this gold price forecast leading indicator.

However, we have to look carefully at the events that took place when these divergences took place. In particular gold and the USD are not correlated during major events: a major rally in gold , a major breakdown in gold or a major breakout .

In other words gold and the USD are negatively correlated but only directionally . When disruptive events take place the gold market goes its own way, and does not correlate to the USD.

Thats exactly why our point is that both markets track each other directionally. They do so except when major chart events hit the gold market.

Chart update: 11.08.20

My Silver Price Projections

There are many other potential catalysts that could impact the silver price. Frankly, there are so many possibilities that theyre hard to catalog.

What I covered here are the unique circumstances the silver market finds itself in right now, and why the upcoming bull market could be bigger than many anticipate.

Suffice it to say that whatever impacts gold is also likely to impact silverheres a list of those possible catalysts, in our Gold Predictions article.

Based on all these factors, here are my predictions for the silver price for both 2021 and where the silver price could be in the next 5 years.

As a result of my research, I decided to buy more silver! Heres what I bought.

I encourage you to consider that regardless of where the price may end up over the next few years, silver represents a very compelling investment opportunity for the foreseeable future.

Recommended Reading: How Much Does Xbox Gold Cost

Gold Price Forecast By Day

| Date | |

| 46121 | 45439 |

In 1 week Gold price forecast on Wednesday, September, 29: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price in India on Thursday, September, 30: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Friday, October, 1: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price in India on Monday, October, 4: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Tuesday, October, 5: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs.

In 2 weeks Gold price in India on Wednesday, October, 6: exchange rate 45555 Rupees, maximum 46238 Rs, minimum 44872 Rs. Gold price forecast on Thursday, October, 7: exchange rate 45476 Rupees, maximum 46158 Rs, minimum 44794 Rs. Gold price in India on Friday, October, 8: exchange rate 45473 Rupees, maximum 46155 Rs, minimum 44791 Rs. Gold price forecast on Monday, October, 11: exchange rate 45476 Rupees, maximum 46158 Rs, minimum 44794 Rs. Gold price in India on Tuesday, October, 12: exchange rate 45548 Rupees, maximum 46231 Rs, minimum 44865 Rs.

In 4 weeks Gold price in India on Wednesday, October, 20: exchange rate 45278 Rupees, maximum 45957 Rs, minimum 44599 Rs. Gold price forecast on Thursday, October, 21: exchange rate 45015 Rupees, maximum 45690 Rs, minimum 44340 Rs. Gold price in India on Friday, October, 22: exchange rate 45437 Rupees, maximum 46119 Rs, minimum 44755 Rs.

Go For Gold Not For Broke

No matter your view of whether the price of gold is a good bet, it makes sense to subject investment decisions in gold stocks or an ETF tracking gold or gold stocks to the same rigorous process as regular stock buys. That means waiting for a proper buy point and a buy signal.

The charts of gold stocks like NEM and GDX no longer look constructive. While FNV, IBD’s top-rated gold stock, looks more solid, all gold stocks are pretty closely tied to the fortunes of GLD, which has fallen well below its 200-day moving average. Prospects look somewhat brighter for the iShares Silver Trust ETF that tracks the silver price. SLV has bounced above its 200-day line and is about 6% below its recent buy point. Silver has both precious metal and industrial metal characteristics.

To find the;best stocks to buy or watch, check out IBD Stock Lists and other IBD content.

Please follow Jed Graham on Twitter for coverage of economic policy and financial markets.

YOU MAY ALSO LIKE:

Read Also: Where Is The Best Place To Buy Gold Jewelry

Read More About Cryptocurrencies From Cnbc Pro

On Friday, the Bureau of Labor Statistics said nonfarm payrolls increased by 943,000 in July, above the 845,000 new jobs forecast by Dow Jones.

While gold has since recovered some losses, Dhar said it was “difficult to remain bullish on the precious metal,” given the hawkish outlook for U.S. monetary policy.

The Federal Reserve is expected to dial back monetary easing and slow its stimulus efforts as the economy recovers from the pandemic. The U.S. central bank has held rates near zero, but officials have signaled that hikes could happen soon, especially with inflation running hot.;

But Dominic Schnider, chief investment officer at UBS Global Wealth Management, predicts that real yields will “go less negative” and that means more downside for gold. He told CNBC’s “Street Signs Asia” on Wednesday he expects outflows from the gold exchange-traded funds and futures markets.;

When real yields go up, gold prices go down, and vice versa. In such a scenario, the opportunity cost of holding gold, a non-yielding asset, is higher as investors are foregoing interest that would be otherwise earned in yielding assets.

“A stronger US dollar combined with a gradual increase in US 10 real yields suggest that gold prices should trend lower,” Dhar wrote.

Gold Futures Drop Below The Key $1900 Mark

Gold prices dropped on Thursday, losing their grip on the key $1,900 level to mark the lowest settlement in more than two weeks, as the U.S. dollar strengthened following a jump in U.S. private-sector payrolls data for May.

While the 13% gain in gold prices since March 2021 has been impressive, confidence has actually been fragile and momentum was already easing off before the ADP private-sector jobs data and correction in prices for the metal on Thursday, said Ross Norman, chief executive officer at Metals Daily.

Gold looked as if it was topping out, he told MarketWatch. Some profit taking exacerbated the decline and gold will rebuild from here.;

Some profit taking exacerbated the decline and gold will rebuild from here.

Ross Norman, Metals Daily

For now, investors remain disappointed that gold seems to have foregone the significant gains that many other commodities have enjoyed especially as it was designed for precisely these conditions that is to say with inflation on the near-term horizon, said Norman.

On Thursday, gold for August delivery GCQ21 fell 1.9%, or $36.60, to settle at $1,873.30 an ounce. The most-active contract fell under the key technical level of $1,900, and finished at its lowest since May 18, FactSet data show. On Wednesday, prices settled at $1,909.90, the highest since Jan. 7.

Government data, meanwhile, showed U.S. Initial weekly jobless claims dropped for a fifth week in a row, by 20,000 to 385,000.

You May Like: How Much Is 10 Ounces Of Gold Worth