What Should You Look For When Investing In Gold

Once you understand how spot prices of gold work, how can you determine the best route to purchasing it? Should you observe the long-term directions golds been going in or the short-term, spot price trends? The truth is you should be following both.

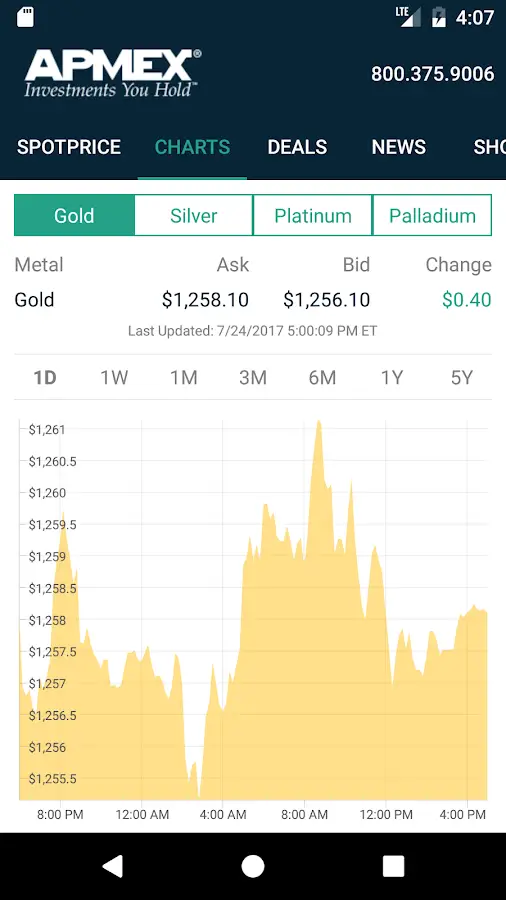

While you cant purchase gold from its spot value, you can check with the U.S. Money Reserve or the stock market to find how the spot prices fluctuate. If youre looking to trade gold, check with the spot prices to see when your next move is. Even though you cant buy from the spot price, its crucial to consider how these prices fluctuate on a daily basis to understand their market value. Dont let the fluctuation in spot prices intimidate you when investing in precious metals, such as gold.

If youre looking to invest in gold for the sake of investment growth, its best to observe the long-term trend in gold. Although you should always consider the spot pricing of gold, keeping up with the long-term market trends will give you a better feel of the market history. Over time, gold prices will fluctuate just as other commodities do on the market.

Its important to understand that the value of gold will experience long and short-term effects from the market, but this doesnt mean you shouldnt invest. When looking to invest in gold for value growth, its critical to observe the overall market trends instead of daily spot prices. These long-term market trends will give you a good idea of how your investment will change over time.

Importance Of Silver Spot Price

The silver spot price is the amount you can expect to pay for 1 oz. of silver, on any given day. Like all investments, the ROI is dependent on the initial silver price you pay, so make sure to buy low. Track the changing live spot price of silver with our silver price ticker. It runs 24/7 and provides actionable insight into the trending price of silver. Hover over any point in time to observe the price of silver from any particular day. Monitoring the price of silver can also offer insight into economic events and potential market crashes. Keeping up to date on the price of silver and precious metals is an important habit for wise investors globally.

Gold And Silver Move Higher Ahead Of The European Open

Kitco News

– Gold and silver are both trading higher as risk sentiment shifted positively overnight. In the rest of the commodities complex, copper and spot WTI are also trading in positive territory as commodities catch a bid.

Indices also moved higher overnight as the Nikkei 225 , ASX and Shanghai Composite all moved into the black. Futures in Europe are also pointing towards a positive cash open.

In FX markets, the dollar index is down 0.26%. The biggest mover overnight was USD/JPY which fell 0.86%. In the crypto space, BTC/USD is trading at $23,155.

News from overnight:

Summary of what happened with the Fed rate decision .

BoJ’s Amamiya: Fed policy decision has no bearing on BOJ policy moves.

BoJ Deputy Governor Amamiya: BOJ must support the economy with monetary easing.

People’s Bank of China mobilizing US$148bn property developer bailout.

China is to conduct military drills in the South China Sea Friday and Saturday.

North Korean dictator Kim Jong Un has spoken about his readiness to go nuclear against the South and the U.S.

Hong Kong’s central bank raises its base rate by 75bps .

RBNZ says the Funding for Lending Programme working as planned, and will stay ’til December.

German North Rhine Westphalia July CPI 7.8% vs 7.5% y/y prior.

NZ July business confidence -56.7 .

Read Also: What Does Xbox Gold Do

Different Types Of Numismatic Silver Coins

Many collectors of numismatic silver bullion coins prefer to diversify their coin holdings with minted silver coins from around the world. These reputable numismatic silver coins can be purchased at different prices, such as: Canadian maple leafs, American silver eagles, Australian Perth mint silver coins, Chinese silver pandas, Austrian silver philharmonic coins, British silver coins, African silver coins& Mexican silver libertads.

