Gold Versus The Dollar

Historically, gold has been closely tied to the relative buying power of the U.S. dollar as the de facto global currency.

A whole lot of factors weigh into the important relationship between gold and the dollar as a result, with the inflation rate being a primary driver.

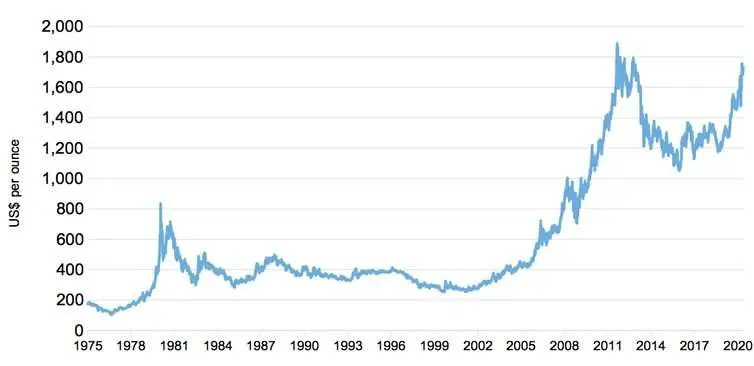

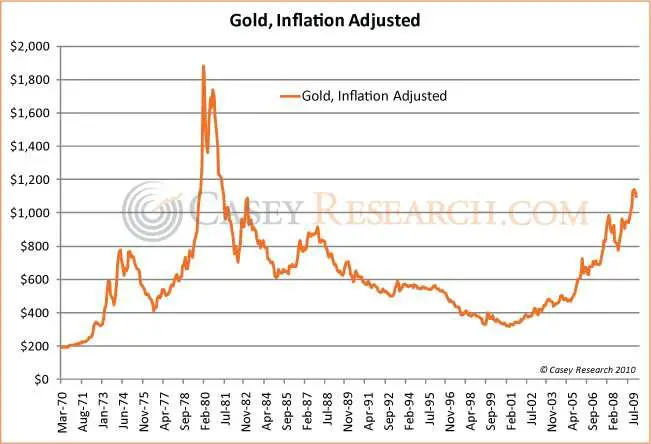

The price for gold has increased rapidly, but when adjusted for inflation, the purchasing power of an ounce of gold isn’t far from where it was in 1980.

Gold has to be at around $2,000 per ounce to match the purchasing power of an ounce back then.

Gold, for our purposes, is an investment. As such, we should give a lot of weight to the price of gold compared with other broad investment metrics as well.

Another way to look at it is this is that gold is competing with other investments only for dollars that people are willing to invest.

Now that the economy is on the precipice of reopening, gold is predicted to withstand the inflation that is bound to follow.

Does The Value Of The Us Dollar Predict The Price Of Gold

As gold is traditionally quoted in US dollars, the price of gold is negatively correlated to the strength of the USD. The weaker the US dollar, the cheaper it is to purchase gold. Therefore, if economic factors predict a strengthening of the US dollar then this will tend to drop the price of gold, and vice-versa. According to the statistics , the long-term correlation between the U.S. dollar index and the gold prices is -0.6 so this link is quite strong.

My Silver Price Projections

There are many other potential catalysts that could impact the silver price. Frankly, there are so many possibilities that theyre hard to catalog.

What I covered here are the unique circumstances the silver market finds itself in right now, and why the upcoming bull market could be bigger than many anticipate.

Suffice it to say that whatever impacts gold is also likely to impact silverheres a list of those possible catalysts, in our Gold Predictions article.

Based on all these factors, here are my predictions for the silver price for both 2021 and where the silver price could be in the next 5 years.

As a result of my research, I decided to buy more silver! Heres what I bought.

I encourage you to consider that regardless of where the price may end up over the next few years, silver represents a very compelling investment opportunity for the foreseeable future.

