The End Of The Gold Standard: The Last Bastion Falls

Switzerland was one of the few places to buck this trend and maintained use of the Gold standard right up till May 1st 2000. Remaining neutral during World War 2 made it possible for Switzerland to keep hold of its gold reserves and even to profit during the war to stockpile more ensuring it had a large stock of gold when compared to the size of its population.

Even during and after the great depression, the US managed to keep hold of the majority of the worlds gold reserves. In 1944, an agreement was put in place that set the exchange rate for all currencies and gold and it was at this time the US was able to price the Dollar against its reserves. With the US holding the majority of the worlds gold supply it became easier for most of the rest of the world to start to price their currencies against the dollar instead of gold. The result of this was that currency was no longer tied to the price of gold but to the price of the dollar. The US dollar rose in value and became the standard world currency used.

This presented major issues, as with such an influx of demand for dollars, and eventual pegging of currencies to the dollar, the value of dollars drastically outsized the value of the USs gold reserves, which gives you the current funny-money nonsense system we have today where The USs debt can be nearly unserviceable without issue and the FED can create most recently over 100 billion dollars a day without the dollar evaporating.

Gold Standard 20th Century

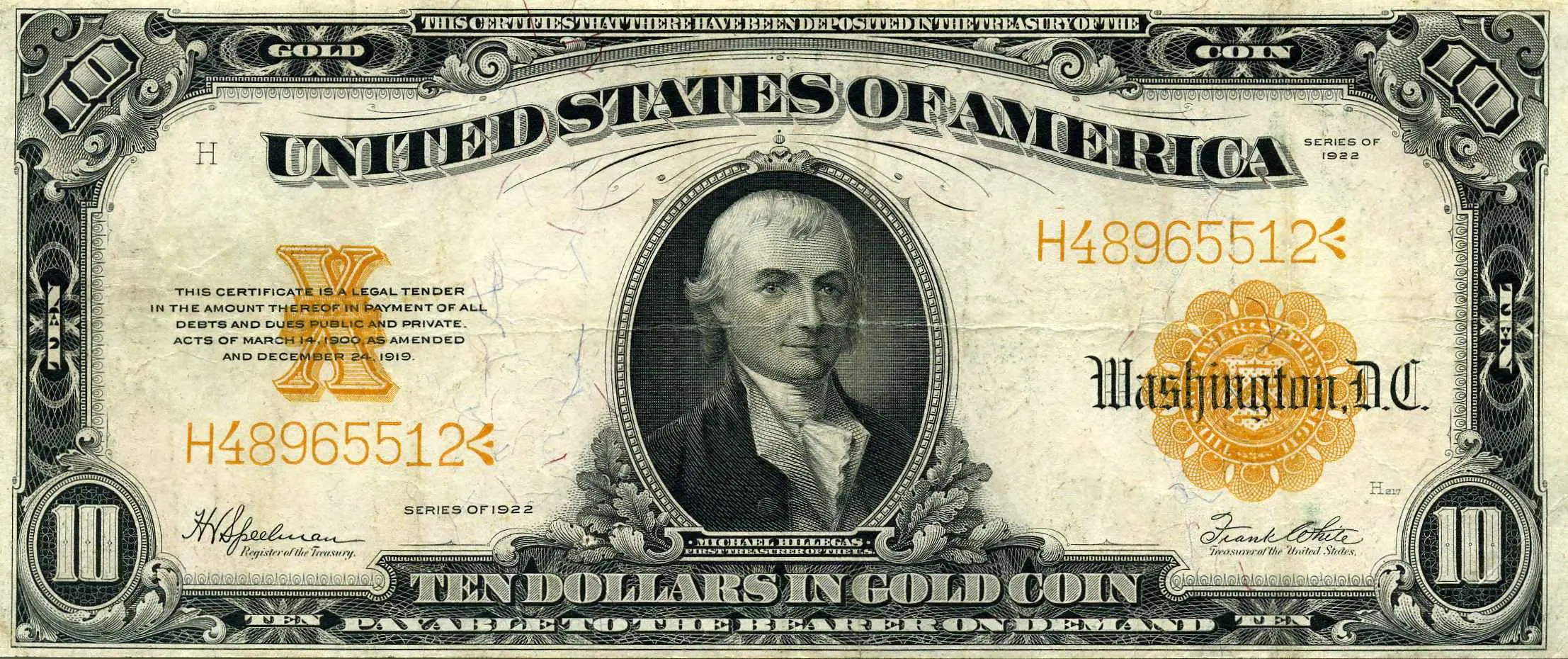

Though the dollar came under the gold standardde jure only after 1900, the bimetallic era was ended de facto when the Coinage Act of 1873 suspended the minting of the standard silver dollar of 412.5 grains, the only fully legal tender coin that individuals can convert bullion into in unlimited quantities, and right at the onset of the silver rush from the Comstock Lode in the 1870s. This was the so-called “Crime of ’73”.

