Is The Spot Price Universal

Yes. You may see some minor variance in the daily gold price from region to region. These differences are invariably due to local issues. Otherwise the spot price at a given moment applies everywhere in the world.

Realtime spot prices in Zurich, London, New York, and Shanghai are key reference points. It is usually measured in USD but may be expressed in the local currency, as well. The gold gram price may be quoted in addition to the price per troy oz.

How Many Grams In An Ounce Of Gold

Precious metals, including gold are measured in Troy Ounces. There are 31.103 grams in a Troy Ounce of gold.

Gold is not measured in the typical Ounce. Precious metals, gold included, are measured in what is known as a Troy Ounce.

Although many measurements from the beginning of the metric system have adapted to adjustments and changes, the Troy Ounce remains a standard measurement among those in the gold trade. When you hear or see descriptions of ounces in relation to gold, you can assume that it is the Troy Ounce and not a standard Ounce that is being used.

The Troy Ounce is used as a standard measurement that is shared among anyone that deals with the purchasing and manufacture of anything related to gold. The Troy Ounce is part of a larger measurement system for precious metals that is known as Troy weights. A regular Ounce is comprised of 28.35 grams. A Troy Ounce, however, is comprised of 31.1034807 grams. As you can see, there isnt much of an overall difference between the two types of Ounces, but when it comes to gold weight, that extra 2 or 3 grams affects the size of the finished product. If you were to compare a piece of jewellery, like a ring, that weighed a standard Ounce and one that weighed a Troy Ounce the latter ring would be slightly bigger or thicker.

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

Don’t Miss: What Dentist Does Gold Teeth

What Is The Gold/silver Ratio

It is the number of ounces of silver required to buy one ounce of gold. Silver and gold price chart history and the fluctuating gold/silver ratio is often used by investors to analyze how much silver is worth in comparison to gold, to evaluate if one of the two is overpriced at any given time. This enables investors to determine whether it is a favorable time or not for either buying or selling one of these commodities.

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

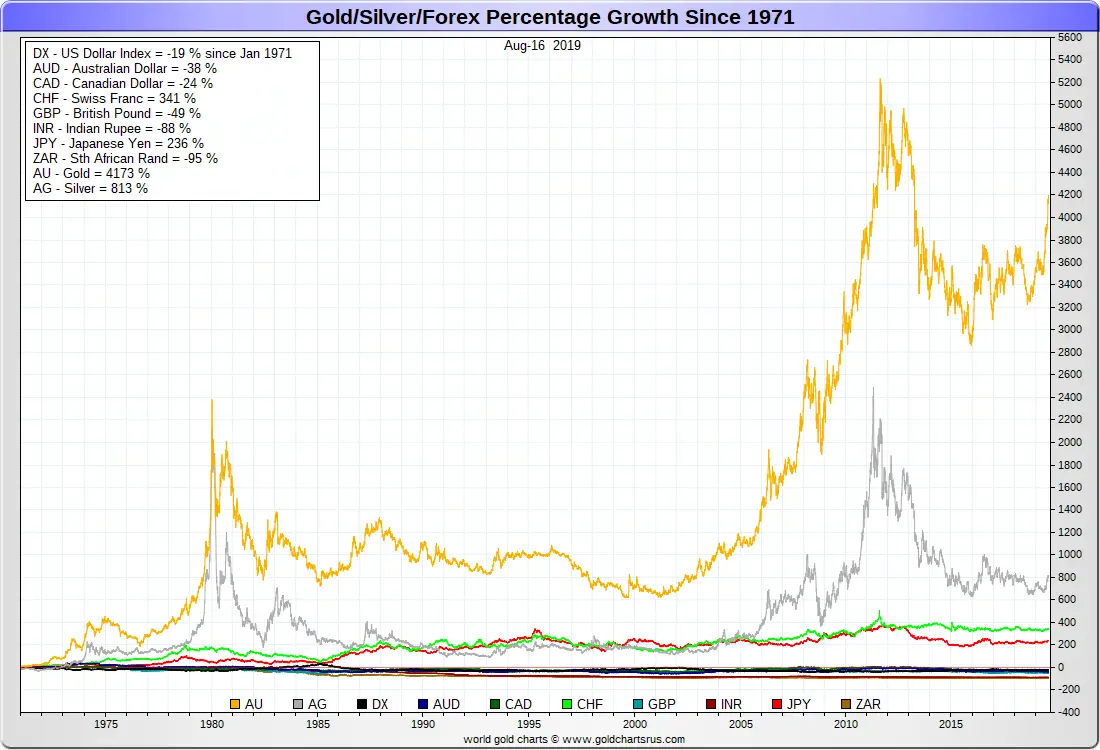

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

You May Like: What Is Goodrx

Does The Monetary Denomination Of A Gold Coin Affect Its Overall Value

Not particularly. Having a legal tender status, in and of itself, can help increase the total value of a coin. But the actual face value or denomination has little to no bearing on that value. It doesn’t mean the coin contains an amount of gold worth the face value. It’s actually much higher.

