Whats The Price Of Silver Per Ounce

The price of Silver can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Silver per ounce, they are referring to the spot price. The spot price of Silver is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Silver per ounce.

What Is Silver Bullion

Silver bullion refers to a Silver product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Silver bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Silver bullion, meaning the product is either 99.9% or 99.99% pure Silver.

Buy The American Eagle 1 Oz Gold Coin

Money Metals Exchange is pleased to make available the highly popular American Eagle gold coin series in the 1 ozgold bullion size, produced by the U.S. Mint since 1986. Each Golden Eagle Value is based on its gold content, but it also carries a legal tender value of $50 US , $25 US , $10 US and $5 US . The Golden Eagle’s weight, content, and purity are guaranteed by the United States Government. While Gold American Eagle coins contain either a full 1 ounce of gold , by weight it is 91.67% gold , 3% silver, and 5.33% copper.

Here is more about the product, specifications, and purchase price:

1 Oz Gold Coin Specifications

Introduced in 1986 by the United States Mint, the American Eagle gold coin series, minted in four different sizes:

- 1 oz.

- 1/2 oz.

- ¼ oz.

- 1/10 oz. .

The front of the gold bullion coin looks similar to the 1907-1933 twenty-dollar gold coin and its depiction of a robed lady Liberty, designed by Augustus Saint-Gaudens.

The back of the coin is adorned by a family of eagles, and the words United States of America, In God We Trust, E Pluribus Unum, the face value, and the gold weight of the coin.

You May Like: How Many Grams In 1 Oz Of Gold

How To Buy 1 Oz Gold Bars In The United States From Goldcore

You can buy gold bars online from GoldCore for delivery or storage using the BUY button or you can call our office to place your order over the phone.

We deliver gold bars and coins fully insured to our American clients throughout the United States from our depository partner vaults in Delaware. We offer all major bullion bar and coin products for delivery and storage and you can pay by bank wire, by credit card or by debit card.

Many of our U.S. clients opt to store their gold bars in fully insured, offshore Secure Storage locations. We specialize in offering U.S. clients access to allocated and segregated bullion storage in secure nonbank vault partners in safer jurisdictions in the world such as Zurich, Hong Kong, London, and Singapore.

Insured delivery of gold bars to homes or offices is also popular and many clients do both – take delivery of a portion of their gold and own the rest in Secure Storage.

How Frequently Does The Gold Ounce Price Change

Spend any time studying gold price history or a current gold price chart, and youll notice that the gold price changes, and it can do so frequently. The market opens at 6 PM EST and closes at 5:00 PM EST, and operates from late Sunday night when the gold derivative markets open in Asia to late Friday evening when they close in the west. There is a one hour window daily where the market closes on weekdays.

The frequency of these price changes will depend on what events are affecting the live gold price. For instance, breaking news usually has an immediate impact on the market, but other factors can include order flow, supply and demand, mine closures, investor decisions and many others.

Also Check: 400 Oz Gold Bar Weight

Cash For Gold Calculator

| $1,787.27 |

This is the original Cash for Gold Calculator.

This software was developed by the National Gold Market Corporation to educate the public, providing the most accurate market price for Gold, Silver and Platinum at 100% of the current New York Spot Price and the Asia Stock Market. The Live Price chart gives you a breakdown per gram, DWT and Troy Ounce. What is the right amount to receive for your gold? If you’re selling Gold Jewelry, a reasonable settlement would be 70% to 80% of the market value. If you’re selling Gold Coins a reasonable settlement would be 90% of the market value. If you are near The Los Angeles area, National Gold Market is located in Pasadena, California. They pay 75% to 80% for Gold Jewelry and 90% for Gold Coins. You can walk in and get your items tested for free to determine the Karat metal purity and the gram weight. The company will give you a quote based off the current Live Prices on the LA Cash for Gold website. Payments are made in CASH.VISIT THE LOCAL SITE BY CLICKING HERE: You can also send your gold using our Prepaid, insured FEDEX Package by following the simple instructions on National Gold Market.com website.VISIT THE NATIONAL SITE BY CLICKING HERE: National Gold Market

What to avoid when selling Gold?

How to sell your Gold Properly:

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Don’t Miss: How Much Is One Brick Of Gold

Investing In Gold With 1 Oz Bars

The 1 oz gold bars that are offered here by the United States Gold Bureau come within an air-tight assay card that guarantees the quality and purity. Buying gold 1 Troy oz bars , are a perfect starting point or addition to a precious metals portfolio since they are easy to store and liquidate as-needed. Our 1 oz gold bars come from a variety of highly recognized and widely traded manufacturers including Credit Suisse, International Trade Bullion, PAMP Suisse, and Royal Canadian Mint to ensure the highest quality gold content and purity. Each gold bar comes in a durable assay card for long-term storage and safe-keeping. Many bars are stamped with the exact weight, fineness, and an individual serial number. The 1 oz bars are about the same size as a military dog tag which makes them an ideal size for storing in quantity.

