Can You Day Trade On Robinhood

- Yes, you can day trade on Robinhood just like you would with any other broker. You will still have PDT restrictions if you dont have at least $25,000 in your account. Also, Robinhood offers zero commissions when trading. There are some helpful tips you should know though

So even though you can, it has its challenges and disadvantages. Lets start at the beginning of what day trading is all about. If youre familiar will all the basics, scroll deeper to the million dollar question and well cut to the chase.

Did you know RH charges zero commission for US stock, options, and cryptocurrency trading? Youd be hard pressed to find that anywhere else. For the first time trader with limited funds, thats a big deal because commissions can quickly eat up your gains. Its easier to grow a small account with a free commission broker.

Nonetheless, the pressing question is: can you day trade on Robinhood? Or better yet, should you day trade on it?

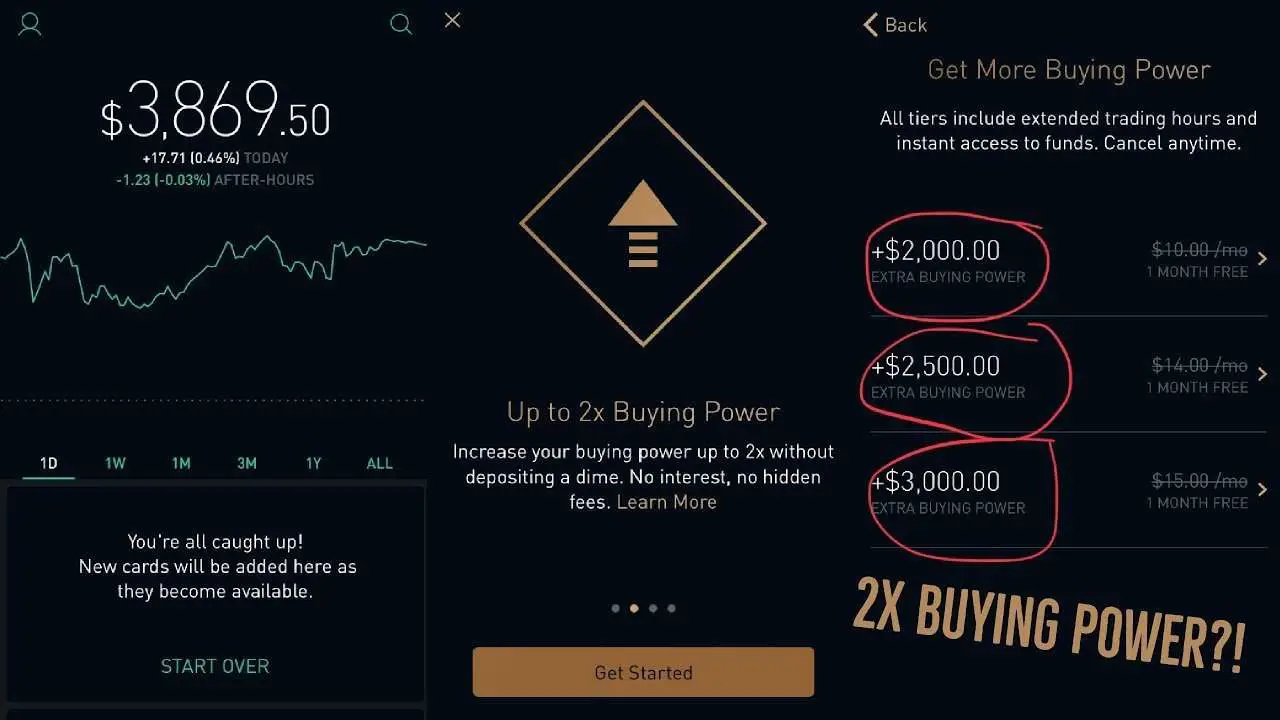

So Is Robinhood Gold Worth It

Whether or not Robinhood Gold is worth the money depends on who you are as an investor and what your goals are. Things you should consider are:

- Will you read the Morningstar reports?

- Do you plan on using margins?

- Will larger deposit maximize your investment goals or get you in on deals sooner?

- Do you understand Level II market data and how to use it? Are you willing to learn?

If you answered yes to all or some of these questions, it may be worth your while to sign up. Even if you didnt, every Robinhood user gets a 30-day free trial, meaning you have nothing to lose by giving it a try!

However, keep in mind that if you are using margin or the larger instant deposit feature when your trial expires, you wont be able to downgrade back to the free version.

