How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

How The Price For Live Spot Gold Is Calculated

Gold has a benchmark price that is set every day. The most common entities that make use of these benchmarks include producer agreements and commercial contracts. The benchmarks are based on the spot markets trading activity on decentralized OTC or over-the-counter markets.

OTC means that the prices are not set by formal exchanges and are negotiated privately by participants over the phone or electronically. While prices for spot gold are not regulated, financial institutions still play a valuable role by serving as market makers, providing an ask price and bids for the spot market.

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

- American Eagle

Also Check: Are Gold Dollars Worth Anything

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Don’t Miss: How To Buy Gold On Robinhood

Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

You May Like: Wow Classic Gold Buying Ban

Read Also: What Is The Price Of 1 Oz Of Gold

Gold Has Numerous Applications

While gold has been the cornerstone of flourishing capitalistic markets, it has found numerous industrial uses such as the manufacture of electronic devices for GPD units, and personal use as jewelry. The latter is more popular in South Asian countries during the wedding season.

Gold has many desirable properties that are not easily found in other metals. It can conduct electricity but does not corrode. It is malleable and ductile, which means it can be sculpted and shaped.

Gold is utilized in the medical field and is best for crowns, bridges, fillings, and other orthodontic applications because of being chemically inert. Many patients are not allergic to the metal, making it ideal for treatments. Scientists use trace amounts of isotopes of gold in diagnosis and radiation treatments.

Due to its luster, gold is used in awards, statues, and crowds. Its exceptional beauty and rarity has turned gold into a status symbol. The metal is used in everything from Olympic medals to Academy Awards, and holds high esteem throughout the world.

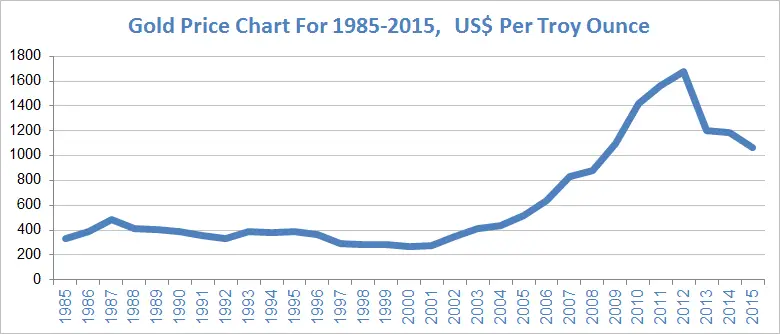

How Does The Current Gold Price Compare To Historical Gold Prices

The price of gold has increased approximately 4,750% since 1935 when President Franklin D. Roosevelt raised the value of gold to $35 per ounce. This is compared to todays gold prices that are hovering around $1,700.If you compare the goldprice today with the prices at the beginning of this millennium , the price of gold has increased approximately 496%. This is 3x the increase of the Dow Index during this period.

You May Like: How To Get Gold In Wow

Value Of Gold Per Ounce: Things To Remember

Do remember that the value of gold per ounce is always a function of supply, demand and many other factors. Just because the price of gold is high right now does not mean it will still be high about a year from now.

Ten years from now, however, this will likely be a different story. Gold is a long-term investment, and if you are not familiar with the ins and outs of purchasing this type of asset for the long haul, its important to consult people who have the knowledge base to help you.

Certain events can also change the current price of gold, so make sure that you keep yourself tuned in to the latest fluctuations to determine the best time to buy.

What Is Gold Jewelry

Jewelry made of gold can be combined with other precious elements and gems to enhance its appearance and value. The value of jewelry depends on gold purity and mass, worth of gem used, and artistic work used to build it. Jewelry is used to be worn, and as an investment, e.g., 22k gold is the famous and 91% pure gold.

Recommended Reading: Can Rose Gold Be Resized

How Does The Price Of Gold Perform During Recessions

Gold prices typically increase during economic recessions. One way to analyze gold prices during a recession is by comparing its performance with the S& P 500. Below are the dates of the largest declines of the S& P 500 and the performance of gold prices during the same period. This data shows that gold increased significantly in 75% of these recessions.

