The Real Value Of Gold In The Ground

This is the second in a series of musings and accompanying videos with Vancouver-based Cipher Research Ltd, which evaluates exploration and mining companies for investment. Once again, we assess a segment of the gold resource sector.

Our first musing was posted in early February and titled The Real Cost of Mining Gold. It evaluated seven major gold miners over the 11-year bull market from 2003-2013, showed how and why they failed to profit and reward shareholders, and provided a solution for the future, i.e., a value versus growth philosophy. Three short videos on the subject can be accessed here: Mercenary GeologistVideos.

Today, our subject is the value of an ounce of gold in the ground.

Venture always flows where potential reward is perceived to have the lowest risk. In my opinion, advanced explorers and developers often offer the best risk/reward profile in the junior resource market.

There is a plethora of companies to choose from in all segments of the resource sector. For any speculator, the challenge is to separate the many pretenders from the very few contenders. This is an especially daunting task for the retail lay investor. In this musing, we provide insights based on decades of experience evaluating companies and their projects.

All junior resource companies can be evaluated and ranked utilizing four key criteria:

- Working capital: should have significant cash on hand and/or the ability to raise funds without severe dilution.

What Are The Factors That Affect The Gold Price

- 1. Demand and supply of Gold

- 2. Speculations

- Technology: 11%

- Unaccounted: 2%

They are available in markets. Bullion bars and coins are mostly used for investment of money, and jewelry is used to be worn, and it was used as an investment in the old-time, still, in some countries, it is used for investment.

What Are Benchmark Prices For Gold

There are no official opening and closing rates for silver or gold. As a result, traders are forced to peg their investment decisions on benchmark prices which are decided by different organizations during different times of the day. The technical lingo for benchmarks is also known as fixings.

The leading organization that maintains benchmarks for different precious metals is the London Bullion Market Association . It governs prices for gold and silver, both of which are well-respected benchmarks used by dealers in the precious metals marketplace.

The most typical way to determine benchmark prices is through electronic auctions between participating financial hubs such as banks.

Don’t Miss: 19.99 Kay Jewelers

How Does The Current Gold Price Compare To Historical Gold Prices

The price of gold has increased approximately 4,750% since 1935 when President Franklin D. Roosevelt raised the value of gold to $35 per ounce. This is compared to todays gold prices that are hovering around $1,700.If you compare the goldprice today with the prices at the beginning of this millennium , the price of gold has increased approximately 496%. This is 3x the increase of the Dow Index during this period.

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

Read Also: War Thunder Unlimited Golden Eagles Hack Tool

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

You May Like: Dial Gold Body Wash Tattoo

Calculation : Value Of Gold Metal

This calculation determines the value of gold metal based on the weight, purity, and bid price for gold metal.

| Weight of gold |

|---|

| Gold price per troy ounce |

| Step 1: Convert the weight of the gold alloy into troy ounces |

|---|

| Weight of gold alloy = Weight of gold alloy × Conversion factor= 0 × 31.1034768 |

| Step 2: Convert the weight of the gold alloy into the weight of gold metal |

| Weight of gold metal = Weight of gold alloy × Gold purity ÷ 100= 0 × 99.9 ÷ 100 |

| Step 3: Calculate the value of gold metal |

| Value of gold metal = Weight of gold metal × Price of gold metal= 0 × 0 |

| 1 avoirdupois ounce = 28.349523125 g | 1 baht = 15.244 g | 1 carat = 0.2 g |

| 1 grain = 0.06479891 g | 1 kilogram = 1000 g | 1 masha = 0.97 g |

| 1 pound = 453.59237 g | ||

| 1 ratti = 0.1215 g |

| How many gram in a troy ounce |

Is The Gold Price The Same As The Spot Price

When looking at gold prices, the figures quoted are typically going to be spot gold prices unless otherwise specified. The spot gold price refers to the price of gold for delivery right now as opposed to some date in the future. Spot gold prices are derived from exchange-traded futures contracts such as those that trade on the COMEX Exchange. The nearest month contract with the most trading volume is used to determine the spot gold price.

