What Are The Differences In Grams And Ounces When Applied To Gold Bullion

All gold prices are based on troy ounce basis. However, youll find bars available in gram sizes, as well as kilograms. Understanding how a troy ounce breaks up into these other forms is important to ensure that youre getting a good deal. A troy ounce is 31.103 grams. So, a one-gram bar is only a very small fraction of a troy ounce. There are 32.151 troy ounces in a kilogram gold bar. Its also important to understand that a troy ounce is different from a standard ounce. A standard ounce is actually 28.35 grams, so a troy ounce is slightly heavier.

Thank you for visiting our live gold price page. Be sure to bookmark this url to keep on top of gold price movements, not merely day to day, but also with a historic perspective.

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Does Volatility In Gold Prices Affect Interest Rates

Interest rates are tied to inflation, so they have historically been closely related to gold prices, as well. When the dollar’s strength increases and inflation decreases, then interest rates could be expected to fall at the same time as gold prices. Inflation is decreasing, so cash-like investments don’t need to offer such high interest rates, and fewer people are rushing to gold as a stable store of value.

Read Also: How Much Is 10k Gold Worth

What Is Spot Gold

The spot gold price refers to the price of gold for immediate delivery. Transactions for bullion coins are almost always priced using the spot price as a basis. The spot gold market is trading very close to 24 hours a day as there is almost always a location somewhere in the world that is actively taking orders for gold transactions. New York, London, Sydney, Hong Kong, Tokyo, and Zurich are where most of the trading activity takes place. Whenever bullion dealers in any of these cities are active, we indicate this on our website with the message Spot Market is Open. For the high and low values, we are showing the lowest bid and the highest ask of the day.

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Recommended Reading: Does Kay Jewelers Sell Real Gold

How Does The Price Of Gold Perform During Recessions

Gold prices typically increase during economic recessions. One way to analyze gold prices during a recession is by comparing its performance with the S& P 500. Below are the dates of the largest declines of the S& P 500 and the performance of gold prices during the same period. This data shows that gold increased significantly in 75% of these recessions.

The 8 Stages Of The Gold Mining Cycle

Gold mining is uncertain, expensive, competitive, and highly intensive.

In 2014, the Minerals Council of Australia broke down the typical mining cycle into eight stages. The most expensive stages are 4, 5, and 6.

The process of discovering mineable gold deposits. Generative refers to the application of geoscientific tools to identify general areas for potential gold exploration.

This is where exploratory drilling and extensive geochemical analysis take place. Once a potential spot is identified, gold companies often need to halt the process until the local authority grants an exploration license .

The mining company, having estimated the size and location of the gold reserve, must conduct socio-economic analyses and undergo various other environmental processes.

The stage where a gold mining company prepares the new site for construction. New buildings, roads, and mining apparatus need building. Sometimes, old buildings or structures need clearing out before construction begins. This process can last for years.

