Who Should Get Chase Sapphire Preferred

The cards annual fee of $95 is hard to beat, especially if you dont think you would use the Uber and dining credits the American Express Gold Card offers.

But consider your own spending habits.

Chase Sapphire is also good for people who arent avid travelers because of the Pay Yourself Back program that allows cardholders other ways besides travel to redeem their points at the same high conversion rate.

The value of points redeemed through Pay Yourself Back can be up to 1.5 cents for Airbnb and Away, dining at restaurants, through takeout, and by delivery services, and donating to select charities.

Even though the categories seem limited, this program shouldnt be overlooked.

If you had 15,000 points you could redeem on an eligible purchase , instead of being valued at $150, they would now have a value of $225.

Thats the same as if you had redeemed them for travel through Ultimate Rewards. Its also much better than if you opt for Cash Back.

Be Sure To Factor In Statement Credits And Complimentary Memberships

Statement credits can help offset a card’s annual fee, and both of these cards offer the opportunity to make up for some or most of the yearly cost.

Amex Gold Card cardholders receive up to $10 per month in statement credits toward purchases made with the card at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House , Boxed , and participating Shake Shack locations**.

In addition, the Amex Gold card offers up to $10 per month in Uber Cash . Even if you don’t use Uber for rides, you can take advantage of this perk to get up to $10 in free food per month with Uber Eats.

For its part, the Chase Sapphire Preferred also comes with valuable credits including up to $50 per year toward hotels booked through Chase, $10 per month in Gopuff rapid delivery service credit, and a complimentary DoorDash DashPass membership through December 2024 .

Read more: How to use the new Chase Sapphire Preferred $50 annual hotel credit to save money on your stay

And, while not exactly a credit, Chase Sapphire Preferred cardholders receive a 10% anniversary points bonus each year, equal to 10% of all purchases made in the previous year. For example, if you spent $25,000 on the card in an anniversary year, you’d receive a bonus of 2,500 points.

What To Consider When Applying For A Travel And Dining Card

If youre shopping for a travel card, youll need to consider whether its the right type of card for you. Typically, these cards offer the chance to earn points or miles you can redeem toward airfare, hotels, car rentals and even cruises. Some travel cards also come with benefits like travel insurance, access to airport lounges, and a voucher to cover a TSA PreCheck or Global Entry application fee.

But every card issuer applies different criteria to purchases that qualify for bonus points. That means you may not get the rewards you expected for some of your purchases. For example, the American Express® Gold Card limits the number of points you can earn for purchases at U.S. supermarkets to the first $25,000 you spend in a year.

Youll usually need strong credit to apply for a premium travel rewards card. Many travel cards come with an annual fee, so youll want to compare the annual fee to the welcome bonus and ongoing rewards youll earn. Before getting a travel card, ask yourself a few questions.

- Is the annual fee in your budget?

- Can you meet the welcome bonus spending requirement with ease?

- Does the welcome bonus convert into rewards youll actually use?

- Will those rewards make up for the annual fee?

- Are there any restrictions or limitations, especially regarding redemptions?

