Are You Sure You Want To Decline

If you do not log in as a TD customer, you may continue to shop as a guest or as a TD Precious Metals profile holder. Please note that you will not eligible for TD Customer Pricing and that lower daily transaction limits will apply. See our FAQs for more details.

If you will like to review and agree to the Terms and Conditions, please click Cancel.

Why Buy Gold Or Silver

Golds appeal lies in the fact that its value is not tied to the health of the stock market and that it has an inverse relationship with the values of major currencies. In a time where economies all over the world are experiencing instability, gold behaves in a different way. Its value holds as other markets crash. Purchasing gold also comes with significant tax benefits.

Unlike other investments, gold does not require investors to pay VAT on investment grade gold, or Capital Gains Tax on UK investment grade gold and silver coins.

How Do I Buy Gold Certificates From A Bank

Gold is considered by many to be a secure investment because it is in high demand, it is a limited commodity and it rarely drops significantly in value. Although you can purchase gold and store it in a safe at home, you run the risk of losing the precious metal due to theft. It is far safer to buy gold certificates from a local bank. These certificates are documents stating that you own a specific amount of gold, even though you do not have the gold in your possession.

Monitor the prices at which gold is trading. Gold prices are listed daily in your local paper and on financial websites.

Stop by your local bank when gold values have dropped. Ask your bank if it provides gold trading. Larger banks often offer this option, but smaller banks or credit unions typically do not handle these sorts of investments. If your bank does not offer gold certificates, the manager may be able to direct you to a nearby bank that does.

Request the amount of gold you want to purchase. You can do this in either ounces or in dollars.

Pay for the gold certificates. If you pay with a check and you are not a customer of the bank, the gold certificates are considered void until your check clears. That means that if the price of gold suddenly changes dramatically, you may not yet be able to sell your gold certificates. Typically it takes a few days for your check to clear. Once this occurs, you are free to do with the gold certificates as you wish.

Warnings

References

Recommended Reading: Where To Sell Gold Rdr2

Physical Or Paper Gold

An easy way to differentiate between paper and physical gold is to think of one as a bank cheque and the other as cash. Paper gold is allocated in gold certificates instead of physical gold bars or bullion, and often comes in the form of futures contracts, mining stocks or gold exchange-traded funds . Paper gold comes with a much higher risk of purchasing and isnt as useful in times of financial crisis.

Physical gold is gold you have within your possession. Should investors need to liquidate their assets quickly, physical gold can be easily sold for needed capital, exempt from the Capital Gains Tax.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: War Thunder Eagles Hack

How To Buy Gold Stock

The best way to prepare yourself to buy a gold stock is to study the different types of available gold investments. You can:

- Buy physical gold bullion in the form of bars or coins.

- Trade gold options or futures contracts.

- Purchase gold certificates backed by a government mint.

- Acquire solid gold jewelry as an investment.

You can also find ways to invest in stocks that revolve around the gold industry, such as stock in gold mining, refining, and production.

If you choose to buy gold stocks, remember that gold can be a volatile market. Most investors allocate funds to both gold and traditional stocks to hedge their investments. By investing in only one type of stock, you can make yourself vulnerable to swings in the market.

Buying a gold stock is easy, too. For instance, if you use , they have a collection of almost 100 different gold stocks to choose from. Simply open up your Robinhood app, type in the ticker symbol of the stock you want to buy, click buy , and youre done. The hardest part is picking which gold stock you like best.

You should make gold a component of your portfolio without sinking all of your investment dollars into gold stocks. Gold acts to protect you against inflation but usually does not provide a fast return on investment.

Buying Gold Online Versus From A Bank

Most transactions today take place online. Like modern stock, bond, and equity trading, technology has enabled users to find the best deals and products quickly on the Internet.

Buying gold from a bank requires you to physically visit a location and then transport your gold and precious metals to a storage facility. But when you buy gold online, you have a custodian or other financial representative assist you in having your assets delivered directly to your or your secure location. This reduces the level of risk and concern associated with personally handling assets. Shopping online also allows users to explore and compare all possible precious metal offers, and not just those within driving distance.

While purchasing precious metals and gold from a bank may seem like the safest idea, its important to evaluate all of your options before you invest. Some people do feel more confident purchasing gold directly from a bank, and thats perfectly normal just make sure you are getting a fair price and that the inventory is in place before you make the trip.

