Are Gold Certificates Legal Tender Today

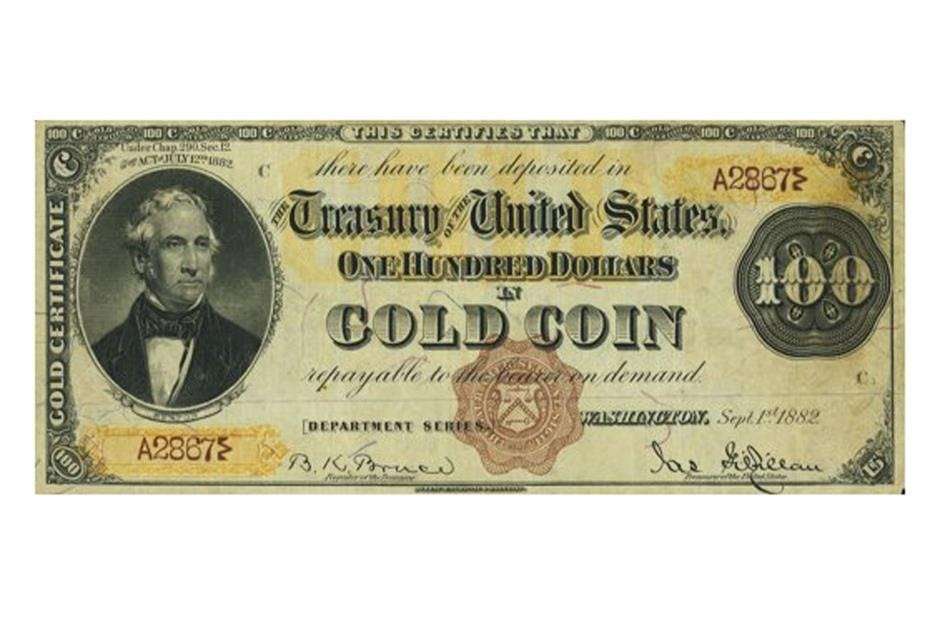

Gold Certificates are no longer redeemable for gold coins or gold bullion. However, all gold certificates are considered legal tender and can be redeemed at any financial institution for their face value in equivalent current coin or paper money. However, if the Gold Certificate was redeemed, it was canceled by punching a series of holes in the note that spelled the word CANCELED. These notes are not redeemable at face value.

Choose A Gold Company

One of the smartest ways to ensure you’re getting the best gold bar at the best price is to buy from a reputable gold company that puts your needs first. How do know if you’re dealing with a reputable company? Look for

- Third party ratings and a long history of client reviews.As the Federal Trade Commission advises, Check out the seller by entering the company’s name in a search engine online. Read about other people’s experiences with the company. Reputable, established gold companies can show that they have a long history of great service. Many also have the highest ratings from consumer advocate groups like the Better Business Bureau and the Business Consumer Alliance.

- A focus on education.A company that prides itself on client education won’t rush you into making a purchase that’s not right for you. We specialize in educating customers not only on the gold industry, but the type of portfolios they can use to protect their , said U.S. Money Reserve’s CEO Angela Koch in an interview on Enterprise Radio.

Sign up to receive U.S. Money Reserve’s free Gold Information Kit to learn everything you need to know before purchasing precious metals. Explore special offers, discover diversification strategies, and dive into U.S. Money Reserve’s exclusive precious metals guidebook. This expertly prepared tool is our gift to you!

The Best Places To Buy Gold Coins

Most gold coins are bought in one of two places: at a local coin shop, or online.

Believe it or not, youll likely find better pricing online than at a coin shop, even after factoring in shipping costs. Thats because the overhead at a brick-and-mortar store is higher. But thats just part of the difference between them.

