How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How You Are Protected

There are two major entities within Robinhood: Robinhood Financial LLC and Robinhood Crypto LLC. The former deals with stock and options trading, while the latter is responsible for crypto trading.

Robinhood Financial LLC is a member of FINRA and falls under the US investor protection scheme, the SIPC. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.

Not all investments are protected by SIPC. In general, SIPC covers notes, stocks, bonds, mutual funds and other investment company shares, and other registered securities. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options.

Robinhood Crypto LLC is not a member of FINRA or the SIPC. This means trading cryptocurrencies is not protected by any investor protection scheme.

Robinhood does not provide negative balance protection.

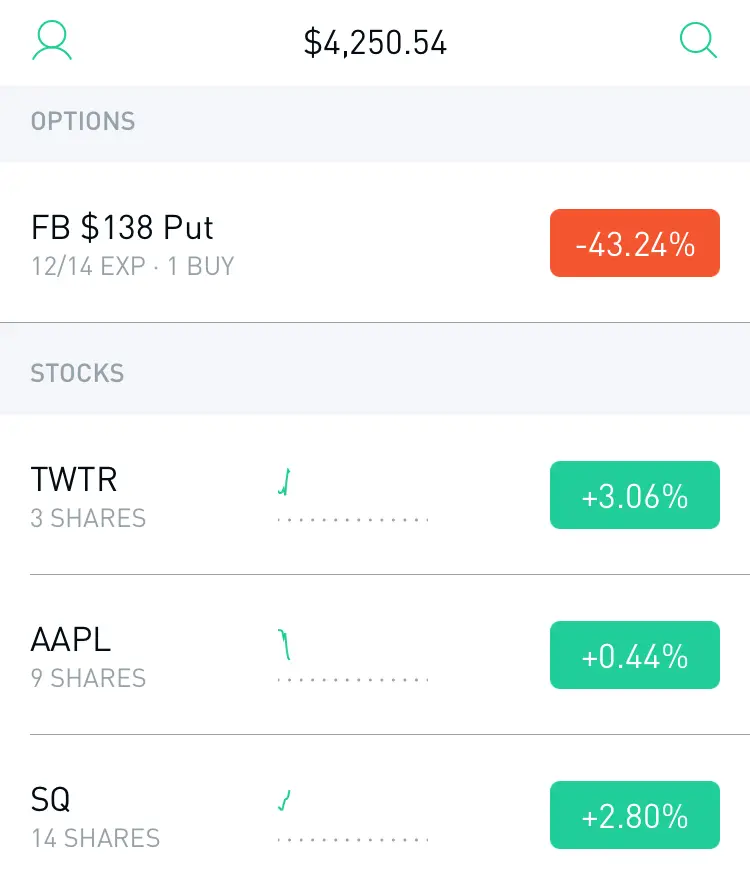

Things To Consider When Trading Options On Robinhood

You should know what you are doing. Options are a beast in the trading world, and you should know the risk and its good that Robinhood gates access to the higher risk/reward levels.

I hope this goes without saying, but you should know the market and instrument are you trading intimately.

Options market can have considerable upside but unlimited downside risk if you are not careful. There are a great many horror stories of individual traders and even experienced brokerage houses who have lost more than the value of their accounts in the options markets.

For any new and current trader in any market, it should haunt you and reinforce the importance of risk management. I would heavily encourage you to learn, read, and make sure you know what you are doing before you dive into the options markets.

Read Also: 18 Gold Price

How To Get Approved For Options On Robinhood

Youll need to disclose several details if you want to trade options on Robinhood. Heres what the app generally requires:

- Your investment objectives

- Investment knowledge and experience

- Financial data

Once youve submitted the necessary information, Robinhood assesses it and decides whether or not to approve you for options trading. The platform evaluates if youre eligible for certain levels of trading, depending on your information. If you obtain a level two designation, youll be able to execute three types of trades:

- Cash-covered puts

- Covered calls

- Long puts and long calls

Customers who want to engage in level-three options trading also undergo a thorough evaluation. Robinhood determines if youre eligible according to the previously mentioned criteria . Once the assessment is complete and you get approved for level-three trading, you can perform all level-two operations, plus the following trades:

