What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Calculation : Value Of Gold Metal

This calculation determines the value of gold metal based on the weight, purity, and bid price for gold metal.

| Weight of gold |

|---|

| Gold price per troy ounce |

| Step 1: Convert the weight of the gold alloy into troy ounces |

|---|

| Weight of gold alloy = Weight of gold alloy × Conversion factor= 0 × 31.1034768 |

| Step 2: Convert the weight of the gold alloy into the weight of gold metal |

| Weight of gold metal = Weight of gold alloy × Gold purity ÷ 100= 0 × 99.9 ÷ 100 |

| Step 3: Calculate the value of gold metal |

| Value of gold metal = Weight of gold metal × Price of gold metal= 0 × 0 |

| 1 avoirdupois ounce = 28.349523125 g | 1 baht = 15.244 g | 1 carat = 0.2 g |

| 1 grain = 0.06479891 g | 1 kilogram = 1000 g | 1 masha = 0.97 g |

| 1 pound = 453.59237 g | ||

| 1 ratti = 0.1215 g |

| How many gram in a troy ounce |

Are You New To Investing In Gold Learn Why Gold Bars Are A Great Place To Start

For centuries, gold has been one of the most popular commodities when it comes to accumulating and building wealth. For investors who are interested in purchasing gold, one of the most economical and convenient forms to buy are gold bars.

There are many types of gold bars available, all in various sizes that fit the needs of individuals with different budgets. In addition, since gold bars are typically priced lower per ounce than gold coins or some numismatics, it makes them an even more attractive investment.

Don’t Miss: 1/10 Oz In Grams

Pricing And Volume Discounts*

Save on your order when you purchase in larger quantities.

Quantities ofTD Customer PricingNon-TD Customer Pricing

1-9 C$240.14 / productC$247.34 / product

10-24 C$237.58 / productC$244.71 / product

25+ C$235.02 / productC$242.07 / product

* Pricing shown is based on TD Customer Pricing with payment from a TD bank account. Final pricing will be confirmed at checkout.

