Gold Has Numerous Applications

While gold has been the cornerstone of flourishing capitalistic markets, it has found numerous industrial uses such as the manufacture of electronic devices for GPD units, and personal use as jewelry. The latter is more popular in South Asian countries during the wedding season.

Gold has many desirable properties that are not easily found in other metals. It can conduct electricity but does not corrode. It is malleable and ductile, which means it can be sculpted and shaped.

Gold is utilized in the medical field and is best for crowns, bridges, fillings, and other orthodontic applications because of being chemically inert. Many patients are not allergic to the metal, making it ideal for treatments. Scientists use trace amounts of isotopes of gold in diagnosis and radiation treatments.

Due to its luster, gold is used in awards, statues, and crowds. Its exceptional beauty and rarity has turned gold into a status symbol. The metal is used in everything from Olympic medals to Academy Awards, and holds high esteem throughout the world.

What Is The Gold To Silver Price Ratio

The gold to silver ratio involves simple mathematical principles. It shows you how many kilograms or ounces of silver it would take to buy a single ounce of gold. If this ratio is at 50 to 1, it means that 50 ounces of silver would be required to obtain one ounce of gold.

This ratio is used by investors to decide if one of the metals is overvalued or undervalued and if it is a good time to sell or buy a particular metal.

A higher ratio means that silver is more favored. On the other hand, a lower ratio shows the exact opposite and usually means that now would be the best time to buy gold.

Carat Gold Price Per Gram :

24K gold is the purest form of gold. It contains 999.99% pure gold. It is softer than the other gold forms and is also pliable, so, therefore, is not used in making regular jewellery items. Coins and Gold bars are manufactured with fine gold, of which the purity is typically graded using a scale of millesimal fineness. 24 kt is the purest form of gold and is marked with 999, indicating a gold content of 999.9 parts per thousand.

Medical devices and electronics also use components made with fine gold. For example, older computers containing a modem and installed hard drive contain gold. Although time-consuming, it can be profitable to extract and recycle gold from devices such as cell phones, computers, camcorders, gaming consoles and circuit boards.

Read Also: How To Get Free Eagles In War Thunder

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

Don’t Miss: Weight Of A Brick Of Gold

Why Us Dollars Are Used To Quote Prices For Gold

It is possible to buy gold in just about any currency, but the US dollar is the most popular choice because all fiat currencies are compared to it. This is because of the privileged position of the US as the worlds largest and most stable economy. The US dollar is also used to pay for all global imports and exports, so it makes financial sense to measure gold value according to this currency.

As a result, the dollar is widely considered as reserve currency, which means that it is used in international transactions by major institutions and governments across the world. The US dollar has become the defacto reserve currency since the start of the 20th century.

Live Prices For Gold Bullion

Gold bullion prices are guided by the gold price, but it is not a direct correlation. There are lots of costs involved in transporting gold and in manufacturing the gold from the raw material to the gold bars that are offered for sale. Whilst these costs are typically lower than in gold coins, for instance, there remains an element of additional manufacturing, transport and marketing costs that are factored into the final selling point and indeed the purchase price when someone is selling gold.

To find out the live market cost of gold we would recommend visiting our constantly updated live gold price page. Not only does this page give you an overview of line and intraday pricing, we are also able to show you the historic prices for gold going back to 1975.

Don’t Miss: Free War Thunder Golden Eagles Codes

The Scrap Value Of 9ct Gold / Gram

Gold-Traders is currently paying £ for 9ct gold. You can use our scrap gold calculator on the right of this page to calculate what your gold is worth.

All our prices are guaranteed and we offer exceptionally fast turnaround on all packages received. If you elect to have payment made into your bank account and you have an account with any of the main high-street banks, the funds will be available to you usually within an hour of us completing the transaction, on the day we receive your items. Yes, it really is that quick!

Factors That Influence The Gold Market

Gold is one of the most important commodity markets in the world, with only crude oil being more valuable. Despite this, the bullions price doesnt function on the basis of supply and demand. As is typical of most commodities, their prices are determined by expected demand and market supply.

Prices tend to rise when demand is high and inventories are low however in the case of gold, price are more heavily influenced by fluctuations in the currency and interest rates.

Some analysts like to think of gold as a currency instead of a commodity because of its intrinsic value. It is commonly believed that gold prices are driven by sentiment instead of traditional market factors. Gold has traditionally had an extremely inverse relationship with bond yields and the US dollar. Heres the rule of thumb: when the dollar and interest rates go down, gold rates soar.

Also Check: War Thunder How To Get Free Golden Eagles

How Much Is 67 Grams Of Gold Worth

troy

| 67 Grams of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Is The Gold Price The Same As The Spot Price

When looking at gold prices, the figures quoted are typically going to be spot gold prices unless otherwise specified. The spot gold price refers to the price of gold for delivery right now as opposed to some date in the future. Spot gold prices are derived from exchange-traded futures contracts such as those that trade on the COMEX Exchange. The nearest month contract with the most trading volume is used to determine the spot gold price.

Recommended Reading: War Thunder Golden Eagles Code

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

- American Eagle

What Are The Different Units Of Gold

The entire precious metals market in general quotes prices in troy ounces. Throughout history, countries have used different systems including the metric system to measure the weight of gold in grams, kilograms, and tonnes, and similar prefixes.

- 1 gram = 0.032 troy ounces

- 1 kilogram = 32.151 troy ounces

- 1 tonne = 32,151.7 troy ounces

- 1 tola = 0.375 troy ounces

Another popular unit for weight measurement is Tael and is commonly used in China. The tola is typically used to measure precious metals in South Asia.

