When Is The Gold Price The Strongest

It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement however, historically, there have been high and low seasonal period in the gold market. Historically, September is golds strongest month. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year. The worst month has historically been March, April and then June.

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Gold Trading For Beginners

For dummies, gold trading 101 is to first focus on trading gold only. Next, consider market sentiment. If the market view today is looking up, the price of gold is probably going to come down.

Alternatively, if the market outlook is bleak, expect a rise in price. Start with this straightforward gold trading strategy.

As your confidence and returns from trading using gold grow, consider the demand for jewellery for cash.

Keep a particular eye on live demand in China and India, where gold jewellery is used as a long-term investment vehicle. This could indicate future price trends.

You May Like: How To Get Free Golden Eagles In War Thunder

Understanding Forex Market Hours

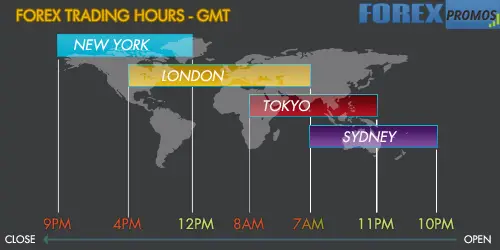

International currency markets are made up of banks, commercial companies, central banks, investment management firms, hedge funds, as well as retail forex brokers and investors around the world. Because this market operates in multiple time zones, it can be accessed at any time except for the weekend break.

The international currency market isn’t dominated by a single market exchange but involves a global network of exchanges and brokers around the world. Forex trading hours are based on when trading is open in each participating country. While the timezones overlap, the generally accepted timezone for each region are as follows:

- New York 8am to 5pm EST Tokyo 7pm to 4am EST Sydney 5pm to 2am EST London 3am to 12 noon EST

The two busiest time zones are London and New York. The period when these two trading sessions overlap is the busiest period and accounts for the majority of volume traded in the $6 trillion a day market. It is during this period where the Reuters/WMR benchmark spot foreign exchange rate is determined. The rate, which is set at 4pm London time is used for daily valuation and pricing for many money managers and pension funds.

Despite the highly decentralized nature of the forex market it remains an efficient transfer mechanism for all participants and a far-reaching access mechanism for those who wish to speculate from anywhere on the globe.

Why Is Gold Mostly Quoted In Us Dollars

While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Given that the U.S. is the worlds biggest economy and one of the most stable, the dollar has become a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Reserve currencies are used to settle international transactions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

Read Also: Does Kay Jewelers Sell Real Gold

I’ve Heard That Gold Traded 24/7 Is That True Is There An Open And A Close

Gold, actually trades 23 hours a day Sunday through Friday. Most OTC markets overlap each other there is a one-hour period between 5 p.m. and 6 p.m. eastern time where no market is actively trading. However, despite this one hour close, because spot is traded on OTC markets, there are no official opening or closing prices.

For larger transactions, most precious metals traders will use a benchmark price that is taken at specific periods during the trading day.

Futures Contract Open Interest

On a futures exchange, open interest is defined as the total futures and/or option contracts entered into that have not yet been offset by a transaction, by delivery, or by exercise. By definition, the aggregate of all long open interest = the aggregate of all short open interest for that futures contract type.

Participants in futures trading can be viewed in terms of their motivation for trading, i.e. as a hedger or as a speculator. Hedgers may, for example, use futures to hedge price fluctuations, hedge financial risk, or hedge a cash market position using a futures market position. Futures participants can also be viewed in terms of trader type, e.g. clearing members or brokers.

Using COMEX as an example , all trades on COMEX are technically undertaken between the CME Group and the clearing members. There are approximately 50 active clearing members on COMEX. However, the original trades could have been initiated by individual traders, brokers, or clearing members.

You May Like: Where To Find Gold Earring Rdr2

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Us Based Gold Wholesalers

There are a number of well-known full-service precious metals wholesalers operating in the US gold market, the largest being A-Mark, Dillon Gage, Coins N Things and Manfra, Tordella & Brookes . Note that these 4 companies are also extensively involved in supplying gold bars and coins to the international market also.

A-Mark, established in 1965, is the largest precious metals dealer in North America. Its headquartered in Los Angeles, with an operation in Vienna, Austria, and it provides precious metal trading, leasing, storage, consignment, and financing, and is an Authorised Purchaser of the US Mint, and official distributor for many other government Mints. A-Mark does not sell to the retail public.

