What Is The Gold/silver Ratio

It is the number of ounces of silver required to buy one ounce of gold. Silver and gold price chart history and the fluctuating gold/silver ratio is often used by investors to analyze how much silver is worth in comparison to gold, to evaluate if one of the two is overpriced at any given time. This enables investors to determine whether it is a favorable time or not for either buying or selling one of these commodities.

What Moves The Price Of Gold

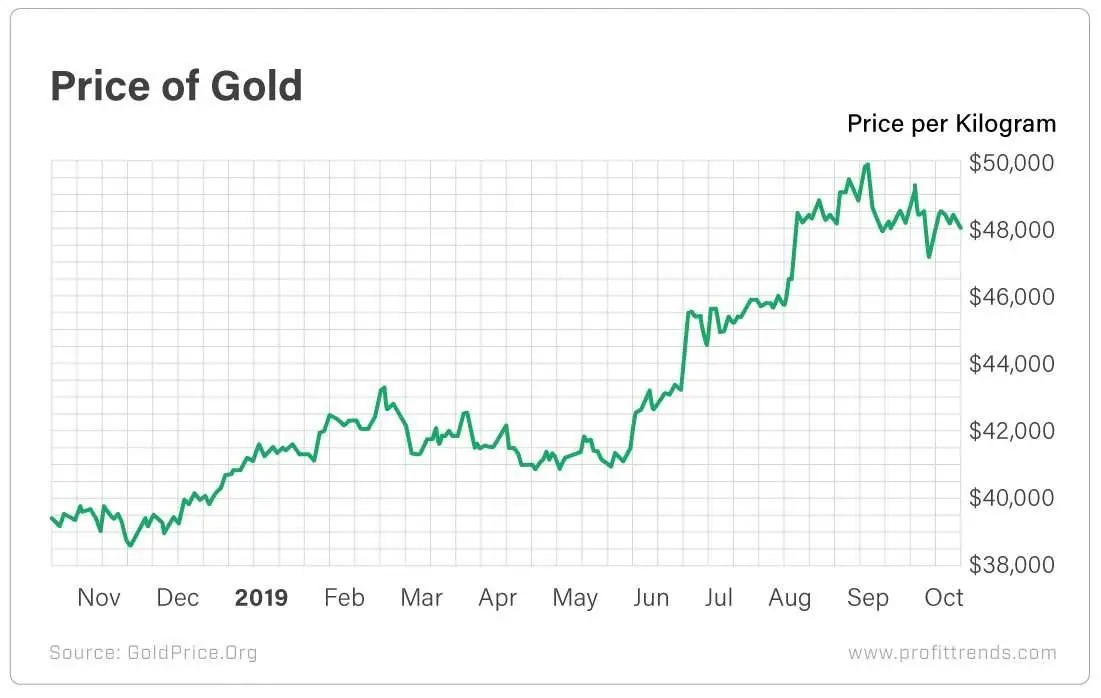

The price of gold moves depending on a combination of supply, demand, and investor behavior. Its value tends to increase along with demand. Its supply, however, tends to remain rather constant, making it a famous hedge against inflation when the supply of paper money starts increasing. The spot price fluctuates throughout the day, making it important to follow current events and market conditions, as they will affect your buying and selling price for precious metals.

What Is The Price Of The Gold And Silver Ratio

The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold.

Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold.

Recommended Reading: Kay Guest Appreciation Event

How To Buy 1 Oz Gold Bars In The United States From Goldcore

You can buy gold bars online from GoldCore for delivery or storage using the BUY button or you can call our office to place your order over the phone.

We deliver gold bars and coins fully insured to our American clients throughout the United States from our depository partner vaults in Delaware. We offer all major bullion bar and coin products for delivery and storage and you can pay by bank wire, by credit card or by debit card.

Many of our U.S. clients opt to store their gold bars in fully insured, offshore Secure Storage locations. We specialize in offering U.S. clients access to allocated and segregated bullion storage in secure nonbank vault partners in safer jurisdictions in the world such as Zurich, Hong Kong, London, and Singapore.

Insured delivery of gold bars to homes or offices is also popular and many clients do both – take delivery of a portion of their gold and own the rest in Secure Storage.

What Is Oz Gram Kilo Tola

Gold and most precious metals prices are quoted in troy ounces however, countries that have adopted the metric system price gold in grams, kilograms and tonnes.

Grams = 0.032151 troy ounces

Tael = 1.203370 troy ounces

Tola = 0.374878 troy ounce

Though not as popular as kilograms and grams, Tael is a weight measurement in China. The tola is a weight measurement in South Asia.

Don’t Miss: Can You Buy Gold On Robinhood

How Frequently Does The Gold Ounce Price Change

Spend any time studying gold price history or a current gold price chart, and youll notice that the gold price changes, and it can do so frequently. The market opens at 6 PM EST and closes at 5:00 PM EST, and operates from late Sunday night when the gold derivative markets open in Asia to late Friday evening when they close in the west. There is a one hour window daily where the market closes on weekdays.

The frequency of these price changes will depend on what events are affecting the live gold price. For instance, breaking news usually has an immediate impact on the market, but other factors can include order flow, supply and demand, mine closures, investor decisions and many others.

Is The Price Of Gold Different In Other Countries

The current price of gold is the same, all things considered, in other countries. The US gold price is converted to the currency in that country based on the current exchange rate. In other words, no matter where in the world you purchase gold, the actual value of that gold in US dollars is the same. The below chart shows the annual gold price performance versus various fiat currencies.

