Q: How Big Is A Gold Bar

A: Gold bars may look big in pictures, but theyre relatively small in size. Heres a rundown:

- A 1-oz. gold bar from the Perth Mint is about 0.95 inches wide, 1.65 inches long, and 0.08 inches thick.

- A 10-oz. gold bar from the Perth Mint is about 1.46 inches long, 2.28 inches long, and 0.35 inches thick.

- A 1-kilo gold bar from the Perth Mint is about 1.58 inches wide, 3.15 inches long, and 0.71 inches thick.

- The standard gold bar, the type youd find at Fort Knox, is about 7 inches wide, 3.63 inches long, and 1.75 inches thick.

Here’s What Some Of Our Clients Have To Say

TOM R.

Enjoyed every step of the process and all that I worked with were very helpful and professional. Will continue to do my business with Oxford Gold Group.

PATRICK

Very helpful. I appreciated working with this group and would recommend. My next purchase, I will for sure use them.

JODYE W.

From the start to finish I had nothing but excellent and professional service with Patrick and Johnathan. Both were knowledgeable, thank you both.

DENNIS C.

I am new at this buying metals and got some nice coins to start. Got alot of good information and sale was pleasant. Will be buying again soon.

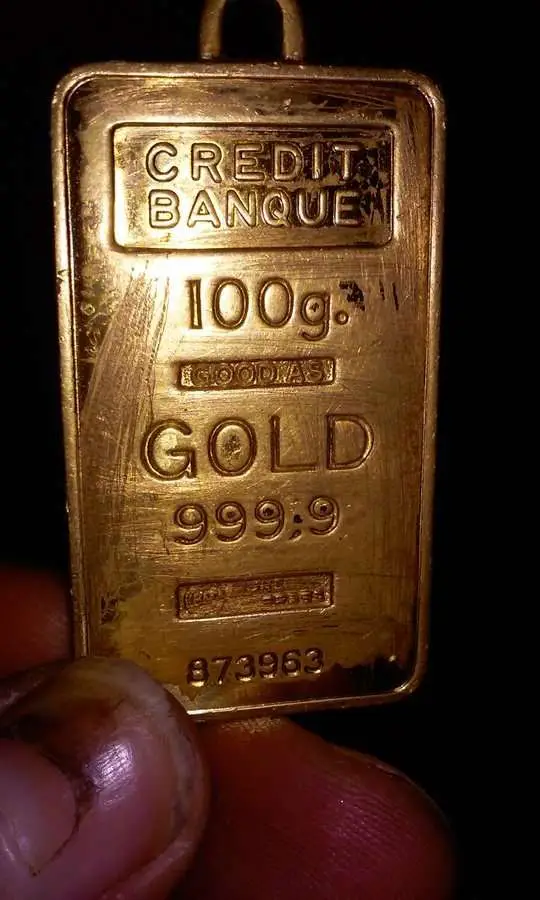

Beware Today Counterfeit Gold Is Everywhere

Gold might have a stamp with a particular purity mark, but it isn’t always an accurate certification of its actual gold content. Some gold products of low quality have a false higher fineness marking. On top of this, there are gold-plated fakes filled with different metals underneath the plating. Other times, you might have an unmarked piece of gold. To understand its actual value, you need to authenticate it.

These factors are why its crucial for you to know how to tell if your gold is real. It will help you protect your investments, accurately appraise your belongings, and make sure you get the exact gold you are paying for.

This guide was created to provide you with all the necessary information about carrying out different tests before or after purchasing your gold bullion. You might be asking how do I test gold at home or with a professional? Or, you may be asking how to tell if gold is real. There are many tests for gold, some of which you can do yourself at home!

Through this guide by Bullion Exchanges, you will learn how to avoid buying counterfeit gold products by following some simple steps. But before proceeding to specific gold testing stages, lets review its history and key properties.

Don’t Miss: What Is Vermeil Gold Plated

Question : Do You Have To Pay Taxes When You Buy Gold

In his book “How to Buy and Sell Gold and Silver Privately,” internet marketer and business coach Doyle Shuler explains many of the complexities surrounding taxation and buying gold. Some states apply sales tax for gold bullion, and others do not.