Silver numismatic bullion coins are another option for coin collectors and come in many different forms & prices. Silver numismatic coins offer investors rare products that carry a premium well above those of common silver bullion coins. Numismatic Silver coins include products such as Morgan Silver Dollars, Carson City Silver Dollars and Peace Silver Dollars, with varying conditions ranging from Circulated all the way up to MS-64, MS-65 and MS-66. The prices vary significantly depending on the coin and the grading. Investors should always do proper research before purchasing these coins.

Gold Premiums On Gold Bullion Bars And Gold Bullion Coins

As the worlds physical gold markets are price takers that use the international gold price as established on the London OTC and COMEX gold markets, these physical gold markets take in the gold spot price feeds as discovered on these international gold markets.

Prices for gold bars and gold coins therefore reflect the spot gold price but additionally they also contain a premium which is that part of the gold bar or gold coin price in excess of the gold value of the gold metal contained in the gold bar or gold coin.

The gold price premiums are based on a number of factors such as gold refining, gold fabrication and minting costs and other costs of the refiner or mint, for example, distribution, insurance and marketing, and in some cases precious metals wholesaler costs. Some of the most popular gold bullion coins that derive their prices from the international spot price of gold are the Canadian Gold Maple Leaf from the Royal Canadian Mint, the Australian Gold Kangaroo Nugget from the Perth Mint, the Gold Brittania from the Royal Mint, the Gold Philharmonic from the Austrian Mint, the American Gold Buffalo from the US Mint, and the Chinese Gold Panda from the Chinese State Mint.

You May Like: How To Buy Stock In Gold And Silver

Whats The Difference Between An Ounce And A Troy Ounce

The troy ounce is the standard unit of measurement used for precious metals like gold and silver. A troy ounce, when converted into grams, is equal to 31.103 grams, which is heavier than the traditional ounce, equal to 28.349 grams.

A troy ounce is approximately 10% heavier than a regular ounce. An avoirdupois ounce, or traditional ounce, can be converted into a troy ounce by simply dividing it by 0.91. However, for every troy pound, there are only 12 troy ounces, making a troy pound lighter than a regular pound, which is 16 ounces. It can be confusing, but this is the standard for measuring precious metals like gold and silver.

Why Do Gold And Silver Prices Fluctuate

Like other investment assets, gold and silver are prone to price swings based on investor sentiment. They can also fluctuate due to trends in underlying supply and demand fundamentals.

Traders determine gold spot prices on futures exchanges. Metals contracts change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price.

A hundred years ago, gold sold for just $20 per ounce. In recent years gold has traded between $1,200 and $1,900 per ounce. Thats a huge move up in nominal terms over the past century. Yet in real terms gold prices today arent much different from what they were when they were last quoted at $20 an ounce.

Its not that gold has become so much more expensive. Its that the currency in which gold prices are quoted has depreciated so much.

Recommended Reading: Where To Do Quantiferon Tb Gold Test

Do Gold And Silver Prices Move Together

Yes, in general, the prices of gold and silver tend to trend in the same direction. Silver is the more volatile of the two metals and therefore tends to amplify golds moves on both the upside and the downside.

That said, there are periods when silver may decouple from gold. For example, a physical shortage particular to the silver market could cause silver prices to skyrocket independent of gold. And in the event of a financial crisis, gold may benefit from its safe-haven status while silver suffers from a hit to industrial demand.

Can You Buy Gold At The Spot Price

Not likely. As noted, the spot price is determined by the action in the futures market. It is for unfabricated metal . There are value-added costs involved in transforming molten metal into a gold or silver coins, small bars, or jewelry. So premiums are charged along the way: by the refiner, the fabricator who manufactured the product, and the dealer who procures and sells the product.

Your cost will depend on the form of gold you buy.

What Is a “Premium?”

A premium is the amount over spot price that you pay. It is the sum of the additional fees charged to consumers for the services of refining, molding, fabricating, and handling precious metals.

The lowest-premium items are bars, which can be either poured or stamped. Coins and rounds carry slightly higher premiums, since they have more intricate designs and are always stamped. Gold jewelry tends to carry the highest premiums, given the craftsmanship involved .

All dealers charge a premium over the spot price. Heres how to find a reputable dealer with competitive premiums, along with advice on what to buy.

How Does the Gold Market Differ From the Stock Market?

The stock market involves the trading of stock, the transfer of shares from sellers to buyers. For the most part, buyers want to own that stock in their account until they sell it for a higher price. This holding period can be measured in seconds, decades, or any time period in between.

Read Also: What Is The Current Value Of Gold

Gold As An Investment

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

Troy Ounce Or Avoirdupois Standard Ounce

A troy ounce is not the same as a standard ounce, or what is referred to as the avoirdupois ounce. A single troy ounce measures out to be one-tenth heavier than a standard avoirdupois ounce, and it has been set as the international standard since the days of global trading in precious metals began.