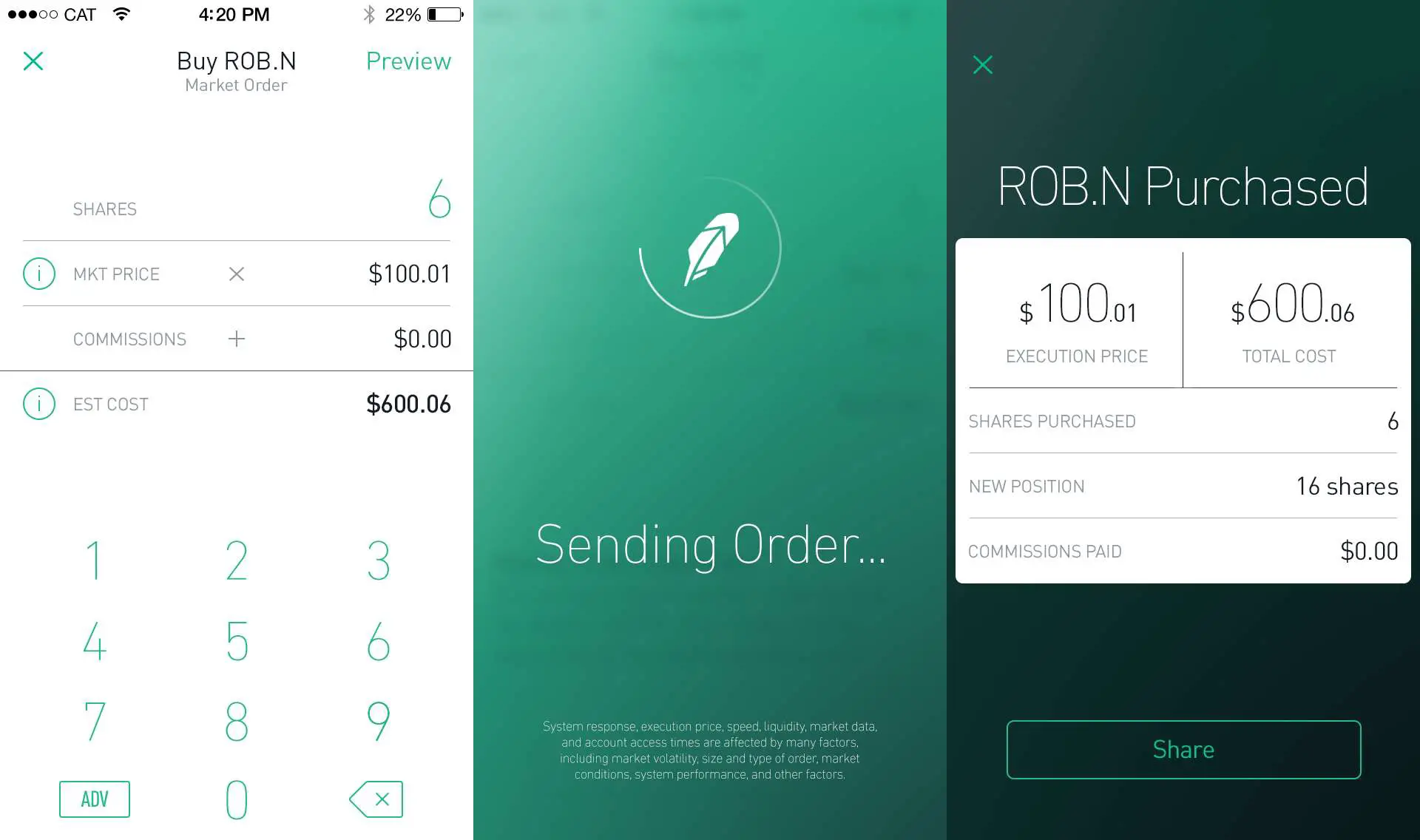

You can then start placing your options trades:

Can I Try Gold For Free

You can try Robinhood Gold for free for your first 30 days. After your free trial ends, you will be charged $5 at the beginning of each billing cycle unless you cancel your subscription before the next billing date. You can find the billing date in your account settings under Robinhood Gold.

The free trial only covers the $5 monthly fee and does not cover any interest accrued if you invest on margin. This means that if you borrow over $1,000, youll still pay interest at the end of your billing cycle.

Recommended Reading: How Much Is One Brick Of Gold

How To Buy Crypto On Robinhood

As a new investor on Robinhood, you can begin the crypto buying process by logging into your Robinhood account via the desktop or mobile apps. You will need to transfer money from your bank account, which will be held as brokerage cash on the Robinhood platform. This deposited amount is now your buying power to buy stocks and crypto via the app.

All crypto trading is done through a separate Robinhood Crypto account, which some users may not be able to access depending on their state or country. States such as Hawaii in the U.S. dont currently offer crypto trading with Robinhood.

To purchase crypto on the Robinhood app you will need to:

Is Robinhood Margin Worth It

Robinhood Financial is an online broker platform designed to open doors to the financial markets by offering commission-free trades on an easy-to-use mobile app. It does not require any account minimums. They dont charge any fees when you open an account, transfer funds to it, or for maintaining your account.