You May Like: How Many Grams In 1 Oz Of Gold

How Are Gold Bars Prices Set

Currently, there are many types of gold bars circulating the world’s precious metal market – meaning there are endless possibilities to pick from. Buying Gold Bars is the most popular way of investing in the precious metal market. Their price is set based on their quality, craftsmanship, weight, and sometimes year of issue and rarity. The price of a gold bar contains three main elements: the metal price, the premium, and the VAT. However gold is exempt of VAT in most European countries. The metal price is directly based on the spot price which is the most recent price of gold on the market. Depending on its weight and quality, a gold bar will have a higher or a lower metal price. Finally, the premium is our margin, it is the part of the price of your gold bar that will come back to GOLD AVENUE to pay for production and others costs related to selling the bar. The margin can vary for each product depending on its level of craftsmanship for example. This is why minted bars tend to have slightly higher premiums than cast bars, as it takes into account the bars artistic value.

What Are Gold Bars 1 Oz

1 oz gold bars are made from investment grade gold bullion and each one weighs exactly 1 troy ounce, or 31.1034768 grams. 1 oz gold bars have a fineness, purity or gold content of at least 99.9%.1 oz gold bars are usually rectangular. They are produced either as cast or minted bars. Because 1 oz gold bars are manufactured from a variety of refineries and government mints, their look and feel can vary.

You May Like: How Many Grams Is 1 10 Oz Of Gold

Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

Why Should I Invest In Gold

With a rich history amongst almost all global cultures, gold remains a highly popular investment. Although it has multiple uses, its primary function is typically to hedge against inflation in an often volatile futures market, as well as to diversify existing Precious Metals Investment Retirement Accounts.

Gold has been one of the most valuable precious metals throughout human history, used by elites as a symbol of wealth for centuries due to its rarity and its ability to hold its worth for a long time. Historically, it has been the most common way to pass on ones wealth as an inheritance from one generation to the next.

Gold is considered a worthy investment, with coins and bars available for purchase in various sizes, ranging from one gram to a whopping 400 ounces. At Bullion Exchanges, we carry a wide selection of gold products to suit the likes of both savvy investors and passionate collectors.

Being the most reliable investment commodity available, gold has proven to be a perfect way to diversify your investment portfolio and an excellent safeguard against volatile currency.

Recommended Reading: How To Get Free Golden Eagles In War Thunder

How Much Is An Ounce Of Gold

The price of gold per ounce is perhaps the most common way investors monitor the gold market. The image below shows a 1 ounce gold nugget and a 1 ounce gold coin – in this case a gold eagle coin. The Gold Price Now chart at the top of the page shows the current value of gold in US dollars. You can also get the price of gold in other world currencies by selecting a different currency from the drop down menu below the chart.

Live Gold Spot Price Chart

The precious metals market is always fluctuating. Every second, the price of gold either rises or falls in response to the market. This is referred to as the spot prices and relates to how much one raw ounce of a particular metal sells for on the market at a certain moment in time. For your convenience, we have provided charts and tools to help you keep up to date with the spot price of some of our most popular precious metal offerings in real-time. From a microscopic one-hour view to data gathered over the course of a year, our goal is to give you the tools you need to make the most informed investment decisions possible.

Simply navigate to the list below and click on the metal of your choice to access its chart. Then, click on a time period in the charts upper section to see its data. You can also scroll over the chart itself to see price points at specific moments.

You May Like: Where To Buy A Bar Of Gold

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

Also Check: How Many Grams In 1 Oz Of Gold

Is The Price Of Gold Im Quoted Going To Be The Price I Pay

Gold prices change, and they can change quickly, even by the minute. This makes the prospect of buying gold a little nerve-wracking for some investors new to the process. You might wonder if the price youre quoted will be the gold price you pay if the prices fluctuate up and down constantly.

The good news is that gold bullion dealers “lock in the price” when your order is placed, so that will be the price of gold you pay regardless of what occurs afterwards. If youre buying gold online, then you can lock the price in at the checkout page. Then, youll have a specific amount of time to make your purchase and keep the current price of gold. If you take too long, the lock-in is removed, and youll pay the new price of gold instead .

However, understand that not all gold dealers offer online price lock-ins and purchasing options, so verify this before making any purchase decisions.

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Also Check: How Much Is 10k Of Gold Worth

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

How Are The Premiums Over Spot Calculated Are They The Same For All Gold Products

Premiums vary depending on the product.

Generic gold items usually have lower premiums. A more intricate design on a gold bar or gold coin will raise the premium. Rare or limited edition products will also have high premiums.

The reason for this is twofold. Highly artistic gold products are more costly to manufacture. Buyers are also willing to pay more for such items.

Don’t Miss: What To Mix With Bacardi Gold

Is There A Single Spot Price

Quite simply, no. The spot price is liable to change throughout the world as each countrys exchange platforms begin trading. Starting with Sydney, then Tokyo, Hong Kong, Singapore, Bombay, Zurich, London, New York ending in California, trading never stops, so it is impossible to condense every trade around the world into a single price.

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

Also Check: How Much Is 18 Karat Gold Per Ounce

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2. Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

Recommended Reading: Golds Gym 450 Treadmill Specs

What Is The Spot Price Of Gold

The spot price of gold is the current price gold can be bought and sold for on the market. It is usually calculated in Troy ounces but can also be given in grams or kilograms. The price of a gold product is the spot price plus the premium, which is the part of the price covering our margin, production, and operational costs.

Who Makes 1 Oz Gold Bars

GoldCore only sells gold bars of recognized and widely-traded brands. These would include the one-ounce gold bars from such highly regarded and LBMA approved refineries such as Johnson Matthey, Credit Suisse, MKS PAMP, Heraeus and government mints such as the Royal Canadian Mint, the Royal Mint and the Perth Mint of Western Australia. Perth Mint gold bars remain our most popular bullion bar.

Read Also: 3 Month Xbox Live Cost

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.