Gold Holds Tight Range As Higher Yields Counter Omicron Fears

22 Dec, 2021, 07.45 AM

Gold traded within a tight range on Wednesday as higher U.S. Treasury yields and improved risk appetite countered concerns about the rapidly spreading Omicron coronavirus variant. Spot gold was little changed at $1,789.12 per ounce by 0126 GMT. U.S. gold futures also remained unchanged, at $1,789.50.

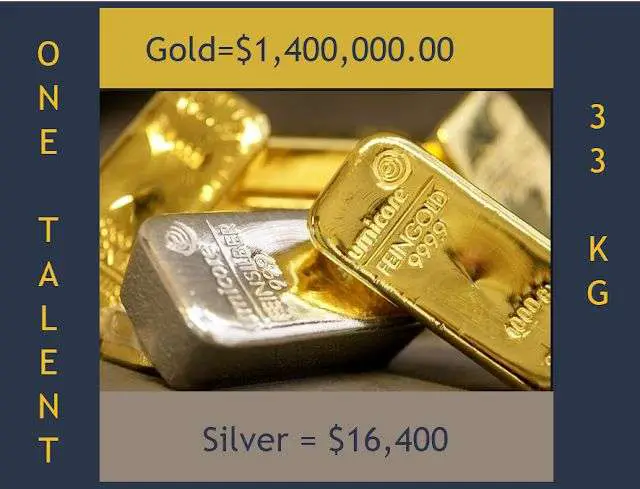

What Is The Gold To Silver Price Ratio

The gold to silver ratio involves simple mathematical principles. It shows you how many kilograms or ounces of silver it would take to buy a single ounce of gold. If this ratio is at 50 to 1, it means that 50 ounces of silver would be required to obtain one ounce of gold.

This ratio is used by investors to decide if one of the metals is overvalued or undervalued and if it is a good time to sell or buy a particular metal.

A higher ratio means that silver is more favored. On the other hand, a lower ratio shows the exact opposite and usually means that now would be the best time to buy gold.

What Is The Difference Between An Ounce And A Troy Ounce When Looking At A Gold Chart

A troy ounce is used specifically in the weighing and pricing of precious metals and its use dates back to the Roman Empire when currencies were valued in weight. The process was carried over to the British Empire where one pound sterling was worth one troy pound of silver. The U.S. Mint adopted the troy ounce system in 1828.

A troy ounce is about slightly heavier than an imperial ounce by about 10%. An imperial ounce equals 28.35 grams, while a troy ounce is equal to 31.1 grams.

Recommended Reading: Does Kay Jewelers Sell Real Gold

What Is Gold Price Per Gram

The gram is the entry level weight of a gold or silver bar. It is the smallest bar you can buy. Coins can also be bought in grams and are referred to as fractional because most coins are 1 troy ounce. The troy ounce is the standard unit of measurement for precious metals and one troy ounce is 31.1034807 grams. The standard ounce is 28.35 grams, a little bit less than the troy ounce. Even this slight difference demonstrates where grams can matter or might be worth noting. Buying in grams allows for versatility.

What Are Spdr Gold Shares

SPDR Gold Shares, short for GLD, is the largest gold-backed exchange-traded fund in the world. It is marketed and managed by the State Street Global Advisors. The market cap for GLD is $32.44 billion as of March 2019. The exchange-traded fund was first launched in November 2004. It originally appeared on the New York Stock Exchange under the name streetTRACKS Gold Shares.

This name was changed to SPDR Gold Shares later in May 2008. It trades on the NYSE Arca. GLD also trades on the Singapore Stock Exchange, Hong Kong Stock Exchange and the Tokyo Stock Exchange.

Read Also: Wow Classic Buy Gold Safe

Why Is There A Difference Between The Prices Of Gold And Silver

The primary reason behind the large discrepancy in the value of gold and silver is due to their rarities. The usual market principles such as supply and demand play a pivotal role in determining the value of gold. Since gold is low in supply, it is also much harder to obtain than other metals.

Silver is much larger in supply and is easier to mine. In fact, silver is often obtained as a by-product of other metals during mining. Silver can be obtained at a rate of 0.07 parts per million. In contrast, the average occurrence rate of gold is 0.004 parts per million.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

Don’t Miss: How Much Is 14k Italian Gold Worth

What Is Gold Bullion Used For

Gold bullion can be used as a hedge against inflation and for portfolio diversification.

