Relative Value Of Silver And Gold

Since the time that silver was discovered by the Spanish in the New World in the 16th century, until the latter half of the 19th century, the value of gold in relation to silver maintained a relatively stable ratio of 15½:1. The reason for the subsequent sharp decline in the relative value of silver to gold has been attributed to Germany’s decision to cease minting the silver thaler coins in 1871. On 23 November 1871, following the defeat of France in the Franco-Prussian War, Bismarck exacted one billion dollars in gold indemnity, and then proceeded to move Germany towards a new gold standard which came about on 9 July 1873 with the introduction of the gold mark.

It has also however been suggested by Nevada Senator John Percival Jones in 1876 in a speech to the US Senate, that the downward pressure on the market value of silver began somewhat earlier with the formation of the Latin Monetary Union in 1866. Jones argues that the Latin Monetary Union involved a partial demonetization of silver.

Performance Of The Gold Standard

As mentioned, the great virtue of the gold standard was that it assured long-term price stability. Compare the aforementioned average annual inflation rate of 0.1 percent between 1880 and 1914 with the average of 4.1 percent between 1946 and 2003.

But because economies under the gold standard were so vulnerable to real and monetary shocks, prices were highly unstable in the short run. A measure of short-term price instability is the coefficient of variationthe ratio of the standard deviation of annual percentage changes in the price level to the average annual percentage change. The higher the coefficient of variation, the greater the short-term instability. For the United States between 1879 and 1913, the coefficient was 17.0, which is quite high. Between 1946 and 1990 it was only 0.88. In the most volatile decade of the gold standard, 1894-1904, the mean inflation rate was 0.36 and the standard deviation was 2.1, which gives a coefficient of variation of 5.8 in the most volatile decade of the more recent period, 1946-1956, the mean inflation rate was 4.0, the standard deviation was 5.7, and the coefficient of variation was 1.42.

Finally, any consideration of the pros and cons of the gold standard must include a large negative: the resource cost of producing gold. Milton Friedman estimated the cost of maintaining a full gold coin standard for the United States in 1960 to be more than 2.5 percent of GNP. In 2005, this cost would have been about $300 billion.

Why The Gold Standard Failed

Once we take this sequence of events into account we can see that the gold standard broke down because of WWI and it never returned to its normal functionality. The gold standard cannot be responsible for the Great Depression for the simple fact that it stopped working more than a decade before.

Now, there is a more subtle argument made by some economists that the gold standard was responsible for the Great Depression, not because of the gold standard regime but because of the gold standard mentality that constrained the central bankers of the time.

However the behavior of UK and US policymakers of the time went against the gold standard mentality. Especially in the US, where the idea of increasing the money supply without a commensurate increase in gold reserves, all in an effort to help the British Pound, was not part of the gold standard mentality.The gold standard did not fail due to its own internal problems, but because of government driven, calamitous events such as WWI and the post-WWI policy makers looser monetary policy, made possible due to the inconvertibility of the banknotes.

Read Also: How Much Is 18 Karat Gold Per Ounce

Gold Makes A Comeback

Despite the myriad reasons that a return to the gold standard seems impossible, the dream remains alive, in part because of the efforts of Ron Paul. Paul was first moved to run for office in 1976, in reaction to Nixon scrapping gold standard a few years prior. I remember the day very clearly, he told Texas Monthly in 2001. Nixon closed the gold window, which meant admitting that we could no longer meet our commitments and that there would be no more backing of the dollar. After that day, all money would be political money rather than money of real value. I was astounded.

Pauls views were shaped in part by economist Friedrich Hayeks accounts of how the Nazis effective abandonment of the gold standard allowed them to beef up fiscal spending in preparation for their war of conquest, Eichengreen wrote in National Interest in 2011. Paul subsequently spent most of his career as a vocal but lonely goldbug in Congress. He retired in 2013.

Though they are not US legal tender, state law in Utah allows them to be used as currencythough its an expensive way to get $50 of gas or groceries. Other state laws have mostly moved to lift taxes on them, broadly recognizing them as money rather than collectibles, on the order of baseball cards and Beanie Babies.