If you decide that buying gold online is for you, check out Nationwide Coinsproduct catalog and compare our prices and reputation against our competitors to see why were the best place to buy gold online.

Government-Issued Gold Online

Don’t Miss: Rx Gold Card

Buying Gold Mining Stocks

If you can’t get your hands directly on any gold, you can always look to gold mining stocks. Keep in mind however, that gold stocks don’t necessarily move in concert with bullion prices, because mining companies succeed or fail based on their individual operating performance and how they deploy their capital and generate profits. You don’t have the security of physical possession of the metal if the companies you buy are unsuccessful.

How To Buy Gold Bullion

Are you wondering how and where to buy gold bullion? The best option is to go through a reputable gold dealer or a gold seller connected to a government mint to ensure that you receive real gold bullion. Gold bullion is available by the ounce or by the gram .

Buy physical gold bullion if you want raw gold that you can hold in your hand. Buying bullion gives you direct exposure to gold, but you need to store it somewhere safe in case of an emergency. Remember that gold bullion bars are a long-term investment.

You can buy gold bullion locally or online . Make sure to only buy pure gold bars, too. You can look at sites such as JM Bullion or APMEX. Youll also want to ensure that its minted by a popular gold minter such as Valcambi or Royal Canadian Mint.

Decide what currency you want to exchange for gold bullion. Almost any major currency, and even cryptocurrency, is tradable for gold. However, keep an eye on exchange rates to ensure your gold seller isnt taking undue advantage.

Using a reputable dealer, you may not need a third party to appraise the gold. However, if you buy gold from an unknown source, check for a 99.99% stamp mark indicating its purity and obtain an appraisal, to be sure. You dont want to end up with fake gold bullion.

Read Also: Where To Sell Gold Rdr2

Where Is The Best Place To Buy Gold And Silver Online

Gold has always been a popular option for storing wealth. Because of its perpetual shelf life and limited, predictable supply , gold maintains its purchasing power over the long-term.

Due to these factors, investors typically see gold as a safe haven in times of economic crisis. Just look at 2020, when the price of gold skyrocketed as high as 40% in the six months after the Federal Reserve made emergency rate cuts in an attempt to contain the economic fallout from the coronavirus.

Silver is also seen as a safe haven, although perhaps not as safe as gold. Unlike gold, silver is used in a lot of industrial applicationssuch as semiconductors, solar panels, and medical devices, which severely limits the supply of silver available for investment. As a result, the silver price is subject to more extreme fluctuations than gold. In other words, silver has a higher risk/reward ratio.

If youre thinking about investing in gold or silver, there are a few different ways you can go about it. You can purchase shares of mining companies that produce gold and/or silver purchase shares of an exchange-traded fund that tracks the price of gold or silver or actually buy physical gold or silver bars or coins . The purpose of this article is to help you find the best place to buy gold and silver online.

