Investing In Gold With Gold Bars

Gold investors need gold dealers who can provide any size order of gold coins and gold bars when they want to buy gold, but who will also buy gold back when they want to sell. Clients at Silver Gold Bull like gold because of its liquidity, which is why we have never refused a legitimate request to sell gold to us. Gold bars are one of our gold top picks because they offer investors gold bullion at low premiums thats easy to ship and store.

Brands & Refiners Of Gold Bars

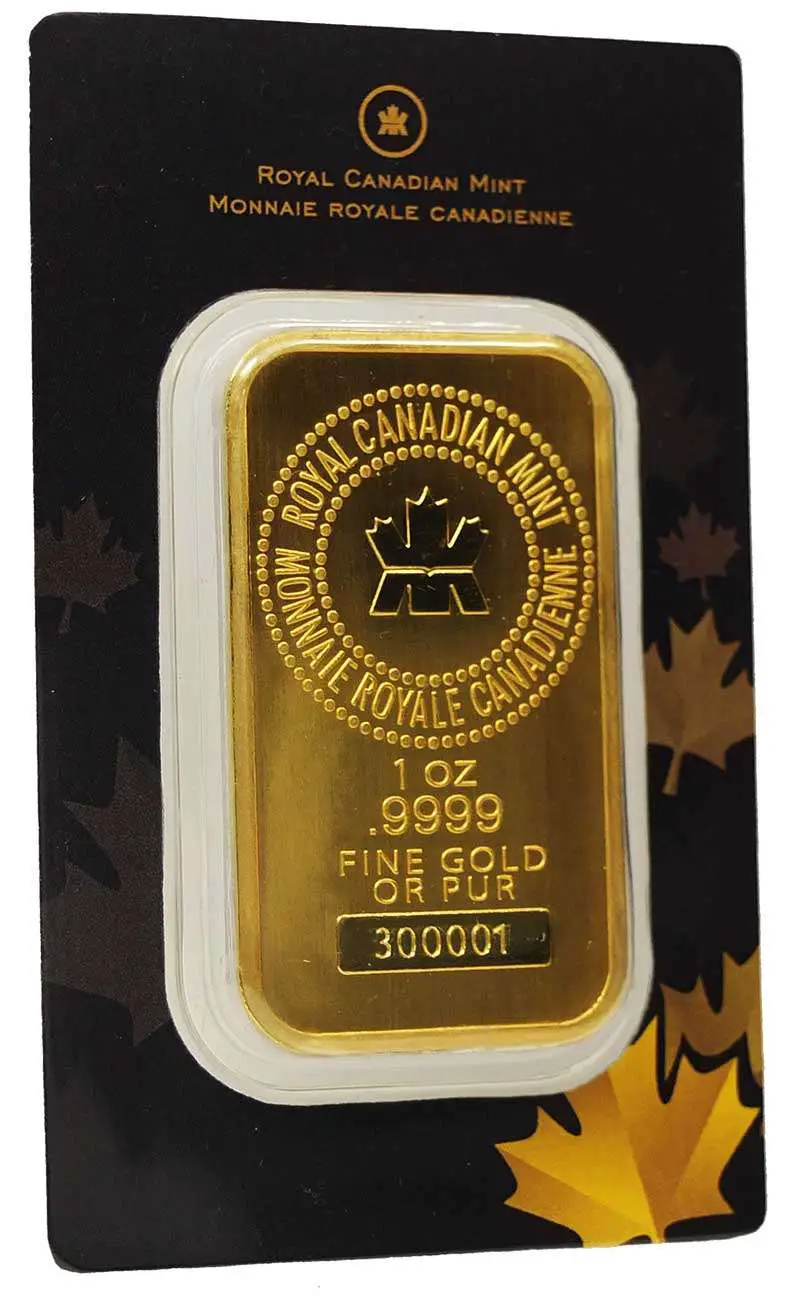

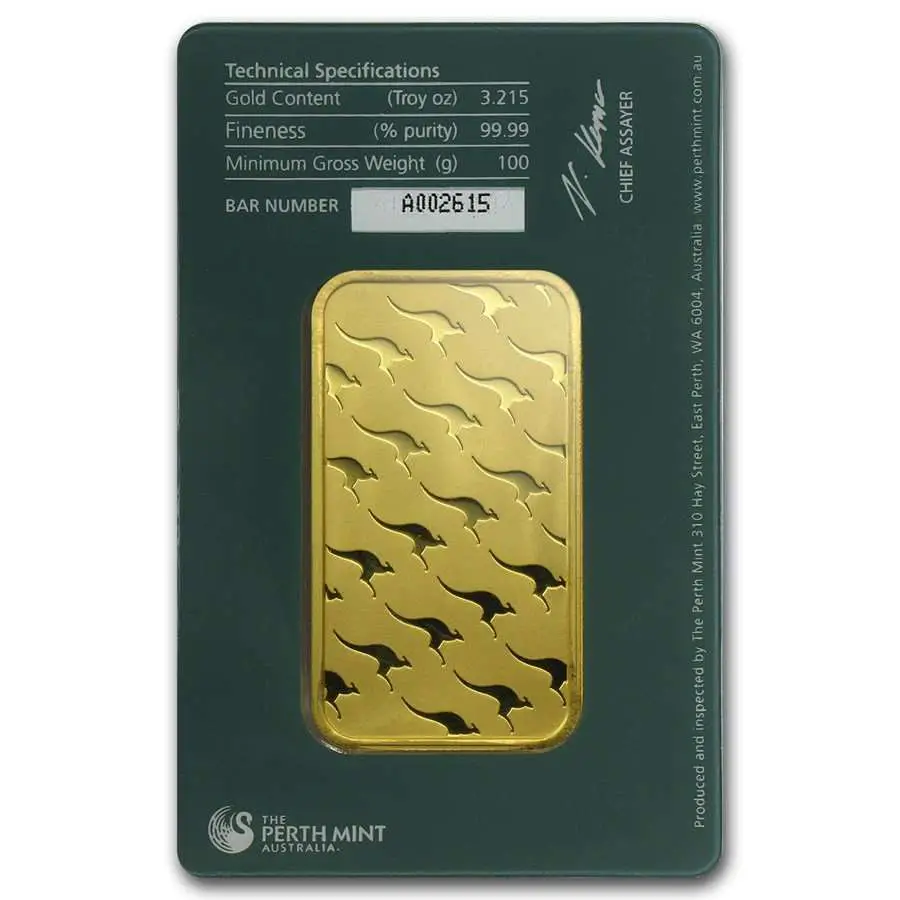

The list of metal refineries the U.S. Gold Bureau offers products from is staggering. Regardless of what your favorite mint is, you should be able to find multiple different sized gold bars from them on our site; plus our catalog is expanding all the time. We also offer bars from a number of international mints such as the Australia’s Perth Mint and the Royal Canadian Mint.

You can even find gold bars that were refined by the Republic Metals Corporation. Most gold buffs will recognize this refinery as RMC. Headquartered in Miami, Florida, this group has grown to become of the world’s primary precious metal refineries. In fact, their modern, state-of-the-art refinery has a refining capacity of upwards of 7,000 combined tons of silver and gold; and it’s right here in the United States. We also carry gold bars , the official bank of Switzerland. Since Credit Suisse Bank is one of the most trusted and secure banks in the world, you can be sure that bars from the Swiss bank are especially popular among sage investors who want to make sure they’re purchasing quality metal. When the sheer number of variations is taken into account in terms of gold fineness, weight, and size, it’s no wonder that the manufacturing of the gold bar itself is so important to the informed investor.

The Best Types Of Coins To Buy

Many factors will determine which coins are best to buy for you. The condition, purity, and the producing mint can vary widely. So investors must take great care if they choose to buy gold coins online from unknown sources. Rest assured that when you buy from Provident Metals, you are buying products that are produced by the most trusted mints in the world.