Coins N Things , established in 1973, is headquartered in Massachusetts and is the largest wholesale seller of gold in the US, and notably, the largest supplier of precious metals to the US Government, as well as being the largest contractor to the US Treasury Department. CNT also runs its own storage facility called the CNT Depository. Note that CNT does not have a public internet site.

Dillon Cage, established in 1976, is headquartered in Dallas, Texas, and is one of the largest wholesale precious metals trading firms in the world. Its an Authorised Purchaser for the US Mint and other major government mints, and runs its own precious metals refinery , as well as owning International Depository Services of Delaware .

Recommended Reading: Where To Sell Gold Tooth Rdr2 Online

Trading Gold In Forex

Gold is effectively a currency in the forex market. It is nearly always traded against the US dollar with the code XAU/USD.

As a result, your strategy needs to track movements in the US dollar.

An increase in the price of the US dollar could push the value of gold down. So keep abreast of forex news websites for tips on upcoming trends and analysis.

Liquidity also plays an important role when trading gold on the forex market. Average daily trading volumes of gold exceed all currency pairs, excluding EUR/USD, GBP/USD, and USD/JPY.

Note gold trading hours on forex websites often run continuously around the clock.

Forex Market Hours Based Strategy No# : Intraday Trading During Second Half Of London Session

As we discussed earlier, when the market in New York opens, the London trading session has already progressed halfway for the day. As a result, the trading volume in the Forex market typically reaches the highest during the day at the opening hours of the New York trading session.

To illustrate the situation at the opening of the New York trading session, take a look at figure 5 to see how the trading volume spiked up the moment market opened.

Most short-term intraday traders decide to trade during the second half of the London session. Because during this time, two of the largest financial centers are operational, which increases liquidity in the market. High market liquidity is a pre-requisite of low spreads and short-term traders who only bag 10-15 pips at a time need low spreads to reduce their cost of business.

If you are an intraday trader, trading during this particular time of the day will certainly be going to increase your odds of success regardless of which technical trading strategy you are pursuing.

Recommended Reading: War Thunder Golden Eagle Generator

Getting Started With Commodities

If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. For more information on how commodities trading can help you achieve your financial goals, contact the team at Daniels Trading today.

Filed Under: Tips & Strategies

About Daniels Trading

Daniels Trading is division of StoneX Financial Inc. located in the heart of Chicagos financial district. Established by renowned commodity trader Andy Daniels in 1995, Daniels Trading was built on a culture of trust committed to a mission of Independence, Objectivity and Reliability.

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Don’t Miss: Selsun Blue For Toenail Fungus

London Session Trading Strategies And Tips

Remember, when trading the London open volatility and liquidity rises, so be wary and utilize the appropriate leverage when trading. If youre new to forex trading, download our Forex for beginners trading guide to get to grips with the basics.

Like the London forex trading session, the New York session and Asian forex session also have unique characteristics that forex traders should be aware of.

Key tips:

New Xauusd Trading Hours

As you may recall, back in August 2016 we introduced a daily 1 minute trading halt to avoid the wide spreads and large candles owed to the low liquidity available at markets open.

Since then our spreads around rollover time have improved significantly and complaints due to SL getting triggered around market open are very rare. Unfortunately, XAUUSD liquidity around rollover time still doesnt meet the high quality standards that our traders deserve, so were extending XAUUSDs trading halt one minute with effect from Sunday 26 March 2017.

The new XAUUSD trading hours will remain in force until further notice. We will monitor the liquidity available at all times and we will remove the daily trading breaks only when we are sure that the liquidity available meets our clients needs.

New XAUUSD Trading Hours *

| Instrument |

Recommended Reading: Coleman Dental Gold Teeth

History Of Trading Gold

Trading physical gold dates back to 2000 BC when ancient Egyptians began mining the precious metal. Now global supply of the commodity is over 170,000 tonnes, with production tripling year-on-year since the 1970s.

So reliable is its value that countries have used it as currency reserves for centuries.