Typically, the specific issuing country will have more effect on the total value of the coin. Investors prefer coins minted by major economic powers, such as the U.S., China, Great Britain, or Canada.

Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

Also Check: How Much Is 10k Gold Worth

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Don’t Miss: How Much Is 10k Rose Gold Worth

Why Should I Invest In Gold

With a rich history amongst almost all global cultures, gold remains a highly popular investment. Although it has multiple uses, its primary function is typically to hedge against inflation in an often volatile futures market, as well as to diversify existing Precious Metals Investment Retirement Accounts.

Gold has been one of the most valuable precious metals throughout human history, used by elites as a symbol of wealth for centuries due to its rarity and its ability to hold its worth for a long time. Historically, it has been the most common way to pass on ones wealth as an inheritance from one generation to the next.

Gold is considered a worthy investment, with coins and bars available for purchase in various sizes, ranging from one gram to a whopping 400 ounces. At Bullion Exchanges, we carry a wide selection of gold products to suit the likes of both savvy investors and passionate collectors.

Being the most reliable investment commodity available, gold has proven to be a perfect way to diversify your investment portfolio and an excellent safeguard against volatile currency.

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Recommended Reading: How To Buy Gold In Robinhood

What Is The Difference Between An Ounce And A Troy Ounce When Looking At A Price Of Gold Chart

A standard ounce is equivalent to about 28.349 grams and is used as a measure for almost all common commodities. Gold, however, is always measured by the troy ounce, which weighs about 31.103 grams. This standard of measurement was adopted by the United States for standard coinage in 1828, but it was created in France during medieval times.

Value Of Gold Per Ounce

Are you wondering, “what’s the price of gold”? The live chart above shows the current spot value of gold per ounce in US dollars. You can change the currency by using the menu at the top of the chart.

As with the other charts located on this site, just hover your mouse over the graph to see the particular price at a given time.

Read Also: 19.99 Kay Jewelers

How To Calculate The Gold Price

If you know the purity , weight unit, and your desired currency . Then provide these detail in the dropdown list mentioned above, and you will see the latest real-time gold rate calculation in your provided currency (currency rates are also latest and updated with 60 minutes interval. The complete description of how to use this calculator has mentioned below.

What Is Spot Gold

The spot gold price refers to the price of gold for immediate delivery. Transactions for bullion coins are almost always priced using the spot price as a basis. The spot gold market is trading very close to 24 hours a day as there is almost always a location somewhere in the world that is actively taking orders for gold transactions. New York, London, Sydney, Hong Kong, Tokyo, and Zurich are where most of the trading activity takes place. Whenever bullion dealers in any of these cities are active, we indicate this on our website with the message Spot Market is Open. For the high and low values, we are showing the lowest bid and the highest ask of the day.

Also Check: Gold In Dubai Online

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this calculator, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. This tool is here purely as a service to you, please use it at your own risk. Full disclaimer. Do not use calculations for anything where loss of life, money, property, etc could result from inaccurate calculations.

How Much Does A Standard Cast Gold Bar Weigh

The standard gold bar that’s held and traded internationally by central banks and bullion dealers is known as the ‘Good Delivery’ bar. It typically weighs in at 400 troy ounces , and measures 7 inches x 3 and 5/8 inches x 1 and 3/4 inches, however dimensions and weights can vary between different institutions and uses.

Recommended Reading: How To Get Free Golden Eagles In War Thunder

Investing In Gold With 1 Oz Bars

The 1 oz gold bars that are offered here by the United States Gold Bureau come within an air-tight assay card that guarantees the quality and purity. Buying gold 1 Troy oz bars , are a perfect starting point or addition to a precious metals portfolio since they are easy to store and liquidate as-needed. Our 1 oz gold bars come from a variety of highly recognized and widely traded manufacturers including Credit Suisse, International Trade Bullion, PAMP Suisse, and Royal Canadian Mint to ensure the highest quality gold content and purity. Each gold bar comes in a durable assay card for long-term storage and safe-keeping. Many bars are stamped with the exact weight, fineness, and an individual serial number. The 1 oz bars are about the same size as a military dog tag which makes them an ideal size for storing in quantity.

The 1 Troy oz gold bar is the most common size of gold bars and they are traded around the world, even in countries using the metric system. A Troy ounce contains 31.1 grams and is the unit of measure used for precious metals, as opposed to the avoirdupois ounce more commonly used in grocery stores that contain only 28.35 grams.

Gold bars often have a lower price premium over market spot price than gold bullion coins and are valued based on the spot price derived from the gold-trading markets around the world. Precious metals like gold are often used to diversify investment portfolios and hedge against inflation and economic downturn.

Calculation : Gold Buyers

This calculation determines how the price compares relative to the value of gold metal from calculation 1.