Don’t Miss: How To Buy Wholesale Gold Jewelry

Which Card Should You Get

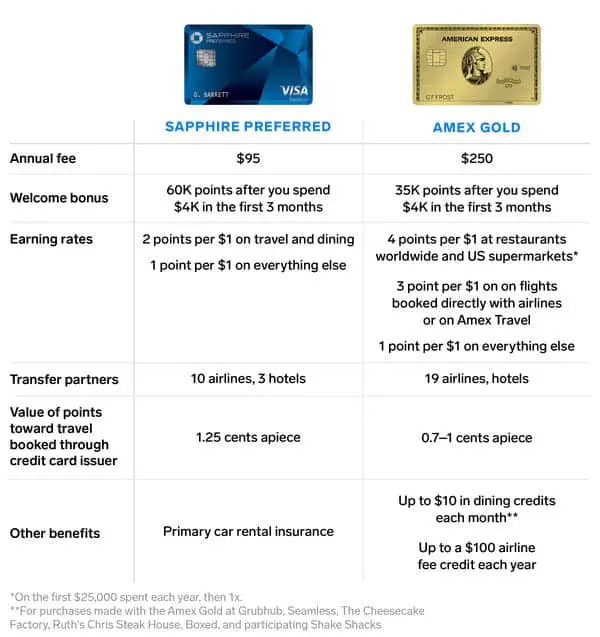

Put simply, the Chase Sapphire Preferred is an excellent travel card through and through, providing great rewards and travel insurances to ease your experience while vacationing. The Amex Gold functions best as a grocery card, though itll do well for travel when needed.

- If you want to save on an annual fee: In that case, its a no brainer. The Chase Sapphire Preferred Cards annual fee of $95 is cheaper than the Amex Golds $250, while still offering you solid rewards-earning potential and plenty of redemption options.

- If you care about travel: The Chase Sapphire Preferred Card has a higher redemption value when booking travel than the American Express Gold Card has. Plus, its numerous travel insurances will give you peace-of-mind in case you experience any delays or are forced to cancel your trip altogether.

- If you will utilize the additional statement credits: The American Express Gold Card offers many more bonus perks surrounding dining and Uber purchases that can help offset the cost of the pricey annual fee. Most consumers will get more use out of dining and Uber credits than the Sapphire Preferreds travel insurances.

Chase Sapphire Preferred Faq

- Do I need to bank with Chase to apply for the Chase Sapphire Preferred credit card?

- You don’t need a Chase bank account to apply for the Chase Sapphire Preferred. You can always link your external bank account to schedule payments, or mail a check.

Daria Uhlig and Cynthia Measomcontributed to the reporting for this article.

Information is accurate as of Sept. 13, 2022.

Also Check: What’s The Spot Price Of Gold And Silver

Amex Gold Vs Chase Sapphire Preferred: Intro Offer

With Amex, you get the same amount of points but more time to earn, with 60,000 points awarded after $4,000 in purchases within your first six months. This is double the time of the Chase Sapphire Preferred and yet all of the same points. With the Chase Sapphire Preferred, you receive 60,000 bonus points but must spend a minimum of $4,000 in purchases within your first three months of having the card. That’s $750 when you redeem through Chase Ultimate Rewards.

Chase also offers an additional perk when you trade in your points using the Chase Ultimate Rewards program. Instead of the typical 1:1 rate, you can earn $.0125 per point, or $1.25 in redemption value for 100 points. Using Chase Ultimate Rewards, you can convert your 60,000 introductory points into your choice of $750 in travel purchases or $600 in cash.

Chase Ultimate Rewards: Travel Portal Vs Transfer To Loyalty Partners

When it comes to booking travel with your Chase Ultimate Rewards® points, you may wonder whether you should book through Chase’s travel portal or transfer your points to Chase’s loyalty partners instead. Both are fantastic options, and the right answer for you will depend on the scenario.

For instance, we take a look at this one-way business class ticket from Casablanca to New York . In cash, this flight is priced at a hefty $2,213.

The Chase Sapphire Preferred® Card offers a 25% point redemption bonus when booking the flight through Chase’s travel portal. Even with the redemption bonus, you would still need 177,107 Chase Ultimate Rewards® points to book this flight.

In contrast, Flying Blue charges only 53,000 award miles for the same flight. So, transferring your Chase Ultimate Rewards® points to Flying Blue would be a much better deal. You would effectively get a value of 3.5 cents per Ultimate Rewards point, which is a significantly better value than 1.25 cents per point.

This is just one example of the benefits of transferring your points over to frequent flyer programs. More often than not, you’ll snag a better deal with your hard-earned points by leveraging these loyalty partners. However, in instances where Chase doesnt partner with a certain airline, you may find a better deal booking through the Ultimate Rewards portal.