Also Check: Does Kay Jewelers Sell Real Gold

Gold Price Forecast 2022

On the supply side, gold production is rebounding from the shutdowns following the start of the Corona-crisis. Analysts expect that production will expand through 2022, given that prices are well above production costs. The World Bank forecasts prices to average 4% lower in 2021 and decline further in 2022.

Gold Prices In The 21st Century

Gold found its prices rising on a financial market in 1979, when prices were topping out in dollars at 850 dollars per ounce in early 1980. Since then, the market went through a correction and prices have risen and dropped to date.

Let’s take a look at how the prices have changed in the last 20 years.

Read Also: Gold Goodrx Con

Special Report: 2021 Gold Price Outlook: Why Gold Will Keep Heading Higher

Gold has always served as a hedge against inflation.

The beginning of 2020 saw gold at $1,500 per ounce. By mid-2020, gold prices almost reached $2,100 per ounce almost a 40% increase.

At the end of January 2021, it was still up to $1,900 per ounce.

The second-largest spending bill in U.S. history, signed by President Biden, gave gold a more optimistic layout for the rest of 2021.

The question is can we expect gold prices to keep record highs and if so, how much further can we expect them to run?

We have already seen spikes from geopolitical dramas and standoffs, the lockdowns, and plenty of other events as well. Headlines will always drive short-term increases, which tend to quickly fade away, but fundamentals will carry the long-term trend.

Now, gold sits at roughly $1,700 per ounce.

Looking at the fundamentals, there is a strong case that gold is far from done with its record-breaking highs. Lets dive in and take a look..

Factors That May Affect The Price Of Gold

Typically, traders associate fundamental analysis with the stock market, not gold. While fundamental stock market analysts monitor certain companies’ financial statements, gold market analysts monitor macroeconomic factors, political and economic world stability, and competition from investment alternatives to forecast prices. Let’s look into five macroeconomic parameters that can influence the cost of the main precious metal.

Don’t Miss: Heaviest Metal Credit Card

Golds Leading Indicator #: Euro

Gold tends to go up when the Euro is in a bullish mindset. Consequently, when the USD is rising it puts pressure on gold.

The long term Euro chart suggests that the Euro is hitting support. The 110 level in the Euro index better holds. IF, and thats a big IF, the Euro turns higher in 2022 AND respects 110 it will be supportive of higher gold prices in 2022. Our 2022 gold price forecast will get a confidence vote from the Euro.

Similarly, the USD is really bullish right before 2022 kicks in. Thats why we believe that gold cant accelerate yet, it needs the USD to complete its bullish move and turn flat or lower. Thats when gold will break out from its 2011 ATH and accelerate its bull run.

The next chart shows the periods in time in which the otherwise positively correlated Euro and gold were diverging. It has been only a few times in 2 decades. The Euro is our #1 leading indicator for gold. The Euro cannot fall in order for gold to start and accelerate its bull run, thats the conclusion.

What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

Don’t Miss: How Much Is 1 Gram Of 10 Karat Gold Worth

We Predict 2022 To Have One Or Two Bullish Cycles For Gold Which Might Push The Gold Price To $2500

We consider our annual gold price forecast one of those important forecasts because of our track record in forecasting gold prices. It is clear that both gold and silver started a new bull market back in 2019. One important dynamic in bull markets is that it starts slowly and picks up speed over time. While the gold bull market is already for +2 years in progress we believe there is more upside potential. We predict golds price could rise to $2,500 area in 2022. Our 2022 forecast is strongly bullish but we need the USD to first run its course before gold can accelerate. We believe gold will accelerate mid-2022.

InvestingHavens research team publishes for many years in a row its annual market forecasts. These gold and silver forecasts have been read by millions of investors over the years.

Our 2022 gold price forecast comes at a very interesting time. At the time of writing the USD being one of the leading indicators for the price of gold has been dominating precious metals prices. It did suppress them throughout most of 2021, more than at any point in time in recent years. Lately, however, the USD has been rising together with precious metals.