The Breakdown Of The Classical Gold Standard

The classical gold standard was at its height at the end of 1913, ironically just before it came to an end. The proximate cause of the breakdown of the classical gold standard was political: the advent of World War I in August 1914. However, it was the Bank of Englands precarious liquidity position and the gold-exchange standard that were the underlying cause. With the outbreak of war, a run on sterling led Britain to impose extreme exchange control a postponement of both domestic and international payments that made the international gold standard non-operational. Convertibility was not legally suspended but moral suasion, legalistic action, and regulation had the same effect. Gold exports were restricted by extralegal means , with the Bank of England commandeering all gold imports and applying moral suasion to bankers and bullion brokers.

Almost all other gold-standard countries undertook similar policies in 1914 and 1915. The United States entered the war and ended its gold standard late, adopting extralegal restrictions on convertibility in 1917 . An effect of the universal removal of currency convertibility was the ineffectiveness of mint parities and inapplicability of gold points: floating exchange rates resulted.

Read Also: Coleman Dental Gold Teeth

What Is The Gold Standard

Its a monetary system that directly links a currencys value to that of gold. A country on the gold standard cannot increase the amount of money in circulation without also increasing its gold reserves. Because the global gold supply grows only slowly, being on the gold standard would theoretically hold government overspending and inflation in check. No country currently backs its currency with gold, but many have in the past, including the U.S. for half a century beginning in 1879, Americans could trade in $20.67 for an ounce of gold. The country effectively abandoned the gold standard in 1933, and completely severed the link between the dollar and gold in 1971. The U.S. now has a fiat money system, meaning the dollars value is not linked to any specific asset.

Which President Took The Us Off The Gold Standard

3.9/5Richard Nixonthe answer

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United

Furthermore, can the US go back to the gold standard? In 1971, to stave off a run on US gold reserves, Nixon halted convertibility . Under intensifying pressure, in 1973 the president scrapped the gold standard altogether.

Secondly, what replaced the gold standard?

The gold standard was completely replaced by fiat money, a term to describe currency that is used because of a government’s order, or fiat, that the currency must be accepted as a means of payment. In the U.S., for instance, the dollar is fiat money, and for Nigeria, it is the naira.

When did the US go off the silver standard?

In the United States, the gold standard was abandoned by Richard Nixon in 1971, whereas the silver standard officially came to an end when China and Hong Kong abandoned it in 1935.

Don’t Miss: How Many Grams In 1 Oz Of Gold

Paralysis Of International Monetary Management

Floating-rate system during 1968â1972

| This section does not cite any . Please help improve this section by adding citations to reliable sources. Unsourced material may be challenged and removed. |

By 1968, the attempt to defend the dollar at a fixed peg of $35/ounce, the policy of the Eisenhower, Kennedy and Johnson administrations, had become increasingly untenable. Gold outflows from the U.S. accelerated, and despite gaining assurances from Germany and other nations to hold gold, the unbalanced spending of the Johnson administration had transformed the dollar shortage of the 1940s and 1950s into a dollar glut by the 1960s. In 1967, the IMF agreed in Rio de Janeiro to replace the tranche division set up in 1946. Special drawing rights were set as equal to one U.S. dollar, but were not usable for transactions other than between banks and the IMF. Nations were required to accept holding SDRs equal to three times their allotment, and interest would be charged, or credited, to each nation based on their SDR holding. The original interest rate was 1.5%.

The intent of the SDR system was to prevent nations from buying pegged gold and selling it at the higher free market price, and give nations a reason to hold dollars by crediting interest, at the same time setting a clear limit to the amount of dollars that could be held.

Smithsonian Agreement

The Stability Of The Classical Gold Standard

The fundamental reason for the stability of the classical gold standard is that there was always absolute private-sector credibility in the commitment to the fixed domestic-currency price of gold on the part of the center country , two of the three remaining core countries, and certain other European countries . Certainly, that was true from the late-1870s onward. In earlier periods, that commitment had a contingency aspect: it was recognized that convertibility could be suspended in the event of dire emergency but, after normal conditions were restored, convertibility would be re-established at the pre-existing mint price and gold contracts would again be honored. The Bank Restriction Period is an example of the proper application of the contingency, as is the greenback period .

Absolute Credibility Meant Zero Convertibility and Exchange Risk

The absolute credibility in countries commitment to convertiblity at the existing mint price implied that there was extremely low, essentially zero, convertibility risk and exchange risk .

Reasons Why Commitment to Convertibility Was So Credible

There were many reasons why the commitment to convertibility was so credible. Contracts were expressed in gold if convertibility were abandoned, contracts would inevitably be violated an undesirable outcome for the monetary authority. Shocks to the domestic and world economies were infrequent and generally mild. There was basically international peace and domestic calm.

