What Zakatable Assets Are In Gold

Gold and silver are zakatable in full. This is whether they are in the form of jewellery, coins, etc.

Calculating it is simple. You take the value of your gold or silver and pay zakat on 2.5% of the value.

1 gram of gold is approx. £40. 2.5% of this = £1. Therefore, you need to pay £1 per gram.

However, this excludes jewellery in day-to-day use e.g., your wedding ring or necklace. The reasoning is that this is part of your everyday dress rather than a pure investment.

Please note though, that the Hanafi school typically even requires you to pay zakat on jewellery you wear day-to-day. For what its worth, our personal view is the majority of other schools here that zakat on such jewellery is not required.

Is All Womens Gold Jewelry Zakat

No. Jewelry hoarded for wealth accumulation, in excessive amounts or in extravagance, must have Zakat paid on it at 2.5% annually. Many Hanafi scholars consider gold and silver Zakatable regardless of its form. Jewelrys Zakat-exempt status for women and its use for personal adornment, however, many scholars deem as the stronger position.

The Concept Of Deduction Of Zakat At Source

Zakat not only helps us purify our monetary assets but is also a means of helping the poor and needy in society as a whole. Use the methods explained above to calculate your Zakat for 2021 and find its rightful owner within your community.

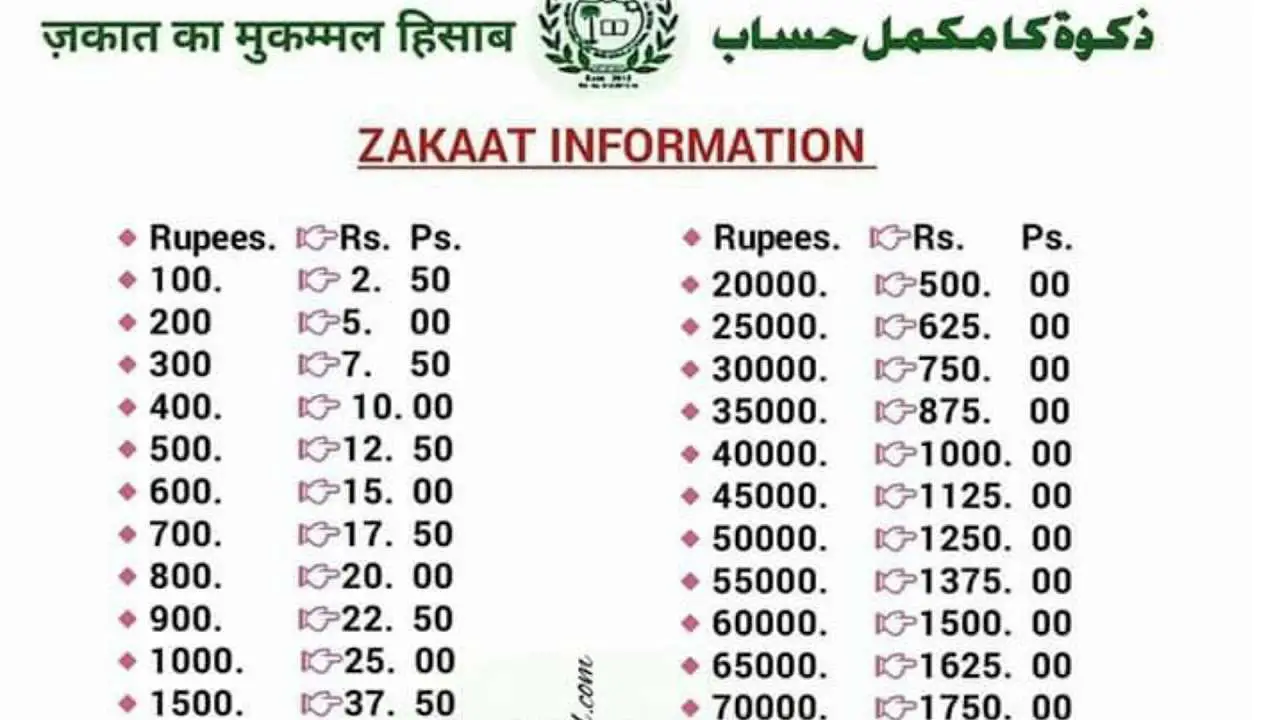

While you are making the calculations, an important fact to remember is that Pakistan is among some of the Muslim countries where Zakat is obligatory and collected by the state on savings and profit and loss sharing accounts. This practice is called deduction of Zakat at source and is performed by all banks across the country on the 1st of Ramadan.

