What Is The Gold/silver Ratio And Why Is It Important

The gold/silver ratio is a calculation meant to serve as an indication of divergence between the market value of the two metals.

To calculate the gold/silver ratio, simply divide the price of gold by the price of silver.

Gold has always been more highly valued than silver, but as each metal fluctuates in price, the ratio between the two also changes. A gold/silver ratio of 80 or more has historically served as a reliable signal that the price of silver is about to rise or the price of gold is about to fall.

In modern times, the ratio has mostly remained between 50 and 80. A divergence to either end of that range often signals that a correction back toward the mean may be ahead.

Mike Maloney has discussed the gold/silver ratios historical patterns and utility, as well as where the ratio is likely headed.

Demand In A Financial Crisis = High Prices

The popularity of silver has been growing greatly over the years in both industrial and jewelry production. Over the past decades, bullion popularity has grown 20 percent. India has now become the greatest silver consumer since 2017. The economy for silver is one reason investors are choosing silver as a solution for their trading portfolio.

The global stock market has also been seeing movement in prices. Investors are jumping at mining stocks to expand their stock portfolios. Despite the disease-threatened global economy, recovery is still eventually going to occur. This is why most active stocks are one of many stock gainers. While buyers are moving their currencies to stocks, this is only seen as a short gain. Buying stocks is one part of the pie in your investment portfolio.

Factors That Determine The Price Of Silver

The spot price of silver is determined by a number of different factors. Like any commodity on the open market, the price of silver is subject to change at any moment due to volatile market dynamics.

Factors that determine the price of silver include :

- Supply and demand

- Currency valuation

- Institutional buying power

Supply and demand pertains specifically to the ratio of how much silver is desired on the market compared to the volume of silver being produced from mining and minting. This is arguably the most common variable in determining the current silver price.

Investor spending refers to the activity of individual and collective investment in silver bullion, coins, and ETFs. Spending patterns will usually reflect the changing price of silver from one day to the next, such that spending will increase when the market silver price is low.

Aside from buying and selling silver, investors also engage in market speculation in the form of silver futures investment. Futures investment is the practice of speculating a future price of silver and agreeing to sell it on a specific day, for a set price. Silver futures trading has a direct impact on the price of silver because a falling price of silver may induce a trader to sell thereby compounding the decline in silver prices & value.

Also Check: Can I Buy Gold Jewelry From Dubai Online

Leading Indicator: Gold To Treasuries Directional Inverted Correlation

The next leading indicator appears to be directionally reliable in forecasting the price of gold. It means this correlation helps understand the direction: up vs. down.

The rate of 20 year Treasuries is shown in light grey on below chart while the gold price is reflected in black.

There is a clear correlation between both markets. The 4 divergences are shown in red, and its clear that its really different compared to the divergences on the gold / USD inverted chart shown above.

These divergences tended to last 6 to 9 months, much shorter than the gold / USD leading indicator. The divergences took place during strong risk off periods.

Chart update: 11.08.20

The Message From History

To help answer the questions posed above, I looked at past stock market crashes and measured gold and silvers performance during each of them to see if there are any historical tendencies. The following table shows the eight biggest declines in the S& P 500 since 1976 and how gold and silver prices responded to each.

What Happens to Gold and Silver During Stock Market Crashes

There are some reasonable conclusions we can draw from this historical data.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

Troy Ounce Or Avoirdupois Standard Ounce

A troy ounce is not the same as a standard ounce, or what is referred to as the avoirdupois ounce. A single troy ounce measures out to be one-tenth heavier than a standard avoirdupois ounce, and it has been set as the international standard since the days of global trading in precious metals began.

This unique measurement has direct implications on your investment decisions, as some websites measure in ounces rather than troy ounces. Always be sure to make the change into troy ounces before deciding on an investment. If you are measuring in grams, be advised that one troy ounce is equal to 31.1035 grams.

Leading Indicator: Gold To Dollar Inverted Directional Correlation

The 2nd leading indicator for golds future price is the Dollar inverted correlation.

The next chart shows the Dollar in light grey, but it is inverted. The price of gold is reflected in black.

In the last 2 decades the gold price chart has tracked the inverted price of the Dollar with just 3 exceptions . Those exceptions only tended to last 6 to 15 months.