: Officer .

Also Check: Can You Get Banned For Buying Gold Osrs

What Are The Downsides

A fixed link between the dollar and gold would make the Fed powerless to fight recessions or put the brakes on an overheating economy. If you like the euro and how its been working, you should love the gold standard, said economist Barry Eichengreen. Beleaguered Greece, for instance, cannot print more money or lower its interest rates because its a member of a fixed-currency union, the euro zone. A gold standard would put the Fed in a similar predicament. Gold supplies are also unreliable: If miners went on strike or new gold discoveries suddenly stalled, economic growth could grind to a halt. If the output of goods and services grew faster than gold supplies, the Fed couldnt put more money into circulation to keep up, driving down wages and stifling investment.

The End Of The Gold Standard

The gold standard remained in place until 1971. In 1970, the growing cost of the Vietnam war and a trade deficit caused the United States to make the decision to print more money. Other countries began to question Americas ability to actually cover all the American currency in circulation with gold.

The first county to actually leave the Bretton Woold system was West Germany. Seeing this move, and fearing that American currency they had invested in would lose value, other countries began demanding that the Unites States turn over gold in exchange for our currency.

President Nixon made the decision to take the country off the gold standard to prevent an economic meltdown.

Read Also: How Much Is One Brick Of Gold

Great Britain From The 17th Century

In 1663, a new gold coinage was introduced based on the 22 carat fine guinea. Fixed in weight at 44+12 to the troy pound from 1670, this coin’s value varied considerably until 1717, when it was fixed at 21 shillings . However, this valuation overvalued gold relative to silver compared to other European countries. British merchants sent silver abroad in payments while exports were paid for with gold. As a consequence, silver flowed out of the country and gold flowed in, leading to a situation where Great Britain was effectively on a gold standard. In 1816, the gold standard was adopted officially, with the silver standard reduced to 66 shillings , rendering silver coins a “token” issue .

The economic power of Great Britain was such that its adoption of a gold standard put pressure on other countries to follow suit.

Return To The Gold Standard

In spite of the tremendous disruption to domestic economies and the worldwide economy caused by World War I, a general return to gold took place. However, the resulting interwar gold standard differed institutionally from the classical gold standard in several respects. First, the new gold standard was led not by Britain but rather by the United States. The U.S. embargo on gold exports was removed in 1919, and currency convertibility at the prewar mint price was restored in 1922. The gold value of the dollar rather than of the pound sterling would typically serve as the reference point around which other currencies would be aligned and stabilized. Second, it follows that the core would now have two center countries, the United Kingdom and the United States.

Third, for many countries there was a time lag between stabilizing a countrys currency in the foreign-exchange market and resuming currency convertibility. Given a lag, the former typically occurred first, currency stabilization operating via central-bank intervention in the foreign-exchange market . Table 2 presents the dates of exchange- rate stabilization and currency convertibility resumption for the countries on the interwar gold standard. It is fair to say that the interwar gold standard was at its height at the end of 1928, after all core countries were fully on the standard and before the Great Depression began.

