Value Of Gold Per Ounce

Are you wondering, “what’s the price of gold”? The live chart above shows the current spot;value of gold per ounce in US dollars. You can;change the currency by using the menu at the top of the chart.

As with the other charts located on this site, just hover your mouse over the graph to see the particular price at a given time.

Gold Vienna Philharmonicsdesign And Specifications

The Austrian Mint in Vienna has been producing innovative coinage and currency for over 800 years and the Vienna Philharmonic is no exception.First struck in 1989, the Vienna Philharmonic coin is the only European legal tender gold coin produced on a large scale and the only regularly issued bullion coin denominated in euros. The Vienna Philharmonic is pure gold, with a fineness of .9999 or 24 karats, and is the largest diameter one ounce pure gold coin in the world.

Each Vienna Philharmonic coin masterfully depicts the cultural pride of Austria, the Vienna Philharmonic Orchestra. The obverse side of the coin is stamped with the name of the orchestra in German, and features a montage of instruments, including a string bass, cellos, violins, a bassoon, harp and Viennese horn, representing Austria’s rich musical and cultural heritage.The reverse side of the coin features the image of the “Great Organ” found in Vienna’s Golden Hall where the Vienna Philharmonic Orchestra performs. The country of issue, the gold weight in ounces, legal tender value in euros and the coin’s purity are also stamped on the reverse side of the coin.With a very close working relationship with the Austrian Mint, Monex remains one of the leading dealers in Vienna Philharmonics.

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

Read Also: How To Buy Gold For Investment

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2.;Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

Get The Gold Price Today From Goldpricecom

Goldprice.com is your destination for industry insight and the best tools to discover live spot prices for gold, silver, platinum and palladium. Our gold price charts provide accurate price data and allow you to research currencies from 37 different countries with 8 options for weights of measurement. We offer analysis and expert opinions to help educate you on the gold price today and prepare you for future purchases and investments.

Don’t Miss: What To Mix With Bacardi Gold

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

- American Eagle

Historical Track Record Of The Value Of Gold

In the early history of gold investment, the value of gold per ounce has been known to remain at the same level for up to two centuries.

In 1717, Isaac Newton, being the master of the U.K. Mint, set the value of gold per ounce at L3.17s.10d. . It stayed at roughly the same price for the next 200 years until 1914 .

- The Government of the United States has changed the price of gold per ounce only four times since 1792 to the present.

- In 1792, the price of gold was $19.75 per troy ounce. It rose to $20.67 in 1834. In 1834, it rose again to almost 60%, amounting to $35 per ounce. In 1972, the price was raised to $38 and then to $42.22 in 1973.

- In 1968, a two-tiered pricing system was imposed. As a result, the market price of gold began to increase sharply. Gold value has fluctuated ever since.

- In 1974, the market price of gold soared to $154 per ounce. It stayed in that range for three years.

- In 1979, the price of gold amounted to $306.00 per ounce, skyrocketing to almost 60% from the previous year at which time the price of gold was $193.4.

- In 1980, the value of gold in currency increased by 100% from the previous year. The average price per ounce that year was $615. It was the year of the highest market price for gold ever recorded in history.

- The value declined sharply to $460 the next year. The price stayed stable near at that price range towards the end of the 20th century

Don’t Miss: Can Rose Gold Be Resized

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value; however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

Read Also: Will Gold Price Go Down

Gold Bar Price Basics

The base prices of all gold products are determined by the gold spot price. The gold spot price is a live price, meaning the price for gold is constantly changing . Since January 2018, the price for gold has not gone below $1,250 per ounce. In late 2019 to early 2020, the gold price has risen to levels as high as $1,650 per ounce.

Now, the price of gold bars is not exclusively determined by the spot price. In fact, it is exceedingly rare for a bullion dealer to have gold bars available at spot price. Every gold bar will have some sort of premium on top of the inherent value of the gold they contain. Depending on the dealer and the mint of the bars, these premiums can vary wildly. I will talk about the latter later in this post.

Check out our blog post on How to Buy Gold Bars

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold; essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?

You May Like: What’s The Value Of An Ounce Of Gold

Why Is There A Difference Between The Prices Of Gold And Silver

The primary reason behind the large discrepancy in the value of gold and silver is due to their rarities. The usual market principles such as supply and demand play a pivotal role in determining the value of gold. Since gold is low in supply, it is also much harder to obtain than other metals.

Silver is much larger in supply and is easier to mine. In fact, silver is often obtained as a by-product of other metals during mining. Silver can be obtained at a rate of 0.07 parts per million. In contrast, the average occurrence rate of gold is 0.004 parts per million.

What Are Benchmark Prices For Gold

There are no official opening and closing rates for silver or gold. As a result, traders are forced to peg their investment decisions on benchmark prices which are decided by different organizations during different times of the day. The technical lingo for benchmarks is also known as fixings.

The leading organization that maintains benchmarks for different precious metals is the London Bullion Market Association . It governs prices for gold and silver, both of which are well-respected benchmarks used by dealers in the precious metals marketplace.

The most typical way to determine benchmark prices is through electronic auctions between participating financial hubs such as banks.

Don’t Miss: What Is Vermeil Gold Plated

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds; however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

Don’t Miss: Can I Buy Gold On Robinhood

What Makes Gold A Precious Metal

This is a classification of specific metals that are considered rare and have a higher economic value compared to other metals. There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesnt corrode.