Therefore, if you are not exempt from Zakat and have more than the Nisab calculated by the State Bank of Pakistan for a particular year, the amount of Zakat will be deducted at 2.5% of your account balance. The collected Zakat is then sent to the Bait-ul-Maal run by the Government of Pakistan to help the needy and the poor. You do not need to calculate and pay your Zakat on your savings account under such circumstances.

Recommended Reading: How To Get Free Gold Bars In Candy Crush

How Much Gold Do You Have To Have To Pay Nisab

The nisab is the minimum amount of wealth a Muslim must possess before they become eligible to pay Zakat. This amount is often referred to as the nisab threshold. Gold and silver are the two values used to calculate the nisab threshold. The nisab is the value of 87.48 grams of gold or 612.36 grams of silver.

A Beginners Guide On How To Calculate Zakat

It is the month of Ramadan, and at this time many of us are wondering how to calculate Zakat. But lets take a step back and take the time to appreciate, what is Zakat? Why does it hold such importance in Islam?

At a time when many services and businesses are restricted, when borders are closed and many peoples livelihoods are uncertain, charities continue to provide aid and support. All over the world, humanitarian organizations are trying to make sure the most vulnerable people are not overlooked during this pandemic.

But they wouldnt be able to operate without the generosity of people who are willing to give at a time of crisis. As Muslims, giving charity is more than a means of earning Allahs pleasure, its also an obligation and a right we must fulfill, known as Zakat.

Those who put aside from their wealth a known right for the needy and the poor they are honoured in Gardens of Bliss.

Quran 70:24-35

To help you fulfill this important obligation, weve put together this beginners guide to Zakat. In the next sections, well cover everything you need to know to get started. The topics we cover will include:

- What is Zakat?

- What is Nisab? How do I know how much it is?

- How is Zakat used? Who receives your Zakat?

- How do I know if I need to pay Zakat?

- How do I actually calculate Zakat?

- Additional resources on Zakat.

You May Like: Gold Earrings Rdr2

Can The Question Of Zakat On Womens Jewelry Be Summarized

no zakat on jewelry in two cases:

-

Womens jewelry for personal use whether of gold or silver, or other precious metals, gems, and stones that do not exceed customary amounts or commonly accepted measures of dimension and value.

-

A plain silver ring for men, or a silver-handled sword, or one with a silver-ornamented hilt, provided it is of real use and not a decorative piece.

-

pay zakat on jewelry in three cases:

-

On gold and silver jewelry kept as a store of value for the purpose of investment or increasing its worth, when it equals or exceeds the market value of 85 gm of pure gold in its appraised value . This is added to ones other gold and silver holdings to determine nisab and due Zakat.

-

On all jewelry or ornamentation in unlawful forms and used as decorations, utensils, or art or prohibited jewelry worn by men.

-

On all jewelry considered, in the common sense, extravagant, either in dimension, value, or amount, whether one wears it or not.

What Measure Determined The Value Of Gold At That Time

Weight determined the value of the silver dirham and gold dinar as currency in the time of the Prophet, on him be peace. He established the weights of Makkah as the Muslims standard measure for currency based on the weights of the dirham and dinar of the Makkans. This remains in force for calculating Zakats niâb on gold.

Read Also: How To Get Gold In Candy Crush

What Are The Rules Of Zakat

Zakat is obligatory on someone who is:

- A free man or woman: A slave does not have to pay zakat.

- A Muslim.

- Sane: The person on whom zakat becomes obligatory must be of sound mind according to Imam Abu Hanifa.

- 4.An adult: Children do not have to pay zakat, even if they own enough wealth to make zakat obligatory.

When Do I Pay Zakat

Zakat is paid annually. It is due on every lunar year on the day that your wealth exceeded the minimum threshold known as nisab. However, there are specific wealth categories that are due immediately when you receive whats known as a windfall.

There are two general categories of Zakat-qualified wealth, with two distinct Zakat payment times :

-

GROWTH WEALTH: This includes currency, gold, silver, business assets, and livestock. The Zakat you pay on these wealth types after 12 full lunar months passes on your full ownership of them, counting from the date of acquisition of each.

-

HARVESTS / WINDFALLS: You need to pay Zakat immediately on crops, honey, and produce, as well as extracted minerals and discovered treasure, at the time of their harvest.

The Zakat you pay on growing wealth is out of their profit or potential profit. Harvests and windfalls are considered growth and income by themselves, which is why Zakat is due when it is harvested.

