What Is A Sovereign Gold Bond

Sovereign Gold Bond means a scheme issued by the Reserve Bank of India. These plans offer all the benefits which you can get from the physical gold. Though, Reserve Bank of India issues these schemes, actually, RBI issues these bonds on behalf of Government of India. The value of the gold bond will increase and decrease with the change in the gold rates in Mumbai. These gold bonds are for investors and individuals who buy physical gold as an investment can go for the gold bonds instead. As in the physical gold, there will be few charges which investor should bear though he likes it or not. But if he goes for a Sovereign Gold Bond he will not need to pay those costs.

These gold bonds were introduced to reduce the demand for physical gold in the market. If investors go for the gold bonds than going for physical gold, they will earn some interest as well. This interest rate will be fixed by the RBI and will be given once every six months. You can buy or sell Sovereign Gold Bonds in the stock markets, and if you follow the gold rates in Mumbai, then you can buy or sell gold bonds quickly.

Sovereign Vs Privately Minted Gold Coins

Sovereign minted gold bullion coins differ from privately minted gold bullion coins because sovereign gold coins are manufactured by government mints. Considering their scarcity, age and numismatic value, these gold coins are prized by collectors and are highly sought-after. Within the past hundred years many of these gold coins have been in circulation as money and were stamped with a number that reflected their value at the time. Like any piece of gold with high numismatic value, the actual price of gold they contain will always be higher than its stamped face value.

Sovereign gold bullion coins are valuable collector items in America because they have not been in circulation since 1933, when Franklin Roosevelt halted their production. Similar gold coins of this type exist around the world as governments replaced gold in currency circulation with other metals and alloys. The price of gold coins from a sovereign mint is typically greater in than the price of gold from most private mints. Be sure to do your research and pay the most ideal gold prices when you choose to invest.

Gold Prices Decrease After Increasing By Rs700 In The Previous Session

Due to the improvement in riskier assets, the prices of gold fell sharply in India on 5 June 2020. The reopening of economies was the reason for the improvement in riskier products.

Gold futures prices on MCX decreased by 0.7% and are at Rs.46,369 for 10 grams. In the early trade, the equities market was firm. Procedures have been set by the health ministry for offices, hotels, restaurants, and shopping malls so that the spread of COVID-19 can be contained. Economies will further reopen from 8 June 2020. In the international markets, the prices of gold increased because of a weaker dollar. Spot gold prices increased by 0.2% and are at $1,714.78 for an ounce. Traders will be closely watching the US payroll data which will be announced later on 5 June 2020. A larger stimulus package has been approved by the European Central Bank. Gold prices hit record highs and crossed Rs.48,000 for 10 grams earlier in May. The tensions between China and the US ensured that the prices of gold remained high. Gold prices in India are inclusive of 3% GST and 12.5% import duty.

5 June 2020

Don’t Miss: Does Kay Jewelers Sell Real Gold

How Do Central Banks Influence The Price Of Gold

A central bank is a national bank that implements monetary policies and issues currency for its respective country. It also provides financial and banking services for its countrys government and commercial banking system. This means a central bank can affect the amount of money supply in its country to help stimulate the economy if needed. The Federal Reserve is the United States central bank while Europe has the European Central Bank . Other central banks include the Bank of Japan, the Bank of England, Peoples Bank of China, Deutsche Bundesbank in Germany, to name a few. Central banks are also responsible for managing its countrys reserves, including its foreign-exchange reserves, which consists of foreign banknotes, foreign bank deposits, foreign treasury bills, short and long-term foreign government securities, gold reserves, special drawing rights and International Monetary Fund reserve positions.

Where To Buy Gold In Mumbai

There are a number of places where you can shop for gold in Mumbaii. One is the famous Zaveri Bazaar, where you find several gold jewellery shops lined-up. The renowned names for shops in Mumbai include Tribhoovandas Bhimji Zaveri and Tanishq among others. There is also a diamond market, which Mumbai is famous for.; There are a host of other places, where you can buy gold from including the local shops around.

