How To Get A Gold Ira

As mentioned already, you need to hear precisely how this entire process works in order to be able to get the hang of it. That is why Ive decided to take you through the necessary steps. As youll quickly see, things arent that complicated. Its just that you need to get familiar with the steps before embarking on the journey.

How To Put Gold In An Ira

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 13,433 times.

Most traditional individual retirement accounts do not offer investment opportunities in precious metals such as gold. However, you can include gold metal in your IRA investment portfolio by establishing a self-directed IRA and purchasing qualified gold with your IRA funds. While gold can offer great returns and can balance your investment portfolio, investing in gold is not for everyone. Gold is extremely volatile . In addition, it can be difficult to value because it is an alternative investment, which means it is not offered on a public exchange. Weigh the benefits and risks of investing in gold before making a move.XResearch source

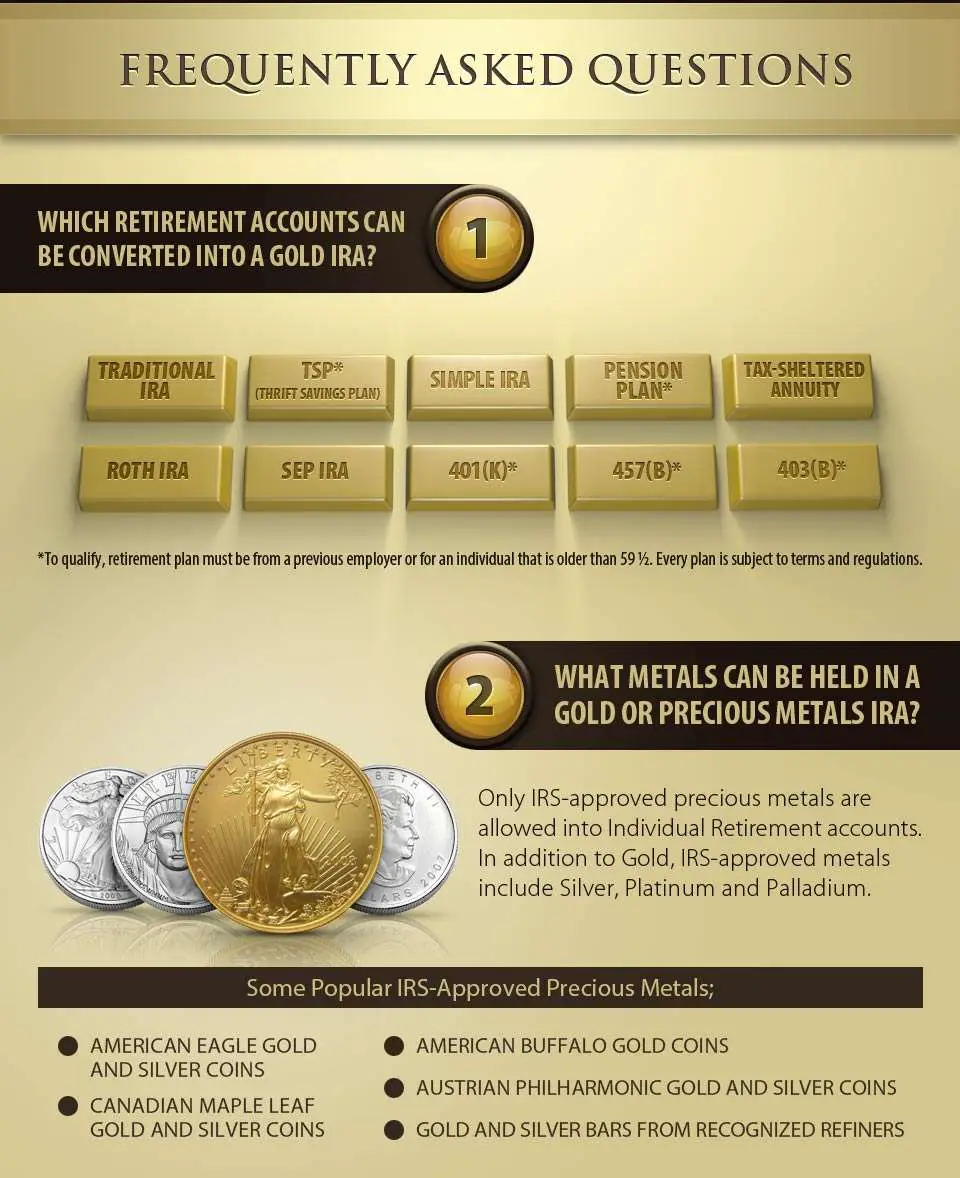

Q Can I Buy Physical Gold For My Individual Retirement Account Or 401

A. You can buy gold coins and bullion, and other precious metals*, in a self-directed IRA or 401 established with a trust company. People with retirement plans typically have a conventional IRA or 401 with a bank or brokerage firm that specializes in bank deposits, stocks, mutual funds, annuities, and other assets. In many cases, these investors have little or no say in the investments being made. A self-directed plan empowers the individual to make his or her own investment decisions and adds to the available investment options. Precious metals are among those options.

* In recent years, many IRA investors have come to view silver as a retirement asset with qualities similar to gold. USAGOLD has placed thousands of silver American Eagles and Canadian Maple Leafs with investors who believe in silvers asset preservation attributes.

|

NEWS& VIEWSForecasts, Commentary & Analysis on the Economy and Precious MetalsCelebrating our 48th year in the gold business_________________________________________________ If you are looking for in-depth, cutting-edge coverage of the gold and silver markets, our monthly newsletter might be just what you are looking for. A contemporary web-based client letter with a distinctively old-school feel. Prospective clients welcome. |

Don’t Miss: Is Kay Jewelers Real Gold

Is It Safe To Own Gold In An Ira

In retirement, you need an investment that either generates current income or is reasonably expected to appreciate in value so you can sell it in the future and use it for consumption purposes. You are essentially wasting tax-deferred space for something that does not generate income thus, it is not saving you from any taxes. Just like any other traditional IRA account, the value of the account will be subject to taxes upon withdrawal. Unlike owning stocks, mutual funds, ETFs, etc., physical gold does not generate any dividends, interest, or capital gains distributions, all of which are tax-sheltered in an IRA.