This calculation is useful for people buying gold. In general, how far the price deviates from the gold metal value determines if it is cheap or expensive.

| Price |

|---|

| Step 1: Calculate gold metal value |

|---|

| Gold metal value = Price ÷ Value of gold metal × 100= 0 ÷ 0 × 100= 0 % |

Read Also: How Much Is 12 Grams Of Gold Worth

What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

Sign Insetup An Investment Accountfund Your Account

Our live gold price charts from The Royal Mint offer you a chance to view the UK gold price in pounds, as well as the price of gold in other currencies including dollar and euro. If you adjust the time range, the live gold price chart will update to show the live gold price as well as historical gold prices depending on the option chosen. As well as the live gold price, you can choose the gold price today or view the gold price history, showing the historic gold value and visualise it over time. Our live gold price charts can be used to calculate the value of your investments such as the current gold Sovereign price or the price of a gold bar.

The gold prices shown on the chart are displayed per troy ounce and are automatically updated every 30 seconds. If you are looking to invest in gold bullion, one of the most important factors is the gold price and using the information displayed on the chart, you are able to calculate the live price of gold, but also look at historical prices to gain a better understanding of how the gold price varies over time. You can also use the live gold price to calculate the value of your current gold investment portfolio or the value of any gold bullion products you are interested in investing in.

Also Check: How To Get Free Golden Eagles In War Thunder

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

How Often Do Gold Spot Prices Change

Spot prices for gold are constantly changing, as can be seen on any gold price chart. The price floats freely on the market and responds to real-time trading behavior.

U.S. markets close at 5:15 pm in New York, but gold continues to trade âovernightâ in Asian and Australian markets. Today’s gold price is rarely the same as yesterday or tomorrow. Therefore the spot price can change at virtually any time.

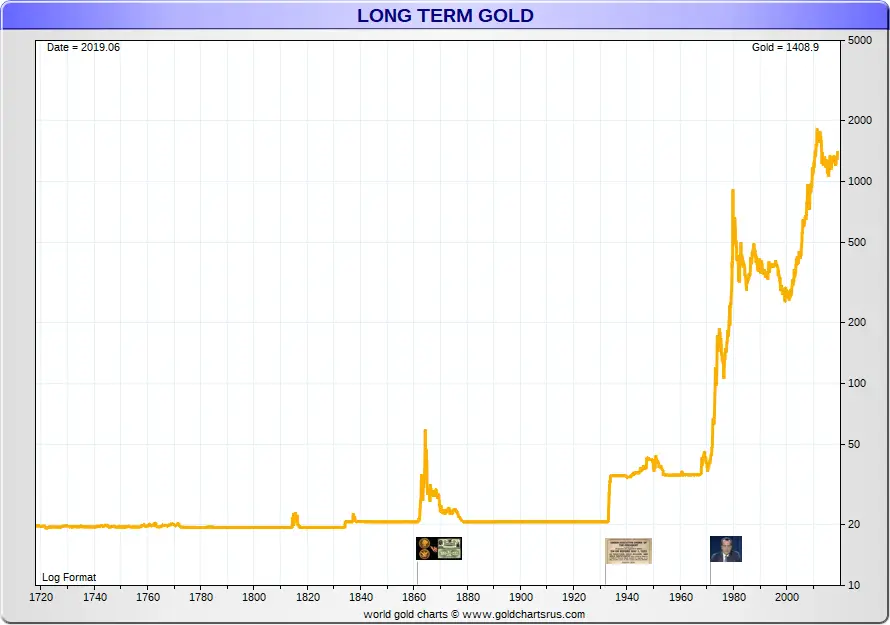

Historical charts before about 1950 don’t reflect this. Reliable data about the historical gold price is harder to find. Gold prices today are more dynamic and well-documented.

Don’t Miss: Value 10k Gold

See What Investors Are Saying About Monex

What is the gold content of a 10 oz. Gold Bullion Bar?

10 oz. gold bars consist of a minimum .995 pure gold and are widely recognized as the industrys standard unit.

How do I buy and receive 10 oz. Gold Bullion Bars?

Once you have decided on the quantity of 10 oz. Gold Bars to purchase, your Monex account representative will assist you in executing your order over the phone. Upon your acknowledgment, your selected purchase and gold price will be confirmed on a voice recorded line and a written confirmation will be sent to you with the details of your order.

Payment may be made after you order, but must be initiated on the day of purchase, which means you must mail or wire funds on the very same day of your transaction. You can have your metal shipped to your home, made available for pick-up at over 30 facilities across the U.S. and Canada, or have your metal delivered to a bank/depository for storage.

Is there a minimum purchase of 10 oz. Gold Bullion Bars in one transaction?

Investors can now start investing in gold bullion with a minimum purchase of one 10 ounce gold bullion bar. Buying gold bars in larger quantities, however, offers greater efficiency, which means better pricing for you. Monex selects only the most popular and liquid investment grade products, and buying more than one gold coin or bar has historically proven beneficial over our extensive fifty years of experience.

Can I purchase 10 oz. Gold Bullion Bars for my IRA?

Monex Deposit Company