While gold rates in Mumbai barely differ from shop to shop, you should watch for the making charges. Sometimes if the value of the gold is large, a slight difference in the making charges could mean a lot. However, gold rates are unlikely to defer from jeweler to jeweler given the fact that gold rates are determined by the local association in the cities. These days it is a question of prestige, reputation and reliability and in this case it is always a better idea to go to your trusted jeweller, whom you have been buying since the last many years. This is better for your own satisfaction on the quality of gold that you are going to buy.

Also Check: What Was The Price Of Gold 20 Years Ago

Trend Of Gold Rate In India For March 2021

| Parameters | |

| Rs.4,931 per gram on 2 March | |

| Lowest Rate in March | Rs.4,539 per gram on 16 March |

| Overall Performance |

- Gold price in India was Rs.4,891 per gram on 1st March. When compared to the closing price of the previous week, the rate of the yellow metal was down by Rs.76 in the country.

- Over the week, the yellow metal recorded its highest and lowest price for the month till date on 2nd and 6th March. A gram of 24-karat gold was retailed for Rs.4,931 and Rs.4,784, respectively.

- Gold closed the opening week of the month at Rs.4,785 per gram. The overall performance of the precious metal in the country witnessed a declining trend.

- Gold rate in India was Rs.4,771 per gram in the second week of the month on 8 March and increased marginally to Rs.4,817 per gram on the following day.

- Due to constant fluctuations seen in the international market, the price of the metal dipped to Rs.4,777 per gram on 10 March and increased marginally yet again to Rs.4,796 per gram on 11 March. With the lower value of the dollar, gold prices increased to Rs.4,834 per gram on 12 March.

- In India, the price of gold was Rs.4,807 per gram on 29th March. When compared to the closing price of the previous week, the price for every gram was up by Rs.12.

- Gold price in India slipped over the last two days of the month and closed at Rs.4,745 per gram.

- The overall performance of the precious metal in the country witnessed a declining trend.

The Gold Market Runs 24/7

There are always changes underway that will affect the live price of gold. From anywhere in the world you can track the changing price of gold in real time from our website.

While there are no fixed end of day gold prices, some companies do list a closing gold price that is held over until the next morning. Firms that do list a closing gold price will usually just take the final price of gold after all their customers gold trades have gone through for the day.

In general, trading on the gold market runs from 6 p.m. to 5:15 p.m. from Sunday to Friday. That leaves a 45 minute pause every day when markets are closed, but it does not slow the frenetic pace of gold investor transactions.

Also Check: Will Gold Rate Decrease In Coming Days

Gold Prices Hit Another Record High In India On 4 August 2020

Gold prices in India continued to hit record highs on 4 August 2020. Gold futures prices for the month of October on MCX increased by 0.2% and are at Rs.53,865 for 10 grams. In the last session, gold prices increased by Rs.267. In the international markets, the prices of spot gold were steady at $1,976.36 for an ounce. In the previous session, spot gold prices hit record highs. The main reason for the increase in prices were the worries about the economy because of the rise in the number of coronavirus cases. In the case of inflation and currency debasement, gold is considered as a safe haven. Gold prices in India are inclusive of 12.5% import duty and 3% GST. In the international markets, the prices of gold have increased by 30% in 2020.

4 August 2020

India Gold Price On 22 July 2021

The spot price of gold on Thursday, 22 July 2021 at Rs.48,110 was considered 0.16% lower than this weeks average of Rs.48,187. Thursdays gold price was also lower than that of Wednesday, 21 July 2021 value of Rs.48,120. After the drop in prices, the Multi-Commodity Exchange future prices also saw a drop of Rs.99.7 with 10 grams of gold valued at Rs.47,481.

23 July 2021

Read Also: Is The Delta Gold Card Metal

The Price Of Gold Today & Gold Price Charts

Follow real-time gold price changes with our live gold price chart. Examine historical gold data over the past 30 years to gain insight into how the price of gold trends in the long-term. Our gold price charts are easy to use and always up to date with the latest gold prices. Hover over any point in the chart to see specific gold price information for that particular point in time.

How Is Gold Used In Electronics In Mumbai

Of all the metals that are mined from the Earth, gold is more useful and most precious metal.

The metal has various unique properties, and hence it is used in different manufacturing sectors across the world. Gold is a perfect conductor of electricity. It can tarnish resistance; it can be drawn into wires, hammered into thin sheets, it is easy to work with, it can be alloyed with other metals for various purposes, it can be molded into different shapes, it has an excellent luster and has a beautiful color.

