How To Ride Massive Trends With The Golden Cross

Heres a fact:

If you want to ride massive trends in the market, you cannot have a target profit.

Because a target profit limits your profit potential?

Its like saying

Hey Mr. Market, dont give me too much profits. Ive had enough.

Instead

This means as the market moves in your favor, youll lock in your gains but still give your trade room to breathe should the price moves further in your favor.

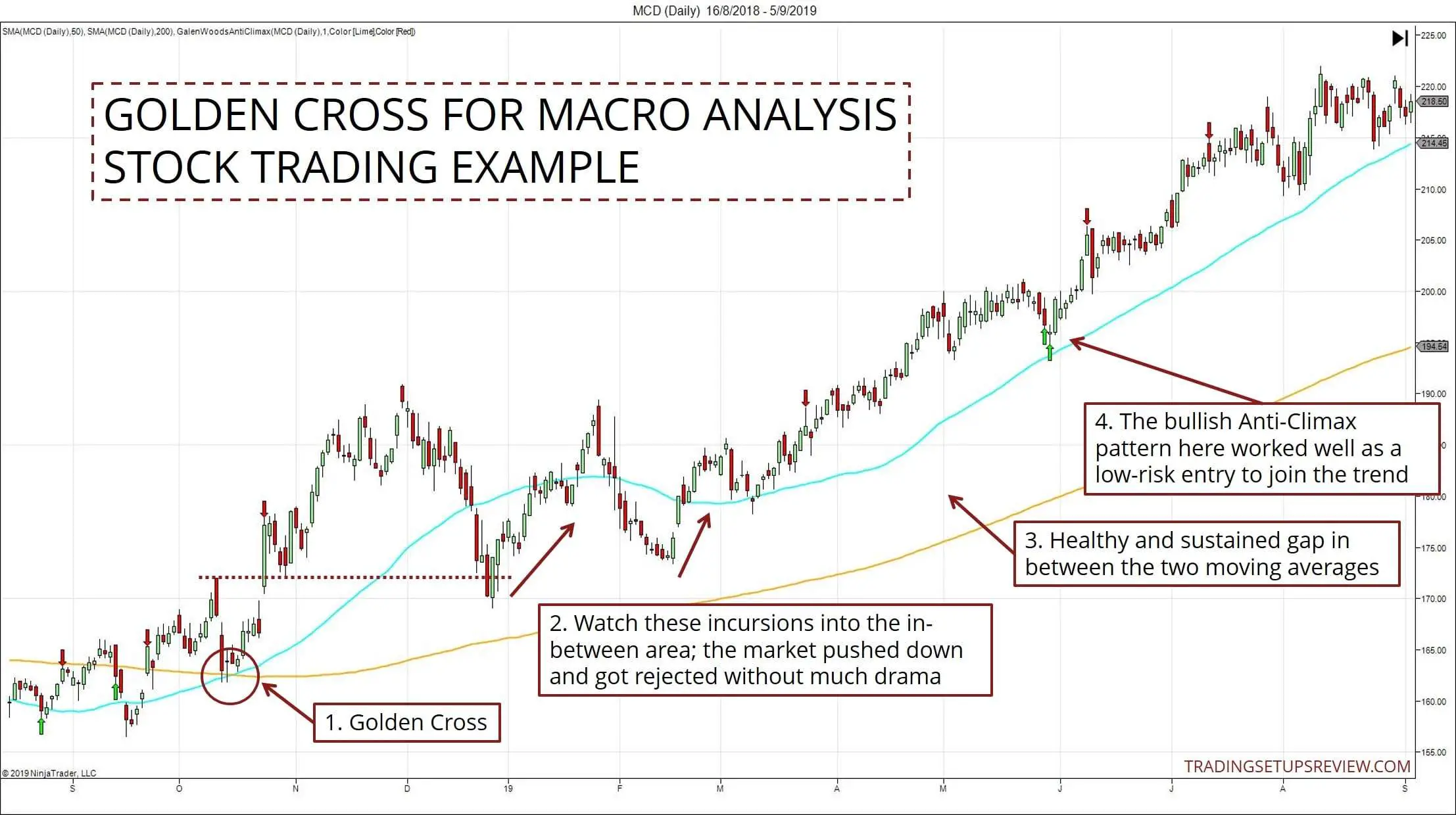

And one way to go about it is using the Golden Cross as a trailing stop loss.