Now one may argue that the divergences are substantial, and it would question the validity of this gold price forecast leading indicator.

However, we have to look carefully at the events that took place when these divergences took place. In particular gold and the USD are not correlated during major events: a major rally in gold , a major breakdown in gold or a major breakout .

In other words gold and the USD are negatively correlated but only directionally . When disruptive events take place the gold market goes its own way, and does not correlate to the USD.

Thats exactly why our point is that both markets track each other directionally. They do so except when major chart events hit the gold market.

Chart update: 11.08.20

Recommended Reading: How Much Does 1 Gram Of Gold Cost

Historical Prices Of Gold And Silver

The price of gold today is determined by supply and demand as it is traded through large global markets of physical metals , and even contracts for future delivery at a specific price.

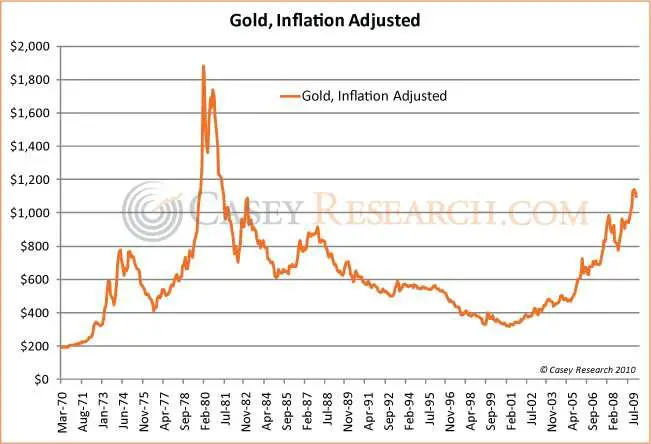

In the US, a market-determined price is a relatively recent phenomenon. For most of US history, government set the price at which gold could be converted to paper currency. In the early years of the republic, the exchange rate was $19.39/ounce. In 1834, it rose to $20.67 and stayed at or near that mark until 1933, when Franklin Roosevelt increased it to $35. Roosevelt also banned the private ownership of gold bullion by US citizens, and canceled the convertibility of paper dollars to metal, so the price only reflected what foreign buyers paid. Finally, in 1972, President Nixon closed the “gold window” citizens could own gold again but foreigners could not redeem paper dollars for gold through the government . The gold price was allowed to freely float.

Silver, by contrast, has always had a market-determined price, and its price history is marked by the sharp fluctuations youd expect absent any constant-price peg determined by the federal government.

Current Gold & Silver Prices

Study the changing price of silver with our interactive silver price charts. Use our helpful silver price chart data to gain insights into the future price of silver. Simply make a selection with the sliders and observe the price of silver over any period of time. Observe silver prices on any particular day by hovering over a point in the silver prices chart.

Silver prices are volatile, and change every minute of every day. Stay up to date on the current price of silver and use our information to your advantage when it comes to your silver investments.

Read Also: How To Stream Golden Globes 2021

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

Are Gold Traders Nervous

The sell-off in the gold price has got many gold lovers rethinking their investment strategies. The total known gold ETF holding is at a record high, but there is a minor indication of retracement, and this could be an initial sign of an easing in upward momentum.

Figure 2: Total known Gold ETF holdings are slightly off their record high

Total known gold ETF holding shows a minor retracement

AvaTrade, Bloomberg

However, it may be too soon to set this in stone, because we need more data to confirm that traders are not backing gold to the same extent that they were before. There is a degree of nervousness among gold traders.

Recommended Reading: How Much Is One Ton Of Gold Worth

Will Gold Price Go Up In 2021 Depends On These Factors

The historic case for gold prices to move higher is its usefulness as a hedge against inflation. If the cost of living rises, the price of gold usually follows suit. However, inflation hasnt been much of a concern in 2020 as developed economies showed relatively low and stable levels of inflation.

Most notably, the US Federal Reserve hinted throughout the months that inflation rates are the least of its concerns. But some experts and analysts believe that inflation rates are due for a rebound and investors are more optimistic that a bullish answer to will gold go upis the correct position.

Stock prices are also a factor in determining if a gold price increase in 2021 is likely. Major US stock indices soared to all-time highs and equity valuations certainly play a role in any gold price analysis. If investors believe that the gold price 2021 offers a better value versus some stocks that are up hundreds of percentage points then a rotation towards the commodity could be seen.

