Highest Price For Gold: Historical Gold Price Action

Gold hit US$2,067.15, the highest price for gold at the time of this writing, on August 7, 2020.

Golds breach of the significant US$2,000 price level in mid-2020 was undoubtedly due in large part to economic uncertainty caused by the sweeping COVID-19 pandemic.

To break through that barrier and reach that record high, the yellow metal added more than US$500, or 32 percent, to its value in the first eight months of 2020.

Despite this recent run up, the gold price has seen its share of both peaks and troughs over the last decade. Rising as high as US$1,920 per ounce in late 2011, the price of gold took a deep dive half way through 2013, dropping to about US$1,220. The gold price then remained between US$1,100 and US$1,300 from 2014 to early 2019 but in the second half of that year, a softer US dollar, rising geopolitical issues and a slowdown in economic growth pushed gold above US$1,500.

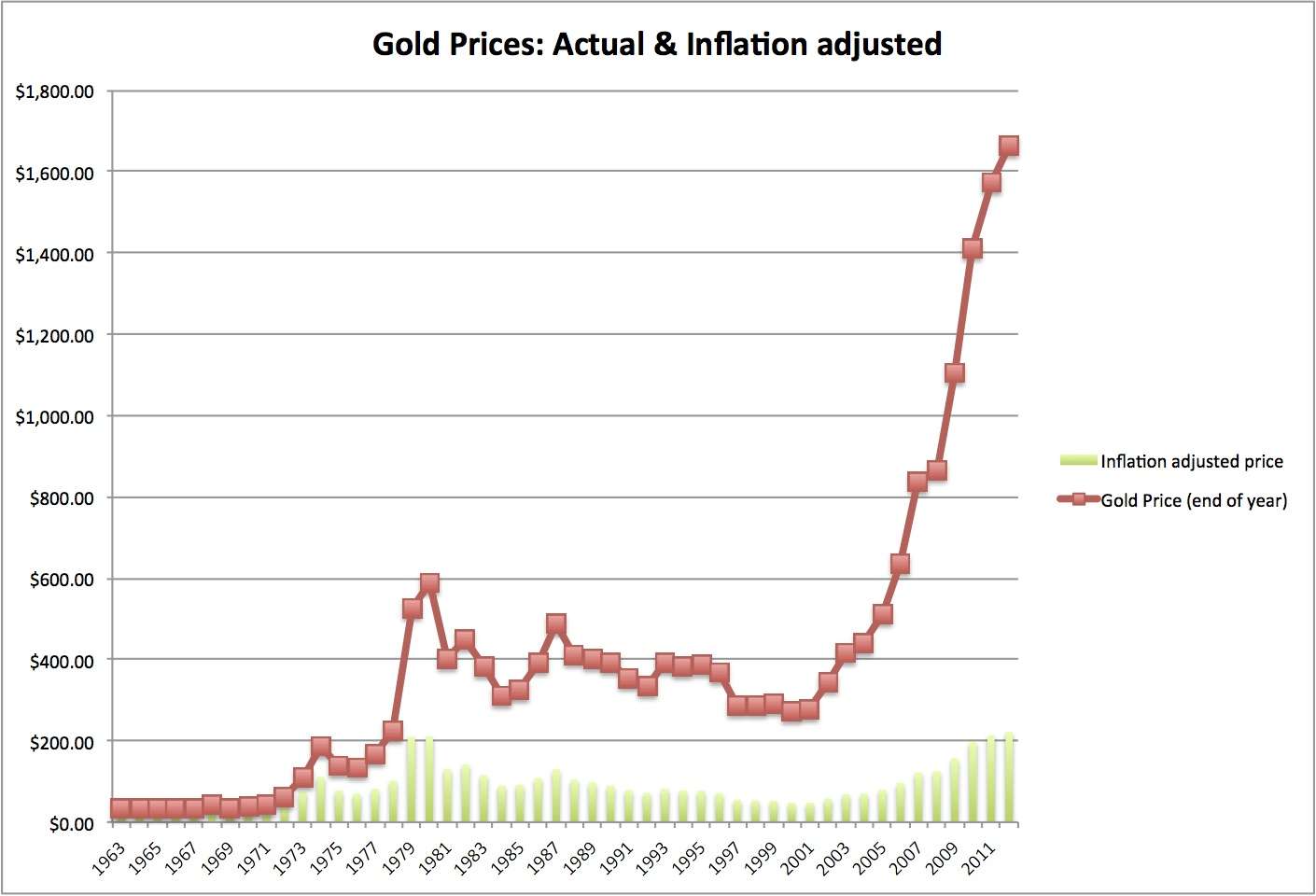

Gold price chart via Kitco.