You May Like: Banned For Buying Gold Wow Classic 2020

How Much Is 5 Grams Of Gold Worth

troy

| 5 Grams of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Understanding The Difference Between One Ounce And One Troy Ounce

Troy ounce has been used historically by the Roman Empire to weigh and set prices for precious metals. Back then, all currencies were valued in terms of their equivalent weight in gold . This process was later borrowed by the British Empire which tied one pound sterling to one troy pound weight in silver.

The US also used the troy ounce system in 1828. A troy ounce is bulkier than one imperial pounce by about 10 percent. A troy ounce is equivalent to 31.1 grams in weight, while an imperial ounce is equal to 28.35 grams.

Also Check: How Many Grams In One Ounce Of Gold

Are Prices For Gold The Same Across The Glove For Every Ounce

A single ounce of gold will be similarly priced throughout the world. Large-scale transactions usually deal in US dollars because of its popularity. The value of gold heavily depends on the countrys currency and follows an inverse relationship. It is typical for stronger currencies to have a lower value of gold, while the opposite is true for weaker currencies.

The most frequently used unit to quote the prices for gold is the ounce per US dollar, although it is common for OTC markets to utilize other options depending on the situation.

Is Gold Always Traded 24/7 If Not Is There A Set Open And Close

Trading for gold takes place Sunday through Friday, 23 hours a day. It is common for OTC markets to overlap. No market actively trades between 5 PM and 6 PM ET. Because of the presence of OTC markets, there are no closing or opening prices for spot gold.

For large scale transactions, most gold traders will utilize the benchmark price from specific periods during the trading day.

Read Also: 1 Oz 24 Karat Gold Price

How The Price For Live Spot Gold Is Calculated

Gold has a benchmark price that is set every day. The most common entities that make use of these benchmarks include producer agreements and commercial contracts. The benchmarks are based on the spot markets trading activity on decentralized OTC or over-the-counter markets.

OTC means that the prices are not set by formal exchanges and are negotiated privately by participants over the phone or electronically. While prices for spot gold are not regulated, financial institutions still play a valuable role by serving as market makers, providing an ask price and bids for the spot market.

How Much Is A Bar Of Gold Worth Today

One common question asked by investors is how much is a bar of gold worth today? This is a trickier question to answer than it might initially sound, after all there is no single standard for the weight and size of a gold bar, and the gold bar price varies slightly from the live gold price. They vary in weight between the different bars that are produced, as well as by the country in which they are produced.

What you can always be assured of though is that the bars of gold you buy from an experience gold bullion dealer such as The Gold Bullion company will consist of the same pure gold held by institutional investors, just usually in smaller bars.

This means that the price quoted on the commodities exchange will closely match the price we use to buy and sell our gold products.

You May Like: Buying Wow Gold Safely

Why Buy Gold In Grams

Buying gold in grams is a great alternative for consumers looking to make a smaller investment or who just want to own more pieces. One gram gold bars require less space to store and allow the individual consumer to have more variety, compared to buying a one ounce bar. Larger gold bars require special storage and insurance and are not as easy to buy, sell, trade or transport than their smaller counterparts. An investor could more affordably purchase multiple bars from many different mints when choosing the one gram size.

Is 18k Gold Better

18k gold is about 75% pure gold, which makes it less durable than 14k gold because it contains more pure gold. The more pure gold present in a metal, the softer the metal will be. If you plan on wearing your engagement ring or wedding band every day, 14k gold will be the best gold choice because it is stronger.

You May Like: 19.99 Kay Jewelers

Gram Gold Bar Premiums

Investors who buy gold bullion pay what is called the premium in addition to the market price of the metal. This premium represents the cost of fabricating the item, shipping costs, the wholesale premiums the dealer may have paid to acquire the item and the dealers profit.

There are premiums associated with both coins and bars, but it will vary from item to item depending upon size and type. For example, coins tend to carry higher premiums than bars. Order quantity is another variable. As a rule, larger order quantities mean lower premiums.

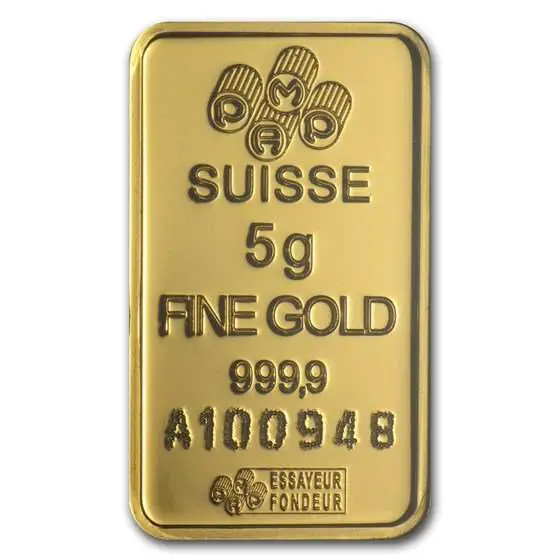

The 5-gram gold bar carries a bit higher premium as a percentage of the gold content due to its size. The machine time and labor involved in fabricating smaller bars is similar to that required for larger bars. The good news is that smaller bars also command a bit higher premium when it is time to resell them.

The 5-gram gold bar is a popular choice for collectors, investors, and people looking for a more unique gift. The bars come in an attractive package with the bar in a clear plastic hold at the center of an assay card with details including the manufacturer, weight, purity and serial numbers.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

Don’t Miss: How To Weight Gold