Robinhood Day Trading: Can You Day Trade On Their Platform

Posted on January 7, 2020 by Ali Canada – Brokers

As you look for a good day trading broker, you may be asking can you day trade on Robinhood? The answer is yes. But there are some risks and important things you should know before you start, or make any mistakes you will regret. Hang around and well spell it all out below.

Don’t Miss: Does Kay Jewelers Sell Real Gold

Can I Overdraw My Account Or Make A Purchase That Will Trigger A Margin Call

Well generally deny any authorization that would put your account into a . An exception to this is if you have a non-authorized transaction . If this is the case, it could result in a margin call.

*When calculating margin maintenance requirements, your portfolio value does not include any cryptocurrency held by our affiliate, Robinhood Crypto, LLC.

What Is A Robinhood Cash Account

If you have an Instant or Gold account with Robinhood, you can downgrade to a Robinhood Cash account. However, the app doesnt make downgrading particularly easy. According to some users reviews of the Robinhood Cash feature, you might not want to make the switch. Heres the scoop on this account type.

Also Check: Does Kay Jewelers Sell Real Gold

Using Robinhood Could Cost You Thousands In Taxes Heres Why

While Robinhoods app may glitter, its lack of automated tax-saving options may cause you to lose … out on a lot of gold. Free trades sound great, until you realize the price you pay for free could be thousands of dollars.

getty

With tax filing season in full swing, many new do-it-yourself investors are dealing with complicated tax issues for the first time. Some are getting caught up in complex IRS policies, like the wash-sale rule, and are now on the hook for hundreds of thousands of dollars. Those who are using new platforms, like Robinhood, are also hamstrung by the lack of critical functionality that helps minimize taxes. These gaps, or the manual band-aid solutions that Robinhood has deployed, could cost new investors thousands in additional taxes. Heres why.

Robinhood Doesnt Allow For Automated Tax-Minimizing Strategy

Despite its many bells and whistles, Robinhood makes it extremely difficult for investors to use a tax-strategy known as specific-lot identification. As was first reported by The Wall Street Journal, this technique allows investors to reduce their tax bill by specifying what shares to sell, which is especially critical if they bought shares at different times and at different prices.

Robinhoods Omission Could Cost You Thousands

The Upshot

You Cant Trade Otc Stocks

This is my biggest issue with Robinhood.

Robinhood says it wants to democratize trading. And yes, it has given millions of young traders their first trading experiences.

Its business is based on catering to small-account traders. It started the commission-free revolution, which is now an industry standard.

And yet they dont have access to OTC penny stocks the stocks that have helped me make $7.2 million in my trading career so far.**

I trade these stocks because I think theyre the best way to exponentially grow a small account. Thats why I start each year with $12,000. I want to show my Trading Challenge students whats possible.

Many Robinhood traders are interested in penny stocks. And yet their broker wont let them trade most of the penny stocks out there.

This is my top argument for staying away from Robinhood.

Don’t Miss: Is 10k Gold Worth Anything

Problems With Robinhood Gold

Robinhood Gold offers margin trading which comes at a risk to the user. While borrowing money to trade is enticing, it is possible to lose more money than what is originally invested. Borrowers could end up owing Robinhood Gold thousands of dollars if they are unlucky with their trades. Skilled traders can do well with margin trading, but those who are new to trading might not want to take on the risk.

Robinhood Gold also has a lack of resources available. This platform isnt meant for research, so traders have to conduct that elsewhere. That means traders dont have reports, analysis software, or educational resources on the app.

Its also worth noting that Robinhood doesnt have a feature for automated broker transfers. Investors who already have accounts set up with another platform cannot automate the transfer process. Instead, they have to conduct the transfer via the Automated Customer Account Transfer Service .

Robinhood Guide: How To Use The Robinhood App To Invest

It is fairly easy to buy your stocks, ETFs, gold, futures or crypto through the Robinhood app. First you have to deposit money on your account. This can be done by linking your bank account. You cannot use a creditcard. You then select the share or fund that you want to own and proceed to purchase by clicking on the Trade button.

The point of investing in Robinhood for beginners is that you select the shares you want, based on the type of investor you are, and then basically move on and not look back to it. Robinhood is definitively not the app you use if you want to day trade for example. It simply doesnt offer the features you need if you like to do technical analysis properly for example. Therefore we think that the best way to use Robinhood is nothing more than to use it as a simple method to purchase the stocks you actually want to own.

However, if you want to have a proper buy-and-hold strategy there may be better methods, as well as Robo advisors that may yield better results.

