$146average Discount At Program Completion*

The Snapshot discount is credited when you complete the program and then renew your auto policy with Progressive . Customers who renewed their policy, and earned a Snapshot discount, saved an average of $146.*

Your rate may increase with high-risk driving. But, only about 2 out of 10 drivers actually get an increase.

Who Is Offering You Roadside Assistance Coverage

You might want to think twice about roadside assistance if you already have it through your cars manufacturer or credit card. Many carmakers and credit card companies will offer free roadside service with certain perks and limitations. Its best to check with your manufacturer and credit card company to confirm before you purchase additional roadside coverage from your insurance provider or a third-party club.

More Insurance From Progressive

For those who need to protect a small business from financial loss, Progressive provides a variety of coverage types including a business owners policy, professional liability, workers compensation, commercial auto insurance and general liability insurance.

With identity theft and cybercrime continuing to pose challenges, many people are searching for a way to protect their assets from fraud and theft. Progressive sells identity theft protection and a credit monitoring service sponsored by Experian.

Progressive also sells life, dental, phone and electric device, health, travel, umbrella, vision and pet insurance. You also can find financial services such as personal loans and car shopping services.

Don’t Miss: Free War Thunder Golden Eagles Codes

Employer Group Health Insurance Plans & Benefits

Are you an employer looking for a customized group health insurance plan Then youre in the right place to find the benefits package you need for your We put you and your members first, so you can reach your health goals and priorities.

Nationwide offers insurance, retirement and investing products that protect your many sides. Get home and auto insurance quotes online or find a local agent. Check out some of the services and benefits available to you. Today we still answer to our members, but we protect more than just cars and Ohio farmers. Were

Jul 31, 2020 Progressives roadside assistance offers peace of mind at fairly Roadside assistance is auto insurance that pays for services to help The benefits of emergency road service coverage State Farm®. Retrieved May 28, 2020, from https://www.aaa.com/aaa/066/web/compare-membership-levels.html

How To Join Car Insurance Loyalty Rewards Programs

Before we go into detail about discounts, here is a video about saving money on teen driver auto insurance.

Car insurance discount eligibility is different for each company. Check out our car insurance loyalty rewards program chart and additional discounts below:

Car Insurance Discounts Offered by Insurance Companies

| Discounts |

|---|

For example, Progressive policy tiers come with different discounts. A list of Progressive discounts for the lowest level will be much different than mid-level or high-tier policies. Progressive uses a loyal rewards program chart that lists all the available discounts and services.

What discounts can you get for car insurance? You can vehicle discounts, student discounts, credit discounts, good driver discounts, and potentially many more. Loyalty rewards, of course, is a discount you earn by consistently renewing your policy for over three years.

Car insurance loyalty discounts come with added perks, such as free accident forgiveness or free windshield repair.

Some companies have referral rewards programs. These discounts work when you refer a family member, friends, or co-worker to your current car insurance company.

A clean driving record is one surefire way to get a coverage discount. Clean driving records indicate that youre less likely to get into an accident or file a claim.

Also Check: Spectrum Gold Package Price

How Much Does It Cost To Add A Teenage Driver To My Insurance

It’s generally cheaper to add a teen driver to an existing insurance policy rather than buy a separate policy for them. That’s because putting a teen driver on their own policy means they don’t benefit from the comparatively lower rate you’ve earned as a more experienced driver. Plus, teen drivers have a greater risk of getting into an accident, which means a separate policy would be priced higher to offset the increased risk of a claim.

Do The Research Define Your Personas

Based on your brand vision, you can create ideal profiles of the people you expect to become your loyal customers. This will remain a hypothesis until you really talk to them, but well-executed UX research not only grounds your former assumptions and explores areas that need a facelift, but also helps you identify the following:

- your realistic loyal customer personas

- their motivations to purchase and return

- their stories and backgrounds

- their values

- the kind of incentives, rewards, and progressive reward levels they want to receive

Having this kind of information makes it a walk in the park to construct a progressive customer journey and score that extra smile when customers come across your brand name.

User experience research helps you see your product or service through the eyes of the customer.

Also Check: What Is A 10k Gold Ring Worth

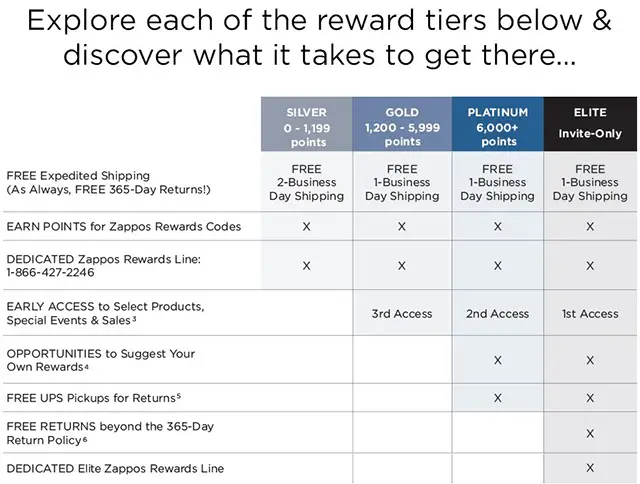

Keep Customers Motivated With Progressive Tiers

If you are looking for a mechanism that encapsulates the essence of progressive loyalty rewards, loyalty tiers are one of the most effective. In tier-based membership programs, customer ranks are determined by a given metric, such as total spend or accumulated points. Each progressive membership level has different rewards and perks attached to it the higher and more prestigious the tier, the more alluring the benefits are.