Gold is used in electronics industry across the globe. The solid-state electronic devices apply low voltage and currents which can be quickly interrupted by corrosion at the point of contact. Gold being a good conductor can easily carry low voltage currents and will remain free of corrosion. Any kind of electronic devices made of gold is highly reliable, and the durability is excellent. Gold is used in switches, soldered joints, connectors, relay contacts, connecting wires. A small portion of gold is used in electronic devices like global positioning system , calculators, cell phones, television. Gold also finds usage in Computers for the accurate and rapid transmission of digital information.

You May Like: What Is Vermeil Gold Plated

Us Dollar Value Rises In The Market; Gold And Silver Rates Record Heavy Declines

Gold prices showed a continuous decline in prices for the fourth consecutive day on 4 March. The value of the yellow metal dipped by Rs.274 to Rs.44,843 per 10 grams in Mumbai. Due to a stronger dollar and mute global trends, the value of gold showed continuous declines. The safe-haven appeal of the metal was also dented due to the U.S. Treasury yields.

Silver prices declined by Rs.1,793 to Rs.66,126 per kg compared to its previous closing price on 3 March 2021. The value of 24-karat gold in Mumbai was Rs.44,843 per 10 grams.

For April delivery, gold futures dropped by Rs.120 to Rs.44,828 per 10 grams for a business turnover of 13,254 lots.

10 March 2021

How Are Spot Prices For Gold Calculated

The total supply and demand for gold in the market ultimately determine the spot price.

Thus, movement of the spot price reflects a change in the available supply or current demand for gold. This includes factors such as:

- output from gold mines

- economic uncertainty

- other geopolitical events

Trading of gold futures has the most significant effect on today’s spot prices. The same is true for all commodities. So the silver price and platinum price behave in a similar manner.

General gold news can also influence investment demand for the precious metals. This includes gold, silver, platinum, and palladium.

For instance, prices today tend to shift dramatically if the Fed cuts rates. There may be a gold price rally if the International Monetary Fund adds to its gold reserves.

Learn more about gold futures contracts by following this link.

Read Also: Will Gold Price Go Down

Gold Prices Fall In India On 20 May 2021

Due to a muted trend in the global markets, gold prices fell in India on 20 May 2021. Gold futures prices for the month of June on MCX fell by 0.29% and were at Rs.48,531 for 10 grams. On 19 May 2021, gold prices saw a roller coast ride because of the cryptocurrency sell-off. Gold futures prices in the international markets settled at $1,881.50 for an ounce. On 19 May, gold prices on MCX hit a high of 4.5 months. Like gold, silver futures prices for the month of July fell by 0.39% and were at Rs.72,094 for a kg.

21 May 2021

How Are The Premiums Over Spot Calculated Are They The Same For All Gold Products

Premiums vary depending on the product.

Generic gold items usually have lower premiums. A more intricate design on a gold bar or gold coin will raise the premium. Rare or limited edition products will also have high premiums.

The reason for this is twofold. Highly artistic gold products are more costly to manufacture. Buyers are also willing to pay more for such items.

Don’t Miss: How Much Is 10 Ounces Of Gold Worth

Factors Affecting Gold Price In India

Trading in gold is a preferred investment mode of investors who are financially savvy and have the required risk-appetite for this kind of market. It requires prudent monitoring of investments as gold prices are subject to change for many reasons. Maintaining or closing a position in this market depends on how well an investor can track, analyze and synthesize pricing information.

Some of the key factors that affect gold prices are outlined below:

Gold Rates Increase And Silver Rates Stand At Rs68500

Gold rates had reversed from losses and gained amidst a recovery in global markets. This had been on the back of weak U.S. dollar that dipped after the U.S. labour market looked weak.

The metal had then bounced back to gains overseas after the U.S. jobless claims had topped one million and the FOMC minutes had hinted at a lot of concerns about an economic recovery. On the MCX, gold had increased 41.5% to a high since the beginning of the year.

