Gold Silver Ratio 70 Year Chart

What caused the lows in the Gold-Silver Ratio in the years leading into 1968, in early 1980, beginning in 2010 and into the year 2011 respectively?

You can learn more about the respective fundamental investment factors for both gold investing and silver investing here at SD Bullion.

Given the way both the silver spot price and gold spot price are currently mainly discovered by dominating synthetic derivatives at this moment in time, it is not really until lessening supplies vs. increased demand factors exacerbate, do we often historically see the Gold Silver Ratio drop sharply.

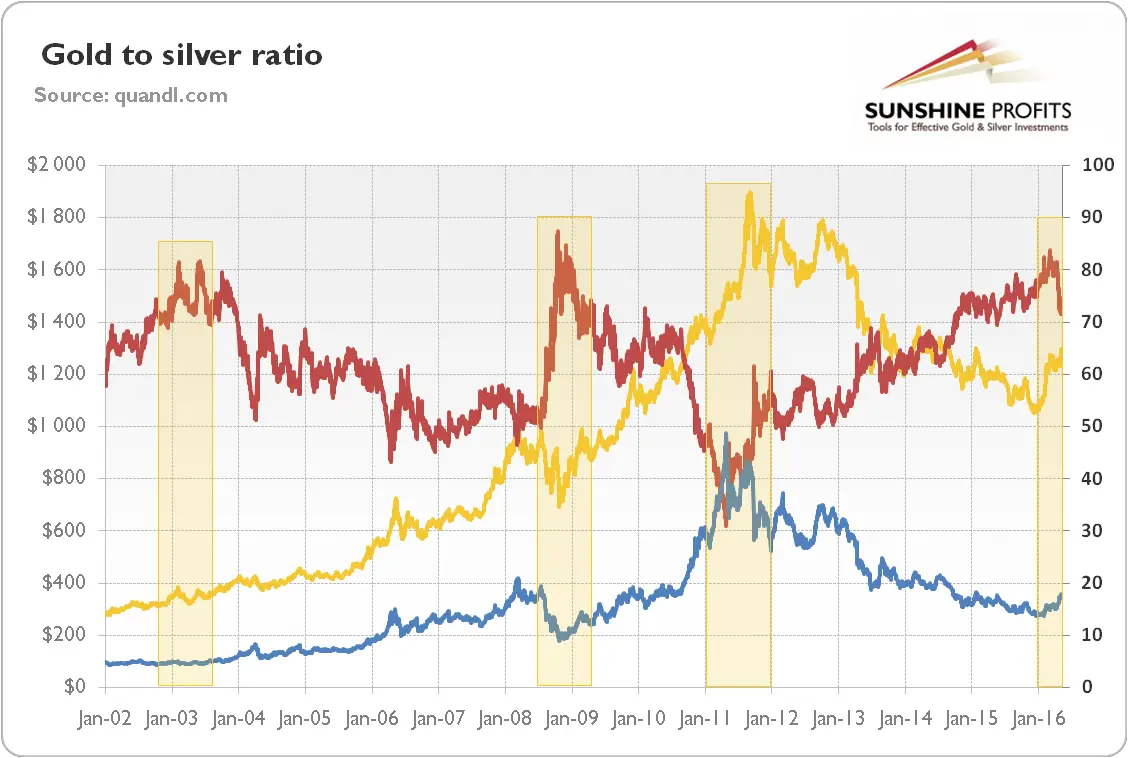

The last significant example of this was from 2009 to the 2011 timeframe in which physical bullion buying at the margin forced the Gold Silver Ratio sharply downwards reaching levels as low as 32 or 33 depending on the derivatives one uses to measure by.

Of course, one doesn’t have to look far to find what may sound like ridiculous gold price predictions. Often many are arithmetically based on historical US dollar monetary base outstanding precedent. Every 50 years or so the US dollar issuance outstanding gets accounted for by Official US Gold Reserves. We believe we are on track for another historic beat down of the fiat US dollar by gold 2020s.