Don’t Miss: Where Is The Best Place To Buy Gold Jewelry

How To Buy Gold Bullion

Bullion refers to a bulk quantity of physical gold sold by major banks and dealers in the form of coins or bars. Gold coins from the U.S. Mint are produced in a wide range of composition from one-tenth to one ounce in weight, and in 22- or 24karat gold. Below is a sampling of the types of gold coins available from U.S. Mint coin retailers:

- American Buffalo 2018 One Ounce Gold Proof Coin

- American Eagle 2018 One Ounce Gold Proof Coin

- American Liberty 225th Anniversary One Ounce Gold Coin

Popular gold coins outside the U.S. include the Australian Gold Nugget, the Canadian Maple Leaf, and the South African Krugerrand. Keep in mind gold coin prices fluctuate depending on the current metal market price.

To buy gold bullion, speak with an investor who specializes in buying and selling gold. Most gold bullion is purchased online. To view a listing of U.S. gold coin retailers, visit the U.S. Mints bullion dealer locator. To find reputable companies who deal exclusively with buying and investing in gold, check out our guide on the best Gold IRA companies.

Plan To Protect Your Gold Bars

Consider how and where you will store and protect your gold. Gold bars require less space than coins to store the same number of ounces, which can make them easy to keep at home. You could also store your bars in a bank safe deposit box or at a facility that specializes in gold storage and protection.

How and where you store your gold bars will partly depend on your financial goals. Do you plan on holding them as a means of protecting your savings until your children are grown, or as a means of emergency financial assistance? If it’s the latter, you may want to consider storing your gold close to home, as a bank or storage facility may have limited hours of operation or be located far away. In an emergency, your gold could be inaccessible. Mitigate risk by making accommodations for storing and protecting your gold bars before taking possession of them.

Read Also: What’s The Value Of Gold

Private Mints Vs Government Mints

While the difference in ownership is obvious due to their names, there are a few other significant differences between government mints and private mints.

The crucial difference is that bullion coins produced by sovereign mints are made for legal tender for that country. Private mints also produce bullion for purchase, but they’re not created as currency.

For example, the U.S Mint makes the American Gold Eagle and the American Silver Eagle. These have a face value of 50 dollars and 1 dollar respectively, and while they are legal tender, as in you could use them to purchase a dollar’s worth of goods, you should never actually do that, as their market value is much higher than their face value.

Private mints make bullion coins that are not a part of legal tender and therefore don’t have a face value shown on the coin and are not considered a currency. If the item being manufactured is in the shape of a coin, it is referred to as a gold round while if it is rectangular, it is a gold bar.

Choose A Gold Company

One of the smartest ways to ensure you’re getting the best gold bar at the best price is to buy from a reputable gold company that puts your needs first. How do know if you’re dealing with a reputable company? Look for

- Third party ratings and a long history of client reviews.As the Federal Trade Commission advises, Check out the seller by entering the company’s name in a search engine online. Read about other people’s experiences with the company. Reputable, established gold companies can show that they have a long history of great service. Many also have the highest ratings from consumer advocate groups like the Better Business Bureau and the Business Consumer Alliance.

- A focus on education.A company that prides itself on client education won’t rush you into making a purchase that’s not right for you. We specialize in educating customers not only on the gold industry, but the type of portfolios they can use to protect their , said U.S. Money Reserve’s CEO Angela Koch in an interview on Enterprise Radio.

Sign up to receive U.S. Money Reserve’s free Gold Information Kit to learn everything you need to know before purchasing precious metals. Explore special offers, discover diversification strategies, and dive into U.S. Money Reserve’s exclusive precious metals guidebook. This expertly prepared tool is our gift to you!

Don’t Miss: How Much Is One Ton Of Gold Worth

The Best Types Of Bars To Buy

Wondering which gold bars are best to buy? It all depends on your style, budget, and investment goals. No matter what you choose, you can rest assured knowing that you are investing in a commodity that has stood the test of time and continues to be the among the safest assets to fund your investment portfolio.

Don’t Buy Using Leverage

Borrowing money to make a bigger investment in gold is a risky game. Say, for example, you invest $4,000 and then leverage your investment five-to-one, so that you control $20,000 worth of gold coins or bars in an account set up by a dealer or brokerage firm. To start, the price of gold is volatile, and if the price dips far enough , youll have to kick in more money to keep your account, or youll have to sell some or all of your investment. Also, the salesmans commission is based on the total amount of the purchase. So hell get, say, 5% of the $20,000, or $1,000. Although 5% is a fair commission, its 25% of your $4,000 equity stake. On top of that, youre paying interest on the money borrowed.