Why Are Off Market Trading Hours Different

Off market hours, also known as the pre-market and after-hours markets have two major differences compared to the main session of the underlying asset, from the perspective of electronic trading. This is due to the fact that futures contracts are based on the underlying asset or market for example the E-Mini S& P500 futures tracks the S& P500 index which is the underlying basket. Any trading that goes on in the futures market when the main underlying market is not fully open makes it a proxy to the real market. To put this differently, the trading in the futures markets outside of the official trading hours doesnt accurately reflect on the underlying market.

Another factor to bear in mind is that trading volumes are generally lower during the off market hours in the electronic trading session, compared to the primary or official trading hours. This usually results in small ranges being established as trading interest is lower than usual resulting in a thinner order book. This makes the futures market in question vulnerable to sudden price movements, often labeled fat finger trades where price posts brief yet strong movement in the markets largely on account of big orders. The low liquidity contributes to this phenomenon.

Don’t Miss: Is Dial Gold Body Wash Antibacterial

How To Trade Breakouts During The London Session

Trading breakouts during the London session using a London breakout strategy is much the same as trading breakouts during any other time of day, with the addition of the fact that traders may expect an onslaught of liquidity and volatility at the open.

When traders look to trade breakouts, they are often seeking firm support or resistance to plot their trades.

The chart below illustrates a rising wedge pattern, a trend line with a resistance level that is eventually broken- a breakout.

The big benefit of this setup is risk management. Traders can keep stops relatively tight, with their stop-losses trailing close to the trend line. If the support/trend line does break, losses are limited, and if the strategy does prevail it could lead to a positive risk-reward ratio.

The increase in liquidity during the London session coupled with the increase in volatility makes potential breakouts much more likely.

Popular Commodity Trading Hours

Whether youre an energies trader or interested in grains and oilseeds, there is a specific time of day when the markets are most active. In many cases, these periods occur regularly in the half-hours preceding or following an opening or closing bell. As traders of all types rush to close out existing positions and enter new ones, liquidity increases. This phenomenon can create an array of strategic trading opportunities.

Here are a few of the most popular futures products and their associated commodity trading hours :

| Product | ||

|---|---|---|

| SunFri 8:00 pm7:45 am, MonFri, 9:30 am2:20 pm | ||

| Chicago SRW Wheat | SunFri 8:00 pm7:45 am MonFri 9:30 am2:20 pm | |

| Soybeans | SunFri 8:00 pm7:45 am MonFri 9:30 am2:20 pm | |

| Live Cattle | LE | Mon 10:05 am Open, 5:00 pm Close TuesThurs 9:00 am Open, 5:00 pm Close Friday 9:00 am Open,2:55 pm Close |

| Lean Hogs | HE | Mon 10:05 am Open, 5:00 pm Close TuesThurs 9:00 am Open, 5:00 pm Close Friday 9:00 am Open,2:55 pm Close |

| WTI Crude Oil | SunFri 6:00 pm5:15 pm | |

| Natural Gas | SunFri 6:00 pm5:15 pm | |

| Gold | SunFri 6:00 pm5:15 pm | |

| Copper |

The commodity trading hours listed above are representative of the electronic trading day for each product. In addition to these periods, there are some nuanced times that are typically active. Here are a few of them:

Read Also: How To Get Free Gold Bars In Candy Crush

Most Influential Political Events In 2021 For Xau/usd

Despite the liquidity flooding the financial markets, inflation outlook in major economies remains subdued and major central banks voiced their commitment to keeping their policies extremely loose until they see a convincing increase in price pressures. This suggests that investors will not give up on gold in the near future.

On the other hand, a return to normality with mass COVID-19 vaccinations could make risk-sensitive assets more attractive, especially in the second half of 2021, and dampen the demand for the yellow metal.

Trading The Gold Silver Ratio

Day trading in gold and silver might be popular, but what is the gold silver ratio and how does it work? Its simply the amount of silver needed to purchase one ounce of gold.

For example, if the price per ounce of gold is $1,000 while an ounce of silver costs $50, the gold silver ratio would be 20:1.

If you can predict which direction the gold for silver ratio is going, you can generate returns regardless of whether the market trends up or down. However, its worth noting that while silver is cheaper than gold, it is more volatile.

Note the trading of gold and silver can also be used to diversify the precious metal held in a portfolio.

Also Check: Is Gold Peak Tea Caffeinated