Some gold buyers are critical of the U.S. government and therefore do not want their gold purchase to be noted by the IRS. According to Shuler, simply paying cash isnt enough to keep you off the grid.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Is The Difference Between Gold And Silver Tequila

Tips To Avoid Gold Scams

Even though it is relatively easy to find and buy precious metal, there are some risks to consider. Avoid Craigslist, online dealers offering massive discounts, pawnshops, TV ads, cold callers and any dealer without a brick-and-mortar location, since there is no way of verifying that the dealer actually exists. Dealers that offer free storage or delayed delivery might not be legitimate, and you may never see the gold that you paid for.

Don’t give in to the pressure of late-night telemarketers insisting you call them immediately for a limited-time discounted rate on gold. Take your time to find a reputable dealer.

Don’t give in to the pressure of late-night telemarketers insisting you call them immediately for a limited-time discounted rate on gold. Take your time to find a reputable dealer.

| Label |

|---|

| Get Started |

Australian Gold Coins: Perth Mint Bullion

The Perth Mint produces a bullion coin called the Australian Gold Nugget. It is part of the Gold Nugget series introduced in 1986. From 1986 to 1989, the reverse of the coin depicted a variety of Australian gold nuggets. In 1989, the design started to feature kangaroos, the internationally recognized symbol of Australia. These coins are used as both legal tender and bullion coins.

Each year brings a new design of this 24 karat coin, which means the numismatic value of certain coins may actually exceed the value of the gold they contain. They are minted in denominations that include 1/20 oz, 1/10 oz, ¼ oz, 1 ounce, 2 ounce, 10 ounces and 1 kilogram. The Perth Mint even created a one tonne coin in 2011 with a face value of $1 million! This creation broke the record for the largest and most valuable gold coin ever. There are also Australian Gold Lunar bullion coins, with .9999 purity, that feature animals from the Chinese calendar rather than the traditional kangaroo.

You May Like: When Does Gold Rush Start

Caveats To Buying Physical Gold

Know where your gold is coming from

Gold mining can leave a significant toll on the environment, to say nothing of social, human rights and governance issues, as many gold mines are located in conflict-affected or otherwise high-risk areas.

In 2019, the World Gold Council took steps to implement guidelines for member companies, as did the International Council on Mining and Metals. Both require that participating mining companies publish information on their progress publicly, making it easier for consumers to find.

If youre buying gold bullion rounds or bars, its best practice to look for pieces stamped with information about the maker, weight, and purity of the gold.

When purchasing gold jewelry, some retailers are taking additional transparency measures similar to those implemented against so-called blood diamonds from conflict areas. Theyre often sold under the tags ethical or sustainable.

Understand the fees involved with physical gold

Buying physical gold entails a number of different costs that you wont find when investing in financial instruments. These include the storage fees in a bank deposit box or precious metals depository, insurance costs, transportation and delivery costs, transaction fees whose percentage is based on the value of the trade, and even fabrication fees. Gold dealers may also impose buy-back fees on any transaction. Small purchases may also involve processing fees and small lot fees.

Confirm the purity of your precious metals

Where Can I Buy Gold Wholesale Where To Buy Gold Wholesale

You can acquire gold bullion at wholesale prices from the largest high volume gold bullion dealers like ourselves here at SD Bullion.

Again to achieve your lowest price point over the gold spot you will want to buy in high volumes and typically in the popular gold bullion products, we carry which have vast and robust secondary markets, not merely here in the USA but around the physical gold bullion trading world.