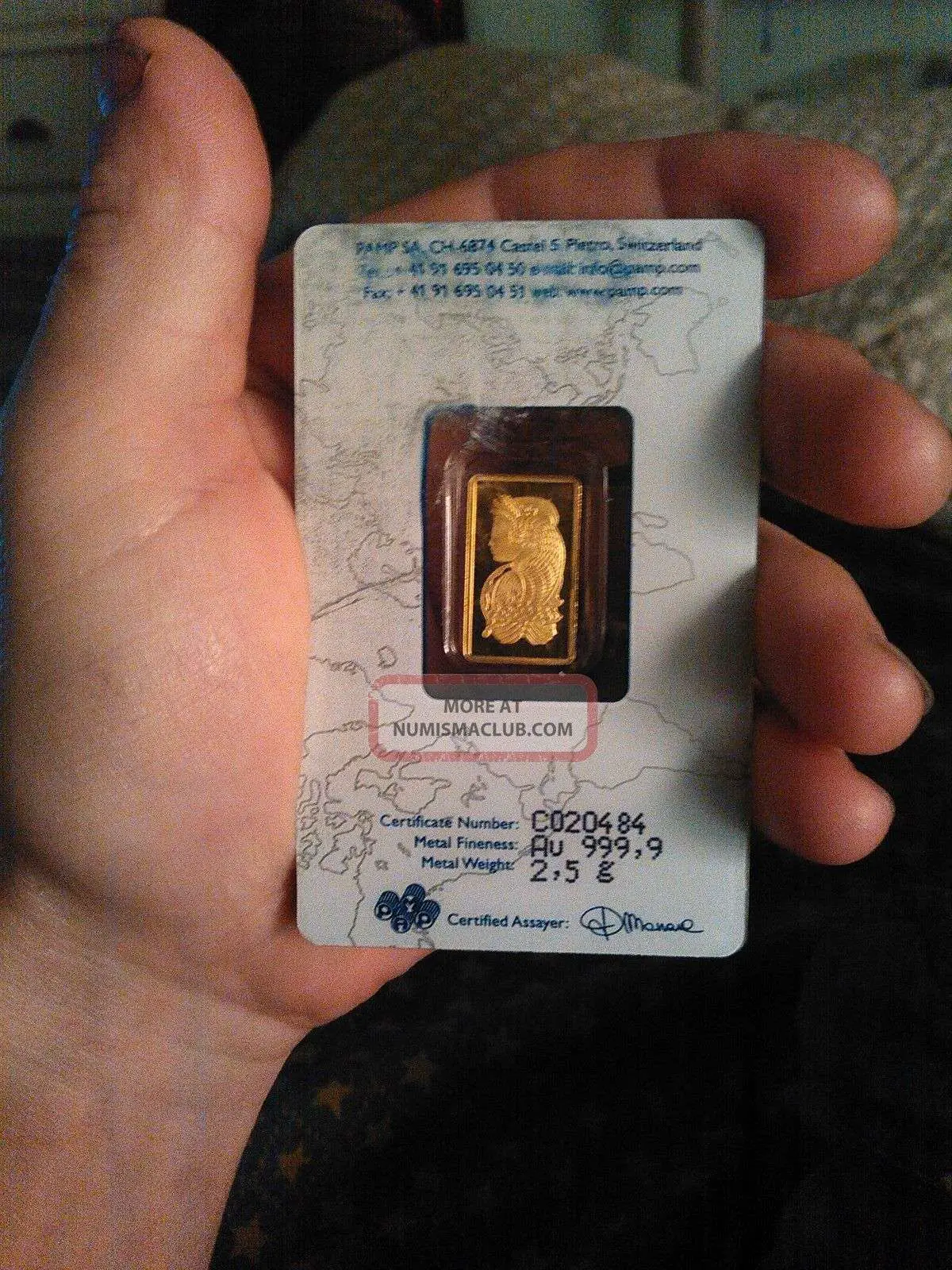

Buy 25 Gram Pamp Suisse Gold Bars From Money Metals Exchange

Money Metals Exchange is proud to offer 2.5 gram PAMP Suisse Gold bars through its direct relationship with the renowned PAMP Suisse company. This Switzerland refinery is perhaps the premier name in bars. Easily recognizable by the design in the front of the bar, PAMP Suisses gold bars are classy and popular. The size of 2.5 gram Gold bar PAMP Suisse makes this product an easy way to invest in gold bullion at a more affordable Price point. Check out our great gold bar prices!

These Swiss-made gold bullion bars are second to none when it comes to quality and security features. PAMP Suisse is known for their innovative security and design features. Each gold bullion bar comes with:

- A tamper-evident assay card to guarantee weight and purity.

- PAMPs exclusive Veriscan® technology uses microscopic topography to identify products in their database. Each bar is scanned when manufactured and can be re-scanned later to verify that the bar is genuine.

- Contains 2.5 grams of .9999 fine gold.

- IRA approval PAMP Bars are eligible to be held inside precious metals IRAs.

The reverse side features the PAMP logo, bar weight, purity level, the assay mark, and an individual serial number. Buy PAMP gold bars when you want the ultimate in trust and recognizability.

The PAMP Suisse headquarters are located in Ticino, Switzerland. The firm has risen to become one of the most respected refiners in the world. The Fortuna design is unique to PAMP Suisse products.

You May Like: How To Get Free Gold Bars In Candy Crush

How To Avoid Getting Ripped Off

It is practically impossible to purchase gold at its current retail price because youre buying through an intermediary who also would like to make some money. A good gold retailer will only put a premium of 5% on the spot value and offer free shipping in the United States. Websites like GoldPrice.org and Kitco.com show the market price of physical gold in real-time.

Gold Prices Hit Another Record High In India On 4 August 2020

Gold prices in India continued to hit record highs on 4 August 2020. Gold futures prices for the month of October on MCX increased by 0.2% and are at Rs.53,865 for 10 grams. In the last session, gold prices increased by Rs.267. In the international markets, the prices of spot gold were steady at $1,976.36 for an ounce. In the previous session, spot gold prices hit record highs. The main reason for the increase in prices were the worries about the economy because of the rise in the number of coronavirus cases. In the case of inflation and currency debasement, gold is considered as a safe haven. Gold prices in India are inclusive of 12.5% import duty and 3% GST. In the international markets, the prices of gold have increased by 30% in 2020.

4 August 2020

You May Like: How Many Grams Is 1 10 Oz Of Gold

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Know About Gold Rate In India

India is the largest consumer of gold in the world, accounting for almost a quarter of the worlds total consumption. It has, since long, maintained this position and, unlike countries like China, India uses gold primarily in the form of jewelry and investments. It is viewed as a solid instrument for investments and even traders who are into commodities trading, invest in gold bullion. These investments are usually dictated by the gold rates prevailing in the economy at that time.

Even the global view of gold is that of a safe haven where you can invest even when investments in the economy of a country are not a good idea.