In other words, if anything gold price predictions might become among the most challenging ones. So far, our track record between 2016 and 2020 was phenomenally accurate. We will be open minded and transparent with our premium members and readers as it relates to our performance, now and at any point in 2022.

Read More About Cryptocurrencies From Cnbc Pro

On Friday, the Bureau of Labor Statistics said nonfarm payrolls increased by 943,000 in July, above the 845,000 new jobs forecast by Dow Jones.

While gold has since recovered some losses, Dhar said it was “difficult to remain bullish on the precious metal,” given the hawkish outlook for U.S. monetary policy.

The Federal Reserve is expected to dial back monetary easing and slow its stimulus efforts as the economy recovers from the pandemic. The U.S. central bank has held rates near zero, but officials have signaled that hikes could happen soon, especially with inflation running hot.

But Dominic Schnider, chief investment officer at UBS Global Wealth Management, predicts that real yields will “go less negative” and that means more downside for gold. He told CNBC’s “Street Signs Asia” on Wednesday he expects outflows from the gold exchange-traded funds and futures markets.

When real yields go up, gold prices go down, and vice versa. In such a scenario, the opportunity cost of holding gold, a non-yielding asset, is higher as investors are foregoing interest that would be otherwise earned in yielding assets.

“A stronger US dollar combined with a gradual increase in US 10 real yields suggest that gold prices should trend lower,” Dhar wrote.

Read Also: Heaviest Credit Card

Follow Our Gold Forecasts In Our Free Email Newsletter

We absolutely recommend to subscribe to our free newsletter in order to receive future updates. We publish updates on our gold forecast. But we also do publish other forecasts.

We continuously, throughout the year, publish updates on our annual forecasts. Any revision in our forecast are published in the public domain and appear in our free newsletter. Therefore, the only way to track the pulse of markets and stay tuned with our forecasts is to

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

You May Like: Why Are Gold Prices Going Down

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

Investment Demand: The Result Of Price Fluctuations

Some precious metals investors flock into this bullion for the silver ratio at different levels. This can result in a percentage basis, a higher rate of appreciation than with gold. Since gold is more inaccessible due to its price, it is easier to ride percentage price volatility with silver. In other words, you get more bang for your investment buck with silver because it’s more accessible compared to gold.

An example of this type of price spike in time is what happened in the 80s. Also known as Silver Thursday when speculators attempted to corner the silver market.

Recommended Reading: War Thunder Free Golden Eagles Code

Gold Holds Tight Range As Higher Yields Counter Omicron Fears

22 Dec, 2021, 07.37 AM

Gold traded within a tight range on Wednesday as higher U.S. Treasury yields and improved risk appetite countered concerns about the rapidly spreading Omicron coronavirus variant. Spot gold was little changed at $1,789.12 per ounce by 0126 GMT. U.S. gold futures also remained unchanged, at $1,789.50.

Gold Price May Jump To A New Lifetime High Say Experts Should You Buy Now

5 min read.Asit Manohar

- Gold price today is most undervalued among the financial asset categories and it may shot up to its lifetime high by end of 2021, say commodity experts

Gold price yesterday at Multi Commodity Exchange slid 0.06 per cent and closed at 47,090 per 10 gm mark. The yellow metal price edged lower for third straight session as Indian National Rupee continue to gain strength against the US Dollar . However, if we go by commodity experts’ views, the bullion metal is most undervalued among the financial asset categories and it may shoot up to its lifetime high by end of 2021. They said that weakness in US dollar, no sign of increase in interest rates post-Jackson Hole symposium and demand for physical gold due to fast approaching festival season in India, the yellow metal may breach its previous lifetime high of 56,191 at MCX.

