Convenient Online Scrap Gold Price Calculator

Welcome to the London Gold Centre online scrap gold price calculator. Thanks to this handy tool, you can easily and quickly calculate the gold price in grams before you sell gold. Our calculator is based on spot gold prices and you can view all rates in London local time. On the London Gold Centre website, you can calculate the price of your scrap gold of any carat:

- 9K Gold Price

- 22K Gold Price

- 24K Gold Price

You will receive the actual value of your gold for the current date and time in pounds sterling. To do this, you do not even need to call and communicate with a specialist from London Gold Centre. The whole procedure is performed automatically to save you time.

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

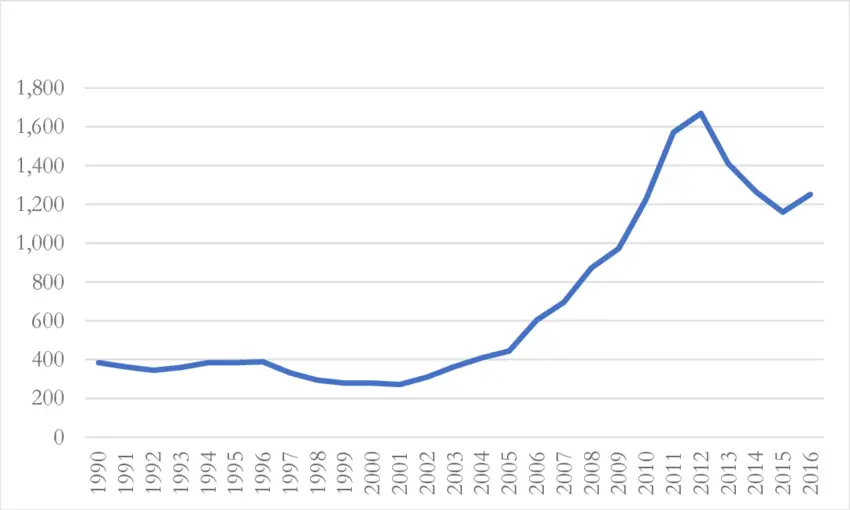

How Is The Current Price Of Gold Per Ounce Determined

There are many factors that contribute to the current price of gold. Chief among these factors is the strength of the US dollar. Traditionally gold has an inverse relationship to the value of the dollar. In other words, when the value the US dollar is strong, gold prices go down. Related, the strength of major economies also has an inverse relationship to the price of gold – at least when an economy has a significant downturn. All of this is due to the safe haven status gold has traditionally had in the investment world. Gold prices are historically far more stable over the course of time than economies and other classes of investments.Supply and demand, of course, also play a key role in the price of gold per gram or ounce. There is only so much gold to be mined and gold mining is not cheap. When gold demand outstrips gold supply, the price of gold goes up. The chief areas of gold demand are in gold jewelry. In 2017, 46% of demand for gold was for jewelry. There is also the use of gold in industry for such things as electronics and medical devices.

Also Check: War Thunder Golden Eagle Generator

Scale Grades Processing Costs Open Pit Vs Underground

The interesting aspect of the AISC metric is the number of factors that feed into the final figure, and similar to any other sector costs, they can vary from month to month and year to year.

In the case of gold stocks, better grades usually translate into lower cost mines.

Open cut mines are normally cheaper to operate than underground mines.

Different treatment processes that may be required because of the composition of the mineral or the amount of waste that needs to be separated to extract the ore also impact the cost of the end product.

Factors such as these can impact decisions such as the economic viability of mining higher grade ore at lower depths where the potential revenue generation is weighed up against the increased mining and processing costs.

Production volumes also feed into the end result with the increased revenues from large-scale production proportionately decreasing the fixed operating costs of running a plant.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Also Check: Buy Wow Gold Safely

Australias Gold Mines By Production Grades And Costs Part 1

PCF Capital Group, a provider of corporate advisory services to the mining and resource sector, has released a report, highlighting current gold all in sustaining costs for Australian and New Zealand gold operations.

While we provide profiles of high performing mines and companies featured in the report, it is important to gain a thorough understanding of what makes up AISCs, and how important this metric can be especially during periods of commodity price volatility.

AISCs are the costs attributed to production at operating mines, and they are an important focus in gauging a projects commercial viability. It is important to note, that they dont include the costs such as building a plant and establishing the infrastructure required to bring a mine into production, commonly referred to as upfront capital expenditure .

AISC is a similar measure to what you might find in anything from manufacturing to retail, only in other sectors acronyms such as CODB and COGS are applied.

