The Gold & Silver Ratio Explained

The value of gold and silver bullion has generally risen and fallen in relative tandem over time; where gold goes, silver follows.; For those who monitor the gold and silver markets, this can feel satisfying, because it makes roughly gauging the relative value of each fairly simple. However, on further inspection, it can be confusing once you begin to understand their different uses in the wider market.

To really get clarity on the relative value of gold bullion against silver bullion, we need to look into the question of what is the gold / silver ratio? How it has arisen and its behaviour tells us more about how to understand pricing.

Essentially, the ratio is a calculation employed by investors to assess the best time to invest. The ratio reflects the weight of silver it takes to purchase one ounce of gold. The calculation for it involves taking the market price of gold, then dividing this by the price of silver. ;If the current gold price is relatively high, it means it will take more silver to buy an ounce of gold, but this has not always been so.

Historically, silver was under-valued by the Spanish two centuries ago, according to some industry commentators, in order to maintain their power on the world stage. Some argue this has left a legacy from which silver has since been catching up.

Industrial Commercial And Consumer Demand

The traditional use of silver in photographic development has been dropping since 2000 due to the decline of film photography. However, silver is also used in electrical appliances , , RoHS compliant solder, clothing and medical uses . Other new applications for silver include RFID tags, wood preservatives, water purification and food hygiene. The Silver Institute have seen a noticeable increase in silver-based biocide products coming onto the market, as they explain:

Currently weâre seeing a surge of applications for silver-based biocides in all areas: industrial, commercial and consumer. New products are being introduced almost daily. Established companies are incorporating silver based products in current lines – clothing, refrigerators, mobile phones, computers, washing machines, vacuum cleaners, keyboards, countertops, furniture handles and more. The newest trend is the use of nano-silver particles to deliver silver ions.

â

Data from 2010 reveals that a majority of silver is being used for industry , jewelry , and investments .

The expansion of the middle classes in emerging economies aspiring to Western lifestyles and products may also contribute to a long-term rise in industrial and jewelry usage.

Gold Outperformed Silver In Most Of Bull Market Of The 70s

Gold actually outperformed silver in most of the bull market of the 70s, when both metals reached historic highs. Only in 1980 at the peak of the bull market did the return on silver outrun gold. Remember, this was the year of the famous silver corner of the Hunt brothers. Then, and only then, did silver outperform gold in the last secular bull market. Silver was the better choice for a mere six months in a period of ten years in the 70s.

Silver did, nevertheless, outperform gold from 2009 to 2011, among some other periods before the Great Recession. This outperformance came with a price, though, as silver prices collapsed afterwards;to an extent far greater than the correction in gold prices.

Don’t Miss: Is Dial Gold Body Wash Antibacterial

Why Bother Following The Gold

The ratio isnt a silver bullet that will tell you exactly when to buy precious metals, but it can be a reasonably reliable indicator. Gold and silver prices have a long-established correlation and have moved in opposite directions only one time since 1968, and it was for a short time that lasted only seven consecutive days.

Consider keeping tabs on the gold-to-silver ratio as you consult other resources you trust. Access free special reports in U.S. Money Reserves Resource Library and call 1-844-307-1589 to speak with one of our professional Account Executives. Youll receive a complimentary in-depth consultation regarding your overall objectives and long-term goals.

Gold To Silver Ratio: So What

Gary Christenson The Deviant Investor

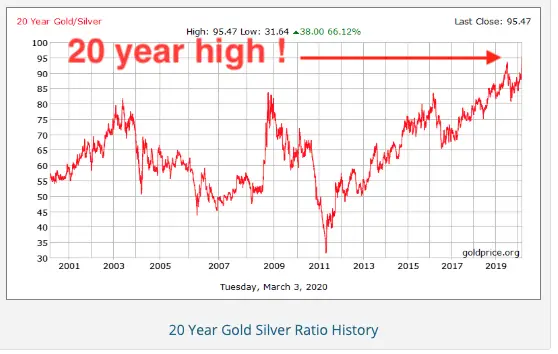

Analysts use this ratio to describe how inexpensive silver is compared to goldlike now. They also use the ratio to show long-term buy zones for both metals.

WHY?

Silver prices move up and down farther than gold prices. That pushes the gold-silver ratio too high, like now, when silver is inexpensive. Or it pushes the ratio too low, as in January 1980, when silver prices zoomed upward too far and too fast.

When the gold to silver ratio exceeds 80, it is often a good time to buy silver.

Do the data support this conclusion? Can we quantify this analysis?

Examine the chart of the ratio for 35 years, starting in 1983 after the early 1980 bubble had partially corrected. Look at the chart of silver prices since 1983. You will notice:

Recommended Reading: How Much Is 5 Oz Of Gold Worth

How Is The Gold

Investors calculate the gold-silver ratio by dividing one ounce of gold by one ounce of silver, or how many ounces of silver equal one ounce of gold. For example, if one ounce of silver is $20 and one ounce of gold is $1,600, then the silver-gold ratio would be 80:1.