Robinhood Gold is a premium feature that lets you buy on margin. However, this is extremely risky, particularly for new investors. You will also have to pay for a gold account. Think carefully about whether or not you need or can manage margin trading to reach your money goals.

In order to trade on margin with Robinhood, you need a minimum of $2,000 in your brokerage account. You also need a Gold subscription for $5 per month. This will cover your first $1,000 of margin. Beyond that, you will have to pay 5% interest on any additional funds borrowed. Before borrowing money, consider whether or not you really need margin.

You May Like: War Thunder Golden Eagles Generator

How Does Robinhood Taxes Work

All users have to pay taxes on Robinhood stocks if the dividend income is over $10 or if you sell stocks for a profit within a filling year. As per the IRS guidelines, all the profits made from the selling of stocks are subject to short-term capital gain tax at your ordinary tax rate and to long-term capital gain tax at either 0%, 15% or 20%.

Robinhood tax documents are available under the Account icon –> Navigate to Statements & History –> Tax Documents.

Robinhood Pros And Cons

Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Its mobile and web trading platforms are user-friendly and well designed. Account opening is seamless, fully digital and fast.

On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Customer support is available via e-mail only, which is sometimes slow. The educational material lineup is slim.

| Pros | |

|---|---|

| Free US stock and ETF trading | Limited product range |

| Great mobile and web trading platforms | Weak customer support |

| Fast and fully digital account opening | Few educational materials |

| Country of regulation | |

| Time to open an account | 1 day |

Trading US stocks and ETFs is free at Robinhood. The broker doesn’t charge an inactivity or withdrawal fee.

| Pros | |

|---|---|

| Commission-free US stock and ETF trading | None |

| No fee for deposit or withdrawal | |

| Transparent fee structure |

| Stock and ETF trading is free |

| EURUSD |

| No inactivity fee |

You May Like: What’s The Price Of 18 Karat Gold

How Does Robinhood Margin Work For Beginners

Trading on margin can be risky business because you are investing with borrowed money.

If the stock takes a downturn, you will lose not only your own cash but also the money you borrowed from Robinhood.

On the other hand, if the stock sees an increase in value, you can see higher returns than if you had just used the cash you had on hand.

It could go either way.

Before trading on margin, it is imperative that you do your own research and understand how it works. Here are the basics of Robinhood margin for beginners.

But before even considering investing on margin, you should give some thought to the following:

- Specific investment goals

- Tolerance for risk

- Current financial status

Most people borrow on margin to invest because they think they need extra buying power. Before doing so, check out this article on earning compound interest. You might not need that extra buying power and risk.

Levels Of Options In Robinhood

There is no doubt that Options are great and flexible investment deals that one can choose for them.

You must also know at the same time that Options are not the best investment option for everyone. But for the security of both parties, the options trading needs approval.

For this, Robinhood has allowed 4 levels of the options approval process. One must know that the approval process becomes more rigorous as the levels of options increase.

It depends on different factors to make you eligible for options trading.

Using level 2 approval, you can use the strategies mentioned below.

- Sell covered calls

- Buy Calls and Puts

- Sell cash covered puts

Moreover, Using level 3 approval, you can use the strategies mentioned below including the ones mentioned in the level 2 approval.

- Iron condors

Also Read:How to Enable Dark Mode in Robinhood?

You May Like: How To Earn Gold Bars In Candy Crush

What Does Robinhood Gold Cost

For $5 a month, you get all the Robinhood Gold premium features.

The platform will also include your first $1,000 of margin. Robinhood will charge you $5 every 30 days at the beginning of your billing cycle.

If you use more than $1,000 of margin, youll pay 2.5% yearly interest on the amount you use above $1,000. Robinhood will calculate your charge daily and debit your account at the end of each billing cycle.

In addition to the benefits listed above, Robinhood Gold is a , so there are additional risks and responsibilities you should be aware of. With margin investing, the returns on any stocks bought on margin have a magnified effect on your account value. Whether positive or negative.

Let us be clear, margin trading on Robinhood is completely optional. You do not need to use the margin features if you choose to purchase Robinhood Gold. You can simply say no to margin investing.

Risks With Trading Options

Options markets, like any market, are not without their risks. Something very singular to options markets is how risk is measured. In options trading, this is known as the Greeks. Option Greeks are five primary measurements of risk: delta, theta, gamma, rho, and vega.

Delta represents the ROC between the options price and the underlying instruments price. Theta measures decay decay measures the decline in the value of an option as it moves closer to expiration.

Gamma measures the delta between the option and the instruments price. Rho measures the rate of change between the options value and a change in interest rates. And finally, vega, which measures volatility (known as implied volatility. In a nutshell, options can magnify your wins and losses.

There are options trades that you can take that create unlimited liability, like naked calls.