For more nuances on when you need to pay Zakat, refer to the Zakat Handbook here.

You May Like: Is Kay Jewelers Real Gold

How Do I Calculate Zakat On Jewelry Gold And Silver

Zakat is only due on gold and silver, and is not due upon any other metals or precious stones.

In order to calculate Zakat on silver and gold you must take into consideration the following:

- The purity of the gold and silver within the jewelry.

- 24K gold is considered pure gold

- To find the purity percentage of your gold, you must divide the karat value of your gold by 24

For example, if you have 100g of 18K gold, you would calculate as follows:

- Purity Percentage = 18/24

- True Grammage = 100 x Purity Percentage

- Value = True Grammage x Current Value of Gold

- Zakat Due on Jewelry = Value x 2.5%

Are There Muslim Scholars Who Deem Womens Jewelry Zakatable

Yes. Some scholars, including the Hanafis, consider gold and silver Zakatable wealth, regardless of their form. Others hold that transforming gold and silver out of their monetary form and into articles of personal adornment makes them like clothing, furniture, and personal use items, categories of possessions recognized as not subject to Zakat.

Recommended Reading: 1/10 Oz Gold In Grams

Zakat On Cash And Bank Balances

Zakat should be paid at 2.5% on all cash balance and bank balances in your savings, current or FD accounts. The amount technically should be in the bank for one year. Usually it happens that the balance keeps on changing as per personal requirements.You may make your best judgement and the best way is to pay on remaining amount on the day of calculation

Conditions For Zakat On Gold

NISAB OR URUF

Depending on the type of gold that you own, Zakat is payable if the gold that you possess meets the Nisab or Uruf .

HAUL

Zakat is only payable if you have completed the Haul, which is a period of 1 Hijri year . For first-timers, your Haul period begins when your savings account first meets the Nisab. For recurring Zakat payers, Haul period begins from the last Zakat payment date.

ZAKAT ON GOLD

Find the value of gold owned: Current rate of gold x Weight of gold owned in grams

If the value of the total gold you own is equal to or above 86 grams, Zakat is required to be paid.

Zakat amount is: Value of gold owned × 0.025

ZAKAT ON GOLD

Find the value of EACH piece of gold: Current rate of gold x Weight of gold owned

If the value of a piece of gold jewelry is equal to or above 860 grams, Zakat is payable.

Zakat amount is: Value of gold jewelry owned × 0.025

Read Also: 10k Gold Calculator

The Rules For Calculating And Paying Your Zakat

Safa Faruqui

Working out how much Zakat to pay and how to pay it can be sometimes difficult and for that reason, we have created this short guide. We’ve broken down some of the most common questions and cleared up the main misconceptions about Zakat.

While you’re here, you can also use our Zakat calculator or read our Zakat policy.

What is Zakat and why is it important to me?

‘You shall observe the Salah and give the obligatory charity , and bow down with those who bow down.’

Zakat is the third pillar of Islam. It is an obligatory act of charity amounting to 2.5% of a Muslim’s annual savings. Zakat is intended to purify our wealth, not only physically, but also spiritually. It purifies our heart against selfishness as well as ensuring that society’s poorest are protected against hunger and destitution.

A common misconception is that Zakat is a form of tax. However, it is a spiritual obligation in which we will be accountable to Allah directly. Zakat plays a key role in supporting the poorest in the community, through providing them with essential aid as well as helping them come out of a life of poverty.

Who has to pay Zakat?

You must pay Zakat if, firstly, you are an adult Muslim of sound mind, and secondly, you have possessed the minimum amount of wealth for one lunar year.

How much Zakat do I need to pay?

What do I need to pay Zakat on?

Zakat is not just paid on the savings in your bank account. You need to pay Zakat on other types of wealth, such as:

Calculate Zakat On Gold By Using Our Zakat Calculator :

Calculating Zakat on gold jewelry seems to get complicated leaving men and women confused most of the time. This happens due to the lack of precise and clear knowledge about the Shariah laws on Zakat.