Because the mining industry is subject to unpredictable and uncontrollable commodity price movements, AISCs costs are what some mines live and die by.

For example, a marginal gold producer that has AISCs of US$1200 per ounce is sailing close to the wind based on the current gold price of around US$1280 per ounce.

On balance, such a company would be much more prone to significant share price volatility in the event of commodity price weakness than a stock with lower costs of production.

Why Investors Prefer To Buy Gold

Investors see gold as opposing power against bad central-bank policies and inflations. Most of the investors observe gold as insurance against the financial instability, uncertain situations, high government expenditures, non-desirable policy of the central bank. The standard 24k gold becomes the ideal choice when real returns on bonds and cash are decreasing or falling, irrespective of a rise of the nominal interest rate.

Also Check: Banned For Buying Gold Classic Wow

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

How Does The Gold Bar Price Vary From The Ounce Of Gold Price

Gold is available in many different forms, including modern gold coins, gold bars and older collectible gold coins.

The gold bar price will vary depending on the amount of gold in the bar. If the bar contains one ounce of gold, the price will typically be slightly less per ounce than the gold price for government guaranteed and minted gold bullion coins or other similar gold bullion collectible items. However, if the gold bar contains more or less gold, the price will vary mostly depending on overall weight. For instance, a one gram gold bar will not cost the same as an ounce gold bullion bar or a one kilo gold bar.

Make sure to know the exact amount of gold bullion contained in any gold bar or gold coin before purchasing or selling to ensure that you are indeed getting a fair price.

You May Like: How Much Is Spectrum Gold Package

Do Current Gold Prices Vary By Country

The price for an ounce or gram of gold remains mostly the same regardless of which country you are in. The price is determined by converting the current spot gold price for an ounce or gram of gold into the country”s currency. For example, the current spot gold price for 1 gram of gold would be converted into Indian Rupees according to the current exchange rate.

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

Also Check: War Thunder Free Golden Eagles Generator

What Is The Gold Bullion Bar

It is a bar or ingot of gold of various sizes bullion word originates from Louis XIII, Claude de Bullion, a French Minister of Finance. Its worth relying on its purity /immaculateness and mass. Pure bullion gold is called parted bullion that is officially 99.5% pure, while impure, sullied gold is called unparted bullion , one example is 22k gold widely using in jewelry. Gold rocks are initially found, mined, and afterward, gold is extracted utilizing great warmth and distinctive chemicals, then changed over into billions.