Perhaps most important, the relationship between gold and the US dollar is a key determinant for future gold price expectation. The two asset classes have shown historically an inverse relationship so when the greenback rises in value, gold prices fall and vice versa.

Capital.com tightens already competitive overnight fees further on Gold and Silver in addition to tight spreads

Leading Indicator: Silver To Inflation Directional Correlation

The next leading indicator appears to be highly reliable in forecasting the price of silver.

In particular the inflation / deflation indicator from Pring appears to have a very strong positive correlation with silver. Again, this is a directional indicator, and we look at the secular trends .

The inflation / deflation indicator in light grey on below chart is in the process of setting a major double bottom. Look at the two green circles at the bottom.

Note how this double bottom did coincide with the test of secular support in the price of silver. Almost at the same time did the inflation indicator and the price of silver bottom.

Whether the recent silver price breakout is forecasting inflation to go up, or vice versa, does not really matter. At least, thats what we believe.

What matters to us is that both markets bottomed, and that silver already broke out in the meantime. With this it ended its 8 year bear market, almost in the same week after it peaked in 2011 !

Chart update: 10.25.20

The price of silver is in a new bull market, period.

The only question that matters is how fast silver will rise. Given the fact that it is in a new bull market, early stage, it will go up slowly. The acceleration phase follows later.

You May Like: What Is Goodrx Gold Card

What Is The Price Of Silver

When someone refers to the price of Silver, they are usually referring to the spot price of Silver. Silver is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Silver is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Silver changes constantly and is updated by the minute on APMEX.com.

Importance Of Silver Spot Price

The silver spot price is the amount you can expect to pay for 1 oz. of silver, on any given day. Like all investments, the ROI is dependent on the initial silver price you pay, so make sure to buy low. Track the changing live spot price of silver with our silver price ticker. It runs 24/7 and provides actionable insight into the trending price of silver. Hover over any point in time to observe the price of silver from any particular day. Monitoring the price of silver can also offer insight into economic events and potential market crashes. Keeping up to date on the price of silver and precious metals is an important habit for wise investors globally.

Recommended Reading: What Time Is The Golden State Warriors Game

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2. Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

How Correlated Are Gold And Silver Prices

The prices of gold and silver tend to trend in the same direction but at different amplitudes. Silver is the more volatile of the two metals and therefore tends to amplify golds moves on both the upside and the downside.

That said, there are periods when silver may decouple from gold. For example, a physical shortage particular to the silver market could cause silver prices to skyrocket independent of gold. And in the event of a financial crisis, gold may benefit from its safe-haven status while silver suffers from a hit to industrial demand.

Recommended Reading: What Time Do Golden Globes Start

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

How High Could The Price Of Silver Go

Silver has actually circulated as currency more often than gold. While silver has numerous industrial uses and can thus be affected by economic activity, it too has served as a safe haven during periods of financial crisis. It will perform in tandem with gold. Mike Maloney thinks silver could ultimately hit the high three figures.

Don’t Miss: Where To Sell Gold Rdr2

What Is The Gold / Silver Ratio

The Gold/Silver ratio measures the relative strength of gold versus silver prices. It shows how many ounces of silver it takes to purchase one ounce of gold.

To get this number, divide the current gold price by the current silver price.

This gives you the Gold/Silver Ratio, a simple way to check which of the two major precious metals is gaining value relative to the other.

When the Gold/Silver Ratio rises, it means that gold has become more expensive compared to silver, and the cheaper metal might offer better value. It hit a new all-time high above 125 in March 2020 when the Covid Crisis saw gold investing jump but crushed the silver price, along with most other industrial commodities, as world economies went into lockdown.

When the ratio falls, it means gold has become less costly relative to silver. It fell dramatically from that 2020 spike in the second-half of the year, even as gold set new all-time highs in Dollar, UK Pound and Euro terms, dropping below 70 ounces of silver per 1 ounce of gold as global industry re-opened in early 2021.

Some analysts, traders and investors look to “trade the ratio”, buying silver when the Gold/Silver Ratio is high and switching to gold when it falls. This is easy, quick and low-cost using BullionVault.