However, Transparent Hands has introduced an online calculator to make our Zakat calculations easier. This online calculator is a simple tool where you are required to insert the following information:

- Bank Savings

- Loans

- Value of shares/stocks/bonds

- Amount of Gold/Silver

- Nisaab of silver

Also Check: Why Are Golden Goose Sneakers So Expensive

How To Calculate Your Personal Zakat

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 40 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 544,404 times.Learn more…

Zakat is one of the pillars of the Islamic faith. Zakat literally means “alms”, and there are different kind of Alm’s, e.g. Zakat ul-Fitr or Zakat ul-Maal . The implied Zakat that makes up the pillar of islam is Zakat ul-Maal, which mandates muslim to donate 2.5% of their personal wealth to those in need, annually.Muslims believe that Zakat purifies the spirit and brings them closer to God, and that not paying it makes your wealth “dirty” .Learn how to calculate your personal zakat so you can fulfill your spiritual duties.XResearch source

How Is Your Zakat Used

Zakat is so much more than a yearly obligation. Its a revolutionary concept with the potential to ease the suffering of millions around the world. Its so important in our religion that it is mentioned over 30 times in the Quran, and very often together with the establishment of prayer.

Allah defines the true believers as those who are steadfast in prayer and give Zakat. Because of this, we are set apart as a people who strive not only toward inner refinement but also public service through our Zakat.

How then is your Zakat used to change lives? The purpose of Zakat is to make sure the poor and the needy, the vulnerable and the disadvantaged are looked after. Its meant to ensure that our collective wealth finds a way to those who need it the most.

At Islamic Relief, we strive to distribute your Zakat in a way that empowers people to break the cycle of poverty. Our goal is to provide relief, and ultimately bring people out of their difficult circumstances by helping them become financially independent.

Also Check: Is 24k Gold Pure Gold

How Do I Calculate Zakat On Jewellery

Over the past few weeks we have been receiving a considerable amount of enquiries about Zakat on Jewellery and specifically how it is calculated. So we have decided to write a blog post about it to help inform those who are unsure. If you would like further information, please do not hesitate to call us on +44 208 767 7627

What is Zakat?

In Islam offering Zakat is one of the five pillars of Islam. It is a charitable contribution that every adult, mentally stable and financially able Muslim has to offer in order to support those less fortunate.

Zakat is obligatory when a certain amount of money, called the nisab is reached or exceeded. Zakat is not obligatory if the amount owned is less than this nisab. The nisab threshold for gold is 87.48g and the nisab threshold for silver is 21 ounces or their cash equivalent.

Zakat is based on giving 2.5% of total savings within a lunar year. These savings include cash in hand, income earned on investments, funds currently in bank accounts and precious metal objects There is no Zakat due on platinum or palladium or other precious metals apart from gold and silver. Diamonds and gemstones are also exempt from Zakat.

Zakat on Jewellery

Calculating Zakat on your jewellery is often seen as being complicated and can leave people confused. This is mainly due to a lack of concise and clear information on the subject.

The calculation for Zakat on Gold & Silver is as follows:

Am I Eligible To Pay Zakat As Per The Nisab

You are Sahib-e-Nisab and eligible to pay Zakat if the total of your assets values more than 7.5 tola/3 ounces/87.48 grams of gold, or 52.5 tota/21 ounces/612.36 grams of silver for a full lunar year. Since gold and silver are not used as currency in todays world, it is important to convert the Nisab into your local currency based on the current rate of either gold or silver on the day of calculation.

READ MORE: Want To Make A Donation? Check Out These Welfare Trusts in Karachi

Please note that well be using Pakistani Rupees as the default currency in our examples, to show you how to calculate Zakat in Pakistan, but all the rates and currency values will differ based on when you are calculating your Zakat and in which country.

Recommended Reading: Where To Sell Valuables Rdr2

And What Exactly Is Nisab

Nisab is the minimum amount of wealth that acts as a threshold to determine whether Zakat is obligatory on you. If what you own is more than Nisab, then it means you are eligible to pay Zakat that year. If it is less, then you dont need to pay Zakat.

In Islamic Law, the threshold of minimum wealth is determined by two set values, 3 ounces of gold or 21 ounces of silver. Since we no longer deal with gold and silver as our currency, we can calculate their cash value online.

Gold

The Nisab by the gold standard is 3 ounces of gold or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of gold.

Silver

The Nisab by the silver standard is 21 ounces of silver or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of silver.

Wondering which Nisab threshold you should use, gold or silver? In the Hanafi school of thought, the silver standard is predominantly used to ascertain the Nisab threshold and eligibility to pay Zakat.

However, there are contemporary scholars within the Hanafi school who recommend using the gold standard, especially in todays age where the cost of living is high and the value of silver has significantly decreased. The other schools of thought use the value of gold. You can choose to use the silver standard if you would like to increase the amount of charity distributed.