The 1 Troy oz gold bar is the most common size of gold bars and they are traded around the world, even in countries using the metric system. A Troy ounce contains 31.1 grams and is the unit of measure used for precious metals, as opposed to the avoirdupois ounce more commonly used in grocery stores that contain only 28.35 grams.

Gold bars often have a lower price premium over market spot price than gold bullion coins and are valued based on the spot price derived from the gold-trading markets around the world. Precious metals like gold are often used to diversify investment portfolios and hedge against inflation and economic downturn.

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

Also Check: How To Get Free Golden Eagles In War Thunder

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

What Is The Price Of A 1 Oz Gold Bar Price

The price of a 1 oz gold bar is shown in the upper right section of this page. The price of a 1 oz gold bar is calculated using three components including the gold price or gold spot price:

In order to determine the gold price of a gold bar , simply multiply the spot price of gold by the number of gold troy oz in the gold bar and add or subtract the current premium for that gold bar.

Read Also: How Much Is 18 Karat Gold Per Ounce

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Oz American Eagle Gold Coin Value

The $50 face value of the 1-ounce coin is marked on the reverse side, but that should not be confused with the coins value or price. The actual value of the coin is based upon its gold content and will fluctuate with the market price of gold in the commodities markets.

Though the one-ounce American Gold Eagle have a face value and are legal tender, their purpose is different. 1 ounce gold coins are not intended to be spent with a merchant, at least not unless the merchant is willing to recognize the coins actual value. Instead, they are an investment and a hedge against the perpetual devaluation of the US dollar.

American Eagle gold coins are very popular and the US Mints guarantee of weight adds some value. For this reason, these coins often carry a slight premium perhaps 1 – 2% – versus comparable gold coins from elsewhere in the world.

Also Check: How Many Grams Is 1 10 Oz Of Gold

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

I’ve Heard That Gold Traded 24/7 Is That True Is There An Open And A Close

Gold, actually trades 23 hours a day Sunday through Friday. Most OTC markets overlap each other there is a one-hour period between 5 p.m. and 6 p.m. eastern time where no market is actively trading. However, despite this one hour close, because spot is traded on OTC markets, there are no official opening or closing prices.

For larger transactions, most precious metals traders will use a benchmark price that is taken at specific periods during the trading day.

Recommended Reading: How Many Grams In 1/10 Ounce Of Gold

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

You May Like: How Much Is 18 Karat Gold Per Ounce

What’s The Price Of Gold

You may also manipulate the graph by choosing a specific range of time located at the top of the graph. You can switch to silver prices by clicking the button at the top left.

This chart updates every 10 seconds . You may always refer to this page to find the current price of gold at any given time.

What Is Paper Gold

âPaper goldâ is the nickname for investment products that track the price of gold. This primarily means gold ETFs and futures.

The distinction between physical gold and paper gold is the latter is only âon paper.â By contrast, physical gold is a tangible asset.

Physical precious metals change hands in over-the-counter markets. The best example is the London Bullion Market, the UK gold hub.

Don’t Miss: How To Melt Gold Jewelry At Home

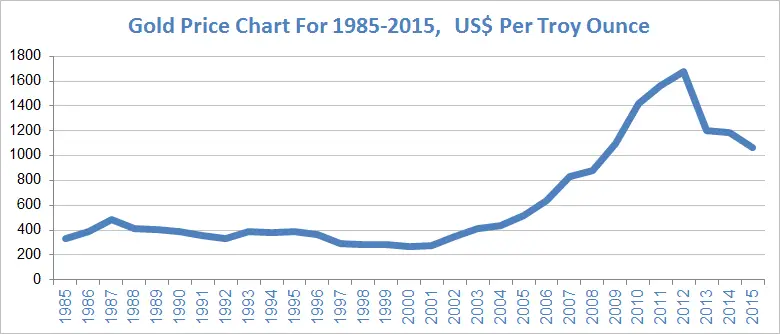

How Does The Current Gold Price Compare To Historical Gold Prices

The price of gold has increased approximately 4,750% since 1935 when President Franklin D. Roosevelt raised the value of gold to $35 per ounce. This is compared to todays gold prices that are hovering around $1,700.If you compare the goldprice today with the prices at the beginning of this millennium , the price of gold has increased approximately 496%. This is 3x the increase of the Dow Index during this period.

How To Buy Silver

First, decide what kind of Silver youre interested in buying. There are several types of Silver, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Silver bullion, choose between Silver coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Silver. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Silver in their own vaults or lockboxes at home, as well.

You May Like: What To Mix With Bacardi Gold