Compared to 2020, golds price performance in 2021 has been a letdown for many market watchers who were hoping to see further gains. Golds failure to do so has surprised investors and commentators alike.

When will gold once again return to its upward trajectory? Only time will tell, but veteran investor Rick Rule, who recently retired from Sprott , views such downturns in the gold market as an opportunity, not a cause for concern, as conditions are ripe for the gold price to push higher.

How To Use A Gold Price Chart

Use U.S. Money Reserve’s gold price chart to compare the price of gold over a specific period. The amount of time is up to you. You can review gold prices from 1980 to 2008, or over the last 5 days, 1 month, 1 year, 5 years, or 10 years.

A gold price chart can help you identify gold price trends and figure out when is the right time to buy gold for you. As market analysts are prone to say, A trend is your friend! But how do you identify a trend?

Start by looking for peaks and valleys in gold prices during the selected period. Do you see a pattern? You might notice a spike in gold prices in late November every four years , or a dip when stock prices skyrocket. Identifying historical market trends doesn’t necessarily mean gold prices will perform the exact same way in the future, but trends and patterns could give you insight into what might happen and when you should act.

Does Volatility In Gold Prices Affect Interest Rates

Interest rates are tied to inflation, so they have historically been closely related to gold prices, as well. When the dollar’s strength increases and inflation decreases, then interest rates could be expected to fall at the same time as gold prices. Inflation is decreasing, so cash-like investments don’t need to offer such high-interest rates, and fewer people are rushing to gold as a stable store of value.

Read Also: Free Ge War Thunder

Historical Gold Prices Vs Silver

One of the best ways to understand golds trading value historically is to measure it against its precious monetary cousin, silver.

Investors often use the historic Gold Silver Ratio to understand perhaps which metal may be more undervalued vs. overvalued short, medium, and even in the long term.

Here is a short definition of the gold-silver ratio:

Gold Silver Ratio– a moving ratio measurement of the amount of silver one can buy with a fixed amount of gold. Typically in the western world, the gold to silver ratio is measured by merely dividing the gold spot price by the silver spot price. Weighed in like-kind amounts: grams, kilos, tonnes, troy ounces, etc.

For recorded history, the gold-silver ratio has been as low as 2.5 to a somewhat recent all-time of about 100 in the early 1940s and 1990s. The gold-silver ratio hit about 33 in the spring of 2011 and dropped to as low as about 16 as gold and silver peaked at prices in early 1980.

As of producing this content, the gold-silver ratio has risen near 80. The following long term charts show the respective history of gold vs. silver price ratios in the USA and UK respectively.

Gold Price Per Gram Today

Actual Gold Price equal to 57.53 Dollars per 1 gram. Today’s range: 57.50-57.61. Previous day close: 57.51. Change for today +0.02, +0.03%.

| 57.53 |

| 28.7% |

Gold Price forecast for .In the beginning price at 57.28 Dollars. High price 61.22, low 55.39. The average for the month 58.05. The Gold Price forecast at the end of the month 58.30, change for December 1.8%.

Gold Price forecast for .In the beginning price at 58.30 Dollars. High price 61.89, low 55.99. The average for the month 58.78. The Gold Price forecast at the end of the month 58.94, change for January 1.1%.

Gold Price forecast for .In the beginning price at 58.94 Dollars. High price 61.45, low 55.59. The average for the month 58.63. The Gold Price forecast at the end of the month 58.52, change for February -0.7%.

Gold Price forecast for .In the beginning price at 58.52 Dollars. High price 62.72, low 56.74. The average for the month 59.43. The Gold Price forecast at the end of the month 59.73, change for March 2.1%.

Gold Price forecast for .In the beginning price at 59.73 Dollars. High price 60.81, low 55.01. The average for the month 58.37. The Gold Price forecast at the end of the month 57.91, change for April -3.0%.

Gold Price forecast for May 2022.In the beginning price at 57.91 Dollars. High price 60.83, low 55.03. The average for the month 57.93. The Gold Price forecast at the end of the month 57.93, change for May 0.0%.

