What Amount Of Gold Does The Spot Price Refer To

The spot price always refers to the cost of one troy ounce of gold. Precious metal weights are traditionally measured in troy ounces. A troy oz is equal in weight to 31.1 grams .

Live spot prices also always refer to .999 fine gold or better. The Royal Canadian Mint is renowned for using .9999 fine gold for its 1 oz Gold Maple Leaf coins.

On the daily gold market, 1 ounce gold bullion coins are often the most common. The smallest size you will find is probably a 5 gram gold bar.

Troy Ounce Or Avoirdupois Standard Ounce

A troy ounce is not the same as a standard ounce, or what is referred to as the avoirdupois ounce. A single troy ounce measures out to be one-tenth heavier than a standard avoirdupois ounce, and it has been set as the international standard since the days of global trading in precious metals began.

This unique measurement has direct implications on your investment decisions, as some websites measure in ounces rather than troy ounces. Always be sure to make the change into troy ounces before deciding on an investment. If you are measuring in grams, be advised that one troy ounce is equal to 31.1035 grams.

The London Bullion Market Association

The LBMA is an association dominated by many of the worlds largest banks who alsomake a market in physical gold and silver bullion bars. The group is headquartered inLondon and is perhaps best known by bullion investors for establishing the fixprice. This price is unlike the spot price in that it is set just once per day in silverand twice per day in gold. The fix price does not fluctuate from moment to moment.

Fix prices are often referenced in contracts and agreements involving large quantities ofmetal. Parties can agree to trade at the fix price and avoid worry about agreeing on aparticular spot price while it bounces around.

And using a fix price makes it easy for either party to hedge. Bullion dealers, forexample, can sell inventory to a customer and buy replacement inventory from a mintusing the same fix price as the basis. Once again, they avoid worrying about the spotmarket moving against them during the period between completing the sale and making theoffsetting purchase.

You May Like: What Dentist Does Gold Teeth

Gold And Silver Prices On 17 August 2021

Following a minor recovery in worldwide precious metal prices on Monday, the price of 10 grams 22-carat gold decreased by Rs.180 to Rs.45,980 on Tuesday, 17 August 2021. The price of silver per kilogram was Rs.62,700. The price of 10 grams of gold in New Delhi and Mumbai is Rs 46,160 and Rs 45,980, respectively. In Chennai, gold was priced at Rs.44,480.

17 August 2021

Are My Silver Investments Taxed

Since the CRA classifies precious metals as investments, profit made on your metals will be subject to taxation when you sell them in the future. A T5008 tax form will be completed for you and a copy is submitted to the CRA, as well as provided to you during tax season. A T5008 form calculates the gain/loss on the investment, and you are taxed accordingly based on standard capital gains tax rules. Our purchasing team can help you calculate this amount and answer your questions

Don’t Miss: How To Get Free Golden Eagles In War Thunder

What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

Why Will Silver Protect Me In A Market Crash

Wise investors know that silver is a safe and reliable commodity.

Silver, along with gold and other precious metals, is unlike most commodities available on the market. Consider that when the market crashes, a conventional stock will follow suit and plummet in value. In this type of situation, silver has shown to actually strengthen in value as investors look for more stable entities to invest their dollars in. Furthermore, while the market might spike right back up within a couple of weeks, thus creating fears of inflation all over again, the price of silver has been known to grow steadily and bring great long-term ROI.

Don’t Miss: Does Kay Jewelers Sell Real Gold

What Is The Gold/silver Ratio And Why Is It Important

The gold/silver ratio is a calculation meant to serve as an indication of divergence between the market value of the two metals.

To calculate the gold/silver ratio, simply divide the price of gold by the price of silver.

Gold has always been more highly valued than silver, but as each metal fluctuates in price, the ratio between the two also changes. A gold/silver ratio of 80 or more has historically served as a reliable signal that the price of silver is about to rise or the price of gold is about to fall.

In modern times, the ratio has mostly remained between 50 and 80. A divergence to either end of that range often signals that a correction back toward the mean may be ahead.

Mike Maloney has discussed the gold/silver ratios historical patterns and utility, as well as where the ratio is likely headed.

Why Do Gold And Silver Prices Fluctuate

Like other investment assets, gold and silver are prone to price swings based on investor sentiment. They can also fluctuate due to trends in underlying supply and demand fundamentals.

Traders determine gold spot prices on futures exchanges. Metals contracts change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price.