When gold prices are high, investors buy more gold bullion to increase their wealth. When the market price of gold is low, they sell some of it off so that they arent risking too much with one single purchase or sale.

Some people want to own their investment instead of just owning a certificate that says they own it. They invest in coins and bars rather than paper certificates which represent ownership.

Gold bullion is also a popular medium of exchange in the form of coins. Throughout history, gold coins have been used as currency by various governments and organizations. Gold coin values vary depending on their weight, purity, and rarity. The most valuable gold coins are those that were minted prior to 1933 when the United States abandoned the gold standard.

The Weight Measurements Of Gold

Gold and other metals that are used for alloying are weighed in troy ounces, but while this is the standard, the units of weight referenced can vary.

Its believed by many that this is mainly in order to prevent consumers from making their own accurate calculations. Lets look at the standard measurements.

One troy pound is 12 troy ounces, while one troy ounce is 20 pennyweights. One pennyweight is 24 grains, and 15.43 grains make up one gram. 31.10 grams make up one troy ounce.

If youre intending to sell gold, you should make note of these equations.

Read Also: How Much Is Brick Of Gold

What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

Where To Buy Gold Bullions

Some popular options include online retailers like APMEX and JM Bullion, big banks such as US Gold Bureau or Kitco Bank, and reputable dealers like Apmex.

Investors should research different companies before making a final decision about which one to work with so that their expectations match up with reality. For example, some online retailers charge higher premiums than physical brick-and-mortar stores.

You can also buy gold bullion from a private seller, but this is not recommended because of the risks involved with selling gold to strangers without any sort of formal agreement in place.

Private sales are usually less expensive than other options available though, which makes them appealing for many investors who want to save money on their purchase.

Read Also: 400 Oz Gold Price

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

Read Also: Spectrum Gold Package Price

What Are The Key Distinctions Between Gold And Gold Bullion

Gold is a precious metal that is used in jewelry, electronics, and other industries. Gold bullion, on the other hand, is gold that has been melted down and formed into coins, ingots, or bars.

Gold bullion also has a lower risk of default because it is backed by physical gold reserves. If an investor needs to sell their gold bullion during a financial crisis, they can always find someone who will buy it from them at the current market price.

In contrast, stocks and bonds may not be worth anything if the company or government that issued them goes bankrupt.

Gold bullion is also easier to sell than gold jewelry or other products made with gold. This is because investors can easily find buyers for coins, ingots, and bars in the open market. It can be difficult to find a buyer for gold jewelry or other items that are not in mint condition.

Finally, gold bullion typically has a lower price tag than pure gold jewelry. This is because investors are buying it for its value as an investment, rather than its aesthetic appeal. Gold jewelry often contains small amounts of precious metals like platinum and silver, which raises the price tag.

Make Informed Decisions About Your Future

Gold Rate uses professional grade data sourced directly from gold dealers, exchanges or brokers with direct exchange relationships. All data sources are vetted by our team of economists, data scientists and finance experts so that you have knowledge you need when taking the future into your own hands.

Don’t Miss: Freeze Golds Gym Membership

What’s The Live Gold Price

The Live Gold Price we use to help you estimate the current Karat Value of Gold is provided by one of Australia’s international market partners. They are a market-leading Gold and Metals Commodity pricing exchange service similar to Kitco. The current live gold price is $2,494.30 .

Our Live Gold Price is sourced from our friends at Gold Price Live Australia who provide up to the minute live gold price information.

What Is The Price Of The Gold And Silver Ratio

The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold.

Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold.

Recommended Reading: Why Are Gold Prices Going Down

Why Gold Calculator

Have you got scrap gold you want to sell? This gold calculator is a tool that uses real-time Australian gold prices to calculate the value of your gold. If you know how much your gold weighs and it’s purity , simply enter the values into the calculator above, then click ‘calculate’ to receive an instant estimation of how much your gold is worth.

This website provides you an idea on what price you could get for your gold if you were to sell it. The selling price may vary depending on time, location and other factors.