Unlike other physical items, precious metals are weighed by Troy Ounce , an historic unit of measurement dating back to the Middle Ages equaling roughly 31.1 grams. By comparison, the standard ounce weighs about 28.35 grams. The price of one Troy Ounce of gold and silver fluctuates daily based on the spot price , or current price at which the metal is trading.

Whereas most precious metals and commodities have futures contracts traded on the market where traders can trade gold and silver based on later-dated future prices, the spot price uses real-time price data. Premiums, or additional seller fees added to the price by metal retailers and merchants do not factor into the spot price or the gold-silver ratio.

So What Is The Ratio Telling Us Now

The gold silver ratio is telling us to buy silver over gold currently. At 120 the ratio is the highest it has ever been. So silver is very undervalued compared to gold on a historical basis.

Or put another way, silver is the most hated it has ever been compared to gold.

We have seen the ratio as high as 100 back in 1991, so there was always the chance it could go higher and it has.

We could yet see it spike even higher up toward say 150. See how the upper trendline in the chart above hasnt been reached yet.

But as fast as the ratio has spiked up, we could yet see it spike down just as quickly. In the 2008 financial crisis the same thing happened. The ratio spiked to almost 90 before then falling sharply for 2 years to 31, as silver caught up to gold.

So currently silver is incredibly undervalued compared to gold. Both metals are undervalued compared to dollars. Whether they be US Dollars or NZ Dollars.

Investors have been rushing toward gold due to the panic around the Corona Virus and crashing sharemarkets. They have been ignoring silver. And recently even selling silver.;

Why? Possibly due to margin calls after stock markets have fallen so much. Investors who have borrowed to buy stocks are forced to sell whatever they can to add to their funds with the lenders. Gold and silver are very liquid and therefore an easy source of funds.

Read Also: How To Invest In Gold Stocks

The Gold To Silver Ratio: So What

Miles Franklin sponsored this article by Gary Christenson, the deviant investor.

Analysts use this ratio to describe how inexpensive silver is compared to goldlike now. They also use the ratio to show long-term buy zones for both metals.

WHY?

Silver prices move up and down farther than gold prices. That pushes the gold-silver ratio too high, like now, when silver is inexpensive. Or it pushes the ratio too low, as in January 1980, when silver prices zoomed upward too far and too fast.

When the gold to silver ratio exceeds 80, it is often a good time to buy silver.

Do the data support this conclusion? Can we quantify this analysis?

Examine the chart of the ratio for 35 years, starting in 1983 after the early 1980 bubble had partially corrected.; Look at the chart of silver prices since 1983. You will notice:

a. Silver prices moved higher in a strong bull market after President Nixon severed the link to gold backing the dollar in 1971. Thereafter the dollar floated lower as commodities and consumer prices rocketed higher. Stagflation reigned.

b. Silver prices went crazy in early 1980 and peaked over $50 in a bubble. The paper exchanges modified the rules and forced selling to collapse the bubble. A silver price of $50 per ounce in 1980 is equivalent to $200 $300 per ounce today if appropriate cost-of-living adjustments are used.

c. Silver prices fell, with occasional rallies, for two decades, bottomed in 1991 at $3.51 and again in November 2001 at $4.01.

Summary:

Can You Trade The Gold/silver Ratio

The gold-silver ratio is used in investing and trading to determine when one metal is undervalued or overvalued and thus a good value investment. However, like any other security, commodities carry some risks for investors.

Sometimes precious metals are extremely volatile and experience wild price swings, and sometimes gold and silver experience long periods of minimal price movement and volatility compared to other types of investments such as equities, commodities, and cryptocurrency. In fact many investors consider precious metals a store of wealth and allocate to it as part of their investors long-term investment portfolios.

Recommended: 7 Investment Opportunities in 2021

Also Check: How Long Is The Golden Gate Bridge

When Will The Next Crisis Start

Once financial, economic, and/or market risks explode, sentiment will shift dramatically for silver . Itll be game on, and investors will turn to precious metals like they have many times throughout history.

- Any one of these, and more, could ignite the silver market. And once they do, current prices and premiums will no longer be available.

Us Debt Clock Shows Real Value Of Silver & Gold $813 & $7340/oz

From Greg Hunter:On the U.S debt clock showing gold being priced thousands of dollars more than it is priced in the markets, and also silver priced hundreds of dollars higher, David Morgan says, I think it is $812 silver and gold $7,300. What that is is year-over-year increases in M2 money supply and yielding production of silver and gold in ounces. Or, you could say its the year-over-year production in ounces . . . and its an arithmetic problem. Its dollars per ounce mined. ;As to why they are doing this, I dont know, but I will take a stab at it. Maybe it is to get this out in the public where few are awake and aware. Its obviously showing the gold/silver ratio is out of whack. . . . Both silver and gold are way undervalued.

Don’t Miss: How Do Golden Goose Sneakers Fit

How To Use The Gold

So far, youve learned that buying silver when the gold-silver ratio is high and buying gold when the ratio is low yielded an attractive return for precious metals investors. However, picking the exact top or bottom isnt always an easy task.