According to Nielsen, 60% of global consumers have stated that tiers appeal to them. Why? For starters, ranks dont expire unlike most point systems relieving customers from a constant source of stress. Furthermore, being on the hunt for better and better rewards is very exciting, since reaching a progressive member level gives people a sense of pride and accomplishment. At the same time, they dont have to worry about losing their progressive loyalty status.

Jörn Roegler, VP of Strategy and Insights and Zsuzsa Kecsmar, CMO and Co-founder of Antavo tackled the topic of loyalty tiers in this episode of Customer Loyalty Minutes.

Perks Of Progressives Insurance Loyalty Levels

Progressives insurance loyalty level system comes with several perks. Below, well explain those perks and how they work with your car insurance policy.

Continuous Insurance Discounts: The longer you maintain continuous insurance coverage, the more youll save with Progressive. Maintaining continuous insurance coverage shows youre a competent and low-risk driver. It shows you have not let insurance lapse, and that youve stayed protected at all times on the road. The longer you maintain continuous coverage with Progressive or other insurers, the more you can save.

Small Accident Forgiveness: Progressive defines a small accident as one with damages totaling less than $500 . Progressives forgiveness policy prevents your rates from rising after you make a claim for an amount less than $500. If you scratch the side of your car and make a claim under your Progressive policy, for example, then this claim wont increase your rates.

Teen Driver Discounts: If you have a teenage driver on your policy, then they qualify for additional discounts at higher Progressive loyalty tiers. Car insurance for teen drivers is expensive, and discounts can help you save hundreds per year on teenage driver car insurance.

VIP Customer Service: VIP customer service is available on Progressives two highest tiers, including Emerald and Lifetime Crown . With this perk, you get VIP priority any time you call Progressive, bumping to the front of the line and avoiding excessive wait times.

You May Like: War Thunder Golden Eagle Hack

How To Save On Car Insurance For Teens

You can lower the cost of car insurance with discounts* for students and teen drivers. At Progressive, we offer a variety of discounts for teens including:

- Good student: B average or better? Your young driver can earn about a 10% discount in most states for good grades.

- Multi-car: If your teenager has their own vehicle, we’ll chip in another discount just for having more than one vehicle on your policy.

- Teen driver: If a driver on your policy is 18 years old or younger and you have been consistently insured for at least 12 months, we’ll add a discount.

- Snapshot®: Our Snapshot® program rewards good drivers based on how they drive. Plus, our mobile app can reveal if your teen was driving distracted. Learn more about distracted driving.

Progressive Auto Insurance Faqs

How is Progressive handling its auto insurance claims during the COVID-19 pandemic?

To protect the health of its policyholders and employees, Progressive says it is currently prioritizing virtual inspections and interactions as much as possible. You can make your claim online, by phone, or via the Progressive app.

If I use my car for business purposes, will Progressive cover any damages?

Yes. Besides personal auto insurance, Progressive offers comprehensive commercial auto insurance for any type of vehicle including food trucks used as part of a business. To find out more about this type of Progressive insurance, .

How long does it take Progressive to handle a claim?

According to the companys website, Progressive requires between 7 and 14 days to complete your claim.

Also Check: Pheet Wipes Reviews

Do I Have To Add My Teenage Driver To My Insurance

A teenage driver must have car insurance in almost every state, so they can either be added to your policy or insured with a separate policy. Buying a standalone policy for a teenager can be expensive due to their lack of driving experience and a higher likelihood of accidents, so it’s usually more affordable to add a young driver to your existing policy. By adding them to your policy, they benefit from the savings and rate you’ve earned as a longtime driver with an established . Here are a few more reasons why it’s usually best to add a young adult driver to your car insurance policy:

Control

Since you already own the policy, you can easily add and update coverages to make sure your teen driver has the right protection.

Flexibility

If your household has multiple vehicles, your teenager will be insured to drive all of them.

Convenience

Youll only have to manage one policy.

Pro tip:

A separate policy is rarely the cheaper option for a young driver, but there may be a few exceptions. For example, if you drive a luxury vehicle or an expensive sports car and your teen isn’t going to drive it, it may be cheaper for them to have a separate policy. Talk to your insurer to fully weigh your options. You should still add your teenager to your policy since they live in your household. However, if the teen has a separate policy and will not drive any of the vehicles on your policy, then he or she may be eligible to be excluded from coverage on your policy.