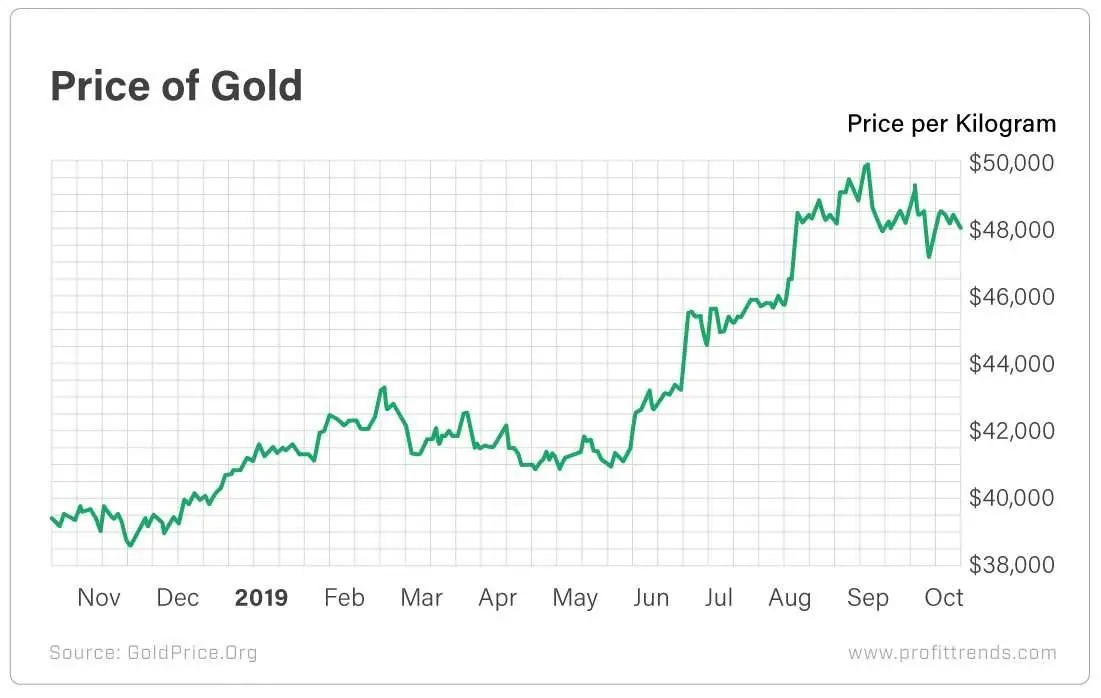

When Is The Gold Price Fixing

Irrespective of Gazetted Holidays and Weekend , the gold price is being changed at each instance of time, e.g., each second of a business day. The gold price is fixed twice every business day, that is, at 10:30 am and 3 pm, by the London Gold Market Fixing Ltd at London time, in the US dollar , the Pound sterling , and the Euro .

Don’t Miss: Runescapegoldmarket

What Makes Us The Best Scrap Gold Buyer

As a company serving in this business for many years, we completely understand how much you value your investments of Gold jewellery, coins, and bars. We also appreciate you for entrusting us with your precious items.

We work hard to give you excellent service and the best prices based on the gold price today. In every customer we receive, our friendly professionals do their best to provide an accurate value for your scrap gold jewellery. We guarantee an efficient and smooth process when selling your scrap gold. We will transfer funds directly into your account on the same day or pay instant cash.

What Are The Largest Gold Producing Countries In The World

The following are four largest gold producing countries, and they are producing more than 40% gold out of 2990 MT . Some decades before, they were not appearing in the map of the largest gold producers, but recently they became the leader of the gold market. These countries significantly affect the price of gold. They had the largest gold reserves and underground unmined gold. Though, there are some countries of the world, which claims of owning huge gold reserves. But there is no authentic proof of that.

1. China:

As per a survey conducted in 2014, China produced 450 Metric tons of gold, which is 15% of the world . Of course, China had a vast territory, and it has more mines than any other country of the world, still a considerable amount of gold underground that is around 1,900 tons, and had about 1762 ton gold reserves, and ranked on the sixth number. Therefore, China influence the International gold market, and can drive gold price up or down. The demand for Gold in China is also increasing day by day, and a significant percentage of gold is using in jewelry.

2. Australia:

3. Russia:

It produced 247 metric tons of gold that are closer to Australia, and 3rd number in the list of largest gold producing countries. In January 2016, Russian gold reserves exceeded the 1414 tons limit and currently in the list of owning most gold reserves. Russia does not export a considerable amount of gold but imports to increase the reserves. Around 5,000 tons are underground and unmined.

Don’t Miss: Golden State Grant Program For Ssi Recipients

What Are The Essential Terms To Understand The Gold Trade

Bid Price: Current market spot price at which one can sell gold.Ask Price: It is the current spot gold price of 24k gold at which investors can buy it.Spot Price: it is calculated using the recent average of bid price and asks price.Gold Price Fixing: It is carried out by the London Gold Market Fixing Ltd. It is also a benchmark for pricing the gold and its products.

What Common Factors Influence The Gold Price

The gold price is affected by a very wide range of factors. This is due to the nature of gold its both a store of value, and a commodity. For instance, supply and demand will affect the gold price in the USA, as well as around the world. If a new gold mine opens and the supply suddenly exceeds demand, then prices should fall. If a gold mine is exhausted and demand remains high, prices should rise. However, other factors that affect gold bullion prices include mint fees, fluctuations in currency, the state of the worlds economy and geopolitical challenges. So, there might be plenty of gold available, but if an unstable situation prevents a mine from transporting the gold out of the country, prices could go up. If the currency in one country becomes devalued to a significant extent, the local price for gold could rise as well.

Also Check: 10kt Gold Ring Value

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

Read Also: How Much Is 1 Oz Of 24k Gold Worth

How Are Gold Coins Prices Set

Gold coins are a very unique investment. They are sometimes considered legal tender and are produced and recognized by the issuing government. The coins are always labeled carefully with the correct year of issue, the gold purity, and the weight of the coin. Gold coins prices fluctuate daily, as they move separately from the stock market. Gold coin prices can be affected by several different factors. Factors like rarity, shifts within the money market and the stock market, a recession, or the threat of a recession, elections, political movement, or even geopolitical issues. These are all factors that can influence the price of gold coins.

Why Is Gold Mostly Quoted In Us Dollars

While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Given that the U.S. is the worlds biggest economy and one of the most stable, the dollar has become a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Reserve currencies are used to settle international transactions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

Read Also: Tinder Gold Free Code