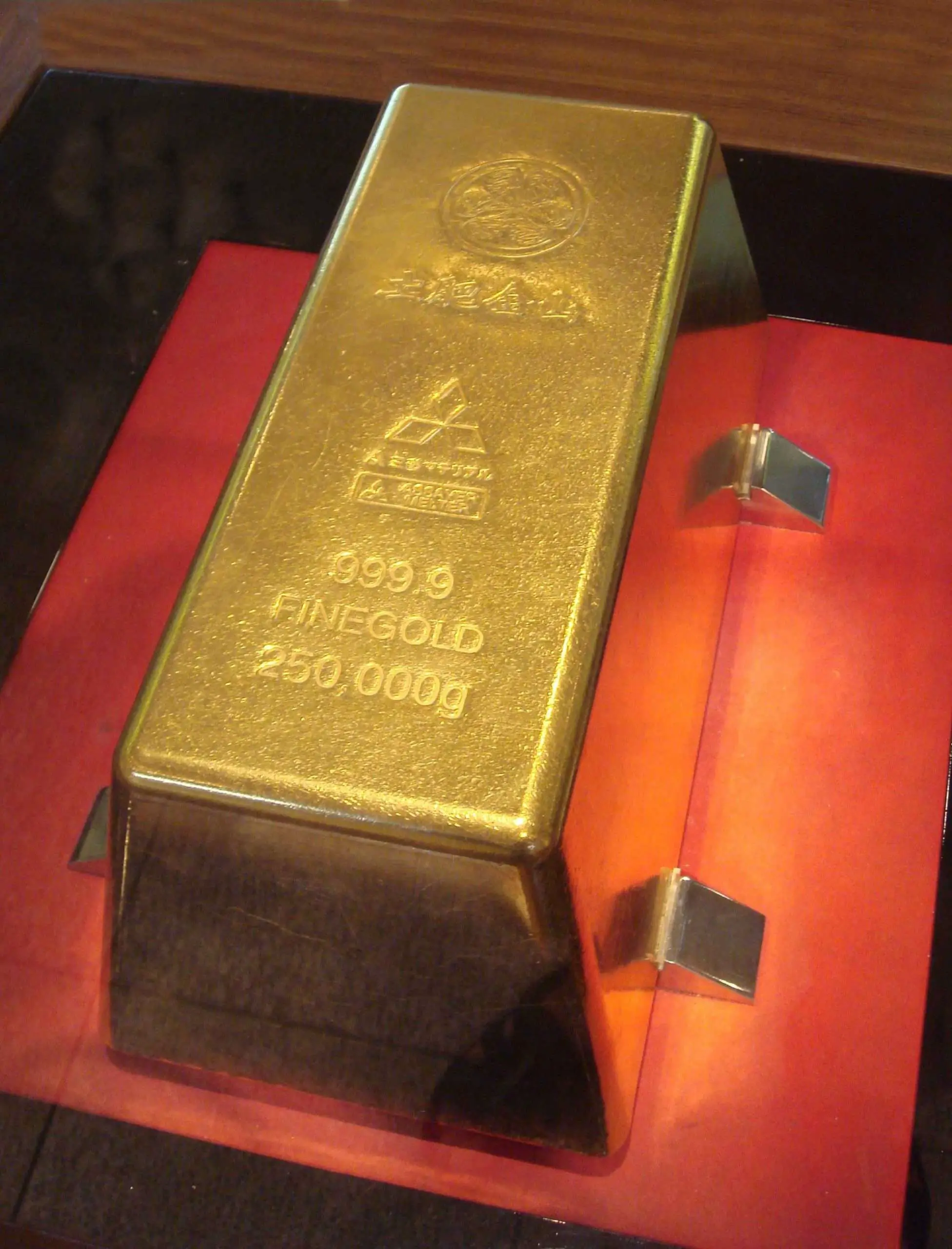

Different Sizes Of Gold Bars

Obviously, different sized gold bars are going to have differing prices. Gold bars can be minted in sizes ranging from 0.5 grams all the way up to 250 kilograms- which is the weight of the largest gold bar in the world. When the average person thinks of a gold bar, they would most likely picture a 400 oz bar, which is considered the standard weight for gold bars. A 400 oz bar is also nicknamed a Good Delivery Bar. They are nicknamed this because they meet the standards set by the London Bullion Market Association.

More practical gold bar sizes are typically much less than 400 oz. The most commonly traded gold bar weights are kilo bars and lighter. The most common weights are 1 oz, 5 oz, 10 oz, kilogram, and other various gram bars.

Don’t Miss: Are Gold’s Gym Treadmills Any Good

Does Gold Fluctuate Too Much To Make It Worth The Time Of An Ordinary Investor

While youll find major players investing in gold constantly, from big banks and governments to investors like George Soros, it is not too volatile for the ordinary investor to use. By knowing the spot price of gold and historic gold prices, you can track the movement of the metal and make smart investing decisions. Many ordinary investors choose to put a percentage of their wealth into gold simply to protect it from paper dollar devaluation.

Gold is a store of value investment. This means that while the gold price might change daily, or even hourly, the value of the gold does not. It protects the money you put into it. This is more important during challenging economic times than it is during the course of normal events.

How Much Is 8 Ounces Of Gold Worth

troy

| 8 Troy Ounces of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

You May Like: How Long Is The Golden Gate Bridge

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.