Can You Make Money From Buying Gold

The price of gold isconstantly fluctuating, so making money off it will depend on the net gain or loss of your investment during a period of time. Apart from selling your gold at a higher price than you bought it, its important to know what taxes will apply to your transaction. Taxes on profits from gold sales are taxed at a maximum of 28%.

As with any tradeable asset, the price of gold is in constant flux. The current 10-year-high sits at $2,067.16, while the 10-year-low stands at $1,049.41 .

In March 2020, the gold price was $1,635.14, while its currently going for $1,732.78 . For current gold prices, you can check pages such as J.M. Bullion or Goldprice.org.

- Categories

Is Now The Time To Buy

That bullish outlook suggests high potential returns ahead. Yet with prices already at multi-year highs, the entry costs are significant, too.

That raises the question of when to buy. However, Albert Cheng, CEO of Singapore Bullion Market Association, said the question should be rephrased from “when” to “how much?”

There is no good time to buy gold … every investor should have some.Albert Cheng

“There is no good time to buy gold,” said Cheng, who said he sees the asset hitting $2,000 per ounce by the end of the year. “Every investor should have some gold in their portfolio.”

Typically, financial advisors recommend a gold allocation of 1% to 5% of an individuals’ overall portfolio. Cheng said that could shift higher from 5% to 15%.

“Gold remains a very small proportion of most people’s portfolio. But even an increase of 1 to 2% can have a massive bearing,” said Refinitiv’s Alexander.

Lady Liberty Gold Round

One of the most affordable ways to get gold is the Lady Liberty round, made of .9999 pure gold in one-tenth troy ounce. They are not legal tender and the goal is to provide the buyer with more gold for the money versus fractional coin bullion. Lady Liberty is featured on the obverse with the image of a descending bald eagle on the reverse.

Read Also: What Season Is Gold Rush On

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

One Can Beat The Rising Inflation By Investing In Incorrect Assets That Give Good Returns Digital Gold Has Become One Of The Mainstream Investment Options Today Alongside Equity Shares And Commodities Here’s Your Detailed Guide On How To Invest In Digital Gold How You Can Buy Online Gold And The Risk

Investing in the right asset is extremely important to ensure that the future in any condition is stable and can help whenever you are in a financial crisis. One of the major concerns of people is rising inflation that affects the working and the economy. Thus investing correctly is important. Among all the various assets of investments, Gold is one of the most famous ones since ancient times, which has time and again managed to give good returns. Nowadays digital gold has become a phenomenon alongside the rising popularity of equity shares, commodities and cryptocurrencies. Here in this article, we take you through a detailed guide on how the term digital gold works, how you can invest in digital gold as well as learn about all the negative and positive points of investing in online gold.

– Sponsored –

Also Check: How To Buy Gold From The Government

Investing In Gold With Jewelry

A lot of first-time gold investors decide to start their investments by buying jewelry. Jewelry is very easy to acquire but can also be very difficult to trade in. You need to ensure that you are getting gold that is at least 14 karats. Most jewelry will also have a pretty high markup due to the fact they are pieces of art not investment items.

Gold jewelry rarely reaches 24 karats because the gold at that point is too soft. You dont want jewelry that will break too easily. When buying jewelry for investing in gold it is often done by looking for some of the most expensive pieces. Besides having a high karat count, you also want it to appear nice.

Investing In Gold Online

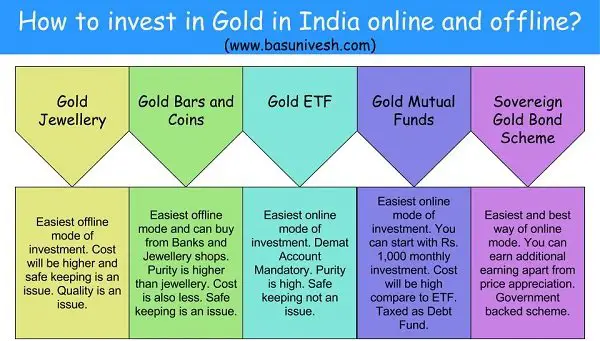

Gold stocks, gold ETFs, gold futures and mutual funds are often the best way to get exposure to gold in your portfolio. The easiest way to buy one of these assets is to open an account at an online broker, which you can easily do with a few clicks on your computer or smartphone. Once your account is up and running, youll need to transfer funds to it before you start picking and choosing among various gold-related assets.

For many tech-savvy investors, owning physical gold is a thing of the past. If you don’t want to buy physical gold and hold gold bars in vaults and safe deposit boxes, your best bet is to open an online brokerage account and buy into gold stocks, gold funds or other gold-related financial instruments.