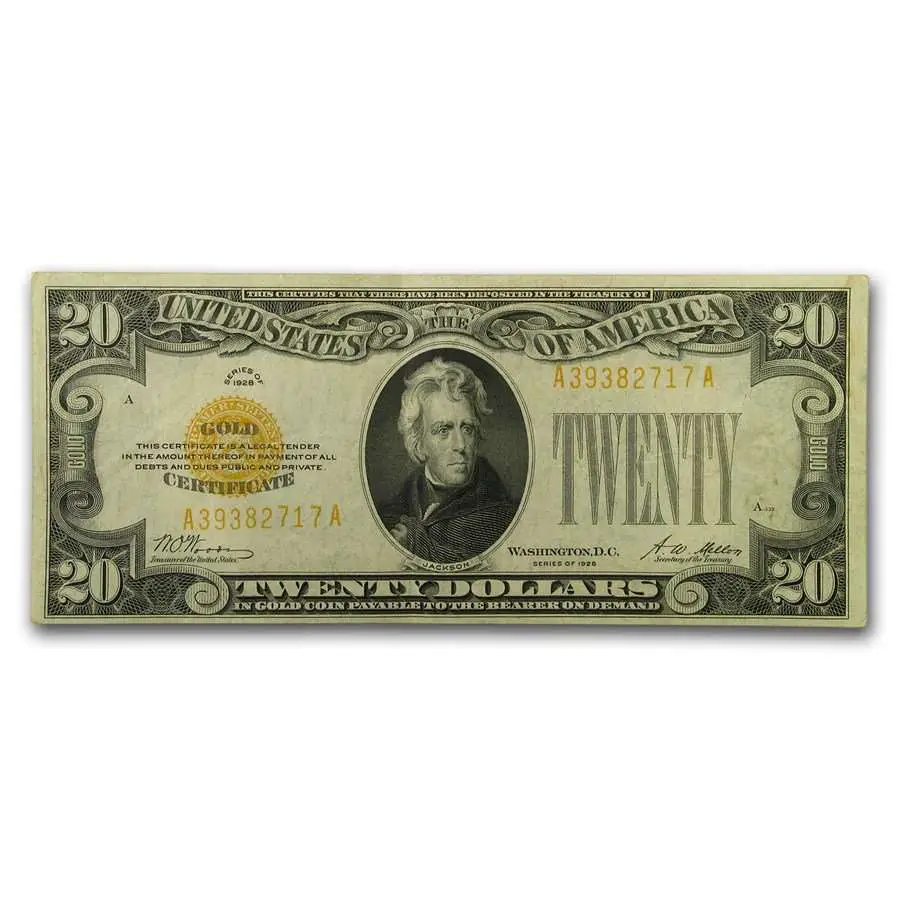

The 1922 Gold Certificate

In 1922, the first ever $10 gold certificates were issued. The notes feature a portrait of the first Treasurer of the United States, Michael Hillegas, on the obverse. The reverses were printed with gold ink, reinforcing their gold backing. Manny of these notes were destroyed following President Roosevelts decision, yet some survive in Fine condition. GovMint.com currently has some of these notes available. Each one that we sell comes with a certificate of authenticity, which is particularly important given the unique history of these certificates.

Don’t Miss: Robinhood Gold Crypto

Etfs That Own Mining Stocks

Dont want to dig much into individual gold companies? Then buying an ETF could make a lot of sense. Gold miner ETFs will give you exposure to the biggest gold miners in the market. Since these funds are diversified across the sector, you wont be hurt much from the underperformance of any single miner.

The larger funds in this sector include VanEck Vectors Gold Miners ETF , VanEck Vectors Junior Gold Miners ETF and iShares MSCI Global Gold Miners ETF . The expense ratios on those funds are 0.51 percent, 0.52 percent and 0.39 percent, respectively, as of July 2021. These funds offer the advantages of owning individual miners with the safety of diversification.

Risks: While the diversified ETF protects you against any one company doing poorly, it wont protect you against something that affects the whole industry, such as sustained low gold prices. And be careful when youre selecting your fund: not all funds are created equal. Some funds have established miners, while others have junior miners, which are more risky.

Why Is Gold Valuable

In ancient times, gold’s malleability and luster led to its use in jewelry and early coins. It was also hard to dig gold out of the ground — and the more difficult something is to obtain, the higher it is valued.

Over time, humans began using the precious metal as a way to facilitate trade and accumulate and store wealth. In fact, early paper currencies were generally backed by gold, with every printed bill corresponding to an amount of gold held in a vault somewhere for which it could, technically, be exchanged . This approach to paper money lasted well into the 20th century. Nowadays, modern currencies are largely fiat currencies, so the link between gold and paper money has long been broken. However, people still love the yellow metal.

Read Also: How To Get Free Golden Eagles In War Thunder Ps4

Buy Precious Metals Now

We offer the following precious metals in gold and silver with a minimum 99.99% purity:

| Physical bullion bars | Minimum investment of 1 oz. for gold and 1 oz. for silver |

| Physical coins | Minimum investment of 1/10 oz. for gold and 1 oz. for silver |

| Specialty collector coins |

Bars and coins are available in the following denominations4:

| Gold bullion bars | 1 oz., 10 oz., 100 oz. or 1 kg |

| Silver bullion bars | 1 oz., 10 oz., 50 oz., 100 oz., 1,000 oz. or 1 kg |

| Gold coins | 1/10 oz., ¼ oz., ½ oz., 1 oz. |

| Silver coins |

Banking Centre prices for precious metals are quoted in Canadian and U.S. currencies.

Online prices for precious metals are quoted in Canadian currency.

You may purchase precious metals from your Canadian-denominated chequing, savings or personal line of credit accounts.

No, theres no minimum purchase amount.

Yes. The maximum purchase amount is $9,500 CA within a 24-hour period. Visit a CIBC Banking Centre for purchases over $9,500 CA.