The Gold Standard Act of 1900 repealed the U.S. dollar’s historic link to silver and defined it solely as 23.22 grains of fine gold . In 1933, gold coins were confiscated by Executive Order 6102 under Franklin D. Roosevelt, and in 1934 the standard was changed to $35 per troy ounce fine gold, or 13.71 grains per dollar.

After 1968 a series of revisions to the gold peg was implemented, culminating in the Nixon Shock of August 15, 1971, which suddenly ended the convertibility of dollars to gold. The U.S. dollar has since floated freely on the foreign exchange markets.

Us Dollar Value Vs Gold Value

The sudden jump in the price of gold after the demise of the Bretton Woods accords was a result of the significant prior debasement of the US dollar due to excessive inflation of the monetary supply via central bank coordinated fractional reserve banking under the Bretton Woods partial gold standard. In the absence of an international mechanism tying the dollar to gold via fixed exchange rates, the dollar became a pure fiat currency and as such fell to its free market exchange price versus gold. Consequently, the price of gold rose from $35/ounce in 1969 to almost $500 in 1980.

Shortly after the dollar price of gold started its ascent in the early 1970s, the price of other commodities such as oil also began to rise. While commodity prices became more volatile, the average price of oil as expressed in gold remained much the same in the 1990s as it had been in the 1960s, 1970s and 1980s.

Fearing the emergence of a gold-based economy separate from central banking, and with the corresponding threat of the collapse of the U.S. dollar, the U.S. government approved several changes to the trading on the COMEX. These changes resulted in a steep decline in the traded price of precious metals from the early 1980s onward.

Recommended Reading: How To Get Tinder Gold Free Trial

The End Of The Gold Standard: World War 1

During World war 1 the UK started the trend as the first large economic nation to suspend the use of the gold standard so they could be more flexible with currency and and stimulate the economy.

In non-financial speak this means their economy was contracting due to a lower over-all economic output and prosperity due to the war and wasted resources put to the war-effort, and the government began to lack the surplus to continue fighting the war as bond-raising dried up for the war-effort, so they decided to extract wealth from their citizens without directly increasing tax rates or issuing bonds to its citizens through literally printing money and thus debasing from the existing currency in their society.

It was 1930 when the UK finally dropped the use of the gold standard for good in favor of a fiat-system. This managed to save themselves from experiencing a depression to the depth of the US Great Depression. The UK was able to stimulate their economy and their currency without the reliance on how much gold they had or could buy. This is what you may call kicking the can down the road normal person speak.

What Are The Downsides

A fixed link between the dollar and gold would make the Fed powerless to fight recessions or put the brakes on an overheating economy. If you like the euro and how its been working, you should love the gold standard, said economist Barry Eichengreen. Beleaguered Greece, for instance, cannot print more money or lower its interest rates because its a member of a fixed-currency union, the euro zone. A gold standard would put the Fed in a similar predicament. Gold supplies are also unreliable: If miners went on strike or new gold discoveries suddenly stalled, economic growth could grind to a halt. If the output of goods and services grew faster than gold supplies, the Fed couldnt put more money into circulation to keep up, driving down wages and stifling investment.

Read Also: Selling Gold Dental Crowns

Economic Function Of Legal Tender

Legal tender serves several purposes. By default, it is used by market participants to fulfill the functions of money in the economy: a medium of indirect exchange, a unit of account, a store of value, and a standard of deferred payment.

Proponents of legal tender laws argue that to produce the optimal type, quality, and quantity of money and that legal tender enhances the usefulness of money as a means to reduce transaction costs. Specifically, having a legal tender can allow flexibility in the money supply and a single currency can eliminate the transaction costs associated with the use of multiple competing currencies. The imposition of legal tender is one way to achieve a single currency.

The legal tender also makes monetary policy possible. From the point of view of the issuer, legal tender allows the manipulation, debasement, and devaluation of the currency by the issuer to obtain seigniorage and facilitates the issuance of fiduciary media by the banking system to meet the needs of trade.

In the absence of legal tender laws, Gresham’s Law would make monetary policy, seigniorage, currency manipulation, and fiduciary media issuance much more difficult as good money tends to drive out bad money in that case.