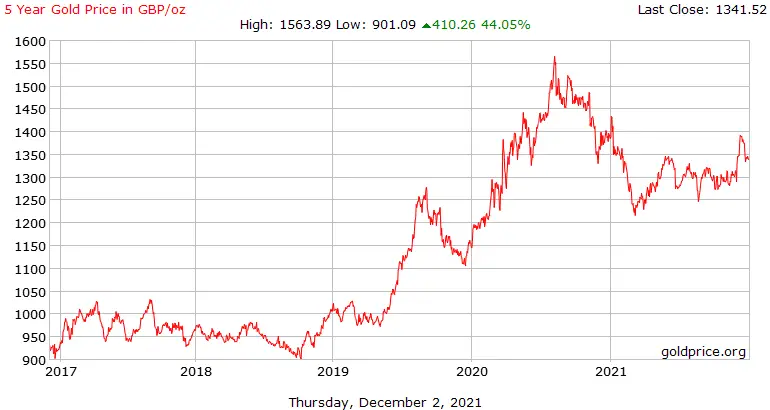

A hundred years ago, gold sold for just $20 per ounce. In recent years gold has traded between $1,200 and $1,900 per ounce. Thats a huge move up in nominal terms over the past century. Yet in real terms gold prices today arent much different from what they were when they were last quoted at $20 an ounce.

Its not that gold has become so much more expensive. Its that the currency in which gold prices are quoted has depreciated so much.

Don’t Miss: How Much Does 18k Gold Sell For

When Determining What Is The Price Of Silver What Is The Difference Between An Ounce And A Troy Ounce

An ounce is not a “regular” ounce when paying the spot on Silver price. When Americans refer to ounces, they generally are referring to avoirdupois ounces. The price of Silver per ounce is always measured in troy ounces, which are equal to 1.09711 avoirdupois ounces. One troy ounce equals 31.1035 grams.

Are Spot Gold Prices The Same Everywhere

Gold is traded and used all over the world for investment purposes, jewelry making and as a medium of exchange. Because an ounce of gold is the same whether it is in the U.S. or in Japan, the spot gold price is theoretically the same everywhere. Of course, differing currency values can have an effect on gold as well, and dealer premiums can also vary. Using the spot price of gold, the yellow metal can be bought anywhere using any currency. For example, if the spot price of gold is $1100 per ounce and you were looking to buy gold in Japan, you could figure out the necessary currency conversion to buy gold using Japanese Yen. Gold is traded all over the world, and thus its price is always on the move. Some of the major hubs for gold trading include the U.S., London, Zurich, India and more. The spot gold market is essentially always open, as markets follow the sun. Keep in mind that gold is typically bought for a premium over spot and sold at a discount to spot.

Read Also: How Much Is 400 Ounces Of Gold Worth

Why Wont My Dollars Hold Their Value

Scenario: the market has crashed, investors are selling stocks in an irreversible panic frenzy. In the months ahead, economic uncertainty conditions the populace to save their money as much as possible and not to spend. Like an economic time-bomb, these dollars sit quietly, waiting to have purpose. When this frugality mindset breaks and confidence is restored in the market, a large-scale sudden wave of spending can cause a rapid influx of dollars to over-flood the economy.

When there are more dollars to spend on goods than there are goods to sell, increased levels of inflation or even the rare economic killer known as hyper-inflation have historically occurred soon after. When this phenomena begins, inflation spirals out of control and collapses the economy into a devastating state, similar to the hyper-inflation of German currency leading up to WWII.

Dollars simply do not store value through turbulent economic periods, they can actually become quite useless – the germans used to burn them for warmth because it was more expensive to buy firewood with their currency!

Without a safe place to store the value locked inside our hard-earned currency, most of us stand to suffer a preventable loss – unless of course the value within our currency is translated into the form of gold bullion.

How Are Spot Prices Determined

Its important that all investors understand how the value of their holdings is established. Most commonly marketplace trading hinges on what is known as the spot price.

The spot price is the current price in the marketplace at which a given asset, such as a security or a commodity, can be traded.

While spot prices are specific to both time and place, in todays global economy the spot price of most assets tends to be reasonably uniform worldwide when accounting for exchange rates.

You May Like: Dial Gold Bar Soap Tattoo

Get The Gold Price Today From Goldpricecom

Goldprice.com is your destination for industry insight and the best tools to discover live spot prices for gold, silver, platinum and palladium. Our gold price charts provide accurate price data and allow you to research currencies from 37 different countries with 8 options for weights of measurement. We offer analysis and expert opinions to help educate you on the gold price today and prepare you for future purchases and investments.

Where Can I Find The Live Gold Price

You wont finder a better resource for observing live gold prices than via our gold price tracker. We measure fluctuations in the price of gold, platinum prices and silver prices as they are happening in real time. Silver Gold Bull Canada is the ultimate hub for measuring ever-changing gold prices. Monitor the live price of gold with our gold price chart data and absorb insights into past gold price trends as well as potential future prices of gold. Gold prices change every minute of the day, so stay informed and invest wisely when the gold price is right.

You May Like: Is Dial Gold Body Wash Antibacterial

The Troy Ounce Vs The Avoirdupois Standard Ounce

Gold prices are always measured in troy ounces. A single troy ounce is one-tenth heavier than the traditional avoirdupois ounce and has been set internationally as the standard upon which gold prices are measured. Some investment websites will measure gold by the gram or in kilos, as well as ounces. As global markets trade gold & other precious metals in troy ounces, it is advisable to always calculate your gold bullion investments in troy ounces.