Gold rate in India change on a daily basis, with a number of factors impacting their price in a particular place on a given day. Demand and supply, global market conditions and currency fluctuations are some of the most critical factors which go into determining the rate of gold in a country, with prices changing every day.

You May Like: How Much Is 10k Gold Worth

Detail Of Gold Jewelry Price Calculator

The process is described in the following image:1. Select a unit or weight. For example, gram, ounce, tola, etc 2. Enter the total number of units or weights, e.g., 1, 2, 3, 1.5, 2.5, etc3. Enter the cost of making that jewelry4. Cost of making jewelry can be in a percentage or an exact amount 5. Enter the amount of tax on both 6. Select purity or karat of gold 7. Select your desired currency like EUR, USD, INR, AUD, NZD, QAR, KWD, SAR, PKR, etc8. Click on the calculate button9. You see the calculated rate as shown in the image

Read Also: Can You Buy Gold Bars From Us Mint

Trend Of Gold Rate In India For June 2021

| Parameters | |

| Rs.5,265 per gram on 12 June | |

| Lowest Rate in June | Rs.4,771 per gram on 30 June |

| Overall Performance |

- In India, gold rate opened the month of June at Rs.5,098 per gram and was steady at the same rate on 2 June due to a mute international trend.

- The price of the metal increased on 3 June due to a fall in the dollar value in the market and was at Rs.5,126 per gram.

- On the last day of the week, gold prices increased further by Rs.10 and closed the week at Rs.5,136 per gram on 4 June.

- Gold price in India at the start of the second week of June was Rs.5,089 per gram. Compared to the price charged on the final day of the previous week, there was a decline of Rs.47 for every gram.

- While the price of the yellow metal shot up over the next two days recorded a slight decline on 8th June before increasing again. Gold recorded its highest price for the month till date on 9th June when a gram of 24-karat cost Rs.5,243.

- Gold closed the week at Rs.5,231 per gram after the price of the precious metal slipped towards the end of the week. The overall performance of gold was one of incline.

Also Check: How Much Is One Brick Of Gold

Kilo Gold Bullion Barsdesign And Specifications

Historically, gold bullion has been referred to as real, honest money and a potential safe haven investment during periods of uncertainty. With a keen understanding of investor demand, Monex proudly offers the 32.15 troy ounce gold kilobar.Each certified one kilo gold bar is stamped with the manufacturers hallmark, weight, and purity of bullion content. The .9999 fine one kilo gold bar is available to investors who wish to make a larger investment in one of the most popular forms of currency in the world.

With billions of dollars in transaction volume, a sizable buy-and-sell market and consistently competitive prices, Monex remains a preferred source for buying gold bars. Monex account representatives are available between 5:30 a.m. and 4:30 p.m. Pacific time each Monday through Friday and on many weekends.

Gold Prices Increase In India After Falling For Three Days In A Row

The prices of gold increased in India on 30 April 2020 after seeing a huge fall in the previous session. Gold futures prices for the month of June on MCX increased by 0.35% and are at Rs.45,700 for 10 grams.

In the previous session, the prices of gold fell by Rs.566. Gold prices have fallen over the last three sessions. Earlier in April, gold rates hit record highs and were above Rs.47,000 for 10 grams. However, the prices have remained volatile since then. In the international markets, gold prices decreased slightly due to an improvement in risk appetite. Spot gold prices decreased by 0.1% and are at $1,708.85 for an ounce. Gold prices have been supported due to an increase in the number of coronavirus cases across the world. According to Kotak Securities, even though the yellow metal may witness a choppy trade, there will be support for gold because of a weak US dollar and the introduction of several measures by the Central Banks to help the economy. Gold prices in the country are inclusive of 12.5% import duty and 3% GST. In the case of currency debasement and inflation, the yellow metal tends to benefit. The fear of a global recession has also seen the prices of gold increase.

30 April 2020

Recommended Reading: How To Buy Gold From Dubai Online

Gold Firms Over Weaker Us Dollar

Spot gold had been up 0.1% and reached $1,779.73 per ounce. The U.S. gold futures had risen by 0.1% and reached $1,779.60. Gold rates have not been able to move forward despite a weaker dollar and lower U.S. Treasury yields because of the metal’s failure to break above the psychological $1,800 barrier, analysts said. Spot gold could retest resistance at $1,792 an ounce, having stabilised around a support at $1,772, said Reuters technical analyst Wang Tao.

27 April 2021

Taking Gold Loan In Kerala

Most individuals in Kerala rise money in bad situations by taking a Gold loan because Banks and other NBFC give loan against gold in a matter of minutes.