Create A Checklist For Your Gold Ira Comparison

Creating a checklist for your gold IRA company search is the best way to track your findings. Make a list and print copies so you can use it for comparison of all companies. As a summary, you are looking for an experienced gold IRA company that provides quality service, fast. They should have great customer reviews, be registered and in good standing with watchdog organizations, and be recognized at a minimum by the U.S. Mint.

Dont forget to check third party reviews websites for reviews. Trusted review sites like the Better Business Bureau can provide you with a lot of information, including how a company handles complaints.

Why American Hartford Gold is the Best of all gold IRA companies?

Of the many decisions one can take to have a sound financial future, one of the most important and dependable happens to be the choice to invest in Gold IRAs. While there are many factors that will help you make all the right calls when it comes to investing in gold and other precious metals, perhaps the most influential role is played by the company you choose to set up your Gold IRA with.

There is no lack of Precious Metal IRA companies out there but only a few have your interests in mind. American Hartford Gold happens to be the best of the best at this and here are the reasons that make it a great choice.

Long track record of success

Unbeatable prices

Buyback commitment

Free and easy IRA rollover

Free storage and insurance

Free shipping

Invest in your knowledge

Don’t Miss: Why Are Gold Prices Down

Security Levels Of Gold Iras

Though investing in precious metals comes with an inherent risk, the security measures that are put in place by companies can significantly reduce this to a bare minimum.

Youll want to look for companies that make use of the most secure storage facilities possible when it comes to your hard-earned assets.

Some of the most reliable precious metals IRA companies make use of vaults in highly secure, insured, and guarded facilities.

These could be located in geographically private areas such as islands or other remote places. Furthermore, they should be staffed by experts who will ensure that you get your assets back when requested.

The location of vaults used is also crucial as they should be far away from the companys main office, reducing the chance of them being robbed or attacked. Additionally, youll want to know how often their security systems are checked and tested to ensure that theyre up to date.

Gold IRA companies should store your physical gold in a segregated storage option to protect it from theft or damage while ensuring full documentation for all of the precious metals within the account.

This provides you with peace of mind knowing that your investments are safe and can be traded or sold at any time.

Adding Gold To An Ira

Adding gold to an IRA follows a near identical route to buying any investment bullion, especially if you usually store your gold in a vault with three exceptions:

So rather than paying your gold dealer in cash, check, credit card or bank wire you simply set up a transfer from the IRA account to the broker.