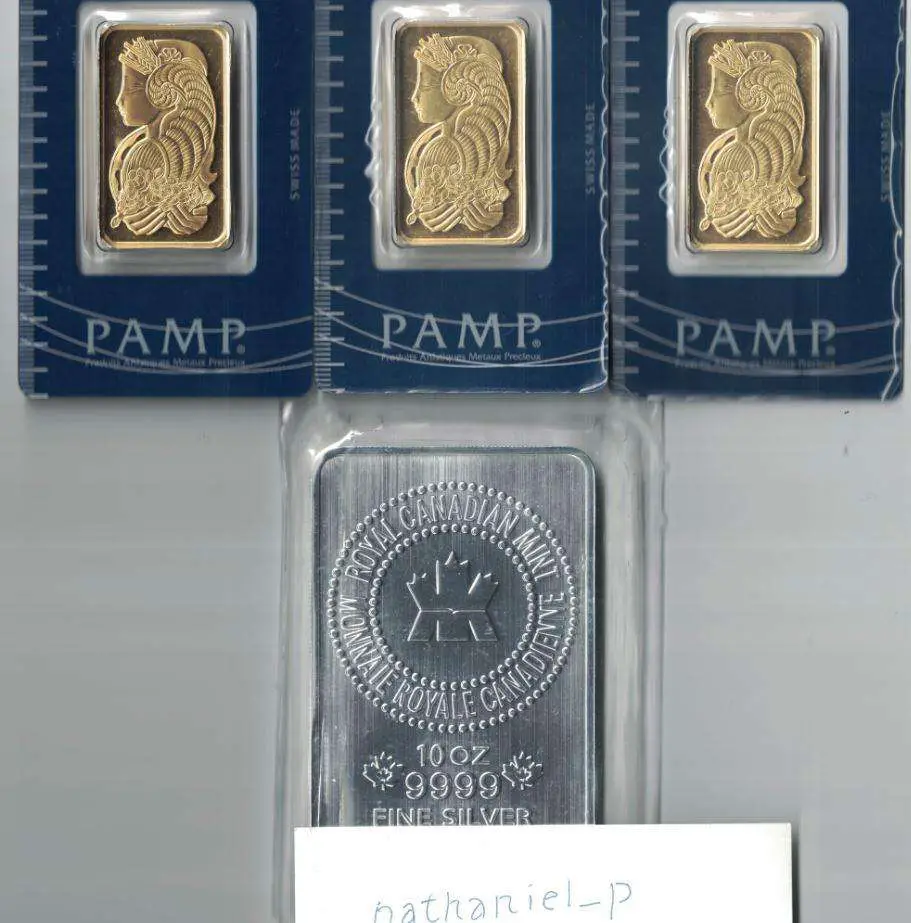

For example, the 400 oz gold bars pictured below are cast in Switzerland. Likely they represent the lowest gold price one can acquire over gold’s fluctuating spot price for those parties thinking of allocating high seven to eight dollar figures into gold bullion.

Two PAMP Suisse 400 oz Gold Bars pictured above

The 400 oz gold bars pictured above are typically the size gold bars used by governments and their central banks, as well high net worth investors and financial institutions.

Just two of these gold bars represent over one million US dollars in value currently.

The two gold kilo bars pictured below are cast in the USA and Canada respectively.

Likely they represent the next level lowest gold price one can acquire over spot for those parties thinking of allocating large dollar figures into gold bullion. Gold kilo bars are becoming the new standard for eastern central bank and gold futures market trading .

Recommended Reading: How To Get Free Tinder Gold

Why Should You Buy Gold

Buying gold is a way you can diversify the types of investments that you hold. By diversifying, you are protecting yourself against the possibility that all of your assets will lose value.

Gold in particular is thought of as a safe kind of asset. Since gold has had value in some form for millennia, people generally are confident that it will continue to have value. If you are less confident in, say, paper currency or the stock market, then you may be interested in the safety of gold. Another plus with gold is you can expect little to no effect from inflation. Because the process of finding and extracting gold is long, its almost impossible for the supply to fluctuate in the short term.

An important thing to remember about gold is that it wont earn you any kind of lucrative return or interest. The price of gold moves up and down like any asset, but you shouldnt invest in gold with idea that your money will be earning lots more value. Gold should be one portion of your portfolio, not the whole thing.

Evaluate The Quality Of Your Gold

Not all that glitters is gold…literally!

Just because your jewelry looks like it is made of gold doesnt mean it actually is. There are very few exquisite pieces of gold jewelry that are made of 24-karat solid gold . But there are what we call gold filled and gold plated jewelry and you need to know the difference if you want to buy gold.

Gold filled jewelry is, as the term implies, filled with gold.

As we have already mentioned above, the metallic mixture we call an alloy is made up of gold and other metals combined to create a tougher metal.

Shoppers generally prefer gold alloys over gold-plated jewelry for various reasons:

- This is the second most valuable type of golden jewelry next to pure 24-karat gold.

- They do not tarnish, fade, chip or change color overtime apart from the occasional need for cleaning – they are even considered lifetime products because they do not wear out.

- In some countries, the government regulates the trading of gold-filled jewelry which means that your investment is well-protected.

Gold plated on the other hand are made of non-gold base metals that are then dipped into molten gold to create a golden coat on the surface. This is a budget friendly alternative to gold-filled jewelry because:

- The plating is usually very thin and will wear off easily.

- The sale of gold-plated jewelry is loosely if not at all regulated.

- They are readily available on the market.

Don’t Miss: How Do You Buy Stock In Gold

Know The Difference Between Bars And Coins

While all forms of pure gold have significant monetary value, not all investment-quality gold is equal. From an investment perspective, investors wanting to add the physical product that tracks the price of gold may wish to avoid gold coins. These coins often feature attractive designs, have historic value, and contain a lower quantity of gold, but still, cost more due to their numismatic value.