This unique measurement has direct implications on your investment decisions, as some websites measure in ounces rather than troy ounces. Always be sure to make the change into troy ounces before deciding on an investment. If you are measuring in grams, be advised that one troy ounce is equal to 31.1035 grams.

Read Also: How Much Is One Brick Of Gold Worth

If The Gold Price Is Always Changing How Do I Lock In A Price

Precious metals dealers have a number of procedures in place to lock in an exact price on gold products in accordance with existing price levels. Such procedures differ quite dramatically from one precious metals dealer to the next. To lock prices with MyGold, you will be required to complete full payment within the time specified in your purchase order. There is a brief window of time to lock rates as gold prices and foreign exchange rates are constantly moving. This window can close in as little as 5-10 minutes as the price of gold is quite dynamic.

Why Does Gold Trade Effectively 24 Hours A Day

Gold trades around the clock as people are willing to buy and sell at just about every hour of the day and night. Furthermore, precious metals refineries, large gold mints, gold traders and bullion distributors, are located across the globe in different time zones. The freedom to trade gold 24/7 makes the market for this precious metal that much more liquid.

Read Also: Does Gold Go Up With Inflation

What Factors Can Make The Spot Price To Go Up Or Down

Many factors influence the habits of buyers and sellers of precious metals. Silvers price tends to be more influenced by industrial demand, due to the many applications for which it is used . Gold has some industrial uses, but is overwhelmingly purchased for investment . The catalysts that have the greatest impact on spot prices are:

Why Do People Say the Price of Gold Is Manipulated?

The short answer: because it is. A short answer, however, may not be a simple answer, and thats the case here. Many, many words have been written about manipulation of the gold price. There is far too much available material to hit more than just a few of the high points.

The short answer is correct because ALL markets are manipulated, according to the most basic definition: trading with the intent of influencing a price and succeeding. Such an effort may be illegal, as with the LIBOR rate-fixing scandal. Or it may be legal, such as George Soross attack on the British pound that made him a fortune. Or it may fall into the gray area in between, such as when short sellers stage a coordinated attack on a companys stock price.

These big banks are in business to make money, period. It is to their advantage to push prices around to ensure that they make a profit. Because of their size, and the size of their contracts, they have a huge impact on the supply/demand equation, where the buyer of 10 coins from his or her local dealer has none.

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Also Check: What Time Does Gold Market Open

Price Predictions For Gold And Silver

Gold and silver prices dont rise or fall for the same reasons that stock prices do. In general, gold is inversely correlated to the stock market. Precious metals are a historical safe haven, so if investors get skittish about stocks or fearful of what could happen in that market, they tend to buy gold, pushing its price higher. Conversely, if investors are confident that the stock market will rise, thats where theyll invest the gold price tends to fall.

Gold and silver performance depends on more than just the stock market, though. Since precious metals are, among other things, a store of value, their prices tend to rise when times are tough, whether those tough times be economic, monetary, financial, or geopolitical in nature. History also shows they perform well when inflation climbs.

In addition, gold and silver are money, and a hedge against financial catastrophe. If worse comes to worst if there is hyperinflation and a loss of confidence in fiat currencies precious metal coins will be one of the only methods of payment nearly universally recognized as having real and permanent value, and are likely to be accepted in exchange for goods and services.

Etf Prices Vs Precious Metals Prices

Prices for ETFs are easily confused with the spot prices of physical gold. But they arederivative investments. While the fund may buy and sell physical gold or silver bars,the shareholders, with exception for a small and select group who hold a specialdesignation, have absolutely no claim on the bars held by the fund. And transaction andmanagement fees gradually chip away at the share price which means, over time, ETFprices fall relative to the market price of the metal held inside the fund.

There are also ETFs which specialize in the shares of precious metals mining companies.The XAU is one such holding stocks in primary gold producers. Once again you should notbe confused into thinking the XAU price is the same as the gold spot price.

Also Check: Do You Need Xbox Live Gold To Play Online

What Were Gold And Silver Prices In 1986

After peaking in January 1980, gold and silver prices moved sharply lower over the following two years before basing out in the mid 1980s. By 1986, gold had found a floor around $300/oz.

A rally ensued through 1987, but it proved to be fleeting. Gold prices fell back into a long, protracted trading range. The market finally bottomed out from 1999-2001 before embarking on a multi-year secular upleg.

Current Gold & Silver Prices

Study the changing price of silver with our interactive silver price charts. Use our helpful silver price chart data to gain insights into the future price of silver. Simply make a selection with the sliders and observe the price of silver over any period of time. Observe silver prices on any particular day by hovering over a point in the silver prices chart.

Silver prices are volatile, and change every minute of every day. Stay up to date on the current price of silver and use our information to your advantage when it comes to your silver investments.

You May Like: Which Gold Bar Brand To Buy