Heres how

If youre in a long trade and the market moves in your favor, then youll hold the trade till the 50-day crosses below the 200-day Moving Average.

Heres what I mean

Now Ill be honest.

A trailing stop loss is not easy to execute.

Because often, your winners will become losers as you try to ride the trend and thats the price you must pay.

A Golden Cross Usually Occurs In Three Stages:

- During a downtrend, the short-term moving average is lower than the long-term moving average.

- The short-term moving average crosses above the long-term moving average, reversing the trend.

- When the short-term moving average holds above the long-term moving average, an uptrend begins.

- For example in 2017, the weekly chart of Reliance company showed a crossover and after that the Reliance market went through its golden time which is still continuing.

But Does The Golden Cross Really Work

Check this out

Source:

This shows the returns after 1 month, 2 months, 3 months, 6 months, and 1 year after the Golden Cross occurs on the S& P.

Clearly, the Golden Cross has a positive bias, and the market is likely to head higher after it occurs.

And in the next section, youll learn how to better time your entry when trading the Golden Cross.

Read on

Read Also: Kay Jewelers Buy Gold

The 5 Most Powerful Golden Cross Trading Strategies

Have you ever heard of golden cross trading strategies for the cryptocurrency market? If not, theres good news for you because in the following section, we will see the top five golden cross trading strategies that may make your trading life more fruitful.

In golden cross strategies, a lower-valued moving average crosses over a higher valued moving average, indicating a strong momentum in the trend. Nevertheless, the challenging factor is to find where to enter the market based on golden cross strategies.

Dont worry!

After completing the Golden Cross trading guide, you will have a deep understanding of the Golden Cross strategies that you can apply to any crypto asset.

Three Stages Of A Golden Cross

While the abovementioned crossing of moving averages sound reasonably intuitive, technical analysts would highlight that there are three stages to the golden cross.

An example can be seen below using Apple looking at a short-term 20-DMA and 100-DMA golden cross. Following the intersection in March 2019, prices were kept above its short-term DMA before a break below, suggesting a change in trend.

Also Check: How To Get Free Golden Eagles In War Thunder

How To Use This Excel Sheet

Step 1: Open the sheet from the link provided at the end of this post.

Step 2: Provide inputs in Cells B4 to B7. Make sure that you are connected to the internet.

Step 3: Wait for around 30 seconds. The sheet will update automatically depending on the inputs you provided.

Step 4: Check the outputs in Cell E4 to E7.

Step 5: Take Buy/Short position based on the signal at Position column.

How Can Tradingsim Help

Tradingsim is the best market replay platform on the web. You can cycle through thousands of charts and replay the data to see which golden cross setup works best for your trading style.

Put Your New Knowledge to the Test

Want to practice the information from this article?get trading experience risk-free with our trading simulator.

Recommended Reading: What Dentist Does Gold Teeth

If You Prefer To Trade More Passively Check Out Our Newsletter Trade Ideas And Live Analysis In The Elite Trader Package Here > For Free News Update Click Here

The information contained in this post is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable for your own financial situation. TRADEPRO Academy is not responsible for any liabilities arising as a result of your market involvement or individual trade activities.

Should We Use Ema Or Sma For Cross Signals

Simple moving averagesâ calculate the average of price data over the period. They are the more widely used MA, although each trader can decide for themselves which type of moving average they prefer. One is not better than another.

The calculation for an exponential moving averageâ places a higher weighting on recent price action than an SMA does. This means that an EMA reacts more quickly to price changes. For example, if the price of an asset drops, a 200-day EMA will start to turn down before a 200-day SMA. This means the SMA is slower to react to price changes.

Both are useful in that they are both providing slightly different information. Traders and investors usually pick one type of MA and stick with it.

Read Also: Is Gold Peak Tea Healthy

How To Trade The Death And Golden Cross Technical Analysis Signals

What Does The Golden Cross Tell You

The golden cross signals to traders and investors that market sentiment is potentially shifting bullish after a period of sustained bearish pressure and a new bull market is in the early stages of development.