If for example the spot price of gold were to hit $5,000 oz USD and the Gold-Silver Ratio tightened to its multi-millennia and naturally occurring near the ground averages, the world could simultaneously have silver spot prices well above $100 oz USD.

Trade The Ratio With Etfs

Another strategy for trading off the gold-silver ratio is to trade exchange-traded funds . These funds are traded on the market the same way stocks are investors can buy or sell according to their own strategy, holding whichever positions suit their goals.

For example, trading some ETFs, such as iShares Silver Trust and SPDR Gold Shares , generates a similar effect when trading off the gold-silver ratio. Trading gold and silver ETFs lets investors take advantage of price movements in a simple way.

However, keep this important point in mind: There is a huge difference between actual physical metals and “paper metals,” like ETFs. For example, if you purchase the GLD ETF, you do not actually own any gold. Rather, you have an investment on paper, which tries to base its value on the underlying metal.

Is The Silver Market Manipulated

A popular belief, especially among bullion investors, is that the price of silver is artificially kept low. Youve probably heard rumors of the Federal Reserve manipulating silver prices, together with bullion banks, in order to keep the attractiveness of the US dollar. But is this really true?

Proponents of market manipulation in the silver market often refer to the heavy short positions in the market.

Some of them blame the central banks, while others say that big banks use naked short-selling techniques to short silver without actually borrowing it. They also say that, given the size of the silver market, its much easier manipulated than the gold market.

A popular rumor was that JP Morgan maintains outsized short position in the silver market. However, there is no real proof that the bank one of the biggest in the world does naked short-selling in the silver market.

After all, JP Morgan is an LBMA bank and has the interest to participate in the silver market as a bullion bank. The bank is also responsible for clearing silver transactions, so its mandatory for the bank to be engaged in the silver market.

Finally, the Reddit and WallStreetBets short squeeze frenzy tried to corner the silver market in January 2021, just like they did with GameStop. The price of silver did jump to the highest level in years after the Reddit group announced the mother of all short squeezes, but it fell shortly afterward to its pre-Reddit levels.

You May Like: Selling Gold Bars Rdr2

Ultimate Guide To Understanding The Gold Silver Ratio

00

Whether you are a bullion investor or active trader, you can take advantage of the gold-silver ratio and incorporate it into your trading strategy. In the following lesson, well explain what the gold-silver ratio is, why it rises or falls, and how the ratio can provide valuable hints for your future investments.

Gold Silver Ratio Volatility

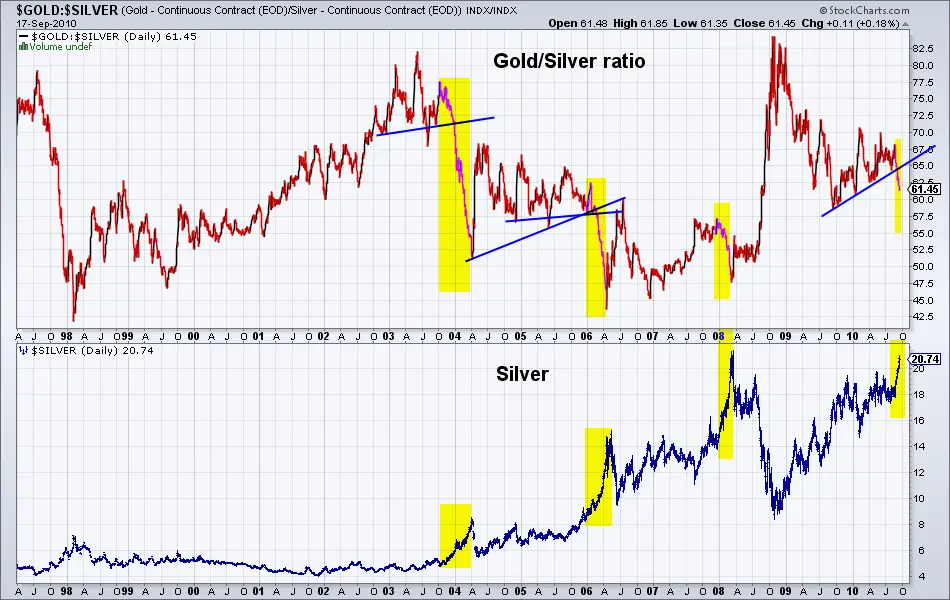

Throughout documented history, the Gold Silver Ratio has varied widely.