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

Also Check: How Do You Buy Real Gold

Why Is There A Difference Between The Prices Of Gold And Silver

The primary reason behind the large discrepancy in the value of gold and silver is due to their rarities. The usual market principles such as supply and demand play a pivotal role in determining the value of gold. Since gold is low in supply, it is also much harder to obtain than other metals.

Silver is much larger in supply and is easier to mine. In fact, silver is often obtained as a by-product of other metals during mining. Silver can be obtained at a rate of 0.07 parts per million. In contrast, the average occurrence rate of gold is 0.004 parts per million.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

You May Like: Where To Buy Pure Gold

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

You May Like: Can You Hold Gold In An Ira

What Are The Differences In Grams And Ounces When Applied To Gold Bullion

All gold prices are based on troy ounce basis. However, youll find bars available in gram sizes, as well as kilograms. Understanding how a troy ounce breaks up into these other forms is important to ensure that youre getting a good deal. A troy ounce is 31.103 grams. So, a one-gram bar is only a very small fraction of a troy ounce. There are 32.151 troy ounces in a kilogram gold bar. Its also important to understand that a troy ounce is different from a standard ounce. A standard ounce is actually 28.35 grams, so a troy ounce is slightly heavier.

Thank you for visiting our live gold price page. Be sure to bookmark this url to keep on top of gold price movements, not merely day to day, but also with a historic perspective.

What Are Bid And Ask Prices

The ask price is the lowest price at which a dealer is willing to sell a troy ounce of gold. The bid price is the lowest price that a dealer is offering to pay for a troy ounce of gold.

This why the current price is important to know if you are buying gold bullion or you want to sell gold to a dealer.

The difference between bid and ask prices is called the dealer spread.

Read Also: How To Buy And Sell Gold

What Common Factors Influence The Gold Price

The gold price is affected by a very wide range of factors. This is due to the nature of gold its both a store of value, and a commodity. For instance, supply and demand will affect the gold price in the USA, as well as around the world. If a new gold mine opens and the supply suddenly exceeds demand, then prices should fall. If a gold mine is exhausted and demand remains high, prices should rise. However, other factors that affect gold bullion prices include mint fees, fluctuations in currency, the state of the worlds economy and geopolitical challenges. So, there might be plenty of gold available, but if an unstable situation prevents a mine from transporting the gold out of the country, prices could go up. If the currency in one country becomes devalued to a significant extent, the local price for gold could rise as well.

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

You May Like: How To Invest In Gold Futures

Classification Of Gold As A Precious Metal

Rare metals have higher economic potential than common metals. Of the five precious metals, gold has the largest market. Some investors refer to gold as a monetary metal because of its use throughout the history as a form of currency. Gold as an asset has a high store of value because it maintains its value without degrading. The yellow metal is also used in industrial units because of its desirable properties such as being a good conductor, malleability, and resistance to corrosion.

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

Don’t Miss: Should You Buy Gold Now

Is It True The Price Of Gold Goes Up When The Stock Market Goes Down

The price of gold is negatively correlated to the stock market most of the time. When the markets go down gold prices often go up. That being said, there are times when the price of gold and the stock market both go up or down in unison. Overall, however, time has shown that gold prices are not tied to the movements of stocks and bonds and it is for this reason the gold should be an important consideration to protect the long-term value of your investment portfolio.

Gold Price Factors Faq

The price of gold seems to move around quite a bit. What are some things that cause changes in the gold price?

Gold is a commodity that can have very rapid price changes during periods of high volatility and can also have very little price movement during quiet periods of low volatility. There are many different things that can potentially affect the price of gold. These issues include but are not limited to: supply and demand, currency fluctuations, inflation risks, geopolitical risks, and asset allocations.

Gold is viewed by some as a safe-haven asset for it is one of the only assets with virtually no counter-party risks . This is why golds value may potentially rise during times of economic instability or geopolitical uncertainty.

Isnt the price of gold too volatile for most investors?

Gold can, just like any other commodity, become volatile with rapid price changes and swings. The gold market can also, however, go through extended periods of quiet trading and price activity. Today many financial experts see gold as being in a long-term uptrend and that may potentially be one reason why investors are buying gold.

Why does gold trade essentially 24 hours per day?How often do gold prices change?

Don’t Miss: How Much Money Is One Gold Bar Worth