When Is The Gold Price Fixing

Irrespective of Gazetted Holidays and Weekend , the gold price is being changed at each instance of time, e.g., each second of a business day. The gold price is fixed twice every business day, that is, at 10:30 am and 3 pm, by the London Gold Market Fixing Ltd at London time, in the US dollar , the Pound sterling , and the Euro .

What Is The Gold To Silver Price Ratio

The gold to silver ratio involves simple mathematical principles. It shows you how many kilograms or ounces of silver it would take to buy a single ounce of gold. If this ratio is at 50 to 1, it means that 50 ounces of silver would be required to obtain one ounce of gold.

This ratio is used by investors to decide if one of the metals is overvalued or undervalued and if it is a good time to sell or buy a particular metal.

A higher ratio means that silver is more favored. On the other hand, a lower ratio shows the exact opposite and usually means that now would be the best time to buy gold.

What Is Spot Gold

The spot gold price refers to the price of gold for immediate delivery. Transactions for bullion coins are almost always priced using the spot price as a basis. The spot gold market is trading very close to 24 hours a day as there is almost always a location somewhere in the world that is actively taking orders for gold transactions. New York, London, Sydney, Hong Kong, Tokyo, and Zurich are where most of the trading activity takes place. Whenever bullion dealers in any of these cities are active, we indicate this on our website with the message Spot Market is Open. For the high and low values, we are showing the lowest bid and the highest ask of the day.

Also Check: Golden Eagle Rdr2

Numismatic Value And Gold Price Premiums

Numismatic value refers to certain beneficial features of a gold coin that increase its price. These include rarity, scarcity, artistic merit, age, condition, and so forth. Its up to you as an investor to decide if numismatic value is something to focus on or not. While the upfront prices are higher for gold with numismatic value, due to its rarity investors can be sure numismatic gold coins will bring a strong return on investment, yielding a high sale price no matter how volatile the market is.

To estimate numismatic value, take the total gold price of a numismatic 1oz coin and subtract the live gold spot price, fabrication costs, distribution fees and dealer mark-up. What remains is the current approximate numismatic value of the gold coin. While these numbers are sometimes hard to predict, doing the math before buying or selling your gold bullion will give you a more accurate estimate of what prices you will pay for your gold, and of what your ROI will look like.

Many collectors of numismatic gold bullion coins prefer to diversify their coin holdings with minted gold coins from around the world. The most reputable numismatic gold coins many collectors prefer consist of: Canadian gold coins, American gold eagles, Australian gold coins, Chinese gold pandas, British gold coins& African gold coins.

The Troy Ounce Vs The Avoirdupois Standard Ounce

Gold prices are always measured in troy ounces. A single troy ounce is one-tenth heavier than the traditional avoirdupois ounce and has been set internationally as the standard upon which gold prices are measured. Some investment websites will measure gold by the gram or in kilos, as well as ounces. As global markets trade gold & other precious metals in troy ounces, it is advisable to always calculate your gold bullion investments in troy ounces.

When assessing multiple pounds of gold, keep in mind that one pound of gold works out to be 12 troy ounces. If you prefer measuring gold in grams, consider that a single troy ounce of gold works out to be 31.1035 grams.

Recommended Reading: Does Golden Goose Fit True To Size

What Is Gold Jewelry

Jewelry made of gold can be combined with other precious elements and gems to enhance its appearance and value. The value of jewelry depends on gold purity and mass, worth of gem used, and artistic work used to build it. Jewelry is used to be worn, and as an investment, e.g., 22k gold is the famous and 91% pure gold.

What’s The Price Of Gold

You may also manipulate the graph by choosing a specific range of time located at the top of the graph. You can switch to silver prices by clicking the button at the top left.

This chart updates every 10 seconds . You may always refer to this page to find the current price of gold at any given time.

