What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

How Tons Of Gold Flow Through The Gold Bullion Market

Since beginning in 1987, the London Gold Bullion Association has taken the position as the world’s dominant physical gold bullion settlement organization.

This situation or trend will likely remain so until the eastern world wrestles away gold price discovery power.

The ongoing disconnect from representative gold derivative traders and physical gold flows is a real phenomenon. Many of the individuals involved in day-to-day trading representing massive gold tonnage have often never even touched a Good Delivery 400 oz Gold Bar throughout their entire working career.

As well, since the LBMA established its dominance in the physical gold ton game, the daily west vs. east compounding daily gold price discovery leaves doubt. Much of what is perceived as gold price discovery has likely meant a more sophisticated western gold fiat price containment over the last three decades or longer. Similar to the attempt made to contain the gold price after World War 2 through the late 1960s with the country conspiring price rigging London Gold Pool.

Policies Of Central Banks

Central banks the world over implement policies that will either impact gold pricing positively or negatively. Below are some of them.

Change in Interest Rates

Central banks such as the Federal Reserve and many others can at times increase interest rates in an attempt to curb inflation. When interest rates increase, commercial banks will borrow less from the Federal Reserve and thus will not have a lot to lend to the general public. This will reduce money supply in the economy and decrease interest rates on investments such as treasury bonds, thereby encouraging investors to buy gold with a favorable opportunity cost. If the government decreases interest rates, the contrary will be the outcome.

Quantitative Easing

In QE, the Federal Reserve tries to increase the money held by commercial banks by buying securities. Thus, commercial banks will have more to lend to customers and the result will be an increase in money supply to the public. This will drive down interest rates, which will increase demand for gold as an alternative investment therefore leading to an increase in gold bar prices.

Gold Reserves

Ever wondered why central banks the world over hold reserves of gold? Well, they hold gold as a backup to printed currency. When central banks such as the Federal Reserve buy gold in large quantities for the reserves, they increase money supply while diminishing the quantities of gold available in the market. This will drive gold prices up.

Don’t Miss: Is Dial Gold Body Wash Antibacterial

Whats The Price Of Gold Per Ounce

The price of Gold can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Gold per ounce, they are referring to the spot price. The spot price of Gold is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Gold per ounce.

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Don’t Miss: What Is Goodrx Gold Card

Global Value Of Gold Per Ounce

Gold: used as money for centuries

Gold has been considered as the most popular and the most valued precious metal globally. For centuries it was used as a monetary vehicle. It was also the determinant of wealth of a country.

It was once the standard of value for currencies all over the world. Now that this is no longer the case — most notably marked by President Nixon taking the USA off the gold standard in 1971 — investing in gold has become more important than ever.

The price of gold is usually stated in a currency value, usually in US dollars per troy ounce.

What Is A Ton Of Gold Worth

A rough calculation can be executed using a simple live gold spot feed and a simple calculator, smartphone, or search engine.

The equation for ‘How Much is a Gold Ton Worth’ is as follows:

32,150.7 oz X live Gold Spot price = A whole lot of continually debasing fiat currency.

At the moment of writing this blog post:

Read Also: Gold Teeth Dentist In New Orleans

Solid Pure 24k Gold Amounts

This calculator tool is based on the pure 24K gold, with Density: 19.282 g/cm3 calculated Gold can be found listed either in table among noble metals or with precious metals. Is it possible to manage numerous calculations for how heavy are other gold volumes all on one page? Yes, all in one Au multiunit calculator makes it possible managing just that.

Convert gold measuring units between ounce and grams of gold but in the other direction from grams into troy ounces.