There are generally threestages to a golden cross:

Read Also: War Thunder Free Golden Eagles App

Better Periods For Day Traders

However, since the 50-day and 200-day moving averages are relatively wide for day traders, most of them have narrowed down the periods. Some will combine the 10 and 50-period moving averages while others will combine the 25-period and 50-period MAs.

Golden cross can be used in all types of financial assets, including currencies, stocks, indices, commodities, and exchange-traded funds .

What Does A Golden Cross Tell You

There are three stages to a golden cross. The first stage requires that a downtrend eventually bottoms out as selling is depleted. In the second stage, the shorter moving average forms a crossover up through the larger moving average to trigger a breakout and confirmation of trend reversal. The last stage is the continuing uptrend for the follow through to higher prices. The moving averages act as support levels on pullbacks until they crossover back down at which point a death cross may form. The death cross is the opposite of the golden cross as the shorter moving average forms a crossover down through the longer moving average.

The most commonly used moving averages are the 50-period and the 200-period moving average. The period represents a specific time increment. Generally, larger time periods tend to form stronger lasting breakouts. For example, the daily 50-day moving average crossover up through the 200-day moving average on an index like the S& P 500 is one of the most popular bullish market signals. With a bellwether index, the motto “A rising tide lifts all boats” applies when a golden cross forms as the buying resonates throughout the index components and sectors.

Don’t Miss: Is Dial Gold Body Wash Antibacterial

Golden Cross With 50 Ema Carry

We have seen how the price comes below the 50 EMA and forms the double bottom pattern. However, in strong trending markets, after the crossover, the price should not break below the 50 EMA.

In this case, we look for the price to find support at the 50-period EMA, which is going to stop the price from dropping further.

You can take trades from the 50 EMA carry.

When does the 50 EMA carry happen?

If the bullish pressure is strong, the price might move along with the 50 EMA instead of moving below it. It is often tricky to know whether the 50 EMA will hold the price, or not. Still, if at least two bearish rejection candles appear at the 50 EMA level, we may consider it a carry.

We can see that the Bitcoin golden cross happens in the above chart, and the price becomes corrective immediately afterward. Instead of moving down below the 50 EMA, it starts to stall at the 50 EMA area.

So, the 50 EMA carry happens when the price stays glued to the 50-period moving average.

What Is Moving Average Golden Cross And Death Cross

A trend signal is formed when a short-term moving average crosses a long-term moving average above or below in a chart pattern. We know this as the moving average golden cross and death cross. So the uptrend or bullish pattern formed through a short-term moving average breaking above its long-term moving average is known as the golden cross.

Let us check an example of a golden cross. In March 2014, Reliance weekly charts went through a golden crossover which is quite visible.

You May Like: War Thunder Golden Eagle Codes

How The Golden Cross/death Cross Is Supposed To Work

The chart lines tracking moving averages that form both the bullish golden cross and the bearish death cross trace the simple 50-day and the 200-day moving averages of a stock or cryptocurrency over an extended period of time.

The death cross, recorded by Bitcoin in July, indicates that the short-term trend expressed by the 50-day moving average line had accelerated downward by crossing below the long-term trend line, the 200-day moving average. This event was supposed to herald a breakdown of the long-term upward trend that began in March 2020.

The golden cross is the bullish flipside, and happens when the 50-day moving average breaks above the 200-day moving average. Bitcoin was on the cusp of recording a golden cross as recently as Sept. 6, when, according to crypto Web site CoinDesk, the 200-day moving average was around $46,100 and the 50-day was about to move above that, following a string of closes above $50,000. As it happened, Bitcoin prices retreated the second week in September. It would have been the first time the golden cross has happened on a bitcoin chart in more than a year, suggesting a break-out to a more dramatic rally, according to technical analysts.

Golden Cross And Death Cross: Excel Trading System

Golden Cross and Death Cross are very popular strategies for any Trend following Trading system. You might have heard about these terms if you have subscribed for any of the Technical analysis course or tutorial. Even if you havent, we would help you understand these terms and its application. In this post, we would also provide you an Excel sheet where you can backtest Golden Cross and Death Cross on any of the Stock or Index. Please read through below.