Also Check: What Is Goodrx Gold Card

You Can Buy Gold But Should You

Despite its age-old allure, gold isnt always the strong investment that movies and TV shows may have led you to believe.

I advise all of my clients to stay away from investing in gold, says Smith. Gold is a speculative investment and has a very poor long-term performance record. For individuals that still move forward on purchasing gold, buying gold in the form of a tradable security is a much easier and cheaper way of incorporating it into a portfolio.

I advise all of my clients to stay away from investing in gold. Gold is a speculative investment and has a very poor long-term performance record.

But while hes clear that he doesnt think investing in gold is a good idea, Smith does acknowledge the draw the physical metal can have. Theres something comforting about being able to touch what you own. You dont get that if you own a part of Johnson & Johnson.

Greg Young, a CFP and founder of Ahead Full Wealth Management in North Kingstown, Rhode Island, agrees. People like gold because its so easy to understand, he says. But anytime someone insists on a specific asset, there is an underlying emotional rationale.

About the author:Alana Benson is one of NerdWallet’s investing writers. She is the author of “Data Personified,””WTF: Where’s the Fraud?” and several young adult titles. She has spoken at multiple fraud conferences, most notably for the FTC.Read more

How To Buy And Keep Gold Coins

If you decide to buy gold coins, get it from a reputable dealer or financial institution. We wouldnt buy gold coins on Craigslist, but thats just us.

If you buy gold coins from individuals or from anyone else youre not sure of, have the gold coins authenticity verified first. You dont want a collection of gold-plated lead.

U.S. gold coins come in one, one-half, one-quarter, and one-tenth ounce denominations. You pay a premium over the price per ounce when you buy gold coins, which is how the dealer makes a profit.

You may pay a higher premium if you buy gold coins less than one ounce each. You should generally buy bullion coins, such as the American Gold Eagle, Canadian Gold Maple Leaf, or South African Krugerrand.

Collectors coins, called numismatic coins, are a different game than bullion gold coins. They can sell at a very high premium, and their prices are dependent on more factors.

Unless you are very knowledgeable about collectors coins, stick with bullion coins.

Once you have the coins, you may be tempted to run the coins through your hands, like Ebenezer Scrooge.

But of course you wont you should leave coins in their cases, away from scratches and fingerprints.

Dont even think of hiding gold in your house, unless you have a safe. Thieves know where to look, or they can find it with a metal detector.

For very little money, you can rent a safe at a bank for your gold and other valuables.

You May Like: What Banks Sell Gold Bars

Spdr Gold Minishares Trust

The SPDR Gold MiniShares Trust ETF provides investors with one of the lowest available expense ratios in the gold ETF market, and is thus very popular among small investors. If you want a low-cost gold ETF for your investment portfolio, the SPDR Gold MiniShares Trust is an excellent pick.

- Assets Under Management: $2.664

- Expense Ratio: 0.18%

How Does Digital Gold Works

One can invest in digital gold through several trustworthy e-wallets such as Paytm, Google Pay, PhonePay or any other options. Brokers such as HDFC Securities, Motilal Oswal and others help the investors to purchase digital gold. Among popular companies that offer digital gold include Augmont Gold Ltd, MMTC-PAMP India Pvt. Ltd, Digital Gold India Pvt/ Ltd with its SafeGold brand. Here below are steps on how you can invest in digital gold.

Recommended Reading: What Are The Different Karats Of Gold

Investing In Gold: Gold Shares Gold Bullion Or Gold In Your Rrspwhich Is Best

At TSI Network, weve long recommended that you stay away from buying gold bullion, coins or certificates representing an interest in bullion. If you are looking at investing in gold for 2021, theres a better way.

Thats because gold investing in bullion does not generate income. Instead, bullion and coins come with a continuing cash drain for management, insurance, storage and so on.

Instead, we recommend that you limit your investing in gold to gold-mining stocks. Unlike bullion, gold-mining stocks at least have the potential to generate income.

|

Discover 5 top stocks you should consider for your portfolio this monthwhen you access the FREE report 5 Long-term Stock Picks to Buy in September right now! |

However, if you do want to hold physical gold or silver in an RRSP, heres how to do it:

The 2005 Canadian federal budget made investment-grade gold and silver coins, as well as gold or silver bullion bars, eligible to be held in an RRSP.

To be considered investment grade, gold coins must be at least 99.5% pure, and silver coins must be at least 99.9% pure. As well, only legal-tender coins produced by the Royal Canadian Mint are RRSP-eligible.

Bullion bars are also eligible for RRSP gold investing, as long as they are produced by a metal refinery that is accredited by the London Bullion Market Association. Accredited metal refineries include the Royal Canadian Mint and Johnson Matthey.