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

Also Check: How To Earn Golden Eagles In War Thunder

What Are Safe Haven Assets

Gold is a great way of storing wealth and has been used for this purpose since the ancient Egyptians. Despite having a history of being highly volatile, gold has traditionally performed well above expectations during tumultuous periods such as economic weakness, political disruptions, and financial turbulence.

In order to stabilize the economy, central banks create dovish monetary policies and introduce fiscal initiatives to influence the countrys currency and stimulate more demand for gold. It is commonly observed by investors to buy gold when they tend to lose confidence in their currency.

Is There A Gold Benchmark

Because there is no official closing or opening price for gold or silver, market participants rely on benchmark prices, set during different times of the day by different organizations. These benchmarks are also referred to as fixings.

The London Bullion Market Association is the leading organization that is responsible for maintaining benchmarks for all precious metals. The LBMA Gold Price, the LBMA Silver Price, and the LBMA PGM Price are the widely accepted benchmarks in the precious metals space. Kitco.com also provides a variety of benchmark prices for gold and silver.

The benchmark price is determined twice daily in an electronic auction between participating banks with the LBMA, which is administered by ICE Benchmark Administration.

Recommended Reading: What Can You Mix With Bacardi Gold

What Makes Gold A Precious Metal

This is a classification of specific metals that are considered rare and have a higher economic value compared to other metals. There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesnt corrode.

Calculating The Karat Value Of Gold Manually

If the gold you own is scrap gold, theres a good chance you wont know enough about it to determine its value.

You can work out the karat weight of your gold either by taking it to a gold dealer or by performing an acid test. For an acid test, youll need a gold testing kit, or at least the individual parts that will make up an acid test.

These supplies can be bought at jewelry stores, and tend to be fairly cheap.

Most kits will contain bottles of testing acid for 10 karats, 14 karats, 18 karats, and 22 karats. The acid inside said bottles tends to be nitric acid. Also included in a test kit will be a touchstone, or streak stone.

To carry out an acid test, first, rub your piece of metal on the stone, then place a drop of acid right where you rubbed it.

Start with the lowest karat acid, and keep applying the karat acids in ascending order.

When the stone turns brown for, say, 22 karats, but is not affected by the 18 karat acid, then you can assume your piece of gold is 18 karat. The acid that turns the stone brown is one karat above the weight of your gold.

Another method to calculate the karat value of your gold is the Skey test.

For this method, youll need to buy a gold tester or gold verification pen that uses the Skey test. You can usually find this equipment for less than 50 dollars, and youll be able to perform around one thousand tests.

You May Like: Gold Versus Silver Tequila

Calculation : Value Of Gold Metal

This calculation determines the value of gold metal based on the weight, purity, and bid price for gold metal.

| Weight of gold |

|---|

| Gold price per troy ounce |

| Step 1: Convert the weight of the gold alloy into troy ounces |

|---|

| Weight of gold alloy = Weight of gold alloy × Conversion factor= 0 × 31.1034768 |

| Step 2: Convert the weight of the gold alloy into the weight of gold metal |

| Weight of gold metal = Weight of gold alloy × Gold purity ÷ 100= 0 × 99.9 ÷ 100 |

| Step 3: Calculate the value of gold metal |

| Value of gold metal = Weight of gold metal × Price of gold metal= 0 × 0 |

| 1 avoirdupois ounce = 28.349523125 g | 1 baht = 15.244 g | 1 carat = 0.2 g |

| 1 grain = 0.06479891 g | 1 kilogram = 1000 g | 1 masha = 0.97 g |

| 1 pound = 453.59237 g | ||

| 1 ratti = 0.1215 g |

| How many gram in a troy ounce |

What Are Benchmark Prices For Gold

There are no official opening and closing rates for silver or gold. As a result, traders are forced to peg their investment decisions on benchmark prices which are decided by different organizations during different times of the day. The technical lingo for benchmarks is also known as fixings.

The leading organization that maintains benchmarks for different precious metals is the London Bullion Market Association . It governs prices for gold and silver, both of which are well-respected benchmarks used by dealers in the precious metals marketplace.

The most typical way to determine benchmark prices is through electronic auctions between participating financial hubs such as banks.

Recommended Reading: War Thunder Silver Lions Hack