Often what happens in bullion bull markets, gold tends to outperform silver in the beginning acquisitions phases. Silver historically plays catch-up and outperforms gold in a more speculative environment, when the average ‘man on the street’ and even high net worth investors begin choosing silver bullion over gold bullion allocations.

Look back to the bull markets of both 1980 and 2011 for illustrations of these stated facts. And no older-timers, it was not merely the scapegoated Hunt Brothers silver speculations that caused virtually all commodities to multiple in US dollar values many-fold throughout the 1970s.

When silver performs best versus gold in recent history is often during timeframes in which fiat currencies and their enduring values are most acutely called into question by the investing masses. Many bullion buyers, including ourselves, believe another era of fiat currency faith loss will come to fruition soon enough.

Over the last few centuries, the Gold-Silver Ratio has gotten either fixed by authoritative government decree, their central banks or even heavily influenced by commodity futures contract price discovery markets .

The Gold-Silver Ratio has been as low as 2.5 oz of silver to acquire 1 oz of gold . The Gold-Silver Ratio has gotten as high as over 100 oz of silver to buy 1 oz of gold in the 1930s as the US government forced US citizens to turn in their gold coin savings.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

Gold Silver Ratio Analysis

03 December 2021 close: Daily risk weight has turned down after the Gold to Silver ratio touching 80.20 on Thursday. It is always hard to predict where this correction will end but the super cycle scenario points towards the technical condtion of a new low being made sometime in the near or more distant future. The Weekly and Monthly time intervals show an historically weak correction upward. Like Platinum, a Silver shakeout would present with an extraordinary opportunity to buy more and not as a signal to remove the silver allocation. It is a matter of time for Silver to reach again its long term equilibrium versus Gold. The interim quarterly chart below show a pattern that does appear often and resembles most the 1990’s period where silver ended the rally against gold at around a price ratio of 50 Silver ounces to one Gold ounce. We would expect this type of move to play out again in the coming few years. Hence a slight overweight silver in our metals portfolio.

19 November 2021 close: Silver also reacted sharply to the previous week’s rally with a 2% loss versus gold finishing the Gols/Silver ratio at 74.74 last Friday. The Gold/Silver ratio is currently battling against the 74 handle support and this may take a while longer. The chart pattern that is unfolding is morfe likely to develop that necessary break that will this cross to seek the initial mid 60’s handle direction.

What Is The Gold/silver Ratio

The gold/silver ratio measures the number of ounces of silver required to purchase one ounce of gold. By measuring the change in the gold/silver ratio over time, investors hope to estimate the relative valuations of the two precious metals, thus informing their decisions of which metal to buy or sell at any given time.

Recommended Reading: Where To Sell Gold Rdr2

What Is A Good Gold To Silver Ratio

What constitutes a good Gold to Silver ratio will depend on your trading strategy and whether youre bullish or bearish on either commodity. Remember, Commodities trading requires an in-depth knowledge of the asset you decide to trade.

So, understanding how and why the price of Gold and Silver move in relation to each other is key to using the ratio as a guide on when to buy or sell either precious metal.

Some traders use it as a hedge, which means they take a long position in one market and a short position in the other. This can help them potentially make a profit even if the price of both metals fluctuates significantly. Like with any trading, there is risk as well as reward when trading the Gold to Silver ratio. Make sure you trade intelligently and with caution.