You May Like: How To Get Free Golden Eagles In War Thunder Pc

Gold Bullion Price Charts

Gold bullion bars are tangible assets, and throughout history, have been an ideal store of value with good trading potential. They are easily stored and transported, and can be a uniquely private way to preserve one’s wealth. Research historical pricing data and track the latest prices with our interactive gold price charts.

onoff

Copy and Paste below code into your HEAD tag / before end tag of body to embed chart.

Copy and paste code below wherever you want your chart displayed.

Copy and Paste below code into your HEAD tag / before end tag of body to embed chart.

Copy and paste code below wherever you want your chart displayed.

Official British Gold Price Data

You can download each years official British gold price from 1257 to 1945 by .

The nearly seven hundred year data set begins with a British gold per ounce price of 0.89 £ oz and ends with multiple centuries of a fixed 4.25 £ oz price for gold in British pounds.

Following World War II the price of gold in British pound terms has almost gone up exponentially eclipsing 1000£ oz for multiyear stretches in this decade ,

Recommended Reading: How Much For A Brick Of Gold

Whats The Price Of Gold Per Ounce

The price of Gold can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Gold per ounce, they are referring to the spot price. The spot price of Gold is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Gold per ounce.

Gold Price Forecast For 2022 And Beyond

Forecasts for the gold price outlook next year from different analysts vary, based on how they expect the market to respond to inflation and central bank policy.

Technical analysis from brokerage firm Zaner on 8 December noted that key points on the upside in gold are the 200-day moving average at $1,796.25 and then again at $1,800.

But, even though we leave the bull camp with a minor edge, the precious metals markets lack a definitive bullish fundamental storyline and lack upside momentum. Furthermore, recent gains have been forged on extremely low trading volume and almost no change in open interest, the companys analysts wrote in a note to clients.

Analysts at Australian bank ANZ expect gold to find support in the first half of next year but undergo downward pressure later in the year when the Fed is expected to raise interest rates. They wrote in their latest commodity report: As ultra-loose monetary policy nears an end and stimulus starts to shrink, support for the precious metals sector likely to wane in 2022. Despite more than a year of US Federal Reserve discussions around tapering, higher inflation and negative real interest rates have protected the downside of gold prices.

They added: In fact, with both an accelerated taper and more than three rate hikes already priced in for 2022, the balance of risks for gold positioning remains to the upside, as geopolitical risks and virus risk could catalyse a positioning reshuffling.

Also Check: 10kt Gold Ring Value

Gold Price History When France Called The London Gold Pool’s Price Rigging And Stood For Physical Gold Bullion Delivery

After the late 1960s collapse of the gold price rigging London Gold Pool, the August 1971 Nixon Shock ushered in our current floating fiat currency exchange standard where gold prices seemingly only gain value vs. fiat currencies over the long term.

Below is a chart of gold prices in US dollars during the year 1971.

What Was The Highest Price For Gold

Gold is considered a safe haven for investors during turbulent times. What is the highest price for gold so far?

Gold has long been considered a stable means of storing wealth, and the gold price often scores its biggest gains during turbulent times as market participants rush into this well-known safe haven investment.

Unarguably, the 21st century has so far been heavily marked by substantial episodes of economic and sociopolitical turbulence. These uncertain times have pushed the gold price to record highs as investors seek the perceived security of the precious metal. And each time the gold price rises, there are bound to be calls for even higher record-breaking gold prices.

Gold market gurus from Rob McEwen to Frank Holmes to David Smith have shared eye-popping predictions on the gold price that would make any market participant salivate gold bug or not.

While some have posited that gold may break US$3,000 per ounce and carry on as high as US$4,000 or US$5,000, there are those with hopes that US$8,000 or even US$10,000 gold could become a reality.

These impressive price predictions have investors asking, What was the highest price for gold? The answer to that question is revealed below. And by looking at how the gold price has moved historically, its possible to understand what that means for the yellow metal in the future.

Read Also: How Much Is 18k Gold Worth Per Ounce

What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

Value Of The Us Dollar

The price of gold is generally inversely related to the value of the United States dollar because the metal is dollar-denominated. All else being equal, a stronger U.S. dollar tends to keep the price of gold lower and more controlled, while a weaker U.S. dollar is likely to drive the price of gold higher through increasing demand .

As a result, gold is often seen as a hedge against inflation. Inflation is when prices rise, and by the same token prices rise as the value of the dollar falls. As inflation ratchets up, so too does the price of gold.