And even worse, says the FTCs Brown, in some instances the telemarketers do not disclose that your precious-metals investment will be leveraged. They bury the details of the leveraging and the interest charges in dense contracts, she says.

You May Like: How Much Is One Brick Of Gold

Where To Buy Gold

When youre looking for the best place to buy gold, start with a company you trust. The right gold company wont push you to buy gold before youre ready. Theyll start by listening so they can match your needs with the right physical gold product. Where are you on your path to retirement? On safeguarding your wealth? On building a family legacy of financial health? You may hear these questions and more because buying gold isnt something you decide to do overnight. Its a strategic move that takes time and thought to do right. While we may not be the only place to buy gold in America, were Americas only Gold Authority®. So stop searching for where to buy real gold and start getting to know U.S. Money Reserve. We will be clear, open, and honest about what you are buying, how it will arrive, and what you will pay. Purchase gold online or over the phone today!

Choose The Size And Type Of Gold Bar

Gold bars are produced in various sizes and are available at many price points. Choose from bars ranging from 1 ounce to 1 kilo, depending on your budget, personal preferences, storage capabilities, and holding strategy.

Size and price

The market value of a gold bar is almost entirely based on its weight in gold. A bar’s price closely follows the spot price of gold, i.e. the price at which you could buy one ounce of gold right now as opposed to some date in the future.

In general, the larger the bar is, the greater the price. What amount of your wealth would you like to safeguard with gold? With this number in mind, you can narrow your options down to only bars that fall into your price range. Note that a bars final purchase price will vary slightly from the spot price of gold depending on the current market supply and demand, as well as local, national, and global economic conditions.

Minted vs. cast

Apart from the bars size, you also have different types of bars to choose from, typically minted and cast. Minted gold bars are hand cut or punched from a large flat piece of gold and are often produced with glossy finishes and artistic designs . Minted bars, depending on their size and refiner, can be packaged in sealed assay cards that provide details about the bar’s authenticity and protect its condition.

Recommended Reading: What Is The Toll For The Golden Gate Bridge

Don’t Buy Fractional Coins

These coins come in fractions of an ounce, such has a half-ounce, a quarter-ounce and even one-twentieth of an ounce. Youll pay a higher markup for such coins than for one-ounce coins. The only real reason to own them is if you believe in a future meltdown of society, at which point paper money will be worthless and youll need small change to buy, say, ammo, freeze-dried food or a latte.

The Price Of Gold Bars

The price of gold bars will vary depending on several factors. First, the current spot price of gold will affect how much a gold bar costs. Next, where the gold bars were minted will also have an impact on their price. Last, the pureness of the gold itself helps determine the price of the bar. Gold generally will rank between 8 karats to 24 karats.

At Silver Gold Bull, we use the most up to date and accurate pricing information possible through our live feed. You can find this feed on any page of our website to ensure you always know what the current gold spot price is at all times.

You May Like: Will Gold Price Go Down

Don’t Buy Coins For Historical Value

Some gold dealers engage in a classic bait-and-switch: They offer gold coins or bullion, then try to sell customers on coins with historical, or numismatic, value. In fact, these coins usually have little or no extra value above their melt value — the value of the coin if it were melted and sold as metal.

Goldline International, a major dealer, has come under fire by U.S. Representative Anthony Weiner for the high markups it charges on such coins. For example, Goldline and some other dealers push a French gold coin, the 20-franc Rooster. Weiner says Goldline charges 69% more than the melt value of the Rooster, which has no numismatic value.

In addition to the American Gold Eagle, the best-known coins typically bought and sold for their gold value alone are the Canadian Maple Leaf, the Australian Gold Nugget and the South African Krugerrand.

The Current Economy Is Unstable

Smart, Safe, and Stable Investments With Us!