Recommended Reading: 1 10 Oz Gold Coin In Grams

Value Of Gold Per Ounce

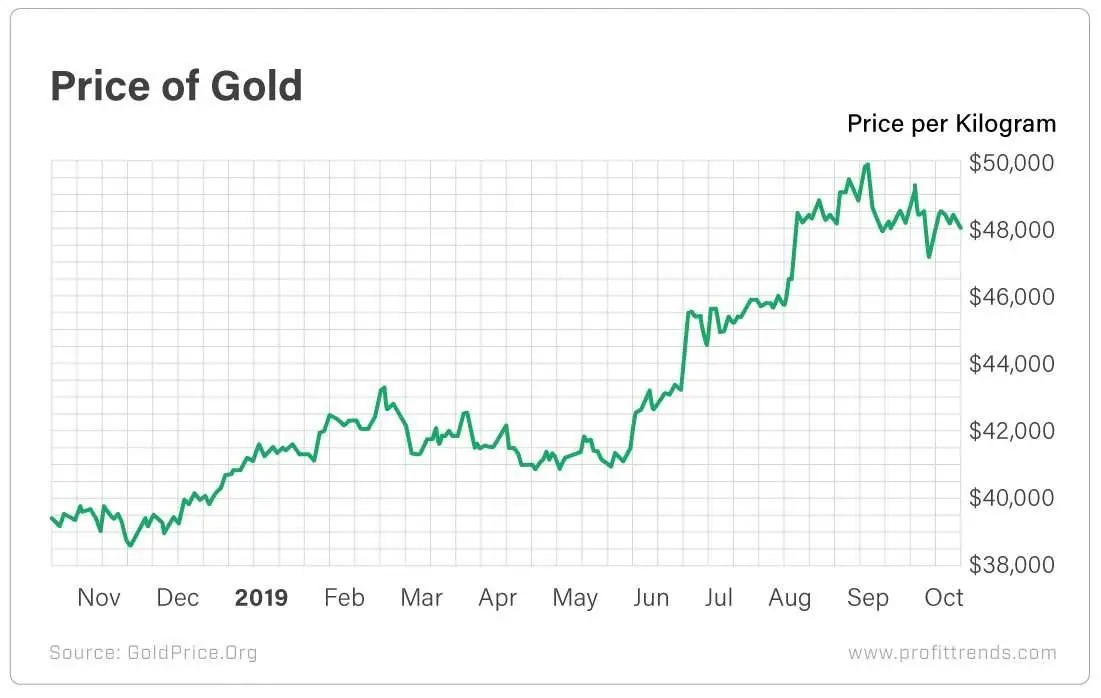

Are you wondering, “what’s the price of gold”? The live chart above shows the current spot value of gold per ounce in US dollars. You can change the currency by using the menu at the top of the chart.

As with the other charts located on this site, just hover your mouse over the graph to see the particular price at a given time.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Recommended Reading: Where To Sell Gold Rdr2

Whats Driving The Rush For Solar Power

The energy transition is a major factor in the rise of renewables, but solars growth is partly due to how cheap it has become over time. Solar energy costs have fallen exponentially over the last decade, and its now the cheapest source of new energy generation.

Since 2010, the cost of solar power has seen a 85% decrease, down from $0.28 to $0.04 per kWh. According to MIT researchers, economies of scale have been the single-largest factor in continuing the cost decline for the last decade. In other words, as the world installed and made more solar panels, production became cheaper and more efficient.

This year, solar costs are rising due to supply chain issues, but the rise is likely to be temporary as bottlenecks resolve.

How Do Designer Jewelry And Custom Jewelry Prices Get Figured Out

Custom Made Engagement Ring

If you have a one-of-a-kind custom-made ring created for you, your price to be paid will be greater, than a ring of similar weight and style that was factory made. The cost of a custom made ring includes the time of t he designer to create it, as well as the wax carving or CAD/CAM creation, casting, polishing, setting and adding the special finishes or textures plus any engraving that make your ring unique.

A custom wedding or engagement ring has no economy of scale because it is one of a kind. So expect to pay more for the singular care that goes into its making.

You May Like: Can You Get Banned For Buying Gold Wow Classic

Is A Gold Etf The Same Thing As Buying Physical Gold Bullion

No, theyre not the same at all. There are actually crucial differences between bullion and ETFs.

Yes, you can invest in gold ETFs if you prefer to perhaps trade in the short term. However, it is important to understand that gold ETF exposure will not provide you with actual gold bullion that you can own and hold outside the financial system. Gold ETFs also always continuously charging fees which can eat into your investment capital over the years. You can find some of those fees, when you learn about the best ways to buy physical gold bullion.

While most gold ETFs are supposedly backed by gold, you will likely not pay the bullion price nor receive any gold bullion at all for your investment. They are priced very differently, and they trade on the market in a completely different manner than physical gold, as well. Theyre also affected by other forces, so they may not make a good investment choice for your specific situation. If youre considering an ETF rather than physical bullion, think long and hard about it. Most investors prefer owning the actual physical precious metal itself. Gold ETFs often obstruct investors from many of the best safe haven aspects which actual gold bullion offers.