For example, lets say you sold naked calls on company XYZ, which is trading at $10. You dont think XYZ has any chance of moving higher, so you sell 100 calls with a strike of $15 for $1 .

You go to sleep , and you wake up to find XYZ had a meteoric rise to $50 instead of $10,000 in your pocket, youve got a $350,000 loss.

Don’t Miss: Does Blizzard Ban Gold Buyers

What Does Robinhood Gold Offer

Robinhood has made a name for itself by offering a wide selection of ETFs and stocks. Investors buy and trade the ETFs and stocks without paying fees or commissions. Those who upgrade to Robinhood Gold can enjoy even more features, but they still wont have to pay commissions or fees on trades.

Some of these features include access to professional research and Level II market data, instant transfers up to your Portfolio Value starting at $5,000 , and margin trading if approved.

With margin trading, federal regulators require you to have a minimum of $2,000 of Portfolio Value in your Robinhood account. If you use more than $1,000 of margin, youll pay 2.5% yearly interest on the amount above that $1,000 mark.

How Do I Get My Money Out Of Robinhood Without Paying Any Fees

First, sell all your stocks and any other positions. Next, transfer all your cash via ACH to your bank account . Finally, contact Robinhood to close your account. If you transfer stock holdings to another broker, Robinhood will charge you a $75 ACAT fee. Switching brokers? See our list of the best online stock brokers for 2022.

Recommended Reading: Safely Buy Wow Gold

How To Get Level 3 Robinhood Options

Like any other level, your profile will undergo an approval process to enable you to trade on level 3. To get approved on level 3 Robinhood options, you will have to get the required experience in trading.

There are times when the application will notify you that you are still not eligible and require more investing experience. In such a case, you will have to apply again after making some more trades.

Also, you will have to keep in mind the risk tolerance is more in level 3 options trading.

Whats Bad About Robinhood

No educational resources for first-timers

For an app focused on first-time investors, Robinhood sure does fail to provide educational resources that could help new investors navigate the stock market. This feels like a huge oversight for a company that has specifically targeted novices. At the very least, Robinhood should have a “Getting Started” article, and at best, Robinhood would build out a library of “Investing 101” resources within the app.

Robinhood does make some gestures to building an “investor profile.” When you first sign up, youll be asked to answer questions about your goals, your timeline, your risk tolerance, and your income. These questions are reminiscent of how robo-advisors like Betterment and Wealthfront build your portfolio. But Robinhood doesnt do anything with this information. Its like someone set out to build an educational feature, but forgot to actually put it in.

Missing research tools

Unlike other brokers, Robinhood doesnt offer much in the way of research tools. If you want to dive deep on a company or an entire industry, youll have to look elsewhere. For more experienced investors, research tools at other brokerages could be worth the cost of a commission fee on trades.

No IRA options

Here’s our easy guide on opening an IRA.

You May Like: Is 24kt Gold Pure

Robinhood And Free Trades: What Every Investor Needs To Know

Robinhood has become a favorite app among young traders, thanks to its free trading platform and the ease at which users can buy and sell stocks and cryptocurrencies.

Over the few years, the investing app has gained popularity as trading stocks has become something of a national obsession but its also seen its fair share of controversy. Earlier this year, Robinhood removed the confetti animation from its platform amid accusations that it was gamifying investing and faced criticism when it curtailed its users ability to trade GameStop stock at its height.

But the company has always been able to tout its commission-free platform. Active investors can execute their trades at rapid-fire speed without paying the fees that they may at traditional brokerages.

Will Your Instant Deposits Count Towards The $25000 Minimum

Unfortunately no. If you want to day trade on Robinhood, your instant deposits wont count towards meeting the $25,000 minimum. For example, lets say you transferred $1,000 into your Robinhood account.

Even though your buying power immediately increases by $1,000, the actual funds that count towards your overall equity wont change until the funds settle. Typically this takes around five days.

Read more on how to get started in stocks if youre new and looking to learn. Trading is exciting when properly trained!

Don’t Miss: How Heavy Is A Brick Of Gold

Fractional Shares & Cash Management Accounts

Robinhood really only stood above Webull in two regards: cash management accounts and fractional share investing.

Many brokerages and investment apps offer cash management accounts, which provide you with a debit card and a checking or savings account that might even earn a modest interest rate. Robinhood offers a decent cash management option, and if you have a margin account you can use it as a line of credit via the cash management options. Webull does not offer a cash management account.

Fractional shares are a popular way for new investors to get access to stocksespecially those belonging to companies with a very high cost per share, like Amazon.com Inc. . Both Webull and Robinhood offer fractional shares. However, whereas most stocks and ETFs that trade on Robinhoods platform are available as fractional shares, only some ETFs and stocks available on Webull can be bought in this way.

| Feature |

|---|