Most popular way of getting a gold loan is by visiting gold loan companies in Kerala such as Muthoot Finance and Mannapuram Finance. These two NBFC’s are popular not only in Kerala but all over south India. There are many more NBFC but because of the interest rate and other facilities, these companies offers.

Muthoot Finance and Mannapuram Finance offers good interest rates, it will be better to compare the same with bank gold loans and also with other gold loan companies before you go for the loan. There might be a marginal variation in interest rates which will be changing time to time, So it is hard to tell which would be better. Also compare gold rates in Kerala before you take a loan because the gold rates in Kerala will be fluctuating depending upon few economical conditions. It is advisable to go for gold loan when the gold prices in Kerala is high.

There are few things one should compare to decide which company is giving better with gold loan those are processing charges and interest rates. The process of gold loan will be very easy in The private NBFC’s. If you have documents in place it will take hardly few hours to get the loan amount.

Recommended Reading: Why Are Sneakers So Expensive

Is The Gold Price The Same As The Spot Price

When looking at gold prices, the figures quoted are typically going to be spot gold prices unless otherwise specified. The spot gold price refers to the price of gold for delivery right now as opposed to some date in the future. Spot gold prices are derived from exchange-traded futures contracts such as those that trade on the COMEX Exchange. The nearest month contract with the most trading volume is used to determine the spot gold price.

Gold Rates And The Rupee

The currency plays a very crucial role in the movement of gold prices. India imports almost all of the precious metal. This means to a large extent, we need to worry about the dollar movement against the Indian rupee.

Todays gold rates in Kerala almost always reflect currency fluctuations. For example, if the dollar moves from levels of 67 to 70 to the rupee, one would have to pay more for gold. In the past individuals coming to Kerala from the Middle East would carry gold along with them.

This would sometimes make it cheaper. However, there are some restrictions on importing the same and investors and consumers need to be aware of the same.

The restriction to carry gold in the form of jewellery is different for men and women. In any case, those who are looking to buy the metal, must keep in mind the exchange fluctuations that take place from time to time.

You May Like: How To Get Free Golden Eagles In War Thunder

Should You Opt For Gold As An Investment

It is a good idea, if you are diversifying your portfolio to look at the precious metal as an investment. This is because, you do not want to place all eggs in one basket. However, the most important thing when investing is to time your investment. This is because, if you buy gold at any and every price, you will end up making losses.

The ideal strategy here would be to seek expert opinion or where gold prices are headed before you buy into the same. Chances are that a patient investor may still end-up making decent money. However, one should hold for the long term, as gold has only given returns in the very long term. Do remember to check the daily price of gold in Kerala, before you decice to buy or sell the precious metal.

Details Of Gold Price In India For October 2020

- In India, gold price opened the month of October at Rs.5,342 per gram on 1 October and increased to Rs.5,380 per gram on 5 October as the demand for the metal was steady due to the rising number of COVID-19 cases.

- However, as the value of the U.S. dollar increased, the price of gold fell to Rs.5,336 per gram on 6 October and increased again on 8 October at Rs.5,387 per gram. The metal hit its lowest price of the month on 9 October at Rs.5,335 per gram.

- On 10 October, the gold rate in India increased to Rs.5,396 per gram as the rising number of cases provided support to the metal. Gold closed at its highest price at Rs.5,397 per gram.

- A gram of the 24-karat gold was retailed for Rs.5,398 in India at the start of the third week of October. When compared to the closing price of the previous week, there was a minimal increase in the rates.

- The price of gold recorded its highest price for the month till date on 13th October. Consumers were required to pay Rs.5,434 for a gram on the mentioned date.

- Gold price in India closed the week at Rs.5,377 per gram after the rates witnessed slight fluctuations. The overall performance of the yellow metal witnessed an inclining trend.

Recommended Reading: How Much Is 10k Gold Worth

Gold Prices Fall In India On 20 May 2021

Due to a muted trend in the global markets, gold prices fell in India on 20 May 2021. Gold futures prices for the month of June on MCX fell by 0.29% and were at Rs.48,531 for 10 grams. On 19 May 2021, gold prices saw a roller coast ride because of the cryptocurrency sell-off. Gold futures prices in the international markets settled at $1,881.50 for an ounce. On 19 May, gold prices on MCX hit a high of 4.5 months. Like gold, silver futures prices for the month of July fell by 0.39% and were at Rs.72,094 for a kg.

21 May 2021