This is why investors and traders may also benefit by applying an average dollar value to their investments. For example, you may start buying silver with 10% of your funds as the ratio nears its extreme highs, and keep adding to your investment in your portfolio as the market tries to establish a top.

There are three popular ways for gold silver ratio investing. First, an investor may choose to buy bullion, coins, and other physical metals, although this isnt always the most practical or efficient approach. Storing a large quantity of precious metals, paying for transportation costs, and insurance fees can quickly add up and erode your profit potential.

Another popular way is to buy gold and silver ETFs. Yes, ETFs have sky-rocketed in popularity in the last decade or two, but some ETFs simply dont track the price of gold or silver very precisely. Also, if you do want to take physical possession of your gold or silver, some ETFs may require large minimum investments to be able to send you your precious metals.

If you prefer trading options over futures, then the CBOE GLD options are a great alternative to the gold futures contracts, especially for the 10-oz micro contract.

Which Factors Influence The Gold

Gold and silver prices generally move in the same direction day-to-day. But the size of their fluctuations varies greatly.

Over the last half-a-century, gold has averaged a daily move of 0.5% up or down in US Dollar terms, but silver has moved more than 0.9%. That’s because silver is a much smaller market than gold by value, around one-tenth the size. So the same flow of cash, in or out, will hit silver prices much harder, and that will move its ratio to gold prices down or up.

Because of the silver market’s size and volatility, speculative trading in the grey metal is much heavier than gold, relative to the physical market’s underlying value.

At its record peak of summer 2019, the volume of betting on silver prices via Comex futures and options was equivalent to 175% of annual mine output worldwide,;and it has averaged 117% across the last decade. For gold, in contrast, the last 10 years’ average open interest in Comex derivatives equated to just 65% of one year’s global mine output. Even;early 2020’s new record high;in gold open interest has taken it only to 109%.

Such heavy speculation in silver contrasts with its solid and steady demand from the industrial sector. Almost 60% of silver’s annual demand now comes for productive uses,;versus barely 10% for gold.

Recommended Reading: Who Buys Gold In Lexington Ky

Ratio Can Be A Diversification Tool Within Precious Metals Allocation

Gold-silver ratio, derived from the prices of the precious metals, is the relative value of one gram of gold to an equal weight of silver.

Simply put, gold price is divided by silver price to arrive at this number.

Taking the latest spot price of gold and silver on the Multi Commodity Exchange , the gold-silver ratio is nearly 81.

Essentially, this means, by selling one gram of gold, 81 grams of silver can be purchased. The ratio goes up when the price of gold rises relative to that of the price of silver and vice-versa.

For instance, as an extension of the above example, say gold price rises to 5,500 per gram and silver price rises to 65 per gram. Now, the ratio would be little higher at about 85.

So, even as price of both the precious metals rose, the relatively better performance of gold lifted the ratio. Similarly, if silver outperforms gold, the ratio will come down. Notably, this ratio can change every day since price of both precious metals are influenced by market forces.

In general, when the ratio rises to extremely high levels because of better performance of gold, silver is expected to play the catch-up game at some point in the future. Consequently, the ratio drops.

Conversely It May Be That Silver Is Merely Lagging Gold And Will Play Catch Up Before Too Long

Gold is viewed as more of a flight to safety or crisis hedge than silver. So it could be that gold has been stronger than silver due to some worry that sharemarkets are overdue for a correction. Given what has happened in recent days, that seems likely now!

Also back in 2001, at the start of the current bull market in precious metals, gold performed better than silver and precious metals miners did better than both metals. Silver was the last of the 3 sectors to recover. Silver reached its lows in November 2001 .

So perhaps we have been witnessing something similar play out recently? In the last 2 days gold miners have moved sharply higher even though gold and silver have been falling. They may be indicating a rebound in precious metals.

Recommended Reading: Should I Buy Gold Now Or Wait 2020

Therefore It Could Be An Excellent Time To Buy Silver Because The Price Is Down

That ratio is now back under 100, but that figure should be closer to 50. Meaning that it would take 130 ounces of silver to buy one ounce of gold. When the ratio rises, the price of gold is higher, so you’d need more ounces of silver to buy one ounce of gold. The gold/silver ratio may not be done climbing, but the value offered by silver, relative to gold, is hard to overstate. Gold/silver ratio 1970 to present. A higher ratio means silver is undervalued compared to gold. Below is a chart of the gold silver ratio as you can see, the chart shows that the gold silver ratio hit a high of 125.89 on the 18th march 2020 and has since declined back to 111.81 (16. This ratio is about as high as it has been in nearly 30 years. As the gold / silver ratio currently hovers around 65:1, silver will outperform gold by miles, or so the thinking goes. When the gold to silver ratio exceeds 80, it is often a good time to buy silver. The gold/silver ratio has fluctuated between 15 and 100 in my lifetime. Therefore, it could be an excellent time to buy silver because the price is down. And the price of silver were $15.11/oz.

Below is a chart of the gold silver ratio as you can see, the chart shows that the gold silver ratio hit a high of 125.89 on the 18th march 2020 and has since declined back to 111.81 or 9:1. It has moved very rapidly between those extremes.