Heres the pros and cons of your two basic options

Don’t Miss: How To Sell Gold Bars Rdr2 Online

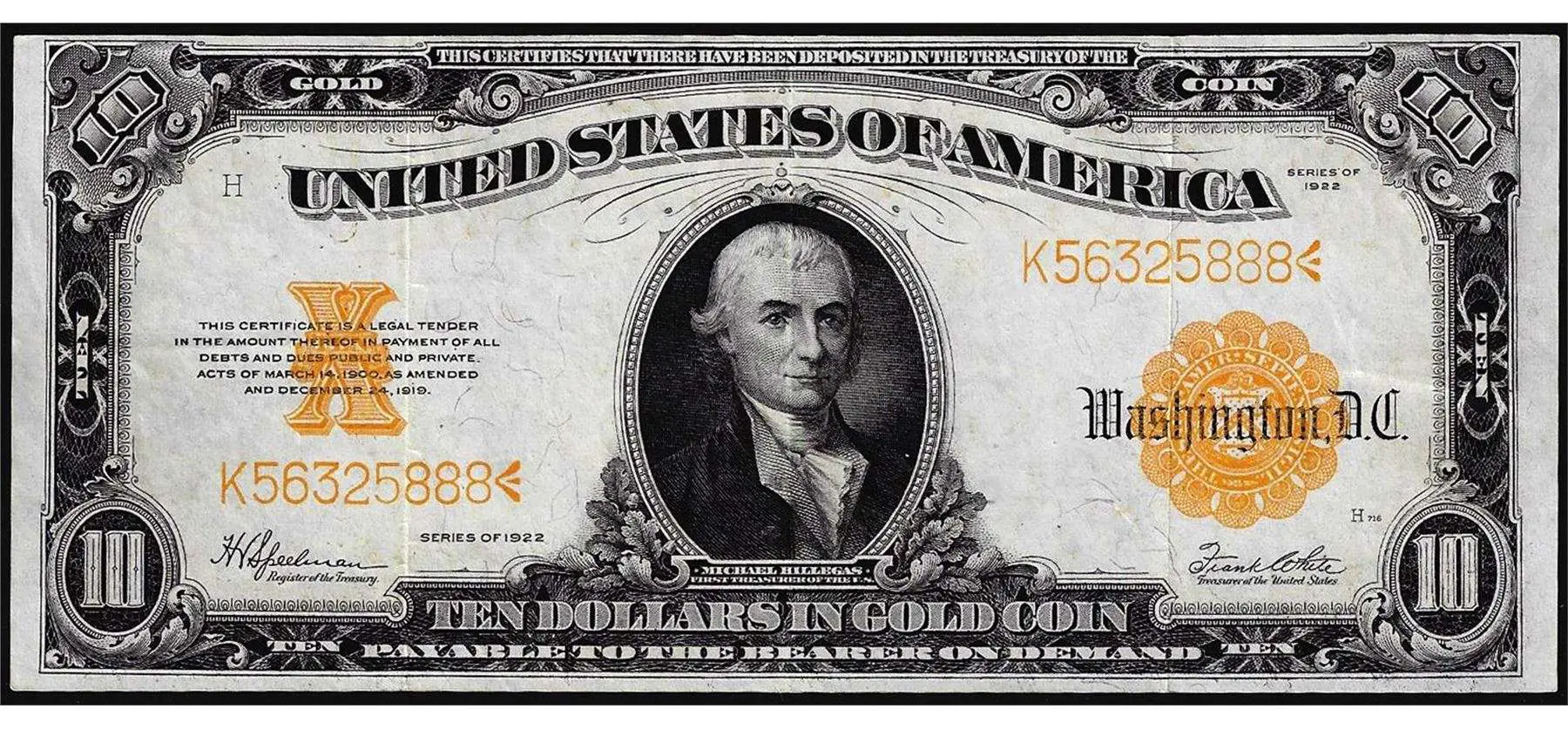

The 1922 Gold Certificate

In 1922, the first ever $10 gold certificates were issued. The notes feature a portrait of the first Treasurer of the United States, Michael Hillegas, on the obverse. The reverses were printed with gold ink, reinforcing their gold backing. Manny of these notes were destroyed following President Roosevelts decision, yet some survive in Fine condition. GovMint.com currently has some of these notes available. Each one that we sell comes with a certificate of authenticity, which is particularly important given the unique history of these certificates.

