Does Humana Medicare Cover Dental

- $0 premium Medicare Advantage plans available in some areas1

- Many plans offer prescription drug coverage and vision and dental benefits

- Over 4 million people are enrolled in a Humana Medicare Advantage Plan2

Original Medicare doesnt normally cover routine dental services.3

However, some Humana Medicare plans may cover certain dental services. Your dental coverage will depend on which Humana Medicare plan you have.

If you dont currently have a Humana Medicare plan, you can get more information by calling a licensed sales agent4 at 1-855-298-6309 TTY Users: 711 24 hours a day, 7 days a week, or by requesting a free plan quote online, there is no obligation to enroll in a plan.

You can find out if your Humana Medicare plan may include coverage for dental care by reading the section below that correlates to your current coverage.

What About House Bill 3503

In the news, you may have seen a mention of House Bill 3503, which requires insurance companies to offer optional coverage for hearing aids, with a reimbursement benefit of up to $2,500. This law went into effect in the state of Illinois on January 1, 2020.

However, if you read the bill, itâs pretty limited.

The insurance company can charge a higher premium for including this benefit, and they can make the hearing aid benefit optional. In addition, the insurance company doesnât have to provide the hearing aid coverage if theyâre unable to âmeet mandatory minimum participation requirements,â and the insurers set those requirements themselves.

We confirmed directly with the Centers for Medicare and Medicaid Services that Medicare and Medicare Supplements are not affected by this bill and are not required to provide hearing aid coverage.

Hearing Aids And Medicare

Medicare does not cover hearing exams, hearing aids, or the fitting of hearing aids. If you have Medicare with or without a Medicare Supplement, you are responsible for 100% of the cost for hearing aids and exams.

That goes for all states, including Illinois.

If you have Medicare with or without a Medicare Supplement, youâll have to pay for your hearing aids and exams entirely out-of-pocket. However, talk to your audiologist first about your options.

Especially if youâre going to private practice, many will work out a payment plan to make the cost of hearing again affordable.

Recommended Reading: War Thunder Silver Lions Hack

Will Coverage On Hearing Aids Change

Over the years, many organizations and lawmakers have tried to update Medicare to cover vision, hearing and dental costs for seniors.

Many people would like to see Medicare evolve to cover dental, vision and hearing care. A Commonwealth Fund report details the financial and health burdens these gaps place on older adults. The report said:

“Among Medicare beneficiaries, 75 percent of people who needed a hearing aid did not have one 70 percent of people who had trouble eating because of their teeth did not go to the dentist in the past year and 43 percent of people who had trouble seeing did not have an eye exam in the past year.”

However, so far, no one has been successful at getting changes made to this part of Medicare coverage. In the summer of 2019, several U.S. representatives introduced H.R. 4056, a bill that would require Medicare to pay for certain audiological services. Time will tell if this bill gets passed.

Finding A Medicare Advantage Plan That Covers Hearing Aids

Seniors who need coverage for hearing care, including testing and hearing aids, should begin by contacting their Medicare Advantage provider to determine whether its covered under their existing plan. If not, their insurer can generally suggest a more suitable plan that offers the coverage they need. However, seniors who want to switch plans may need to wait until the general enrollment period to make the change. That occurs every year from October 15 to December 7.

If a senior is already working with an audiologist or other hearing care provider, its a good idea to ask the provider which Medicare Advantage plans are accepted at that clinic. Medicare Advantage plans generally only cover care at in-network providers, so selecting a plan that is already accepted can help guarantee that theres no need to find a new health care provider.

Recommended Reading: How To Sell Rs Gold

Medicare Hearing Aid Coverage 2022

Whether or not Medicare provides hearing aid coverage will depend on the type of Medicare plan you have.

Original Medicare Doesn’t Provide Hearing Aid Coverage

Original Medicare doesn’t cover hearing aids in 20221. If you have a Medicare Part A or B plan, you will need to pay for your hearing aids out of pocket or with other insurance.