Gold price outlook

A strategy to play the markets during a plunge

Triggers for gold price rally

Third wave of Covid

Rise in demand for physical gold

Indiabulls Housing Finance, Zee Entertainment among sto …

Gold price target 2021

Silver price outlook

Mint Newsletters

Recommended Reading: How Much Is 1/10 Of An Ounce Of Gold Worth

Gold Prices Between 1999

Anytime there is market uncertainty caused by geopolitical problems, gold prices rally. This explains why the gold prices skyrocketed in the first decade of the 21 century.

Between 1980 and 2000, gold prices fell but not at a steep rate.

In 2000, before the dot com excitement started, gold was trading for just $272.65 per ounce. However, from 2001, the country experienced an economic recession accompanied by the fateful 9/11 attacks. And as all investors do in the time of crisis, everyone started buying up gold.

Although this rise can be attributed to the panic that the economy was crashing, the prices of gold still increased at a steep rate even after the stock market started a new rally.

In 2007-2008, there was a severe worldwide economic crisis known as the global financial crisis . This economic crisis also contributed to a spike in the prices of gold. The yearly average was $ 871 per ounce in 2008. The financial crash of 2008 added to the demand, and over the next four years, prices were at an all-time high.

This year the price reached a high of over $ 1000 per ounce since the gold trade began.

The following year gold reached an all-time high with an average yearly price of $ 1,134 plus a high of $ 1,212 per ounce. But that was not the end.

Gold prices continued to increase. And in 2010 there was an all-time high price again of $ 1431 at the close of the year.

If Inflation Is Rising Why Is Gold Price Still Down Lobo Tiggre Answers

Kitco News

– Gold has held a strong relationship with inflation expectations but more importantly, gold tracks real interest rates, so if nominal rates rise faster than inflation, then gold would see pressure, said Lobo Tiggre of The Independent Speculator.

“Look at commodities prices. Look at copper, and nickelmulti-year highs. But even things like food and oil also heading upwards, but the headlines about food that strikes me as the kind of thing that the powers that be really can’t ignore. It could be a while before higher copper prices translate into higher prices into Walmart, but if grains are going up, that translates very quickly to higher food prices, Tiggre said.

When the real interest rate, which is the nominal yield minus the inflation rate, trends up, gold tends to fall under pressure.

“We’re looking at expectationsthe real rate, you take CPI and you take the nominal rate and you subtract the CPI. You have the nominal rate moving with the expectations, now, but you have CPI not moving yet, so mathematically, you’re going to see a situation where the real rate, it’s not turning into positive territory yet but it’s less negative and that directional change matters, Tiggre said.

Should the stock market fall even more as yields rise, the Federal Reserve may have to intervene, Hug said.

“If that Dow into serious trouble, I think the Fed steps in here,” he said.

Read Also: Subscribe Nbc Sports

Reason Why Gold Performs Well

Gold tends to perform well when people are worried about inflation and are worried about risks in the financial system. Investors are becoming more risk averse and are putting money in gold on the hope that they are getting a return on the investment. Analysts are fearing that the Fed will keep increasing rates in 2016 and there are speculations that it might have to go to negative interest rates.

Also check : Today’s Gold Rate in India

More than 20% of the global GDP is operating in a negative interest rate regime and more than $7 trillion of global debt has negative yields. The negative interest rates mean that people are paying the bank to hold their money or are paying the government to invest in their bonds. If it is costing you money to keep cash in bank, it is wise to invest in gold and create an opportunity to provide return on your investment.

What Is Spot Gold

The spot gold price refers to the price of gold for immediate delivery. Transactions for bullion coins are almost always priced using the spot price as a basis. The spot gold market is trading very close to 24 hours a day as there is almost always a location somewhere in the world that is actively taking orders for gold transactions. New York, London, Sydney, Hong Kong, Tokyo, and Zurich are where most of the trading activity takes place. Whenever bullion dealers in any of these cities are active, we indicate this on our website with the message Spot Market is Open. For the high and low values, we are showing the lowest bid and the highest ask of the day.

Read Also: Can You Get Banned For Buying Gold Wow