Buying Gold Mining Stocks

If you can’t get your hands directly on any gold, you can always look to gold mining stocks. Keep in mind however, that gold stocks don’t necessarily move in concert with bullion prices, because mining companies succeed or fail based on their individual operating performance and how they deploy their capital and generate profits. You don’t have the security of physical possession of the metal;if the companies you buy are unsuccessful.

Also Check: Where Can I Buy Physical Gold

What Are Your Thoughts On Gold As An Investment

Or do you have questions about how to craft your investment portfolio? Hop on over to our friendly SeedlyCommunity and you might get a great reply from the savvy members of our community!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.;

Sell To Private Party

You may find you can command a higher price by cutting out the middleman and selling directly to the end buyer. These buyers can be found through online collectors forums or by advertising in your local classified ads.

Unfortunately, choosing to forgo a reputable dealer leaves you vulnerable to scams and theft. Mitigate your risk by meeting in a public place to conduct the transaction. Do not accept a personal check, only a cashier’s check or cash. A bank provides a safe public venue to ward off theft and also allows you to check the legitimacy of the payment immediately.

References

Also Check: How Much Is It To Buy An Ounce Of Gold

New Video: Dominic Frisby

This weeks guest on GoldCore TV is financial writer, author, and comedian Dominic Frisby who joins Dave Russell to discuss financial markets, inflation and why now is gold and silvers time to shine Watch the Video to Learn More Make sure you dont miss a single episode Subscribe to our;YouTube channel. Gold to hit $3,000,

About The Certificate Program

The Perth Mint’s Certificate Program is designed to allow you to buy and sell gold, silver and platinum in unallocated, pool allocated and allocated form via a local firm but with the security of a direct legal relationship with The Perth Mint.

Many precious metal investors would prefer to hold their metal offshore but are dissuaded by the process of dealing with a business in a different time zone and the need to remit funds offshore. With the Certificate Program you can choose from a select group of Distributors who can help you with the account opening process, the wiring of funds offshore and any associated foreign currency conversions , as well execution of purchase and sale transactions.

The key advantage of the Certificate Program is that once the transaction has been executed, The Perth Mint issues a uniquely numbered Precious Metal Certificate printed on high security paper directly in your name, confirming your legal title to a specific amount of precious metal gold that you own and that is stored on your behalf by us. We will not subsequently liquidate your metal until we physically receive the originally issued Certificate for verification, providing you with the reassurance that as long as you hold the Certificate, your precious metal is safe from unauthorised sale or collection.

Also Check: How Much Is The Price Of Gold Per Gram

How To Buy Gold Futures And Options

If you worry about risking a lot of capital, consider investing in gold futures or options on a gold ETF. Options are what they sound like: an option to buy or sell gold at a specific price during a particular window. You dont have an obligation to buy or sell, and you arent paying for individual units; instead, youre paying a premium for the option.

Options can be a low-risk way to play the stock market . You can take advantage of your option if you believe that the selling price of gold is moving up or down. If the price of gold moves in the opposite direction, youve contained your liability. The maximum risk is the premium that you paid for your options contract.

Im oversimplifying the process of buying options intentionally for the sake of the article since thats not the focus, but know that buying options is more for advanced investors.