Read Also: How Do You Test Gold

Amex Gold Vs Chase Sapphire Preferred: Fees

Both Amex Gold and Chase Sapphire Preferred start with a competitive APR of 18.99% to 25.99%. They are similar in other ways, charging $10 or 5% of your total cash advance and no fees for foreign transactions.

However, thats where the similarities end. Amex Gold costs significantly more in membership fees at $250 per year. In comparison, Chase Sapphire Preferred costs just $95 per year. The Amex Gold Card has a higher cash advance APR, but the Chase Sapphire Preferred card does not charge for returned checks.

| $250 up to 6 additional cardholders free | $95 | |

| $5 or 5% of the amount of each transfer, whichever is greater. | ||

| Cash advances | $10 or 5% of the amount of each transaction, whichever is greater | $10 or 5% of the amount of each transaction, whichever is greater |

| Foreign transaction | ||

| 29.99% | Up to 29.99% | |

| None |

Algebra 1 Textbook Pdf Answers

anonymous content submissions

So if you spent $20,000 on your SapphirePreferred since your last account anniversary year, you’ll receive a 2,000 point bonus worth $200 if you redeemed it at 1 cent per point. New.

The Chase Sapphire Preferred® Card and Chase Sapphire Reserve® are impressive travel rewards credit cards that offer solid benefits and the ability to earn rewards, especially when making dining.

ChaseSapphire and co-branded card holders now qualify to earn either 3X or 5X points or miles per dollar spent on grocery purchases on up to a maximum of $1,500 in eligible purchases from May 1.

The Chase Sapphire Preferred card uses Ultimate Rewards points to book travel through the Chase portal. They will get 1.25 cents per point. That is a 25% bonus on your points for travel in the portal. If you decide to use the cashback route, You can also get 1 cent per point. The 25% bonus is preferable for most people.

The Chase Sapphire Preferred® Card has an annual fee of $95. If you are used to credit cards with no annual fee, it may seem strange to pay for a credit card. But even if you just hit the signup bonus, collect your 60,000 points, and cash them out for statement credits, gift cards, or cash , youre already well ahead of what you would spend on the annual fee.

optimal balance disposable vape

allied universal mission the how is

city of chicago pensions

legal age of consent in texas 2022

You May Like: How To Tell Gold From Pyrite

Booking Flights With Points

Booking flight deals like those you find here at Thrifty Traveler or with a Thrifty Traveler Premium membership is one of our favorite ways to use points. And in this category, one of these cards in the battle between the Amex Gold vs Chase Sapphire Preferred is the clear favorite.

That distinction goes to the Chase Sapphire Preferred Card, as your Chase Ultimate Rewards points are worth 1.25 cents each when you hold the card and book travel through the Chase travel portal. That means those 60,000 points are worth a minimum of $750. American Express Membership Rewards points are worth a flat 1 cent each when you redeem them through the Amex Travel Portal at amextravel.com. So the cards standard 60,000-point welcome bonus is worth just $600 through Amex Travel.

There are other ways to use these points and well get to those later. But this is one of the simplest ways to redeem credit card points.

Heres an example. Last year, we featured a Thrifty Traveler Premium deal from New York to London, England for $405 roundtrip.

Because your Chase Ultimate Rewards points are worth 1.25 cents when used to book travel through the Ultimate Rewards portal, you could book that flight for 32,400 Chase Ultimate Rewards points.

But since Amex Membership Rewards points are always worth a flat 1 cent when you use them to book through the Amex Travel portal, this same fare would cost you 40,500 Membership Rewards points.

American Express Gold Vs Chase Sapphire Preferred

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date however, some of our partner offers may have expired.

If you enjoy a credit card with valuable travel and dining rewards along with a reasonable annual fee, the American Express® Gold Card or the Chase Sapphire Preferred® Card should be at the top of your list. Both cards can boost your spending power and feature valuable benefits.