Another popular use of this ratio is as a way of diversifying a precious metals portfolio. Diversifying can lessen risk exposure and position you for potential market movement in your favour.

Final Words Gold Silver Trading Strategy

When we use the gold silver chart ratio in conjunction with the individual price trends of gold and silver we can determine strong buying and selling opportunities. You can also ride massive trends with the gold silver ratio, especially when we have historical readings. However, since these only happen once or twice in a lifetime you can use our gold silver trading strategy to navigate the day-to-date price action.

The ratio can also be used to determine the overall market sentiment, which is a precious thing that can be used to trade other markets. Usually, a high gold to silver ratio is signaling a slowdown in the global activity, while a low gold to silver ratio is signaling improving risk sentiment. You may also enjoy reading this popular Gold Trading Strategy.

Thank you for reading!

Recommended Reading: Can I Buy Gold On Robinhood

Gold Silver Ratio Examples

For example, lets look at the gold-silver chart ratio for that historical high 93 established in the summer of 2019 and see how the markets reacted.

In July 2019, the ratio hit 93.

Check the gold-silver chart ratio below:

Usually, the extreme readings suggest that perhaps gold and silver prices are out of sync.

This will lead to a normalization process where the price of gold and silver will return to their average ratio.

In the above gold chart, we can see the price of gold caught up quite drastically on the gold to silver chart ratio.

Following that extreme reading, the gold price rallied more than $250.

Now, I know what youre thinking

Lets buy gold when the ratio is at an extreme point and we can make a ton of money.

Well, that’s not as easy as it seems.

Unless you know how to time the gold market, otherwise you will be trading blindly.

There are better ways to trade gold and in the next sections, youll learn a gold-silver ratio trading strategy to time the market.

The gold to silver ratio limits can change so you will need a solid gold silver trading strategy.

Now

Lets see what is gold and silver trading at today.

How Is The Gold/silver Ratio Used

The Gold to Silver ratio is used as a method of valuing silver against gold.

It can also be used as a way to determine when it is better to buy silver and when it is better to buy gold. A higher ratio means silver is undervalued compared to gold. Conversely a lower ratio means silver is overvalued compared to gold.

Viewing the gold to silver ratio over time in a chart can be helpful. The chart below shows the 20 year average for the ratio is about 60. Currently it is well above that. Reaching a new all time high today of 120.

Don’t Miss: How To Buy Wow Gold Without Getting Banned

Historical Overview Of Gold Vs Silver Prices

Throughout history people used both gold and silver as money, minting coins from these two rare and beautiful precious metals.

That made the ratio of gold-silver prices a vital piece of information in every day life, because any big move away from more typical levels could cost you dearly if you took silver rather than gold coins as payment or it could give you a windfall profit when the ratio moved back to its average!

Many investors today feel the ratio should trade in line with the physical ratio of gold to silver in the earth’s crust. The availability of the the two metals certainly affected their relative prices in the past.

Historians reckon that gold may have been worth a ratio of 3:1 against silver in medieval Japan and 2:1 in ancient Egypt, due to the lack of domestic silver mines in these regions.

Between the Middle Ages and the start of the 20th Century, the historic level of the Gold/Silver Ratio rose from 12:1 in Western Europe to settle around 16:1, albeit with large swings over time. Huge gaps also opened up with the ratio in bullion-importing regions like India gaps which merchants could exploit for profit.

Shipping gold to where it was most highly valued offered a bumper return in silver. It also helped close these geographical gaps in the Gold/Silver Ratio a process known to modern financial traders as “arbitrage” by improving the balance of supply and demand in each local market.

A Very Brief History Of Coin

The gold/silver ratio exists as a concept today thanks to 2,500 years and more of monetary use. While paper notes began replacing gold in everyday commerce back in the 19th century, and while both metals had been used more as reference points for mental accounting than as hand-to-hand cash for extended stretches of time before then , the very first coins were either gold, silver or copper, wherever they were invented .