Gold futures allow you to lock in your gain or mitigate your loss at any time. If youre buying gold futures based on physical gold, you dont take delivery until the contract has ended, eliminating storage needs in the interim. You can choose to roll your investments into other vehicles and avoid ever having to store physical gold.

offers futures contracts for a reasonable price. Gold futures, for instance, can only be traded during certain months of the year and during certain times during the day.;

How Do I Find A Precious Metal Dealer

Its best to do business with an established precious metal dealer who is located in the United States. Customer reviews can often help clear up concerns, offer personalized takes on a dealers reputation, and give you an idea of what the purchase experience is like. Look for a dealer with lots of reviews and above-average ratings as opposed to a dealer with just a handful of 5-star amazing reviews.

Another thing to consider is how long the dealer has been in business. Most trusted dealers in the industry have been selling gold for years. And while new dealers can certainly be trustworthy, a precious metals dealer that has been in business for many years can be more readily trusted.

Don’t Miss: How To Get Golden State Stimulus

One Ounce Canadian Maple Leaf

Purity .9999 ; $50 Canadian face value

Backed by: Commonwealth of Canada

Can also be bought in half, quarter, tenth, and twentieth-ounce denominations

Special Note: Royal Canadian Mints advanced security measures make this the most secure gold coin in the world.

Can also be bought in half, quarter, and tenth-ounce denominations

Special Note: The Perth Mint produces a new depiction of the Kangaroo every year

Question : What Outside Factors Can Influence The Price Of My Gold Investment

The current price of gold is called the spot price, and it is constantly fluctuating. The spot price reflects the most recent average bid price, according to global professional traders. Several things can influence the spot price on any given day, including war, the central bank, supply/demand;and the size of the average transaction. When you buy gold, you will buy at a percentage above the spot price, and you will sell for exactly the spot price.

Also Check: How Much Is 400 Ounces Of Gold Worth

Fill In Your Who Yellow Card

If you received shots for a previous international trip, you have a World Health Organization Yellow Card . “The Yellow Card has been the de facto standard for proving international vaccination compliance for decades,” says Warren Jaferian, the dean for Endicott College‘s Office of International Education in Beverly, Massachusetts.

I have a Yellow Card from previous trips, and when I received my shots, I asked the clinic to record the vaccines. I had to ask a supervisor, but he did. There are two issues with the Yellow Card. They are scarce , and they are not secure. An e-Yellow Card is reportedly under development.;

Bullion Bars And Coins

These are the best option for owning physical gold. However, there are markups to consider. The money it takes to turn raw gold into a coin is often passed on to the end customer. Also, most coin dealers will add a markup to their prices to compensate them for acting as middlemen. Perhaps the best option for most investors looking to own physical gold is to buy gold bullion directly from the;U.S. Mint, so you know you are dealing with a reputable dealer.

Then you have to store the gold you’ve purchased. That could mean renting a safe deposit box from the local bank, where you could end up paying an ongoing cost for storage. Selling, meanwhile, can be difficult since you have to bring your gold to a dealer, who may offer you a price that’s below the current spot price.

You May Like: How To Invest In Gold Stocks

American Gold Eagle Certified Coins

American Gold Eagle Coins were authorized for production by the United States Congress with passage of the Gold Bullion Coin Act of 1985. Under the terms of legislation, the program was to contain four different weights in total and include two different versions initially . Congress set the face value for the coins as is standard practice with any legal tender issued by the United States Mint.

The first American Gold Eagle coins were produced and made available for purchase in 1986. The bullion gold coin program was immediately available with all four weights, while the proof version of the coin featured only a 1 oz coin in 1986. The proof program expanded to include the ½ oz weight in 1987, and the ¼ oz and 1/10 oz coins in 1988.

For the 20th anniversary of the American Eagle coin series, which includes the Silver Eagle, in 2006, the United States Mint introduced a new burnished version of the coin. The Burnished American Gold Eagle was introduced specifically for coin collectors. Although the United States Mint already had the proof version of the Gold Eagle available for collectors, the burnished version of the coin had a unique minting process that gave it enhanced value for those numismatists interested in the display and exhibition of visually brilliant coins.