Don’t Miss: How Much Is A Brick Of Gold

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Studying The Gold Rate Trend In India

Studying the gold rate trend in India could offer an insight into future fluctuations and investment plans can be made accordingly. The gold rate depends on a number of factors like the stability of the central bank, the supply and demand of gold in the market, quantitative easing, government reserves, the health of the jewellery industry and overall yearly production to name a few.

Gold prices in 2018 saw some significant fluctuations due to ongoing geopolitical tensions in the United States, which impacted the U.S. dollar rate and influenced global bullion demand. Local demand for the yellow metal was influenced by the fluctuating rupee rate, which continued to play second fiddle to the dollar. The ongoing Brexit crisis caused fluctuations across the Eurozone, which led to a surge in bullion demand towards the end of the year. The U.S government shutdown also served to pressure the U.S. dollar, though gold rates did not see much impact at the time.

You May Like: Does Kay Jewelers Sell Fake Diamonds

How Are Gold Bars Prices Set

Currently, there are many types of gold bars circulating the world’s precious metal market – meaning there are endless possibilities to pick from. Buying Gold Bars is the most popular way of investing in the precious metal market. Their price is set based on their quality, craftsmanship, weight, and sometimes year of issue and rarity. The price of a gold bar contains three main elements: the metal price, the premium, and the VAT. However gold is exempt of VAT in most European countries. The metal price is directly based on the spot price which is the most recent price of gold on the market. Depending on its weight and quality, a gold bar will have a higher or a lower metal price. Finally, the premium is our margin, it is the part of the price of your gold bar that will come back to GOLD AVENUE to pay for production and others costs related to selling the bar. The margin can vary for each product depending on its level of craftsmanship for example. This is why minted bars tend to have slightly higher premiums than cast bars, as it takes into account the bars artistic value.

How To Buy Gold

First, decide what kind of Gold youre interested in buying. There are several types of Gold, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Gold bullion, choose between Gold coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Gold. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Gold in their own vaults or lockboxes at home, as well.

Also Check: How Much Does A Gold Bar Weigh Lbs

Gold Price Forecast For 2022 And Beyond: A Buy Hold Or Sell

Gold price forecast for 2022 and beyond: A buy, hold or sell? Photo: Shutterstock

The gold price retreated from a mid-November spike to end the month slightly lower. It has picked up after a further drop at the start of December.

A stronger US dollar offset higher inflation expectations and stable interest rates, preventing the precious metal from holding onto the gains. The market continues to observe the impact of the Covid-19 pandemic on the global economy and gold demand, as well as central bank policy on tapering monetary stimulus and raising interest rates.

Whats the outlook for the gold price in 2022? Should you consider taking a long or short position?

In this article, we look at some analysts latest gold price projections.

Should I Invest In Physical Gold

If you are thinking about investing in gold, then you are at the perfect place! Gold is the most valuable and popular commodity available on the market. GOLD AVENUE has a wide and beautiful selection of gold coins, ingots, and bars available for you to start your precious metal journey. You can choose between the most popular gold coins on the market: the classic American Eagle coin from the US Mint or the stunning Canadian gold Maple Leaf from the Canadian Mint. If perhaps coins arent what you are looking for, you can find the products for you in gold cast bars or minted bars from the world-renowned Swiss refinery PAMP. We are also the official online retailer of the most famous minted bar: the classic Lady Fortuna from PAMP. Gold is a timeless and elegant commodity that every investor should consider to diversify their investment portfolio.

Also Check: Golden State Grant Program For Ssi Recipients

An Exceptional Gold Price Historic Chart On 40 Years

Long term gold charts are crucial because they show dominant trends. The gold price chart on 40 years is the one with the most historic data. It reveals an exceptional pattern not seen on any other historic gold price chart: a historic rising channel with several subchannels which can help us in forecasting gold price. It confirms our gold price forecast 2019.

Most investors tend to forget the importance of long term charts. It is so easy to get caught up in the endless stream of gold price news. Not that we consider this to be the reference but just as an illustration we refer to this gold news stream or simply the Google gold price feed.

The big problem with short term gold price analysis as well as short term oriented gold news is that it distracts from what really matters, i.e. dominant gold price trends.

When it comes to gold we would argue that the most dominant trend is visible on the historic 40 years gold price chart.