What the Robinhood app does well is news coverage and comparing analysts forecast with actual results. Robinhood gives a nice little overview so you can see and understand better the excepted results of a company, an option or an etf. This makes it a lot easier to see if youd actually like to actually buy this particular share or not. Now you dont have to search around the web to actually research a company. See also the video below with a hands-on explanation and more tips.

You May Like: Dial Gold Body Wash Antibacterial

Robinhood Review: Where It Falls Short

The simplicity of the entire Robinhood experience is a double-edged sword.

Ive never experienced such a frictionless investment platform. Robinhood has made a clear judgment to prioritize ease of use over almost everything else.

If the goal is to attract otherwise-uninterested people to learn more about investing and long-term financial planning, thats helpful. But several problems arise from its simple over everything ethos.

Youve got inexperienced people without a lot of capital that are engaging in trading activity that can be dangerous to their financial well-being, Clark said. You have people who are trading like its gambling. To them, its like theyre in a giant electronic casino rather than investing in stocks as a long-term financial security.

High Risk High Reward

Buying securities on margin can be a quick way to earn some fast cash, but the risks are high. Robinhood allows you to get margin accounts, but there are several requirements in place. You need to be careful and its recommended you set a borrowing limit.

Do you find Robinhood reliable? Is buying margin worth the risk? Let us know in the comments section below.

Recommended Reading: Do Diamonds Look Better In White Or Yellow Gold

Does Robinhood Have Cash Accounts

Yes, it does. You can get one by downgrading from a Gold or Instant account. As long as you arent using any Gold Buying Power, you can downgrade to a Cash account.

You need to get in touch with Robinhoods support team before you can make the change.

Here are the steps to downgrade to a Cash account:

1. Tap the Account button at the bottom right.

2. Select the three bars at the top-right corner.

3. Select Settings.

5. Select Downgrade from Gold.

6. Downgrade to Robinhood Instant.

7. Contact the support team to downgrade further to Cash.

Cash accounts dont have the same trading restrictions as the other two accounts, but some users dont like using Robinhood Cash. They believe that getting money late isnt desirable. However, some people want unlimited day trades and dont mind waiting a bit. If you share this sentiment, Robinhood Cash may be the option for you.

What Are The Risks Of Margin

There are a few risks associated with trading on margin. They include:

Increased Losses.

Since youre borrowing money from your broker, youll have to pay them back, even if you experience a loss. Some investors lose much more than they invested in the first place.

Add to the fact that youre also paying interest. The amount to pay back will compound quickly if you cant afford it.

Margin Call.

A margin call is when your broker calls you to add more money into the margin account. This happens when the amount is below the margin minimum. Underperforming securities can cause the amount to dip this way.

To resolve this, youll have to sell some of your assets to meet the margin requirement. Sometimes it gets so bad youll have to sell everything. This still isnt the worst possible outcome from margin trading!

Liquidation.

If you as an investor fail to keep your promise as per your margin loan agreement, the broker can take action. Robinhood can liquidate all the remaining assets in your account. This includes securities from other firms and companies.

Liquidation can happen without your prior approval. Robinhood can simply do so within their rights.

To prevent these outcomes, you shouldnt bite off more than you can chew. Dont borrow too much either. And if you do borrow, try to return in as soon as possible.

If you trade on margin, you should never neglect to regularly look at your portfolio.

Also Check: Gold Peak Tea Commercial

What Is Level Ii Market Data

On many trading apps like Robinhood, the objective of the firm is to keep things simple. This is evident by only providing Level I Market Data. With this level of detail, you are only able to see minimal information about the bid and ask on different securities.

As a long-term investor, this likely won’t make a huge difference. But as an active trader, you’ll want to have as much information as possible before you trade. That’s where Level II Market Data comes in.

Level II Market Data provides additional data about the bid and ask prices of the securities. Instead of just showing you the current bid and ask, you’ll be able to see the next 10-15 bid and ask prices as well as the lot size of each. This provides you with a wider picture of the market for each stock and gives you a leg up over other traders.

Without this information, active traders are putting themselves at a bit of a disadvantage. While you’ll need to pay $5 a month on Robinhood for this kind of data, there are other apps like Moomoo that provide Level II Market Data for free.

How To Withdraw Money From Robinhood

- Tap the Account icon in the bottom right corner.