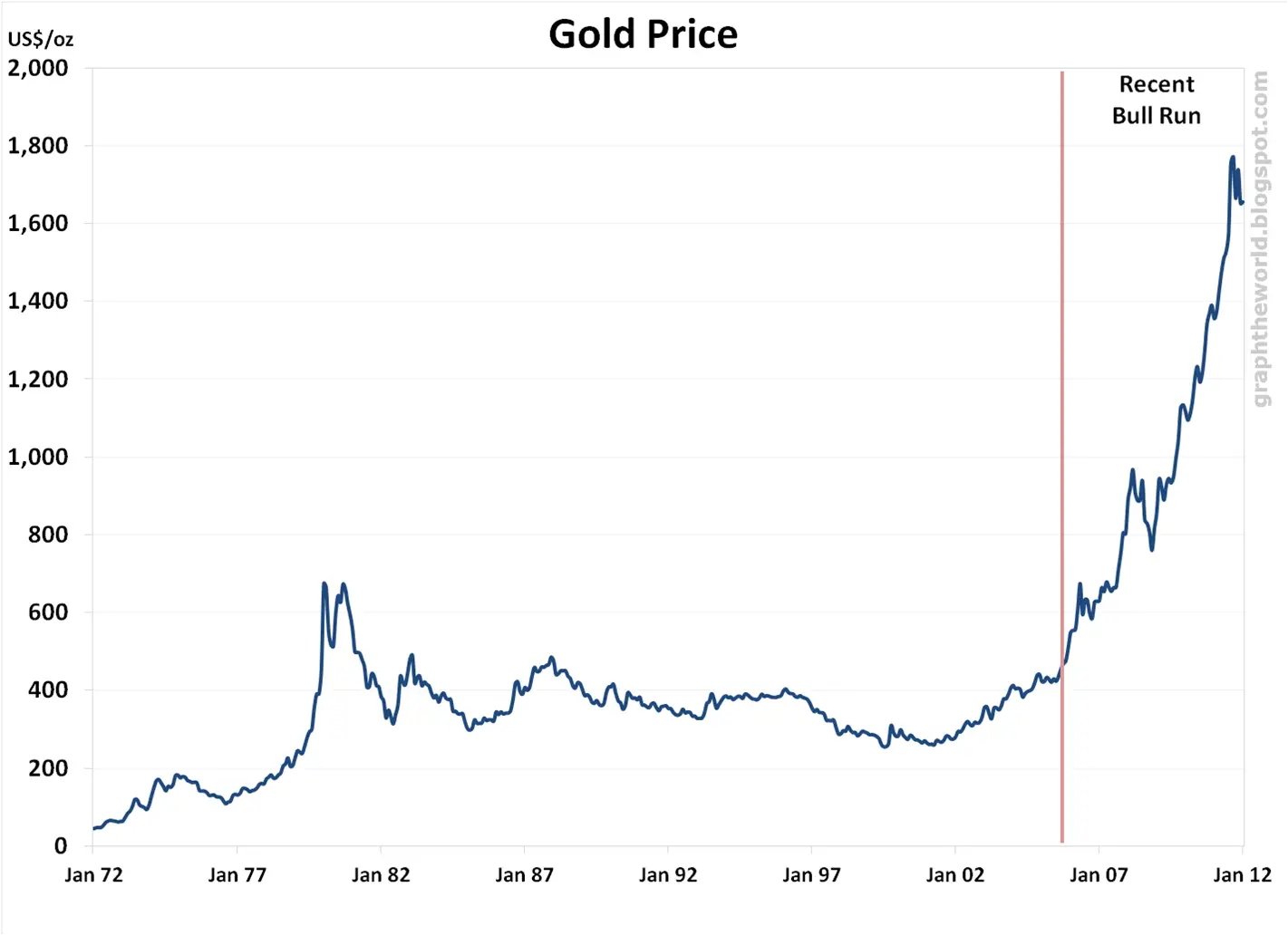

Brief History Of Gold

Gold has been a common currency since the start of written history and possibly even prior to this. Gold like it’s cousin silver is a staple of the money supply.

Did you know that if you took all the gold ever mined in human history and melted it into bricks, that those bricks would be roughly the same size as the base of the statue of liberty or about 5.3 billion troy ounces.

Don’t Miss: Kay Guest Appreciation Event

Is Physical Gold Taxed

Any purchase of physical gold bullion is subject to the sales tax of the state where the buyer is located. Local and municipal taxes may also apply.

If the order is over $500, any applicable sales taxes are waived in Florida. Any U.S. legal tender gold coins are also exempt from sales taxes within the United States.

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Read Also: Is Kendra Scott Jewelry Real Gold

What Is The Gold Spot Price

Spot prices represent what a commodity is trading for at any given moment. It is the live gold price in real time.

This price is used by gold refiners, miners, financial institutions, and gold dealers. It’s how they determine pricing for gold bullion.

In other words, the gold spot price is a benchmark for wholesale transactions. It’s the amount a wholesaler will charge for a unit of physical gold per ounce before any markups or premiums.

Gold derivatives often track with the spot price.