These three metals, the same metals our grandparents and great-grandparents knew as coins in the early 20th century, differ so much from each other in appearance and scarcity that they clearly carried different levels of purchasing power. So where more than one metal was minted and while copper was used to strike token money worth far more than its market value in precious metal terms, a ratio for gold to silver had to be chosen. The choice of a ratio was inevitable, says Glyn Davies A History of Money. Yet that ratio then immediately came under pressure.

THE GOLD/SILVER RATIO EXISTS AS A CONCEPT TODAY THANKS TO 2,500 YEARS AND MORE OF MONETARY USE

Throughout history, silver was mainly the medium of retail and domestic trade, with gold used in wholesale and foreign trade, and also to store out-sized wealth.

You May Like: Can I Buy Gold Jewelry From Dubai Online

What Are The Benefits Of The Gold/silver Ratio

The benefits of the gold/silver ratio arise when there are fluctuations. Today, gold and silver trade mostly in sync with each other without a lot of shifts or variations. But when the ratio widens or narrow to levels that are considered extreme, trading opportunities are created. If the gold/silver ratio widens to 100 then a consumer who owns one ounce of gold could sell it and buy 100 ounces of silver. When the ratio widens silver becomes more favorable because, relative to the ratio, silver is somewhat inexpensive. Trading based on the the gold to silver ratio is considered by many to be a good strategy to follow when trying to accumulate either gold or silver.

Uselessness Hits A New Record

Fast forward to late 2020 and, despite recent attempts by some Bitcoin and other crypto asset promoters to revive the metals monetary use, neither gold nor silver have functioned as units of account or exchange for almost half a century . Where they do retain monetary use, however, is as a store of value. Hard to distinguish from investment in any other assets perhaps, this use is of course led by central banks for gold but is regularly cited for both metals by private bullion buyers and owners.

What then of the gold/silver ratio today? Where gold used to facilitate wholesale and international trade, and silver was for more local and everyday transactions, the yellow metal is now famously useless to industry , while silver has become the indispensable element , needed in a vast and growing range of technologies and processes which consistently account for more than 55% of end-user demand each year.

This explains why the gold/silver ratio shot to new all-time highs this spring, driven above its peaks of 1940 and 1991 as the COVID catastrophe almost shutdown global economic activity overnight, suddenly making useless, incorruptible gold supremely useful in a locked-down world. That peak however gave no real insight into our economic or financial future, not beyond predicting to eager traders that silvers value both industrial and investment was very likely to rally.

You May Like: How Much Is Xbox One Gold Membership

Will The True Gold/ Silver Ratio Please Stand Up

- Contents

- Post

- Copy link

This years COVID pandemic crushed silver prices to a new record low against gold, spurring a surge of investment demand. Marchs buyers have now doubled their money, but might a long- term opportunity remain and does the gold/silver ratio have any value beyond giving a cue to bargain hunters once in a generation?

I can calculate the motions of the heavenly bodies, but not the madness of people, sighed Sir Isaac Newton, or so legend has it, after losing some £20,000 when the South Sea Bubble collapsed 300 years ago this autumn.

If the quote is genuine, Newton was in truth lamenting his own greed and folly. Now so old that he could run for US President today, this shining emblem of Enlightenment rationality, as one recent historian calls him, had sold out of South Sea stock with a handsome profit in the spring of 1720, only to buy back in at much higher prices as the Companys directors fought and failed to keep their fraud alive during the summers trading frenzy in Londons Change Alley.

ANOTHER THING NEWTON COULDNT CALCULATE OR SO POSTERITY CLAIMS WAS THE GOLD/SILVER RATIO

Another thing Newton couldnt calculate, or so posterity claims, was the gold/silver ratio. The diviner of light and gravity, the father of calculus and creator of modern astronomy got his sums wrong when after leaving academia to run Englands coinage as Master of the Mint at the Tower of London he proposed a new price for gold Guineas in terms of silver shillings.