When assessing multiple pounds of gold, keep in mind that one pound of gold works out to be 12 troy ounces. If you prefer measuring gold in grams, consider that a single troy ounce of gold works out to be 31.1035 grams.

Silver Coins Silver Rounds Or Silver Bars

Deciding between silver coins, silver rounds and silver bars comes down to two questions. First of all, you must know how large your investment portfolio is. Secondly, you must have an idea as to how much you will sell in the future. Once you have answers to these questions, the solution will become much clearer. Silver Rounds and Coins come in smaller quantities, such as 1/2oz, 3/4oz, 1oz, 2oz, and sometimes larger such as 5oz and 10oz. When it comes time to sell your investment, you have the added flexibility of selling in smaller quantities. Silver bars come in sizes ranging from 1oz, 5oz, 10oz, 1KG, 100oz and sometimes 1000ozs. These bars have lower upfront purchase prices, but will require you to sell in larger amounts at a time. Remember that your ROI is determined by the silver prices paid on first purchase, so monitor our live silver prices chart for maximum return.

You May Like: 10k Or 14k

What Can Cause The Spot Gold Price To Change

Any change or disruption to either the supply or demand for gold will move the spot price.

If a large gold deposit is discovered, the increased supply will cause the spot price to fall. The reverse is true if the gold supply decreases.

An increase in gold demand will also drive the spot price higher. Perhaps the demand is due to accelerating inflation or extreme economic uncertainty.

Supply and demand are affected on a daily basis, meaning the gold spot price is constantly in flux.

Changing Silver Prices And Gold Prices

Study the changing price of gold with our interactive gold price charts. Use our helpful gold price chart data to gain insights into the future price of gold. Simply make a selection with the sliders and observe the price of gold over any period of time. Observe gold prices on any particular day by hovering over any point in the gold prices chart. Gold prices are volatile, and change every minute of every day. Stay up to date on the current price of gold and use our information to your advantage of the best gold prices when it comes to your investments.

Read Also: How Much Is 14k Italy Gold Worth Per Gram

How Is Price Of Silver Determined

In the Roman Empire, the price of a silver coin was easy to interpret because it was not impacted by global market speculation. Today the silver price determination process is much more complex, as the price of silver is determined via a number of interrelated factors.

Part of the reason why the price of silver is so low compared to the gold price is due to the way in which silver is mined. The cost of silver mining is tremendously low, which can be ascribed to two causes. First, silver is mined in conjunction with gold and other precious metals because primary silver deposits are extremely rare. That means the costs of silver mining itself are shared amongst other mining operations, and are therefore comparatively low. Second, even though primary deposits are hard to find, silver itself is not. Unlike gold, there is no scarcity that holds back the potential growth of the silver market. There are plenty of silver mines in operation today, supplying silver for any number of uses.

This leads us to the second factor in determining the price of silver: industrial use. Silver is a popular metal in a number of industrial areas because of its strength, ductility, malleability, and conductivity . Demand for silver from manufacturing companies pushes against the supply of silver coming from the mines, and this inter-relationship increases the price of silver.

Industrial Commercial And Consumer Demand

The traditional use of silver in photographic development has been dropping since 2000 due to the decline of film photography. However, silver is also used in electrical appliances , , RoHS compliant solder, clothing and medical uses . Other new applications for silver include RFID tags, wood preservatives, water purification and food hygiene. The Silver Institute have seen a noticeable increase in silver-based biocide products coming onto the market, as they explain:

Currently weâre seeing a surge of applications for silver-based biocides in all areas: industrial, commercial and consumer. New products are being introduced almost daily. Established companies are incorporating silver based products in current lines – clothing, refrigerators, mobile phones, computers, washing machines, vacuum cleaners, keyboards, countertops, furniture handles and more. The newest trend is the use of nano-silver particles to deliver silver ions.

â

Data from 2010 reveals that a majority of silver is being used for industry , jewelry , and investments .

The expansion of the middle classes in emerging economies aspiring to Western lifestyles and products may also contribute to a long-term rise in industrial and jewelry usage.

Also Check: 1/10 Oz To Grams Gold

How Do You Determine A Fair Price

The result of the ever-changing factors being considered is that you will find each bullion dealer quoting different spot prices.

This can be confusing to first time investors who are used to, for example, a single price for a company’s stock on a single exchange. It often leads to questions about whether they are being quoted a fair price.

The only way to know if you are getting a fair price is to do what bullion dealers themselves must do, which is to shop around and see who is offering the best price at that time and take it.

In doing so, you become part of the huge, opaque precious metal market network of OTC traders.

With more than 120 years experience in the industry, The Perth Mint has built a reputation as a trusted precious metals trader with clients in over 130 countries around the world.

Gold buyers and sellers are welcome to visit us in-store at our bullion trading desk in East Perth, Australia or trade online.

See our spot prices here. Please note as per above prices are dependent on myriad of factors including product and sales channels which may lead to differing prices.