No, there isnt a fee for buying precious metals. Taxes based on your province or territory also apply.

No, all confirmed precious metals purchases online are final.

If the courier cant complete delivery after at least one attempt, youll receive a notice indicating where your shipment is held.

Yes, we insure precious metals purchased through CIBC Precious Metals Online while in transit.

Sign on to CIBC Online Banking®. Go to CIBC Precious Metals Online and select Order History to check the status of your order.

Reasons Why People Invest In Gold

Gold as a safe haven: A precious metal, gold has been around for centuries, preserving its value over the years and proving to be a good hedge against inflation. It is known to be a safe haven investors fall back on in times of market volatility, as gold can hold its monetary value.

Gold is a tangible asset: Much like cash and property, gold is an item you can see, feel and touch. This makes it an asset you can possess physically, giving it a perception of safety unlike other investment assets such as stocks, bonds or cryptocurrencies.

Diversification of your portfolio: Diversification is one way you can reduce the risk you take in your portfolio. This is done by spreading your investments across asset classes, geographies and industries so that when one industry or asset class takes a hit, your entire portfolio wont go under.

Adding gold to your portfolio is one way to increase diversification, especially as gold has shown to have low correlation to major asset classes.

Globally accepted and recognised: Gold is a precious metal that is recognised and valued all across the world. Be it a jewellery seller in Singapore, South Korea, or the USA, you will be able to sell your gold.

Visual appeal: Some people might purchase gold not just for investment reasons, but also because gold items can look beautiful, classy and elegant. This could be gold items such as your wedding bands, necklace, earrings and bangles.

Don’t Miss: Permanent Gold Teeth Side Effects

Where Does The Demand For Gold Come From

Gold is a safe-haven investment, meaning it should hold its value if paper currencies become worthless. Around 40% of the demand for gold is investment-based and includes gold coins, gold bullion, gold bars, and gold medals. Another 50% of pure gold demand comes from the jewelry industry, which maintains demand for other precious metals and stones.

The remaining 10% of demand for gold comes from various industries. Dental work can require gold, although this demand is slowly fading with the introduction of tooth-colored composites. Gold is a good conductor of electricity, so some electronics also use gold in the manufacturing process.

Where To Buy Gold In India

Gold is one of the most coveted metals in the Indian sub-continent. From weddings to anniversary to birthdays, Indians have been buying and stacking gold for centuries. Gold is considered a symbol of prosperity, purity as well as stability in the Indian culture.

Considering the soaring prices of gold over last several years, gold has become an excellent tool of investment. Gold deposits and gold certificates too have been launched by financial organizations for customers who do not want to buy physical gold but want to invest in the metal because of high associated returns.

Out of the several avenues available for buying gold, some of the most popular ones in India are listed here.

Also check : Today’s Gold Rate in India

Online gold purchase through banks

Pure gold in 24 carat can be obtained online via various banks. Banks like ICICI, HDFC, Axis Bank etc. offer customers an option to procure gold online. Customers just need to login to their online banking accounts, place the order for buying gold and then visit the nearest bank branch to receive their gold coin. Most banks assure highest purity of gold and offer comfortable denomination starting from 0.5g and going up to 100g for customers to buy. The gold that is bought online is generally delivered in a tamper-proof package along with certi-card that guarantees purity.

Wholesale buying of gold

Retail buying of gold

Buying gold through jewelry websites

Gold ETFs

Rates of gold in India

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

How To Buy Gold Jewelry As An Investment

Buy gold jewelry as an investment only after doing your research into the industry. If you go to a jeweler and buy a necklace, bracelet, or ring, you will almost certainly be overpaying for the actual value of the gold. Since retail jewelers add a considerable markup for gold jewelry, it could take decades before gold prices catch up.

Instead, look for gold jewelry from private sellers, preferably not at auction. The gold jewelry at auctions is usually pre-appraised and priced at or above the gold value. You should have better luck with small private sellers or lucky finds at garage sales or junk markets.

Gold jewelrys value depends upon the purity of the gold. Pieces that are marked 99.99% pure, 24-karat, or 24K should be high purity with worth equal to that of raw gold bullion. The lower the karat number, the less pure the gold.

Investing in gold by buying gold jewelry can be labor-intensive. You may be able to find some valuable pieces if the owner doesnt know their true worth or thinks they are costume jewelry.