In addition to costing more, gold coins sometimes skew the value of an investors portfolio. For example, the highly regarded American Eagle coin produced by the U.S. Mint contains 91.67% gold but costs more than plain gold bars because of its value as a collectors piece. Some investors may want collector’s items, while others may want plain gold bars, which typically are the easiest to hold long term and convert to cash.

Gold Bullion Bar Refineries/mints

The primary benefits to gold bullion bars for gold buyers are diversity and affordability. Gold bullion bars have lower premiums over the spot price of gold when compared to gold bullion coins, and the variety of options is far more diverse. Gold bullion bars are available not only in the aforementioned weights, but also styles including cast, hand-poured, and minted ingots. Gold bullion bars are struck continuously to meet the demand for gold, with the following refineries and mints representing some of the greatest refiners of gold bars:

Recommended Reading: Where Is Gold Going From Here

Thinking Of Investing In Physical Gold Consider The Pros And Cons First

Pros

- Protect your wealth. Gold has long been seen as a reliable store of value that is largely unaffected by the factors that influence other investments. For example, when share prices plummet, the price of gold usually rises as investors look for somewhere safe to park their money.

- Diversify your portfolio. Golds safe haven status also makes it well worth considering if youre looking to diversify your investment portfolio and protect your overall financial position during periods of market downturn.

- Easy to buy. There are many dealers who specialize in buying and selling gold, so getting your hands on this precious metal may be easier than you think.

- Its a tangible asset. If global financial systems were to somehow collapse, such as what happened during the Great Depression, owning gold as a physical asset offers financial protection. Gold also cant be destroyed by fire or water damage and wont corrode over time.

- Liquid. Gold is fairly easy to convert to cash whenever you need to do so. However, it can be easier to sell a gold stock or ETF than it is to sell a bar of gold.

Cons

Factors To Consider When Buying Physical Gold

If you decide to buy physical gold, youll want to keep a few things in mind:

- Storage: Physical gold requires a secure storage location. While you can certainly keep your gold at home, many investors prefer a custodian. Make sure you research secure options for storing your gold before you buy it, and keep in mind that safe storage adds costs to your gold investment.

- Insurance: If you decide to store your gold at home, you should insure your gold to protect yourself against theft or natural disaster. This can add to the cost of your homeowners or renters insurance. And even if you dont keep your gold at home, youll want to check in on your storage providers insurance policy to determine how its protecting your investment.

- Manufacturer: Because youre making an investment, youll want to make sure youre buying from reputable sources that will help your purchases value grow over time. When buying gold, look for respected producers like Credit Suisse, the Perth Mint and the Royal Canadian Mint.

- Purity: The gold content in the coin, bar or piece of jewelry has a big impact on its value and worth as an investment tool. Ensure any gold you purchase as an investment has the purity level to help it stand the test of time. That means youre probably targeting gold items that are at least 91%, if not 99%, pure.

Recommended Reading: How Much Is 500 Grams Of Gold Worth

American Gold Eagle: The Official Us Coin

The official gold bullion coin of the United States is the American Gold Eagle. In 1986, the U.S. Mint first released eagles in accordance with the Gold Bullion Act of 1985. Often the weight is used to describe these coins because the term eagle was the U.S. designation for ten dollar gold coins distributed prior to 1933. Lady Liberty appears on the obverse of the coin. The reverse features an eagle carrying an olive branch. He is flying over a nest with a female eagle accompanied by hatchlings. The U.S. government guarantees the current eagles contain an accurate amount of gold weight in troy ounces or units. These are available in denominations of 1/10 oz, ¼ oz, ½ oz, and 1 oz gold coins. The face values are $5, $10, $25, and $50 USD. While eagles are legal tender, their intrinsic value is far greater as based on their troy weight and the current prices of gold.

The gold in these gold eagle bullion coins comes from American sources. It is alloyed with copper and silver for durability. Crown gold refers to 22 karat alloy, per the English standard, which has not been used in the U.S. since 1937. American eagles contain a gold fraction of .9167, which is authorized as 22 karats, with 3% silver and 5.33% copper. Un-circulated and proof versions, which are produced at the West Point Mint in New York, are available for coin collectors. The eagles minted from 1986 through 1991 feature the date in Roman numerals. Now Arabic numbers designate the date on these coins.