In every other respect its you who decides on which bullion bar or coin sizes to buy, and the brands or mints who produce them. Because Gold IRAs have become such a popular route to investing in gold, most bullion dealers biggest sellers are all suitable for precious metals retirement accounts.

The one downside especially for goldbugs is you dont get to physically handle the metals because they are sent directly to your depository vault however the tax savings and the high security of the vault more than makes up for this.

Read Also: 18 Carat Gold Value

What You Need To Know Before You Launch Your Gold And Silver Irahedging Economic Uncertainty In Your Retirement Plan

Setting up a precious metals IRA need not be difficult, expensive, or time-consuming. We are happy to assist you in filling out your account set-up forms. This can be done online over the phone quickly and easily. Your call is welcome. We invite you to put our forty-plus years experience in the gold business to work for you.

Account Form:IRA New Precious Metals Account or Rollover

Final Thoughts Which Gold Ira Company Is Right For You

When it comes to your retirement, a gold IRA can provide significant value that will help your golden years shine.

Your current investment situation, your retirement plan, and your future goals are all unique. Each of these gold investment companies has the expertise and knowledge to help you achieve the retirement of your dreams.

When youre ready to start the gold IRA process, you cant go wrong with these recommendations for the best gold IRA companies. The final choice, of course, is yours. Much of that comes down to your personal feeling of which firm feels like the best fit.

Mine the websites for more information, reach out to their representatives, and enjoy planning for your golden years with a gold IRA backed by solid expertise and top service at your best gold IRA company.

You May Like: Is Kay Jewelers Gold Real

What Is A Gold Ira Account

When wars were won, the first stop of the conquering nation was always the losers treasury, because thats where the gold and silver booty could be found. In todays world, precious metals are an important part of any retirement plan, due mainly to the protection they provide for other assets, particularly paper assets, like stocks, bonds, and fiat currencies.

Historically speaking, during times of economic uncertainty, panic, or devaluation, precious metals prices move in the opposite direction, thereby offsetting losses of those other assets. Additionally, precious metals tend to deliver a long-term increase in value regardless, which makes them perfect components for the long-term investment strategy of a retirement portfolio.

Gold, silver, palladium and platinum bars and rounds produced by a NYMEX or COMEX-approved refinery or national government mint, as long as they meet minimum coin fineness requirements.

The same reporting and distribution requirements apply to a Gold based IRA account, as to a regular traditional IRA. However, the metals must be in the possession of a trustee or custodian. Specifically, the trustee or custodian must be a bank, federally insured credit union, saving and loan association, or an entity approved by the IRS to act as a trustee or custodian.

401

- S & P 500

This data demonstrates that gold outperformed the stock market during this period.

Other Types Of Precious Metals Iras Offered

While gold is a popular option, there are other varieties of precious metals that can be invested in. Some companies offer silver and platinum as alternatives to the traditional gold IRA.

In addition, some companies also offer numismatic gold coins as part of their services. Some IRAs also deal with collectibles including art, oil paintings, and real estate.

You should be able to find out more about the potential of opening an additional precious metals IRA account when you request a free consultation. Ensure that you make the best use of such a consultation to ask as many questions as you can.

You May Like: Cost Of 18k Gold Per Gram

Should You Get A Gold Ira

What do you get by investing in a gold investment retirement account? You are literally turning part of your retirement nest egg into gold. That said, is putting a gold IRA in your portfolio the right move for you? Not all IRA accounts allow gold investments, but this article should help you understand what to look for in your IRA to see if it allows you to build a golden retirement egg.

What Is A Silver Ira

A Silver IRA or a Precious Metals IRA is a special type of individual retirement account that allows you to invest in physical silver in addition to the assets allowed in other IRAs. You can hold silver bars and coins in your Gold IRA, as long as they meet certain requirements, and youll enjoy the same benefits as with Traditional or Roth IRAs.

Like other IRAs, the Silver IRA is a tax-advantaged account created to help investors save for their retirement. You can set up a Silver IRA with pre-tax dollars or with post-tax dollars with the same advantages and disadvantages as either of those IRAs.

The Silver IRA, however, has one clear advantage over a Traditional IRA or a Roth IRA: Whereas typical IRAs limit your investment choices to stocks, bonds, and other paper assets, a Silver IRA allows you to invest in physical precious metals. By including physical silver in your investment portfolio, you will benefit from the protection and growth that precious metals offer.