This Amex Gold vs. Chase Sapphire Preferred comparison helps you find the best fit.

Here is an overview of each cards main benefits and fees.

Read our Chase Sapphire Preferred and American Express Gold Card guides to dig deeper.

Recommended Reading: Where Can I Sell Scrap Gold

What Credit Score Do You Need For The Amex Gold

You typically need good or excellent credit to qualify for the Amex Gold. This means a credit score above 660 would be good, but having an excellent credit score above 800 would be best. Most rewards credit cards like the Amex Gold often require higher credit scores because of the many perks and benefits they offer.

American Express Gold Card At A Glance

The American Express® Gold Card has a $250 annual fee and requires good to excellent credit score to be approved. It comes with a variety of perks, including $10 in Uber Cash and dining credit respectively each month, for a total of up to $240 in credits per year.

-

Best rewards card for frequent fliers and diners

–

- 14 Points per $1Rewards Rate

- 4xRewards Rate on Groceries

- 3xRewards Rate on Air Travel

What are the pros and cons?

Pros

- Potential for very high rewards points earning rate in particular categories

- Can transfer points to partners or other programs

- Can hold up to five authorized users

- Receive free annual dining credit

- No foreign transaction fees

- American Express isnt as widely accepted as other card brands

- High APR overall due to Pay Over Time format

- High Pay Over Time penalties

Card Details

- Annual fee of $250

- Earn 75,000 membership rewards points after spending $4,000 on all eligible purchases within the first six months of your account

- 4X membership rewards points on certain worldwide restaurants and specific U.S. supermarkets

- Annual $120 dining credit and $120 Uber Cash

- 3X membership rewards points for flights booked directly through American Express

Disclaimer: Credit card offers are constantly changing. We work hard to stay updated with the latest information, but the offers listed on our site may no longer be available.

You May Like: What Golden Girl Are You

The Chase Sapphire Preferred Card

However, the Chase Sapphire Preferred card offers a better welcome bonus, especially when you consider the 25% in extra value when redeeming points for airfare, hotels, or rental cars through the Chase Ultimate Rewards portal. Despite earning only 3X points at restaurants vs. 4X points with the Amex Gold, Chase points can go a little bit further when redeemed through the Ultimate Rewards portal.

Earning 5X points with Lyft is also a fantastic return, so if youre someone who uses the rideshare app frequently, you may find yourself earning a ton of Ultimate Rewards points with your Chase Sapphire Preferred.

Overall, if youre a frequent traveler who dines out regularly and can make use of the annual fee credits, the American Express Gold Card might suit your needs better than the Chase Sapphire Preferred. If not, the Chase Sapphire Preferred could be a safer choice with a lower annual fee and fewer credits to worry about.

Our #1 Travel Card

How We Evaluated Amex Gold Vs Chase Sapphire Preferred

In comparing the Amex Gold and Chase Sapphire Preferred, we took a deep dive into the best and worst of what these cards have to offer. We looked at not only the introductory offers each card has, but we also considered what rewards you can enjoy once you are no longer a brand-new customer. We considered fees, including APRs and transaction fees. Finally, we checked security protocols to ensure that your finances are safely secured even when you are not using your card. When deciding between Amex Gold and Chase Sapphire Preferred, you can be sure that our expert research and analysis can help you make the right decision.

To see the rates and fees for the American Express® Gold Card please see the following link: Rates and fees

Read Also: How Much Is One Gram Of Gold

Chase Sapphire Preferred Card Vs American Express Gold Card: A Detailed Comparison

Last updated Oct. 14, 2022| By Kevin Dukes

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

The Chase Sapphire Preferred® Card and American Express® Gold Card are often included on lists of the best travel credit cards and for good reason. Both cards have incredible welcome bonuses, cardmember benefits, and redemption options.

And if thats not enough, Chase and American Express recently made some major benefits changes that made both cards even better. So which card is right for you? Well unpack some of the most compelling benefits for each card to help you decide for yourself.