23 August 2020

You May Like: How Much Is The Price Of Gold Per Gram

What Are Some Of The Factors That Drive Spot Gold Prices

Gold is not only bought as an investment, but it is also bought for use in other areas such as industry and jewelry making. The potential influences on the spot price are extensive, but the following list names some of the major ones:

- Investment demand

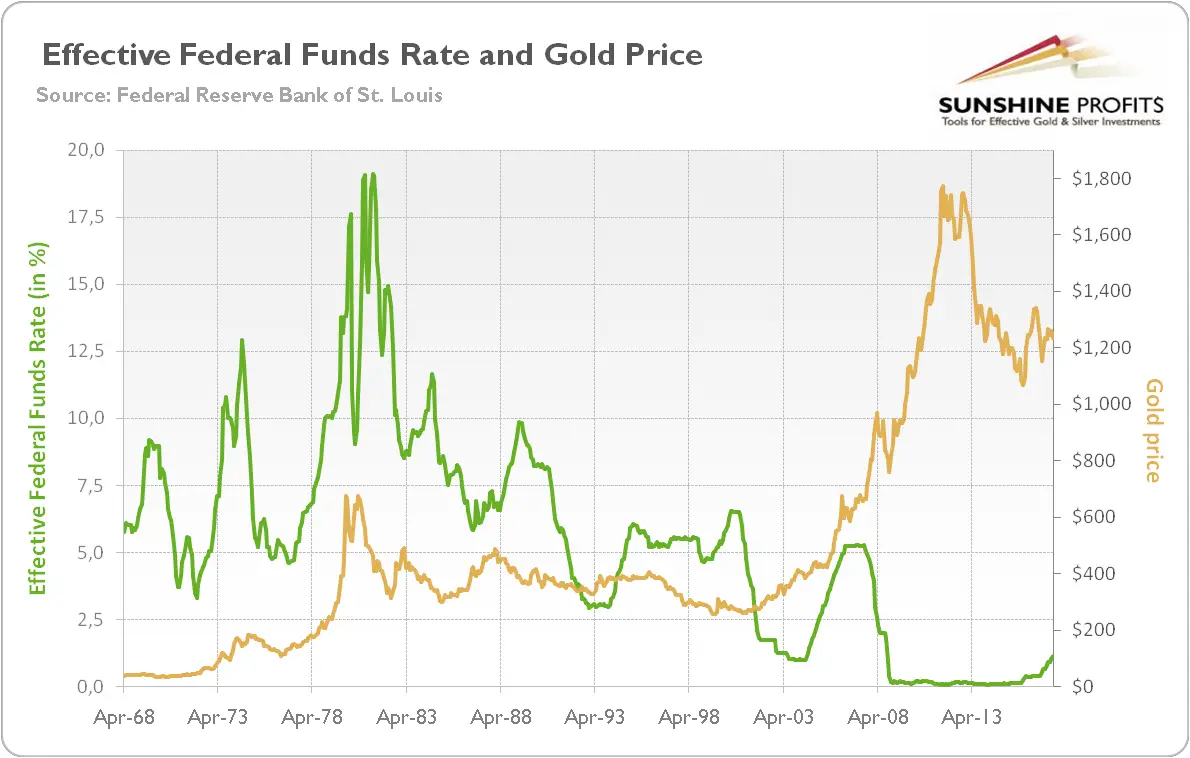

- Interest rates and/or monetary policy

- Risk aversion or appetite

- Geopolitics

- Equity markets

Gold can potentially see stronger investment demand during periods of economic or geopolitical stress. For example, spot gold may potentially move higher during times of war or geopolitical unrest. From an economic standpoint, gold may potentially see increased buying from a stock market collapse or bear market. Interest rates and monetary policy can also have a significant effect on the spot gold price. Gold may potentially benefit during periods of ultra-low interest rates, as low rates make the opportunity cost of holding gold less. On the other hand, gold may potentially come under pressure as interest rates rise, due to the fact that gold does not offer any dividend or interest for holding it. Currency markets are another major driver of the spot gold price. Although gold is traded all over the globe, it is often denominated in dollars. As the dollar rises, it makes gold relatively more expensive for foreign buyers and may potentially cause declines in the spot price. On the other hand, a weaker dollar may potentially make gold relatively less expensive for foreign investors, and can potentially cause spot gold prices to rise.