Also Check: How Many Grams Is 1 10 Oz Of Gold

Classification Of Gold As A Precious Metal

Rare metals have higher economic potential than common metals. Of the five precious metals, gold has the largest market. Some investors refer to gold as a monetary metal because of its use throughout the history as a form of currency. Gold as an asset has a high store of value because it maintains its value without degrading. The yellow metal is also used in industrial units because of its desirable properties such as being a good conductor, malleability, and resistance to corrosion.

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

Don’t Miss: Where Can I Sell Gold Bars Rdr2

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

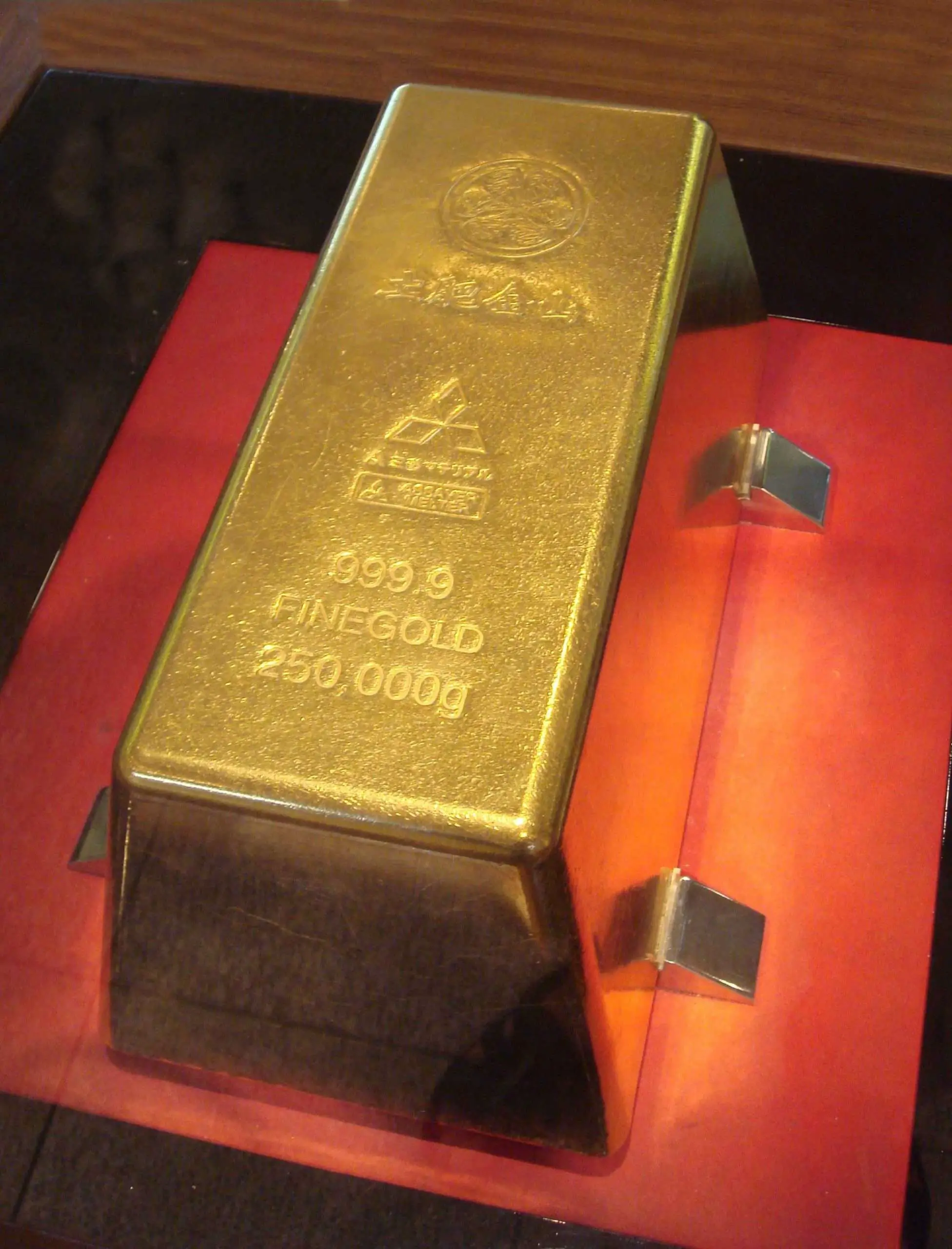

Gold Bullion Barsdesign And Specifications

For centuries, buying physical gold has been recognized as one of the best ways to store wealth and preserve purchasing power. In addition to these well-established attributes, modern day investors continue to buy gold bullion bars for their portfolio diversification properties.Monex offers gold bars in three convenient forms. The 10 ounce gold bullion bar of at least .995 fine purity is the standard industry unit. Also available is the 32.15 troy ounce gold kilobar, a one kilogram bar of at least .999 fine gold purity. Both of these gold bars are hallmarked by a leading refiner to certify weight and purity and are available for personal delivery or storage.

For those who desire the finest investment-grade gold bullion bars available, we offer the exclusive Monex-certified 10 ounce gold bullion ingot. Composed of pure .9999 fine gold, this magnificent bar is one of the purest available to investors today. Each bars weight and purity is certified and guaranteed by Monex and is further hallmarked by Heraeus, a world-leading refiner, and the reputable Austrian Mint. Please note: Although this is our main gold bar offering, Monex may also offer larger gold bar sizes, including 400 ounce gold bars, by request.Gold bullion bars are real, tangible assets, and throughout history, have been an ideal store of value. They are extremely liquid investments, easily stored and transported, and can be a uniquely private way to preserve one’s wealth.

Read Also: Is Dial Gold Body Wash Antibacterial

What Drives The Price Of Gold

Today, gold is sought after, not just for investment purposes and to make jewelry, but it is also used in the manufacturing of certain electronic and medical devices. Gold was over $1,700 per ounce, and while down more than $300 from September 2020, still up considerably from levels under $100 seen 50 years ago. What factors drive the price of this precious metal higher over time?

What Is Gold Jewelry

Jewelry made of gold can be combined with other precious elements and gems to enhance its appearance and value. The value of jewelry depends on gold purity and mass, worth of gem used, and artistic work used to build it. Jewelry is used to be worn, and as an investment, e.g., 22k gold is the famous and 91% pure gold.