- Tap Transfers.

| – | No |

Disclaimer: Robinhood’s system crashed three times between 03 March and 09 March 2020, its clients were unable to log in and/or trade in volatile market conditions. This review and its score don’t reflect these incidents yet. We think such downtimes have a temporary effect, therefore we did not update the respective scores in the broker review. If you happen to experience another outage at this broker, contact us at .

Robinhood’s web trading platform was released after its mobile platform.

Recommended Reading: How To Buy Gold In Robinhood

News And Market Monitoring

As soon as I started investing, I became intensely interested in what the markets were doing. Robinhood provides a newsfeed to help me keep up with the news directly in the app.

Theres also a newsletter and podcast, called Daily Snacks, that provides news in an accessible, easy-to-understand format.

Is There A Difference Between Robinhood And Robinhood Gold

Robinhood, as an entity, specializes in commission-free investing. The company makes up for the lack of commissions through fees. However, the overall concept hinges on the idea that individuals can make their own determinations about how they invest. Robinhood allows users to invest any amount they want, build a portfolio, and diversify into a number of different areas all on their easy-to-use platform.

Robinhood Gold offers just a little bit extra. Like Robinhood Financial and Robinhood Crypto , Robinhood Gold is a new facet of the company’s already robust investment offerings. With Robinhood Gold, investors will be able to trade on margin. They are trading in money borrowed from a broker. Trading on margin isn’t for beginners. You can lose more than you invest in the long run, but the rewards can be substantial.

Recommended Reading: How Much Is 10k Gold Worth

Robinhoods Involvement In The 2021 Gamestop Saga

In January 2021, Reddit users from the Wall Street Bets group loosely organized and created chaos in the stock market when they started buying up shares of the moribund video game retailer GameStop.

The price of GameStops stock jumped quickly, catching off guard the traders who expected the stock to fall. That forced them to buy more stock to prevent massive losses, causing whats called a short squeeze.

Institutional investors with hundreds of millions of dollars were betting on GameStop to go out of business, essentially. Yet the stock price soared nearly 3,000% in January!

This historic event eventually led Robinhood to suspend trading on GameStop, causing a national uproar. Questions arose about whether the fintech investment platform was colluding with hedge funds.

Because Robinhood accepts PFOF, it gets a bulk of its revenue from the hedge fund world. Some felt that Robinhood was doing this to protect the rich hedge fund companies at the expense of the retail investors the opposite of the companys marketing theme .

When are involved , such high volatility can be dangerous even for enormous investment firms. Regulators stepped in and required companies like Robinhood to set aside hundreds of millions of dollars with the National Securities Clearing Corporation.

Other popular trading platforms like Charles Schwab, TD Ameritrade, Interactive Brokers and Webull also restricted trading for GameStop for various periods of time.

What Is Margin Investing

Investing on margin means that youre borrowing money from your broker to buy stocks. This allows you to invest more money than you could otherwise.

It lets you leverage more money without having to sell off any of the assets in your current portfolio. This way you can open larger positions to magnify your results.

Its vital to remember that when you use a margin account, it could result in both major profits or huge losses. With margin, its possible to lose not only the borrowed money but also the value of the securities in your cash account.

You’ll also be paying interest on any borrowed cash throughout the duration of the investment. This cost can eat away at your investment the longer you hold it.

If you start to show losses that are greater than the limit set by the broker, this can lead to Robinhood making a

Don’t Miss: How Much Is 10k Gold Worth

How Do I Fire A Pair Trade Using The Robinhood Api

In this section we will show how to long Box and short Dropbox when they diverge more than 3% over the previous day.

A pair trade is a trading strategy where you identify two stocks that move with high correlation- and long the under-performing stock and short the over-performing stock if they begin to move unusually far apart as a mean reversion strategy- where you assume this is an unusual blip and they will shortly move closer together again.

Box and Dropbox are examples of two stocks that move with high correlation:

We will show you how to create a trading script that longs Box and shorts Dropbox if they began to move unusually far apart in a trading day compared to the last trading day.

Again by shorting, we make the assumption we were already holding some Dropbox that we can sell since we cannot directly short sell on Robinhood, so this strategy will only fully work if we are willing to have a minimum continuous exposure to Box and Dropbox in the first place.

The idea is that we buy Box when it falls unusually low relative to Dropbox and sell Dropbox with the expectation that the two move closer together again in the future. When they do, we can sell some Box and re-buy some Dropbox to re-balance our portfolio to its original levels .

Firstly, lets grab the daily historical data for the last week for Box and Dropbox and convert the response into a pandas data frame:

price_diff_yesterday = dropbox_historical.iloc - box_historical.iloc