| conversion result for gold: |

| g |

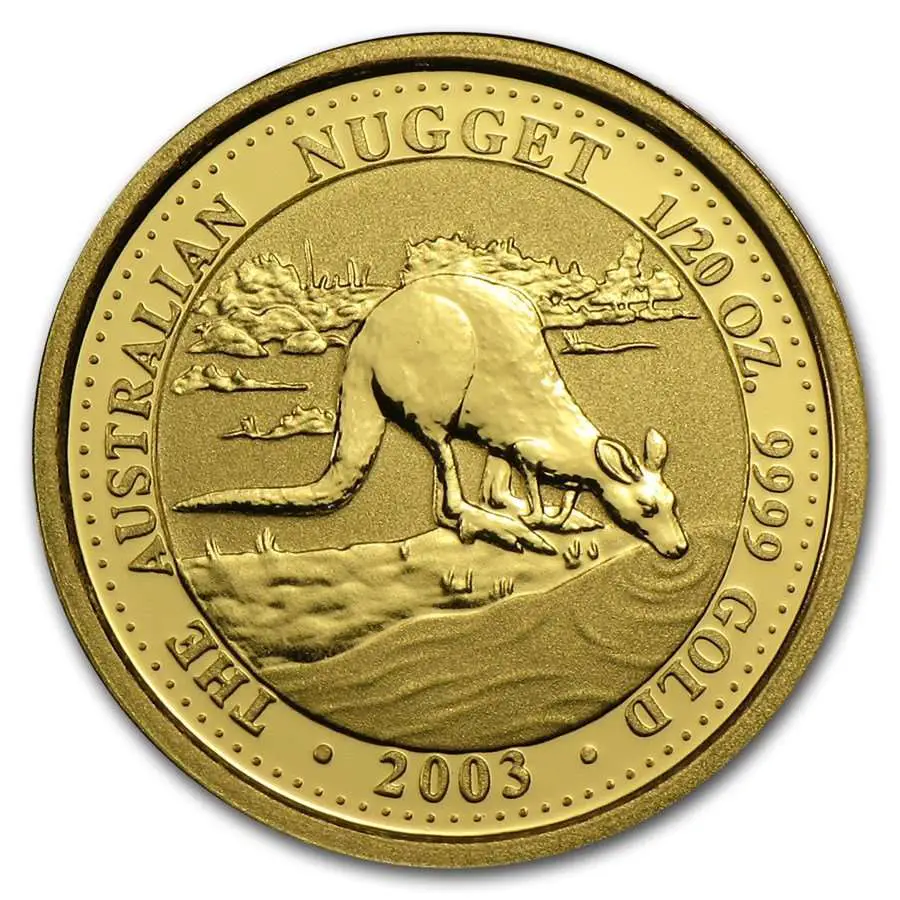

South African 1/20 Oz Gold Krugerrand

South Africa decided to celebrate the 50th anniversary of Gold Krugerrands, by issuing 1/20 oz. coins for the first time in 2017. They were struck at the South African Mint in 22-karat gold, but only 2,000 of them were made, so they are relatively scarce.

The obverse depicts the image of South Africas first president, Paul Kruger, along with the inscriptions that read South Africa in English and Afrikaans.

The reverse features South Africas national animal, the Springbok antelope. The coins gold weight and year of minting are also displayed here.

Recommended Reading: Does Game Pass Ultimate Include Gold

Other Applications Of This Gold Calculator Are

With the above mentioned units calculating service it provides, this gold converter proved to be useful also as a teaching tool: 1. in practicing troy ounces and grams exchange. 2. for conversion factors training exercises with converting mass/weights units vs. liquid/fluid volume units measures. 3. work with gold’s density values including other physical properties this metal has.

International unit symbols for these two gold measurements are:

Abbreviation or prefix , unit symbol, for ounce is: oz tAbbreviation or prefix brevis – short unit symbol for gram is: g

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

You May Like: Rdr2 Where To Sell Gold

Canadian 1/20 Oz Gold Maple Leaf

The Maple Leaf from Canada is another widely traded bullion coin series. Since the Royal Canadian Mint issued the first one in 1979, these coins have been grabbing the attention of investors and coin collectors worldwide.

Unlike the Kangaroo, the 1/20 oz Canadian Gold Maple Leafs comes in just one design. The reverse features the iconic Canadian maple leaf, along with inscriptions that read Canada,1/20 oz Or Pur, and 9999, signifying the 99.99% purity of these coins.

The obverse shows the profile of Queen Elizabeth II, along with the coins face value and the production year.

The Canadian government guarantees the quality and purity of these coins, and the good thing about them is that they can be added to your IRA, in addition to your general investment portfolio.

Money Metals Exchange offers the 1/20 oz Gold Maple Leaf coins from the Royal Canadian Mint. Guaranteed by the Government of Canada, Canadian Gold Maple Leaf coins have become some of the most recognizable and desirable bullion coins in the world today. So if you’re looking to buy gold online, the 1/20 oz among the smallest and most affordable sizes available. This one twentieth-ounce gold bullion coin is beautifully struck with a gold purity of .9999 .