Check out our other Excel based Trading strategies here.

Read Also: How Much Is 10k Rose Gold Worth

What Is Golden Cross In Trading

This is a bullish signalthat emerges when two moving averages make a crossover. The most common periods of the two moving averages are 50-day and 200-day moving averages.

Also, the strategy mostly uses the simple moving average indicator but some traders focus on the exponential, smoothed, and weighted moving averages.

The idea behind the golden cross is very simple. When the asset price starts to rise, it first meets the 50-day moving average. This happens as buyers start pushing the price higher with some staying in the side-lines.

Then, when the price manages to move above the 200 moving average, more buyers get convinced that this is, indeed, a bull run and then continue pushing the price higher.

Tools & Resources Used In This Experiment

- NinjaTrader 8: This is the backtesting platform well be using to generate our signals and test our strategy.

- Microsoft Excel: After we run our strategy in NinjaTrader, well export the reports to Excel and analyze results.

- Norgate: This is where our data comes from for this experiment and its our recommended source for building and testing strategies .

- Github: All of the strategy code can be found and downloaded here.

Recommended Reading: Selsun Blue For Toenail Fungus

Definition Of Golden Cross

A golden cross is a technical chart pattern that indicates the potential for a major rally, i.e., a bullish breakout pattern that is formed by the crossover of a securitys short-term MA that breaks above its long-term MA or resistance level.

Since long-term indicators carry more value, the golden cross pattern indicates an impending bull market that is bolstered by high volumes of trading. It can be distinguished with a death cross which designates a bearish price movement.

The Limitations Of Using Golden Crosses

All the technical indicators are lagging, and no indicator truly predicts the future of a market perfectly. There are many occasions where a golden cross has produced a false signal. Golden crosses are still subject to failure despite its strong predictive ability in speculating prior long bull markets.

Therefore, you should always confirm a golden cross with other indicators and signals before committing to a trade. The secret to using the golden cross indicator correctly along with other filters and indicators is always to use ratios and risk parameters. This way, you get to time your trade properly by keeping a favourable risk-to-reward ratio, which leads to better results than just blindly following a golden cross.

You May Like: How Much Is One Brick Of Gold

Strategy #2 Avoid Wide Spreads Between Moving Averages

At times the averages will have a wide spread. This will present a cup-and-handle-like formation of the averages. On the surface, its going to look really bullish.

However, if you look at the price action, you will notice the pattern is unhealthy. First, the price is shooting straight up. What happens when a stock goes parabolic into a strong primary trend? It usually reverses.

What does this chart example teach us?

You cannot ignore price action. Parabolic reversals should be treated with caution. This is especially true when you have a large overhead gap acting as resistance.

For these types of golden crosses, you may want to avoid them. While it might be considered a valid golden cross, there are better opportunities in the market with smoother, less volatile entry signals.

So, whats the trade here? Well, there isnt one.

As traders, we have to remember that sometimes the best action is no action at all.

Benefits Of Using The Golden Cross

These crossovers are useful for all kinds of investors. If you are value or a long-term investor, you surely need to do your thorough research and fundamental analysis before financing a stock, but it is also equally important to determine how much you are willing to pay for the said stock.

If you feel like the prices are way too high despite being an attractive stock, there is no point in investing as your ROI wouldnt be impressive.

For that purpose, technical analysis tools like the Golden Cross and Death Cross essential to identify the right moment and price to buy the stock. On the other hand, the importance of the Golden Cross and Death Cross for a Stock trader is not even required to be explained.

The whole purpose of trading is speculating, as you are speculating a certain uptrend or downtrend of a stock in order to make use of that in following the good old formula buy low, sell high and earn profits.

If you are a day trader, you would be better off using an even shorter time period for moving averages for both long-term and short-term, for obvious reasons.

The most common averages used by day-traders throughout the world for identifying Golden Cross breakouts are the 5-period and 15-period moving averages. One basic rule that you must not forget while using the Golden Cross is that longer the period used, stronger the signals.

Read Also: Gold In Dubai Online