Medicare Advantage may Provide Hearing Aid Coverage

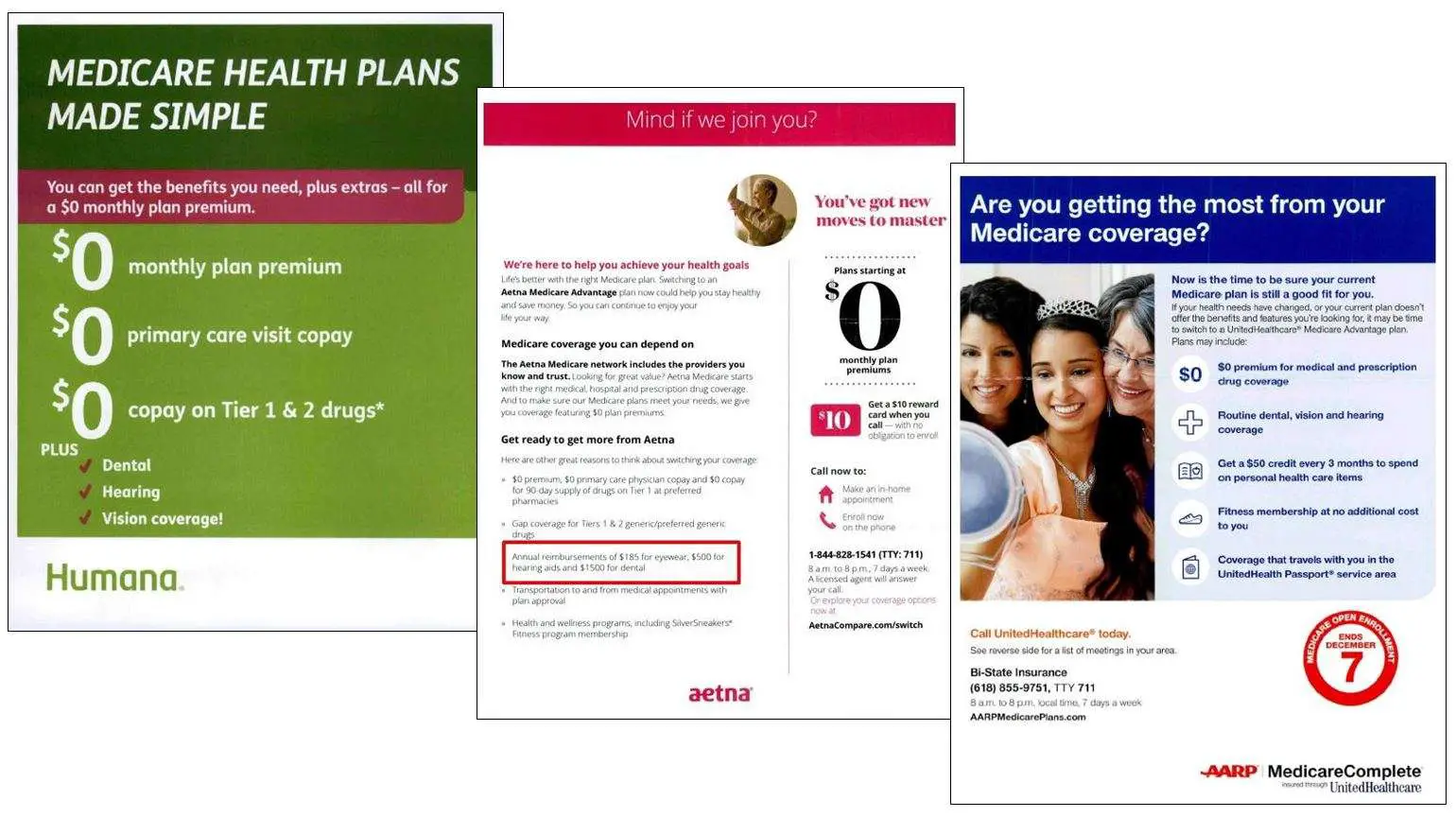

Some Medicare Advantage plans, also called Medicare Part C plans, do provide some hearing aid coverage. For example, Humana, Aetna, and Blue Cross Blue Shield all offer at least one Medicare Advantage plan with hearing aid coverage.

Costs that might be covered include:

- Hearing aids

- Hearing test

- Audiologist visits for fitting and adjustments

Because Medicare Advantage plans are offered through private insurance companies, the benefits vary from plan to plan. And some insurers choose not to offer hearing aid benefits at all. Others only offer a plan with hearing aid coverage to seniors in certain states.

Did You Know: According to the Kaiser Family Foundation, 88 percent of Medicare Advantage plans offer hearing aid coverage, which can significantly lower your out-of-pocket cost.2

You should also be aware that plans with hearing aid coverage may cost more than those without it. But given how expensive hearing aids are, it’s likely worth paying the higher premium if it means you won’t need to pay for your hearing aids entirely out of pocket.

Medicare Advantage Hearing Aid Coverage In 2022

Medicare Advantage plans often include dental, vision, and hearing benefits. Before signing up for a Medicare Advantage plan, make sure the network includes your preferred providers as well as the suite of hearing benefits you need, as some do cover hearing aids. Also, check to ensure that youll have access to a local and reputable audiologist within your plan network for your hearing health needs.

Also Check: Gold Rush Season 10 Release Date

Health Insurance And Hearing Care

Hearing aids can be expensive, often costing thousands of dollars. These prices often include the cost of the hearing aids and the professional services involved in hearing tests and device fitting.