Don’t Miss: Kitco Current Gold Price

Classification Of Gold As A Precious Metal

Rare metals have higher economic potential than common metals. Of the five precious metals, gold has the largest market. Some investors refer to gold as a monetary metal because of its use throughout the history as a form of currency. Gold as an asset has a high store of value because it maintains its value without degrading. The yellow metal is also used in industrial units because of its desirable properties such as being a good conductor, malleability, and resistance to corrosion.

Why Is There A Difference Between The Prices Of Gold And Silver

The primary reason behind the large discrepancy in the value of gold and silver is due to their rarities. The usual market principles such as supply and demand play a pivotal role in determining the value of gold. Since gold is low in supply, it is also much harder to obtain than other metals.

Silver is much larger in supply and is easier to mine. In fact, silver is often obtained as a by-product of other metals during mining. Silver can be obtained at a rate of 0.07 parts per million. In contrast, the average occurrence rate of gold is 0.004 parts per million.

Don’t Miss: How To Get Free Golden Eagles In War Thunder

Where To Track Daily Gold Prices

We provide an excellent gold price resource to help you track live gold prices today. Our real-time gold price updates mean that you will not miss your target in the volatile and exciting world of gold trading a world in which the gold price can fluctuate quite broadly over a 24-hour period. Take advantage of our interactive graph that provides gold price information over the past few decades. Once you understand the historical trajectory of the price of gold it will become much easier to make an informed gold purchase. Monitor the live gold price today and stay on top of your gold bullion investments.

Is The Live Gold Price Just For Canada

Gold is traded all over the globe, and is most often transacted in U.S Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the Canada or Asia.

Recommended Reading: Current Price Of 18k Gold Per Gram

Understanding The Difference Between One Ounce And One Troy Ounce

Troy ounce has been used historically by the Roman Empire to weigh and set prices for precious metals. Back then, all currencies were valued in terms of their equivalent weight in gold . This process was later borrowed by the British Empire which tied one pound sterling to one troy pound weight in silver.

The US also used the troy ounce system in 1828. A troy ounce is bulkier than one imperial pounce by about 10 percent. A troy ounce is equivalent to 31.1 grams in weight, while an imperial ounce is equal to 28.35 grams.

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Don’t Miss: Weight Of Brick Of Gold

Importance Of Spot Gold Price

Just like in any other form of investing, future ROI gained is set upon purchase. Tracking the live spot gold price should be the most important variable in your decision to invest. When purchasing any gold bullion investment, just like in all other forms of investing, buy your gold as low as possible and sell in waves near the peak.

Is Italian Gold Good

regardless of wherever its made, there is a universal scale in measuring gold and the quality doesnt compromise to it italian gold is good and often costly at some part of the world not only due to its craftmanship but also their design their designs are often fancy/fashionable/trendy unlike other gold jewelry that have more traditional designs i.e. alphabet character, gods and goddesses symbol or calligraphic designs

Also Check: How To Get Free Golden Eagles In War Thunder

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

Gold Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The gold price in CAD is updated every minute. The data comes from the gold price in US Dollars converted at the exchange rate of the USD/CAD pair.

Don’t Miss: Golden Eagles Free

What Are The Essential Terms To Understand The Gold Trade

Bid Price: Current market spot price at which one can sell gold.Ask Price: It is the current spot gold price of 24k gold at which investors can buy it.Spot Price: it is calculated using the recent average of bid price and asks price.Gold Price Fixing: It is carried out by the London Gold Market Fixing Ltd. It is also a benchmark for pricing the gold and its products.

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Recommended Reading: How Much Is 400 Ounces Of Gold Worth