Recommended Reading: Does Kay Jewelers Sell Fake Jewelry

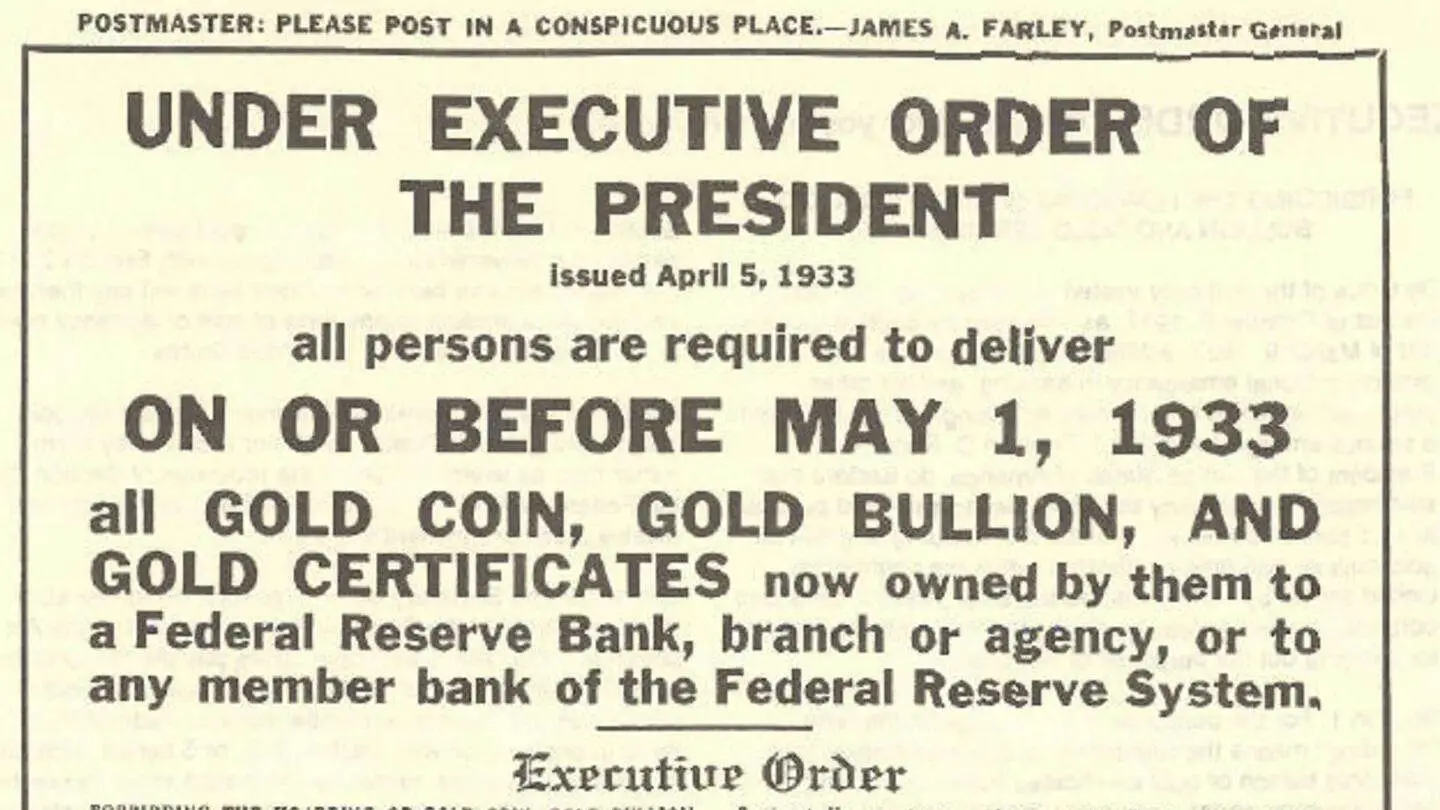

Fdr Takes United States Off Gold Standard

On June 5, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

Soon after taking office in March 1933, President Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. And increasing the amount of gold held by the Federal Reserve would in turn increase its power to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931, and Roosevelt had taken note.

READ MORE: How Did the Gold Standard Contribute to the Great Depression?

The government held the $35 per ounce price until August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. In 1974, President Gerald Ford signed legislation that permitted Americans again to own gold bullion.

Types Of Gold Standards

Pure Coin and Mixed Standards

In theory, domestic gold standards those that do not depend on interaction with other countries are of two types: pure coin standard and mixed standard. The two systems share several properties. There is a well-defined and fixed gold content of the domestic monetary unit. For example, the dollar is defined as a specified weight of pure gold. Gold coin circulates as money with unlimited legal-tender power . Privately owned bullion is convertible into gold coin in unlimited amounts at the government mint or at the central bank, and at the mint price . Private parties have no restriction on their holding or use of gold in particular, they may melt coin into bullion. The effect is as if coin were sold to the monetary authority for bullion. It would make sense for the authority to sell gold bars directly for coin, even though not legally required, thus saving the cost of coining. Conditions and commit the monetary authority in effect to transact in coin and bullion in each direction such that the mint price, or gold content of the monetary unit, governs in the marketplace.

| Table 3Structure of Money: Major-Countries Aggregatea | |

| 1885 | |

| 33 | 99 |

: Triffin , Sayers for 1928 Bank of England dollar reserves .

Gold-Bullion and Gold-Exchange Standards

Gold Points and Gold Export/Import

Gold-Point Arbitrage

Gold-Point Spread

| Table 4Gold-Point Estimates: Classical Gold Standard |

| Countries |

| Table 5Gold-Point Estimates: Interwar Gold Standard |

| Countries |

Recommended Reading: How Much Is The Price Of Gold Per Gram