Read Also: Free Golden Eagles War Thunder No Survey

Special Considerations For Precious Metal Iras

Because they involve the purchase and storage of valuable physical metals, you have to consider a few extra things when thinking about precious metal IRAs. Perhaps the most important is that precious metal IRAs are more expensive than other investment options, according to Drew Feutz, a certified financial planner with Market Street Wealth Management Advisors.

A precious metal IRA will have more fees than a normal IRA, including setup fees, transaction fees, custodial fees and physical asset storage fees, he warns. You cant avoid most of those fees either. You cant, for example, store precious metals youve invested in your IRA in your own home, according to IRS rules. If you do, you risk additional taxes and penalties. And even if you could, storing precious metals at home is risky. If there were a robbery, for instance, you could lose at least a chunk of your retirement savings.

Our Search For The Best Gold Iras

1. We searched for a comprehensive list of Gold IRA providers

2. We evaluated these Gold IRAs based on our expert guided buying criteria, looking for IRS-approved coins & storage options

3. We brought you the best Gold IRAs for consideration

There are dozens of gold IRAs available today, with many of them focusing specifically on retirees. Moreover, not all IRA needs are the same. So we searched the top 20 companies and narrowed the list based on our expert criteria. Then researched further to determine the best fit companies for a variety of needs. These result was a shortlist of companies that have handled precious metals IRAs for years, with thousands of satisfied customers to show for their security and customer service.

Five companies made the list for most reliable and best overall investor satisfaction. They are Lear Capital, Goldco, Orion Metal Exchange, and Patriot Gold Group. Oxford Gold Group is also a notable company to have on the radar. Here is what we did to arrive at our top gold IRA choices.

We looked at the companies you want to know about:Many of the top companies are mentioned numerous times on television, radio, and social media. These are the companies most likely to be used by consumers, so we started with these. We also referenced the lists of top gold IRA sites for new companies that you may not have heard of. Then we went a little deeper.

Also Check: How Much Is 5 Grams Of Gold

What Is A Precious Metal Ira

A precious metal IRA is a special form of self-directed individual retirement account. Self-directed IRAs allow you to invest in a broad variety of unconventional assets, including precious metals, real estate and even cryptocurrency. These are beyond the usual options available in a conventional IRA, though they have virtually identical traits outside of this, including the same contribution limits.

According to Kelli Click, president of the STRATA Trust Companya self-directed IRA custodian that specializes in gold and other metalsprecious metal IRAs are an avenue some people use as part of their retirement plan because gold, silver and palladium have historically grown in value over the very long term.

Adding gold or precious metals to your retirement account may help protect your wealth in several ways, including reducing your potential investment volatility and risk, serving as a hedge in the event of an economic downtown and providing a tax-efficient shelter for potential gains, she says.

Benefits Of A Gold Ira Account

The reason for creating a Gold IRA account is three-fold. First of all, gold and other precious metals have a history of long-term appreciation. Secondly, gold and other precious metals are universally accepted money that has never become worthless, unlike every fiat currency throughout history. And finally, gold and other physical precious metals are the ultimate hedge against potential losses by other popular investments like stocks, bonds, and currencies, because historically speaking, when most other investment vehicles collapse or flounder, precious metals appreciate and excel.

Another tremendous advantage of a Gold backed IRA is the ability to convert principal and profit from investments on a tax-free basis. When a raging bull market runs out of gas and begins to sputter, physical gold and other precious metals increase in value, while equities and other investments falter. Investors have the opportunity to capture principal and profit from high priced equity investments and acquire precious metals at bargain prices. When a major correction occurs, investors have the inverse opportunity, to capture principal and profit from their precious metal investments and reacquire stocks, bonds, and currencies at bargain prices. And all of this occurs on a tax-free basis, until it is needed for retirement, when investors are in a lower income tax bracket.

Don’t Miss: Cost Of 10 Grams Of Gold

What Is Segregated Vs Non

SEGREGATED STORAGEThe exact metal you purchased is what you receive if you sell or do an in-kind distribution.

NON-SEGREGATED STORAGENon-segregated means the purchased metal is mixed with similar metals. If you sell the metals or do an in-kind distribution, you might receive different metals. Instead, you may receive a like metal. For example, you buy one ounce of 2015 American Gold Eagle coins with a non-segregated account. You sell or do an in-kind distribution. You might receive different 2015 American Gold Eagle coins than the ones purchased. Or, you might receive an American Gold Eagle coin of a different year. For example, one ounce of 2018 American Gold Eagle coins.