What Is Legal Tender

Legal tender is anything recognized by law as a means to settle a public or private debt or meet a financial obligation, including tax payments, contracts, and legal fines or damages. The national currency is legal tender in practically every country. A creditor is legally obligated to accept legal tender toward repayment of a debt.

Recommended Reading: Banned For Buying Gold Osrs

President Nixon Breaks The Link

Through the years of 1961 1971 the Federal Reserve had nearly doubled the supply of U.S. dollars with excessive money printing. The Nobel laureate Robert Mundell noted, monetary expansion was more rapid than in any comparable period in a quarter century.

Shockingly, foreign central banks and governments soon realized they held over $64 billion worth of claims against only $10 billion of gold held in the U.S. gold reserves.

In July 1971 Switzerland converted nearly $50 million back into gold, France demanded $200 million, and Great Britain requested nearly $3 billion shortly after.

In August 1971 President Richard Nixon gathered a small group at Camp David to devise a plan to avoid the imminent wipeout of U.S. gold reserves.

On the evening of August 15th, 1971 President Nixon effectively broke the U.S. dollars link to gold. Foreign governments could no longer exchange U.S. dollars for the physical bullion held within the U.S. treasury.

This was essentially the end of the gold-backed Bretton Woods system created in 1944 and the beginning of the U.S. dollar becoming a purely floating fiat currency.

In addition, the rest of the worlds currencies that were pegged to the U.S. dollar also become purely floating currencies.

This undoing meant that the U.S. now reigned free to essentially print as much fiat currency as it wished without having to worry about the constraints of gold held on reserve.

This was when the petrodollar system was created.

Justin Ash, Founder/ Member

How Is The Us Dollar Valued

The Federal Reserve explains that United States currency has not been backed by gold in a long time, or redeemable for it since 1943. If not backed by anything, then how do we know the value of a dollar? It is true that no specific commodity backs the U.S. dollar. That doesn’t mean that the Federal Reserve can print money without anything backing it up, though.

Due to both national and international statutes, the dollar must be backed up by something. Otherwise, the continued printing of money would only weaken the dollar’s value instead of creating more wealth. The collateral on which the value of the dollar rests is complex and challenging to understand. Again, it is not based on commodities but rather on securities exchanges, especially government-sponsored ones.

Another way of understanding it is that the U.S. government essentially promises that the dollar is worth what it says it is. Currency, therefore, is something of a promissory note from the government that indicates they have the means to convert every dollar in circulation into real wealth in some way. If this sounds risky and confusing to you, you’re not alone it is both a less easily understood and more complex way of establishing wealth. That being said, it has worked nationally and internationally for many decades.

You May Like: How To Get Free Tinder Gold Trial

So Why Does The Government Still Borrow Why Does The Government Still Tax

If the government can print dollars at will, then those holding dollars are at the mercy of that will. But since the government can legally, and does legally, create dollars out of thin air as it sees fit, then why does it need to ever borrow money? More importantly, since the government can and does create dollars out of thin air as it sees fit, why does it still need to tax your income to raise revenue?

To put it another way, if the federal government authorized you to print legal tender dollars on your printer at home, would you ever need to borrow or ask anybody for money again? Wouldnt you just print up what you needed instead of indebting yourself or taking money from others? Do you see the scam theyre running on you? Do you dare ask why?

The Political News Report was created in the interests of informing the public and your help is needed to spread the word. Please share this article and website on social media, and also like and subscribe so other people can find this content.

You May Like: Gold Rx Card

Alternative To The Gold Standard

In 1960, the U.S. held $19.4 billion in gold reserves, including $1.6 billion in the International Monetary Fund. That was enough to cover the $18.7 billion in foreign dollars outstanding.

As the U.S. economy prospered, Americans bought more imported goods and paid in dollars. This large balance of payments deficit worried foreign governments that the U.S. would no longer back up the dollar in gold.

The Soviet Union had become a large oil producer. It was accumulating U.S. dollars in its foreign reserves since oil is priced in dollars. The Soviet Union deposited its dollar reserves in European banks, and these became known as “eurodollars.”

By the 1970s, the United States stockpile of gold had declined. Double-digit inflation reduced the eurodollar’s value, and more and more banks started redeeming their holdings for gold. The U.S. could no longer meet this growing obligation.

The U.S. no longer has enough gold at current rates to pay off its debt owed to foreign investors. Even when gold hit its peak price of $1,896 an ounce in September of 2011, there wasn’t enough gold for the U.S. to pay off its debt.

The dollar/gold relationship was changed to $38 per ounce during the Nixon administration. The Fed could no longer redeem dollars with gold, which made the gold standard meaningless.