Only around 25% of adults in the United States who need hearing aids have them, according to the Kaiser Family Foundation . The foundation adds that while most private insurance plans pay for a hearing test, they usually provide only $500 to $1,000 every 25 years toward the cost of a hearing aid.

The primary health insurance providers offer the following hearing care coverage.

Choose The Right Humana Program For You

Hearing benefits vary among Humana plans, so members should carefully review their policy to know what theyre eligible for. Certain brands of hearing aids may not be covered, for example. Cochlear implants are usually only covered for one ear, and members will need prior authorization to avoid paying out of pocket. Knowing what a Humana plan covers can reduce the chance of surprise medical bills and keep hearing aid costs affordable for you.

Don’t Miss: Where To Buy Real Gold Bars

Clarity Hearing Service Solutions

There is enough confusion when it comes to selecting, fitting, and adjusting to hearing aids, so I do all that I can to help alleviate patients stress over insurance coverage.

Our team at Clarity Hearing has the necessary expertise and experience to help determine the level of copayment, deductible, or coinsurance benefits associated with your specific Humana policy, along with any network discounts or restrictions that might apply.

To be sure about their coverage, I advise my patients to take advantage of our online insurance coverage form, which starts the process of finding out all you need to know about hearing aids and hearing care coverage.

My Clarity Hearing associates and I apply our broad range of experience and skills to provide you with the peace of mind that comes with excellent hearing health care.

Are you looking to find out more about your insurance options but dont know which way to turn? Contact the Clarity Hearing Team now, and well give you the support you need!

Do you know somebody that needs to see this? Why not share it?

Hearing Aid Assistance For Low

Many individuals over the age of 65 cannot afford the cost of hearing aids, despite needing them to communicate and avoid hearing loss-related issues like dementia.

The Hearing Loss Association of America has a list of resources for those who need financial assistance. Programs like Medicaid and the VA may be able to help.

Also, donât forget to talk to your audiologist or hearing aid provider. They may have programs or payment plans to help.

Recommended Reading: Classic Wow Banned For Buying Gold

Does Medicare Cover Hearing Aids In Illinois

In Illinois, about 16% of all people suffer from mild to severe hearing loss .

Hearing loss goes far beyond turning up the TV or asking people to speak up. Not being able to communicate well profoundly affects the brain and increases the risk of walking problems, depression, isolation, and dementia .

The best way to stop these hearing loss-related brain changes from compounding is to get properly fitted with a hearing aid as early as possible.

The problem? Hearing aids can be expensive, often costing $5,000 or more for a high-quality, professionally fitted set.

People over the age of 65 are the most likely to suffer from disabling hearing loss, but does Medicare step in to help with hearing aid costs?

Calculate Your Medicare Costs Today

Create a Medicare action plan by estimating your total monthly premiums for healthcare and related expenses in retirement.

Can You Take Advantage Of Humana Hearing Aid Coverage

One in three Americans between the ages of 65 and 74 have hearing loss, which can make it difficult to have conversations and recognize important sounds, such as sirens or fire alarms. Age-related hearing loss usually occurs in both ears and tends to advance gradually. Many people dont realize the extent of their hearing loss until theyre tested for it.

People who struggle to understand what others are saying, either in person or over the phone, might be suffering from some degree of hearing loss. Needing to turn up the TV because the volume often seems too low is another sign of a possible problem. A doctor, hearing aid specialist or audiologist can perform a simple test to determine a persons level of hearing loss. Testing and a diagnosis of hearing loss are usually required for Humana to cover the cost of a hearing aid.

You May Like: How Much Is A Brick Of Gold Worth

Replace Underperforming Hearing Aids

Like most electronics, the performance of your hearing aids may decline over time. Dust, moisture, and everyday wear and tear can lead your hearing aids to simply not work as well as they used to. Nothing lasts forever, and the inevitable decline of your current hearing aids is one of the reasons your health plan offers you a benefit. They know your hearing aids wont function as well after a few years, so your benefit is there to make sure you are always addressing your hearing needs in the best way possible.

Active Duty Service Members And Family

TRICARE only covers hearing aids and hearing aid services if you have hearing loss that meets specific hearing criteriaAdults with: Hearing threshold of at least 40 dB HL in one or both ears when tested at 500, 1,000, 1,500, 2,000, 3,000, or 4,000Hz or hearing threshold of at least 26 dB HL in one or both ears at any three or more of those frequencies or speech recognition score less than 94%. Children with: hearing threshold level of at least 26dB HL in one or both ears when tested at 500, 1,000, 2,000, 3,000, or 4,000Hz.