Don’t Miss: Does Kay Jewelers Sell Real Gold

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Global Value Of Gold Per Ounce

Gold: used as money for centuries

Gold has been considered as the most popular and the most valued precious metal globally. For centuries it was used as a monetary vehicle. It was also the determinant of wealth of a country.

It was once the standard of value for currencies all over the world. Now that this is no longer the case — most notably marked by President Nixon taking the USA off the gold standard in 1971 — investing in gold has become more important than ever.

The price of gold is usually stated in a currency value, usually in US dollars per troy ounce.

Don’t Miss: Does Kay Jewelers Sell Real Gold

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

Gold As An Investment

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

Recommended Reading: 24k Gold Purity

Gold Has Numerous Applications

While gold has been the cornerstone of flourishing capitalistic markets, it has found numerous industrial uses such as the manufacture of electronic devices for GPD units, and personal use as jewelry. The latter is more popular in South Asian countries during the wedding season.

Gold has many desirable properties that are not easily found in other metals. It can conduct electricity but does not corrode. It is malleable and ductile, which means it can be sculpted and shaped.

Gold is utilized in the medical field and is best for crowns, bridges, fillings, and other orthodontic applications because of being chemically inert. Many patients are not allergic to the metal, making it ideal for treatments. Scientists use trace amounts of isotopes of gold in diagnosis and radiation treatments.

Due to its luster, gold is used in awards, statues, and crowds. Its exceptional beauty and rarity has turned gold into a status symbol. The metal is used in everything from Olympic medals to Academy Awards, and holds high esteem throughout the world.

Get Your Hands On Gold

With these properties, its no wonder that so many people have trusted gold over the centuries. Gold has all the properties investors look for: steady value, durability, and scarcity. And that means that theres always a market to buy and sell gold.

Gold also performs well when financial markets dont, making it a great countercyclical asset, or a store of value for when times get tough. And with so many options to choose from, theres a gold product out there for everyone.

Dont let another day go by that your assets arent protected with gold. Call the gold experts at Goldco today to learn more about all the ways gold can help safeguard your wealth.

Don’t Miss: How Much Is 10k Gold Worth

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

You May Like: Does Kay Jewelers Sell Moissanite