The Canadian Maple Leaf is one of the purest gold coins on the market. The 1/20 oz is one of four different sized fractional gold coinsMoney Metals sells in the Canadian Maple Leaf.

ABOUT THE DESIGN

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

Don’t Miss: How Much Is One Brick Of Gold

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

How Much Is 20 Ounces Of Gold Worth

troy

| 20 Troy Ounces of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Recommended Reading: Is Frasier Sterling Real Gold

How Much Is A Ton Of Gold Worth

If you pay attention to physical gold flows and increased government gold bullion buying figures, you will often hear and or see the term gold ton or gold tonne used.

When referring to precious physical metals, a ton refers to a metric tonne. For .999 fine physical gold bullion or any other precious metal, a metric tonne is exactly 32,150.7 troy ounces of gold or other precious metal.

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

Recommended Reading: Can You Use Dial Gold Bar Soap On A Tattoo

Calculation : Gold Buyers

This calculation determines how the price compares relative to the value of gold metal from calculation 1.

This calculation is useful for people buying gold. In general, how far the price deviates from the gold metal value determines if it is cheap or expensive.

| Price |

|---|

| Step 1: Calculate gold metal value |

|---|

| Gold metal value = Price ÷ Value of gold metal × 100= 0 ÷ 0 × 100= 0 % |

Estimates Are Currently 190000 Tons Of Gold Exist Above Ground

Government central banks own only about 1/5th of the above-ground gold bullion supply. Another 1/5th is spread out amongst private investors in various coin and smaller gold bar size formats.

The vast majority, or around half of all physical gold above ground gets held in gold jewelry form, most of which resides in the eastern world .

Total notional gold derivative contract trading volumes around the world every year dwarf the entire physical supply of gold in the world. In other words, ‘bets on the fiat spot price actions of gold,’ are many multiples more than the actual value of physical gold owned by human beings.

This is only one primary reason why when you buy physical gold bullion in any format you will have to typically pay some price premium above the fluctuating gold spot price.

^ If this illustration does not make sense to you, perhaps learn more about how the gold market works ^

Read Also: Phisohex Soap Walgreens

What Are The Factors That Affect The Gold Price

- 1. Demand and supply of Gold

- 2. Speculations

- Technology: 11%

- Unaccounted: 2%

They are available in markets. Bullion bars and coins are mostly used for investment of money, and jewelry is used to be worn, and it was used as an investment in the old-time, still, in some countries, it is used for investment.

How Much Does A Gold Bar Weigh

These heavy gold bricks are comprised of 400 troy ounces of pure 24k gold . A troy ounce is the industry standard for weighing and pricing precious metals, based on the ancient unit of weight developed by the Romans.

A troy ounce is 1.09714 standard ounces.

That means, 400 troy oz gold bars weigh around 27 pounds or 12.4 kilograms each about the same weight as a dumbbell.

Recommended Reading: Where To Sell Valuables Rdr2

How Much Is A Gold Bar Worth In 2021

When trying to determine the price of a gold bar, most people simply look at the gold price charts and make an estimation based on the gold bars weight.

This is a very inaccurate approach to determining how much a gold bar is worth since many factors come into play. The weight of the bar is important but it is not the only factor that determines the bars overall price as well see below.

To know the actual worth of a gold bar, you need to also factor in the manufacturing, handling, storage and insurance costs as these will be passed on to the investor as premiums.

This means that before undertaking any gold investment adventure, you need to conduct a thorough research and get all the facts right to avoid making grave investment decisions.

One advantage of gold bars is that they are manufactured by licensed, reputable entities hence chances of running into risk are minimal.

Attention: Is Your Business or Personal Assets Protected from This 2021 US Dollar Financial Falling Value Crisis? Request Your FREE 2021 Investors kit to learn more .Minimum Investment: $25,000 .

Dangers Of Fiat Currency

Fiat currency denoted in the paper bills we use today is only worth as much as the government printing it can guarantee it for. Its worth is subject to many risks and uncertainties. Physical gold does not have the same ambiguity attached to it. It is a commodity with intrinsic value that has stood the test of time against currencies that have risen and fallen.If todays currencies collapsed under the strain of government spending and borrowing, war, and further economic meltdowns, gold would be a safe haven: universally valued, a trade-able commodity, and a benchmark of wealth.

Don’t Miss: Permanent Gold Teeth New Orleans

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?