Read Also: Tinder Gold Free Trial

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Which Medicare Plans May Be Best For You If You Know You Need Hearing Aids

Original Medicare and Medigap plans do not cover hearing aids. So what type of plan may be best for you if you know youll need a hearing aid in the coming year?

If youre enrolling in Medicare and know youll need a hearing aid, you may want to look into a Medicare Advantage plan. In addition to offering the benefits of parts A and B, many Part C plans also cover additional services like hearing aids and other hearing care services.

- out-of-pocket maximum

- amount of coverage or coverage limits for specific services or items

Because of these variations, its very important to carefully compare several Part C plans before selecting one. This can help you pick one that best suits both your health and financial needs.

Before getting your hearing aid, check with the insurance company to ask how much of the cost will be covered. You can then use this information, along with the total cost of the hearing aid, to help estimate your out-of-pocket cost.

Remember that getting a hearing aid doesnt just include the cost of the device it also includes the exams and fittings. You may want to ask about this coverage and include these costs in your estimate as well.

Recommended Reading: 1 Oz Of 24 Karat Gold

Hearing Aid Coverage With Humana Regional Ppo Example

Another 2021 plan option in Macon County comes from Humana. The HumanaChoice Regional PPO offers some coverage for a hearing exam. With this Medicare Advantage plan, youâd pay a $50 copay for a hearing exam from an in-network provider.

If you saw an out-of-network provider, youâd pay a 50% coinsurance. For context, a hearing exam typically costs between $150-$200, so a realistic cost for seeing an out-of-network provider would be $75-$100.

This particular Humana plan does not offer any coverage for a fitting/evaluation or hearing aids.

As you can see, the hearing benefits provided with this plan are quite different from the Aetna example.

It pays to compare plans to ensure you get the benefits that are the most important to you. Our team of licensed sales agent can help you do this!

Does Medicare Cover Hearing Aids For Tinnitus

Older adults often want to know if Medicare will cover hearing aids for certain conditions like tinnitus. Original Medicare does not cover hearing aids for any reasoneven for that pesky ringing in your ears! If you’re experiencing tinnitus and your doctor recommends hearing aids, you’ll need to pay for them with other means.

Quick Tip: Are you struggling with tinnitus? Visit our list of the best hearing aids for tinnitus to find a device that’s right for your needs.

HearMax’s built-in Tinnitus management program allows you to find the right sound to distract yourself from bothersome tinnitus

Seniors with a Medicare Advantage plan might have better luck getting coverage. Just check your insurance plan to see what your options are. You may find that your coverage only includes discounts from a particular brand or select doctors’ offices. If that’s the case, make sure you’re using covered services.

Recommended Reading: How Much Is One Brick Of Gold Worth

Do Any Medicare Supplement Plans Cover Hearing Aids

Medicare Supplement Insurance plans, also called Medigap, do not provide coverage for hearing aids. In fact, these plans dont provide coverage for any health care services or items at all.

Instead, Medigap plans provide coverage for out-of-pocket costs associated with Original Medicare, such as Part A and Part B deductibles, coinsurance and copayments.

Learn more about Medicare Supplement Insurance plans.

Average Bundled Hearing Aid Cost

In general, the average cost of two hearing aids is around $5,000 in the bundled model.

The total price typically includes the hearing aids, a consultation, your initial fitting, and any follow-up appointments in the bundled model. Sometimes it also covers a warranty, routine cleanings, and batteries.

If you buy your devices from a hearing instrument specialist, the hearing test is often included. When purchasing from an audiologist, you may be charged for the exam, especially if you have private insurance secondary to Medicare. Some of these may pick up part of the cost, but be careful as some may follow Medicare rules and deny the claim since the test is related to a hearing aid sale, which is specifically excluded from Medicare.

Don’t Miss: How To Get Golden Eagles War Thunder

Better Hearing Aids And Lower Prices

Since youve already purchased hearing aids through TruHearing, you know that combining your benefit with our prices saved you a pretty penny. But well never be satisfied with simply offering you a one-time savings on hearing aids. Thats why we continually work with our manufacturing partners and providers to find ways to bring down the cost of hearing aids for members of our partner health plans.

In fact, over the last few years weve substantially lowered the cost of our hearing aids to the point that you could get a better hearing aid today than you could three or four years ago for roughly the same price. For example, if you originally bought a standard-level hearing aid, today youre likely able to get an advanced-level hearing aid with more features and better quality for the same priceor one thats even better for just a little extra cost. In some cases, your hearing aid benefit may even cover the entire cost of a better hearing aid. If youre wondering about our price improvements and how to get the most bang for your buck with your benefit, give us a call and one of our Hearing Consultants can help you out.