You can strengthen your investment position, the smart waysign-up for our monthly premium crates delivery subscription for Gold, Silver and Platinum. Get high-value physical metals, including coins, bars, fractional mintage, rounds, hand-poured items, and more.

Don’t Miss: Who Buys Gold Filled Jewelry

The Us Commemorative Gold Coins

The U.S. Mint produces a large variety of designs for commemorative coins. These coins always carry images of important and iconic figures, places or events in American History. These coins are highly appreciated by passionate numismatists. The most popular U.S. Gold Commemorative coin designs are the $5 Commemorative Gold coins, the $10 First Spouse Gold series and the Centennial Gold Coins.

The $5 Commemorative Gold Coins were released in 1986 and feature the Olympic Games, The Statue of Liberty, the American Bald Eagle, Mount Rushmore, the 50th;Anniversary of the United States victory in WWII, Mark Twain, and many other honorable figures. The $10 First Spouse Commemorative Gold Coin was introduced in 2007 and each year carries the depiction of the First Lady corresponding to the president depicted on the Presidential Gold Coin issued in the same year. The Centennial Commemorative Gold Coins minted in 2016 celebrate the 100-year anniversary of the three most important historical gold coin designs minted: the Walking Liberty, the Standing Liberty and the Mercury first produced in 1916.

Shop For Gold By Mint

One approach to buying gold bullion is choose a particular mint. A handful of trusted government mints rank high on the list.

The privately owned refiner PAMP Suisse is also included. PAMP’s international reputation is on par with any government facility. Most gold buyers consider it to be superior, in fact.

United States Mint

The two flagship products of the U.S. Mint are the Gold Buffalo and Gold Eagle coins. The American Eagle coin series began in 1986 while American Gold Buffaloes began in 2006. The Buffalo is distinguished by its .9999 pure gold. The Gold American Eagle is 22 karats , by contrast. However, the 1 oz Gold Eagle still contains the same amount of pure gold as a 1 oz Gold Buffalo.

Each year the Eagles are available in 1/10 oz, 1/4 oz, and 1/2 oz gold sizes, as well.

Royal Canadian Mint

The RCM mints its own bullion coins and bars. The Canadian Maple Leaf series is its most popular. Other Canadian gold coins are typically commemorative in nature.

The Maple Leaf coin not only is .9999 pure. It also uses multiple layers of defense against counterfeiting.

In addition to the 1 oz Gold Maple, the mint also makes 1/10 oz gold, 1/4 oz gold, and 1/2 oz sizes.

Australian Perth Mint

All gold coins minted in Australia come from Perth Mint. It is located in the Western portion of the country. Circulating coins are struck at the Royal Australian Mint instead.

PAMP Suisse

Other gold PAMP bars with different designs are also available for sale.

Also Check: Where Can I Get Gold Teeth

Are You Having A Hardtime With Investments

With the vast number of dealers and online stores offering you to buy Gold Bars in the US, it can be tiresome to find the perfect ones for your investment. We make it convenient by doing the selection, procurement, assessment, and curation for you. You just sit and chill as we deliver high-value mintage to your mail.

How To Buy Us Mint Gold Coins

Buying precious metals is easier today than it has ever been. Investors can find products, compare prices, evaluate dealer reputations and place orders to have metal delivered right to their home or office with just a few minutes and an internet connection. Or by simply making a phone call.

The most important step is to choose a dealer with a reputation for prompt service, fair prices, and strong quality control.

Money Metals Exchange offers all of these things, plus some of the most knowledgeable and helpful people in the business. We also keep our clients updated and educated on the metals markets and geopolitical events which will impact those markets via regular news, commentary and podcasts.

Clients have the option of purchasing via MoneyMetals.com, or by calling us at 1-800-800-1865. All calls are instantly answered by a live person in Eagle, ID who will be happy to assist.

We will lock your pricing up front, then promptly provide a confirmation of your purchase. Clients can make payment via check, money order, credit card, bank wire or Bitcoin. We will ship your order promptly after clearing your payment, fully insured with signature confirmation at delivery so that your metal will not be left on a doorstep or in you mailbox. We keep you updated throughout the process with regular status updates.

Recommended Reading: What Is Vermeil Gold Plated