How To Buy Gold Coins

You will come across two primary types of gold coins: sovereign coins and numismatic coins. A government mint typically backs sovereign coins with a face value, but their value as raw gold may be higher than their face value.

Numismatic coins, on the other hand, are usually more valuable as collectors items. Avoid numismatic coins unless you want to be a collector. Collecting rare coins isnt an easily liquidated investment since your coins wont be easy to sell.

For those who want to invest in sovereign gold coins, the best place to find authentic coins is from a government mint authorized dealer, who should have several different choices of sovereign gold coins. The most popular gold coins available include:

Like bars, you can buy coins locally or online. If you shop online, WholesaleCoinsDirect is a reputable site to check out.

You May Like: What’s The Value Of Gold

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Legal Issues And Gold

Is there sales tax on gold ?

Not in our home state of Arizona. Therefore, purchases from Onlygold.com are free of sales taxes.

Are gold bullion coins legal tender ?

Yes, most of them are. This nominal face value allows them to travel across national borders without the taxation or fees imposed by many countries on bullion itself.

Do bullion coins come with a certificate of authenticity ?

Yes, a makers mark and statement of weight and fineness is stamped directly onto gold bullion, whether coins or ingots. The bullion itself, in effect, bears its own certificate from whichever Mint or refiner produced it. Fortunately, gold is an element with a unique specific gravity, and other attributes which make it very easy to test for authenticity. The ancient Egyptians pioneered the acid test for gold, and any jeweler, pawnbroker, or high school chemistry teacher can demonstrate the basics of gold.

Are there counterfeit gold coins ?

Yes, over the centuries, crude copies of gold coins have been made. But because of golds unique density , these copies are not very convincing. Once you hold a real gold coin in your hand, and you feel the heft and density of it, you realize that gold is simply hard to imitate. Of course, we recommend that you know your supplier when buying gold, just as you would with anything of real value.

Was gold illegal to own at one time ?

When were gold restrictions lifted ?

Is there any limit on how much gold I can own ?

Read Also: Can You Hold Gold In An Ira

Gold Is Used As A Hedge Against Inflation

When countries go through an intense period of lowering their interest rates, or when they print a lot of money, their currency will be devalued. This causes inflation.

Since Gold is another asset class of its own, it has its own intrinsic value and will not be as affected.

As such, Gold would be useful as a hedge in circumstances when people do not have faith in a countrys currency during times of hyperinflation .

Then, the people there would choose to place their money in Gold instead because it is a safer asset.

Think About Laminating Your Covid

That’s what Paula Miller and her husband did.;

“We felt that they would hold up better when we need to present them while traveling domestically or internationally,” says Miller, a retired teacher from Kitty Hawk, North Carolina.

Like Marcus, she’d prefer the real thing.;

“We have flights to Paris scheduled for November,” she says. “I hope that issue is resolved by then.”

The biggest problem with lamination: The document isn’t secure. If boosters are needed, a laminated card might be a problem. But until we have a vaccine passport, this may have to do.

Recommended Reading: How Much Is 10 Ounces Of Gold Worth

Etfs That Own Mining Stocks

Dont want to dig much into individual gold companies? Then buying an ETF could make a lot of sense. Gold miner ETFs will give you exposure to the biggest gold miners in the market. Since these funds are diversified across the sector, you wont be hurt much from the underperformance of any single miner.

The larger funds in this sector include VanEck Vectors Gold Miners ETF , VanEck Vectors Junior Gold Miners ETF and iShares MSCI Global Gold Miners ETF . The expense ratios on those funds are 0.51 percent, 0.52 percent and 0.39 percent, respectively, as of July 2021. These funds offer the advantages of owning individual miners with the safety of diversification.

Risks: While the diversified ETF protects you against any one company doing poorly, it wont protect you against something that affects the whole industry, such as sustained low gold prices. And be careful when youre selecting your fund: not all funds are created equal. Some funds have established miners, while others have junior miners, which are more risky.