Gold Just Hit $2000 An Ounce But That’s Not Necessarily A Good Sign

The price of an ounce of gold, which has already smashed through one record after another, recently hit $2,000 a milestone that experts say could reveal a lack of confidence in the soaring stock market.

“Gold has become the safe haven of choice,” said Matthew Miller, an equity analyst at CFRA Research with a focus on metals and mining. “A lot of the stock market gains this year have just assumed that everything is going to be fine. If that doesn’t happen, we think the stock market gains that happened are certainly at risk.”

Today’s economic and market conditions create a perfect storm for soaring gold prices.

“The market is not confident that we have witnessed the end of the coronavirus outbreak,” said Giles Coghlan, chief currency analyst at HYCM, a U.K.-based brokerage. “Stock markets may be making modest daily gains but the chance of a second outbreak of cases, which seems to be increasingly likely, could result in these gains’ being lost.”

“There are a lot of skeptics out there looking at the stock market and saying there are a lot of cracks in the real economy.”

Historically, the biggest drawback of investing in gold is that it doesn’t pay dividends, like a stock, or interest, like a bond. “There is an opportunity cost of holding gold,” Miller said.

Download the NBC News app for breaking news and alerts

But that doesn’t mean you should be dumping the mutual funds in your 401 and loading up on gold, experts said.

Read Also: Grams To Troy Ounces Gold

Gold American Buffalodesign And Specifications

The American Buffalo is the United States first large-scale circulation of .9999 fine gold coins in the U.S. Mints history. With the mints weight, content and purity guarantee, this American-made gold beauty is backed by the United States government and offers investors all the security and liquidity of a world-class gold coin.The obverse side of the American Gold Buffalo features the profile of a Native American man while on the reverse side an American bison stands in profile, an image modeled after “Black Diamond,” a popular attraction in the New York Zoological Gardens in the early 20th century. The coin’s images were created by American sculptor James Earle Fraser and were previously featured on the Indian Head Nickel, also known as the Buffalo Nickel, minted in the U.S. from 1913 to 1938.

Each American Buffalo coin contains exactly one troy ounce of pure gold. Its diameter is 1.287 inches , with a thickness of 0.116 inches , making it approximately the same size as a U.S. half dollar coin.The gold American Buffalo features a face value of $50 on the reverse side of the coin and is minted at the United States Mint in West Point, New York, but does not feature any mint mark. By law, all of the gold used in the production of the American Buffalo bullion coin must be from newly-mined sources within the United States.

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

You May Like: Free Golden Eagles Code

The Cost Of Everyday Items In The 1950s Compared To Gold:

The 1950s, on the other hand, saw some serious inflation. The cost of steak nearly tripled, the cost of a car nearly doubled, and suits increased in price by almost 50%. Within a decade, the value of the dollar decreased significantly.

The breakdown:

Cost of steak : 93 cents

Cost of a nice suit: $36.95

Cost of a car: $1510

Cost of an oz. of gold: $40.25

How Gold Prices Are Determined Today

Some people are not familiar with the notion that precious metal spot prices prices are largely determined by trading on the futures market. Because gold is a precious commodity, this trading takes places on the COMEX, the commodities exchange run by the Chicago Mercantile Exchange Group through the New York Mercantile Exchange . As hedgers and speculators enter into futures contracts, the balance of long and short positions moves the price of these contracts. This is why you often hear the net-long or net-short position of futures in the financial news this data is provided by the Commitment of Traders reports each week. The fluctuations of the price of gold futures contracts directly affects the spot price of gold that you see going up or down during the trading session.

- The difference between a dealer’s Bid and Ask price.

- Melt Value

- The value of the metal content of a precious metal object, regardless of workmanship or rarity. The raw value of an object if it were melted down. Metal value is usually only calculated on the precious metal content of an item. For example, the melt value of a sterling silver coin only takes into account the 92.5% silver content of the coin, and ignores the 7.5% copper content.

You May Like: How Much Is 10k Gold Worth

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

You May Like: How Much Is 18 Karat Gold Per Ounce

The Cost Of Making Chains Vs Earrings

A popular style of gold chain will be more reasonably priced than say a pair of earring as an earring takes more time and steps to make. Also a company might make 100 pair of earrings in one year, while they make 1,000 pieces of a frequently ordered chain style.

They can make that chain style again and again for years, but the styles of earrings change regularly, and the cost of designing and testing each earring style would increase the overall cost of the earrings as well.