Read Also: War Thunder Golden Eagle Hack

What Currencies Are Still On The Gold Standard

Now Switzerland has dropped the gold standard, there are no currencies that are backed directly by gold. However, this doesnt mean that gold or other commodites are irrelevant to their economy or currency.

There are plenty of examples of countries where their wealth and currencies are able to be tracked and correlated to a specific commodity or multiple commodities. For example, The Australian Dollar is sensitive to changes in iron prices as they are the largest exporter of iron worldwide. It is for this reason that despite not being backed by their commodity asset, iron, it still has a significant effect on their currency.

Many countries have a currency that is closely linked to oil with currency and economic fluctuations coinciding with oil price changes and availability. These include large economies such as Canada, Russia, Columbia and Norway. These are all large exporters of oil, a commodity with a high value in todays world that relies upon it as a resource.

Countries with large reserves of crude oil can track the demand and rise and fall of these resources alongside their currency. When oil prices drop, oftentimes so does the value of the currency. This correlation between commodity and currency is interesting as whilst they have an effect on a currency that can be seen and tracked they are not directly backed by these commodities.

How Does Fiat Currency Derive Its Value

At its core, fiat money derives no intrinsic value When you examine a U.S. dollar its just a funny piece of paper with a bunch of confusing symbols and words printed on it.

The actual value and printing costs are far less than what it will be able to buy in the open market.

Today, the U.S. dollar is not backed by any type of rare commodity.

When you view the U.S. dollar in this fashion it becomes technically worthless And governments and central banks know this fact.

To overcome these obstacles the U.S. government has required acceptance of the U.S. dollar in all domestic transactions through the passage of legal tender laws.

Americans have essentially been forced to accept the U.S. dollar as money and believe it has value An interesting twist by Uncle Sam.

This faith and belief in the U.S. dollars value despite having no intrinsic value is a common trait shared by all fiat currencies.

Without this faith and belief the house of cards would inevitably crumble.

U.S. legal tender laws have created a required national demand for the dollar Consumers must acquire dollars to pay for goods and services.

And this required demand illusion is exactly how the U.S. dollar derives its value. It is only by maintaining a perpetual faith in the U.S. dollar that our current monetary system can continue operating.

Many have pondered why governments cannot simply print enough fiat currency to do away with hot topics such as poverty, famine, and other social needs.

Also Check: Eiffel Tower Ring Kay Jewelers

Doesn’t Fiat Money Just Lead To Hyperinflation

There is always the possibility of hyperinflation when a country prints its own currency however, most developed countries have experienced only moderate bouts of inflation. In fact, having some consistent low level of inflation is seen as a positive driver of economic growth and investment as it encourages people to put their money to work rather than have it sit idle and lose purchasing power over time.

Having a relatively strong and stable currency is not only a mandate of most modern central banks, but a rapidly devalued currency is harmful to trade and obtaining financing. Moreover, it is unclear whether or not hyperinflations are caused by “runaway printing” of money. In fact, hyperinflations have occurred throughout history, even when money was based on precious metals and all contemporary hyperinflations have begun with a fundamental breakdown in the real production economy and/or political instability in the country.

What Is A Circulating Standard

Circulating gold or a circulating standard is the governments or private individuals use of gold, silver, and other precious metals in the coins of a country that uses fiat currency. Pure gold, silver, copper, and bronze were historys most ancient coins and tokens, and theyre still in use today by modern economies.

Don’t Miss: Buy Oz Of Gold

Only One Currency Is Still Backed By Gold

Dumbfounded.

Thats the only way to describe the reaction that future historians will have when they look back and study the utter perversion that is our global financial system.

We live in a time when a tiny handful of people have their fingers on a button that can conjure trillions of dollars, euro, yen, and renminbi out of thin air. In the United States, it comes down to one man. Just one.

With a single decision, he controls the lever that dominates the entire economy. When you control the money, you control everything financial markets, consumer prices, risk perceptions, investment habits, savings rates, hiring decisions, pay raises, sovereign debt, housing starts, etc. One man.

This irrational, arrogant system presupposes by design that a central banker is smarter than everyone else that markets are incapable of determining appropriate risk and value that he is more effective at allocating our time, capital, and labor than we are.

Future historians will probably also be dumbfounded when they see how long people allowed worthless, unbacked fiat paper to pass as money. Its extraordinary that most people today happily accept a digital abstraction of paper currency controlled by a single individual as valuable.

Meanwhile, M2 money supply at last count was about $9.8 trillion as of March 12, 2012. This means that roughly 4.46% of US dollars in circulation are backed by gold, the rest backed by false promises and goodwill.

Read more posts on Sovereign Man »