Mistakes you should avoid when investing in gold

What Is A Krugerrand

First minted in 1967, the Krugerrand is a South African coin. The South African Mint produced it to help market gold from South Africa. It was also used as a form of legal tender and as gold bullion. By 1980, it accounted for 90 percent of the gold coin market around the world. Paul Kruger, the President of the South African Republic from 1883 to 1900, is featured on the obverse. The South African unit of currency, or rand, is shown on the reverse of the coin.

Krugerands became politically controversial during the 1970s and 1980s because of the association with an apartheid government. As a result, production of the coins varied, with levels of production increasing since 1998. The Krugerrand weighs 1.0909 troy ounces and is made from 91.67 percent pure gold . As a result, the coin has one troy ounce of gold with the remaining weight in copper. Three sizes have been available since 1980 including ½ oz, ¼ oz, and 1/10 oz. Proof Krugerands are also available for collectors. They differ from bullion coins because the proofs have 220 serrations on the coin’s edge, rather than 160.

Also Check: How Much Is Aaa Gold Membership

Gold Mining Companies & Stocks

Investing in gold mining companies is an interesting way to combine gold investments with traditional stocks. By purchasing shares in a company that works with gold, investors can access the profits of gold without buying or selling it themselves. This form of investing can also provide lower risks, as there are other business factors at play that can help protect investors from flat or declining gold prices. That being said, investors conduct significant research when searching for the right company to invest in. There are risks associated with the mining industry that can interfere with overall profits or even bring up ethical concerns. Always do your research when selecting a gold mining company to invest in.

Use A Trading Strategy

A trading strategy helps traders to analyse the price of gold for any clues on where the market could move next. As there are so many ways to analyse a market, having a list of rules is essential in being disciplined consistently over a period of time. Some of the many ways to analyse the price of gold include:

- Fundamental Analysis. This is the study of economic data and sentiment regarding the gold market. For example, in times of economic uncertainty gold prices tend to rise due to its status as a safe haven asset. Advanced traders will attempt to analyse changing world economics to try and position themselves early on in a potential move higher in the price of gold.

- Technical Analysis. This is the study of price to identify possible entry and exit levels. The study of price generally comes down to using chart patterns, price action and technical trading indicators. This will be demonstrated in more detail in the trading strategy section further down the article.

As we move on to explore the factors that affect the price of gold and how to trade it with Admiral Markets using a simple trading strategy, it may be useful to open your Admiral Markets trading platform to follow through on the trading examples on the price of gold in the next section.

Trade With the MetaTrader 5 Trading Platform

You May Like: Where Can I Melt My Gold Jewelry

Why Invest In Gold

Throughout history, gold has been considered valuable. It has been used as money since 600 BC. Until the abolishment of the Gold Standard in 1971, even the US dollar was backed by gold held in vaults.

Today, gold no longer backs sovereign currencies. Instead, the precious metal is used in the creation of jewelry and electronics, and has industrial applications. Additionally, gold has emerged as an attractive alternative investment.

The desire for gold is the most universal and deeply rooted commercial instinct of the human race. Gerald M. Loeb, Wall Street Veteran and founder of brokerage firm E. F. Hutton & Co

There are five main reasons why investors add gold to their investment portfolios:

Gold is widely considered as a safe haven asset during times of economic turmoil. Whether there is a significant economic crisis, the price of gold has the tendency to rally as more and more investors are moving their money to safety.

Additionally, investors also like to place funds in gold as a hedge against inflation. When investors fear that the inflation rate may increase, gold is a popular alternative to the dollar. It is a hard asset whose price cannot be easily diluted by government policy actions.

How To Buy Gold In 2021

There are two main ways for people to invest in gold. They can purchase physical gold in the form of bullion bars, coins, and jewelry. Alternatively, they can invest in financial instruments: whether by purchasing shares of mutual or exchange-traded funds or by trading futures and options.

Our guide on how to purchase gold in 2021 will help you understand your different purchase options and what to look out for when investing.

You May Like: Where Do They Sell Gold

How Well Does Gold Hold Its Value In A Downturn

The answer depends partly on how you invest in gold, but a quick look at gold prices relative to stock prices during the bear market of the 2007-2009 recession provides a telling example.

Between Nov. 30, 2007, and June 1, 2009, the S& P 500 index fell 36%. The price of gold, on the other hand, rose 25%. This is the most recent example of a material and prolonged stock downturn, but it’s also a particularly dramatic one because, at the time, there were very real concerns about the viability of the global financial system.

When capital markets are in turmoil, gold often performs relatively well as investors seek out safe-haven investments.