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

Read Also: How Much Does A Gold Bar Weigh Lbs

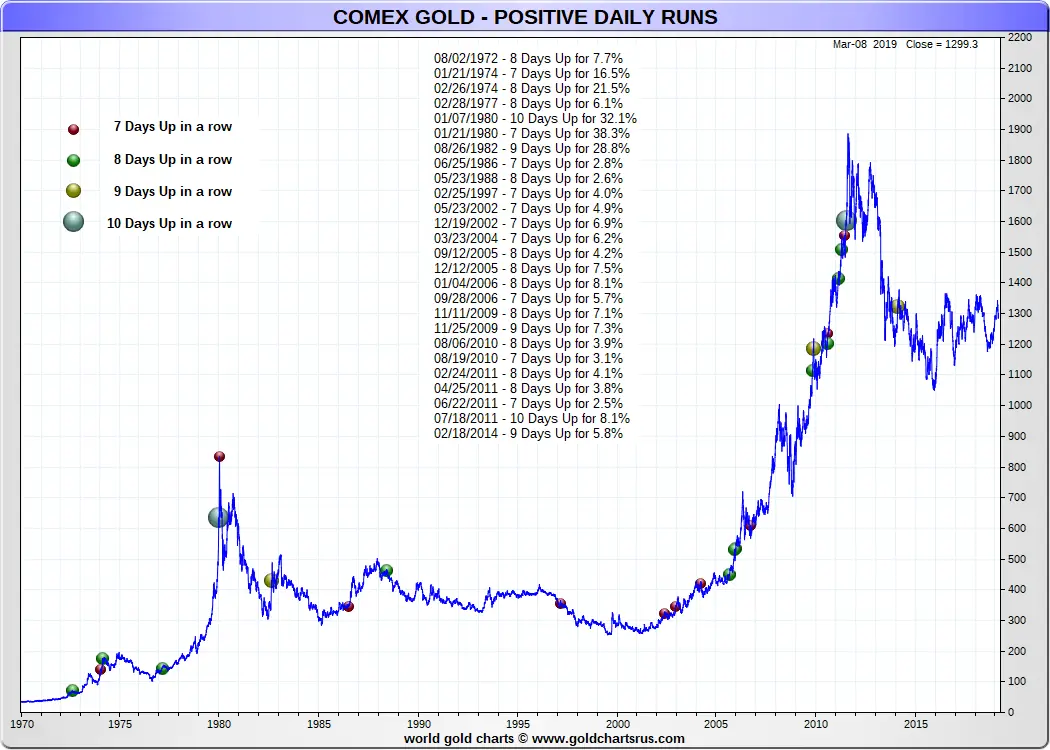

Why Look At Historical Gold Prices

Looking at historical gold prices may potentially provide information that may assist in buying or selling decisions. Looking at the big picture, gold trended higher for many years before making all-time highs in 2011 of nearly $2000 per ounce. Gold has since been moving lower, but could have possibly found a bottom in 2016. Although it remains to be seen, golds declines from the 2011 highs could simply prove to be a pullback within an even longer-term uptrend.

Examining historical gold prices can potentially be useful in trying to identify potential areas of price support to buy at. For example, if gold has pulled back to $1200 per ounce on numerous occasions but is met with heavy buying interest each time, then the $1200 area could be considered a level of support and could potentially be a good area to try to buy at.

In addition to viewing historical gold price charts in U.S. Dollars, you can also view historical gold prices in numerous alternative currencies such as British Pounds, Euros or Swiss Francs. You can even view a historical inflation-adjusted gold price chart using the 1980 CPI formula.

For easy reference, this page also contains a simple table that provides golds price change and percentage change using a single day, 30 day, six month, one year, five year and 16 year timeframes.

What Is The Average Price Of Gold Per Ounce

As of 2019, for example, Canadian company Barrick Gold reported an average realized gold price of 1,396 dollars per ounce. Gold is a metal that is considered malleable, ductile, and is known for its bright lustrous yellow color. This transition metal is highly valued as a precious metal for its use in coins, jewelry, and in investments.

You May Like: What’s The Price Of 18 Karat Gold

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Don’t Miss: Buy Gold In Dubai

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

Is Gold Always Traded 24/7 If Not Is There A Set Open And Close

Trading for gold takes place Sunday through Friday, 23 hours a day. It is common for OTC markets to overlap. No market actively trades between 5 PM and 6 PM ET. Because of the presence of OTC markets, there are no closing or opening prices for spot gold.

For large scale transactions, most gold traders will utilize the benchmark price from specific periods during the trading day.

Read Also: How To Get Free Golden Eagles In War Thunder