How Much Is Car Insurance For Teens

A separate car insurance policy for teen drivers can be expensive because they have a greater tendency to drive distracted, speed, tailgate, and not wear a seatbelt. The average cost of teen car insurance, however, will vary based on the exact age of the driver, their ZIP code, driving history, and vehicle type. Learn more about the factors that impact car insurance rates.

Example:

A car insurance policy for a 16-year-old driver who just received their license will likely be more expensive than a policy for an 18-year-old with more driving experience. As teens get older, their rates can go down due to the added driving experience, especially if they have a clean driving record over time. At age 25, rates tend to go down even more dramatically.

You May Like: How Much Is One Brick Of Gold Worth

Pricing Based On Tracked Driving Habits

Snapshot is a free opt-in program that collects information on your driving habits, including speed, how much you drive and when you drive. Progressive uses the data to adjust your insurance rates up or down next time you renew, and you get an automatic discount for signing up . Data is collected from either a device you plug in to your vehicle or a mobile app.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Amex Gold Card Unboxing

Progressive Auto Insurance Policies

The coverage features of Progressives auto insurance policies are among the most comprehensive in the U.S.

As with most other companies, they include:

- Liability for when youre at fault in an accident, including coverage for bodily injuries to third parties and property damage.

- Comprehensive coverage for events beyond your control, such as theft, vandalism, and weather events.

- Collision coverage, provided regardless of fault, to repair or replace your vehicle in case of an accident. With Progressive, this coverage also includes free pet insurance to pay for any medical expenses in case your pet was injured in the collision.

- Uninsured/underinsured coverage to pay for any injuries or property damage caused by a driver who has zero or insufficient insurance to cover for the costs.

- Medical expenses also known as Personal Injury Protection to cover you, your family members, and/or your passengers in case of an accident, regardless of fault.

The company also offers the following coverages as riders or add-ons to your policy:

Is Progressive Good At Paying Claims

Similarly, just 57% of Progressive customers say they are completely satisfied with how the claim was resolved. Though these arent the lowest scores in our Best Insurer for Claims Handling subcategory, they are much lower than five of the other auto insurance companies we reviewed.

How many auto policies does Progressive have? The third-largest provider of auto insurance in the U.S., Progressive insures cars, motorcycles, boats, and commercial vehicles. It has over 18 million customers and more than 20 million policies in force today.

Dont forget to share this post !

You May Like: 18 Gold Price

Progressive Auto Insurance: Summary And Key Takeaways

More About Progressive Auto Insurance

Website: Progressives website includes an insurance quote tool and a portal where customers can log on, pay bills and see claim status. Additional helpful features include:

-

The Name Your Price tool, which helps you find a policy to fit your budget. Keep in mind that a lower price will come with a trade-off in coverage.

-

A comparison feature that shows competitor rates alongside Progressives quote for the same policy options.

Mobile app: Progressives main smartphone app allows you to report and track claims, view policy information, get quotes for new policies and request roadside assistance.

Snapshot mobile app: When you sign up for Snapshot, this app displays information about your driving behavior, records details about your trips and provides custom tips to improve your driving.

Virtual assistance: If you have a Google Home device, you can use it to ask Progressives digital voice assistant a variety of insurance questions. Or you can use Facebook Messenger to get a quote from Progressives Flo Chatbot or ask an insurance-related question.

Read Also: Do Diamonds Look Better In White Or Yellow Gold

What Should You Not Say To An Insurance Adjuster

Do not sign anything or give a recorded statement. You might omit important details. An insurance adjuster might ask for access to your medical files, and this might seem harmless. However, with access to files from years ago, an insurance adjuster might try to argue that your conditions were pre-existing.

Roadside Assistance Through A Vehicle Manufacturer

Most vehicle manufacturers offer roadside assistance programs for new vehicles. The programs generally provide lockout services, flat-tire changes, fuel delivery, battery jump-starts and towing to the brand’s dealership if needed. These programs last anywhere from the first two to five years of the life of the car, or up to as many as 100,000 miles.

Service is typically limited to your manufacturer’s network of dealerships and auto shops, so you’ll have to consider the geographic coverage of your manufacturer’s network. Remember that this service is only good for a specific vehicle and won’t travel with a driver. If you have an old car, or you simply value flexibility and convenience, then a different type of roadside program could be a better fit.

On the other hand, specialty cars such as hybrids and electric vehicles may require specialized expertise. In that case, your best bet is getting roadside assistance directly from your manufacturer. Other auto shops may not be equipped to fix your roadside headaches.Our table below gives a snapshot of the roadside services for a major and a specialty manufacturer for new vehicle models.

| Tesla |

|---|

| Yes |

Don’t Miss: Free Eagles App