What To Look For In A Gold Dealer

There are several important factors to consider when choosing a gold dealer.

Good ReputationPositive customer reviews are a good indicator that the dealer you’re looking at is a reputable one. And the more reviews, the better.

Physical OfficesIdeally, any gold dealer you choose has physical offices or walk-in stores. If a dealer only lists a P.O. Box rather than an address, it’s probably a red flag.

Transparent PricingGold dealers should have transparent pricing, preferably without commissions or extra fees, which you’ll want to check for before you make any purchases.

And because the price of gold fluctuates rapidly, you’ll want to be sure they maintain up-to-date prices.

Good Payment OptionsIt’s vital to find a gold dealer whose payment options match your preferences. In general, you’ll be able to pay via credit card, PayPal, wire transfer, money order, or check.

Some dealers even take cryptocurrency these days. Some methods, like credit cards, may incur a fee that you’ll want to consider.

Clear Returns and Buyback PoliciesDealers typically accept returns within three days of purchase, but look out for restocking fees. Since most worthwhile dealers will also buy gold back from you, keep an eye out for their listed buyback prices.

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

Is A Gold Etf The Same Thing As Buying Physical Gold Bullion

No, theyre not the same at all. There are actually crucial differences between bullion and ETFs.

Yes, you can invest in gold ETFs if you prefer to perhaps trade in the short term. However, it is important to understand that gold ETF exposure will not provide you with actual gold bullion that you can own and hold outside the financial system. Gold ETFs also always continuously charging fees which can eat into your investment capital over the years. You can find some of those fees, when you learn about the best ways to buy physical gold bullion.

While most gold ETFs are supposedly backed by gold, you will likely not pay the bullion price nor receive any gold bullion at all for your investment. They are priced very differently, and they trade on the market in a completely different manner than physical gold, as well. Theyre also affected by other forces, so they may not make a good investment choice for your specific situation. If youre considering an ETF rather than physical bullion, think long and hard about it. Most investors prefer owning the actual physical precious metal itself. Gold ETFs often obstruct investors from many of the best safe haven aspects which actual gold bullion offers.

You May Like: Where’s My Golden State Stimulus

The London Otc Gold Market

The London Gold Market is a wholesale gold market in which participants trade bilaterally, either by phone, via broker, or over electronic platforms. The London Gold Market is not an exchange-based market and so is referred to as an Over-the-Counter gold market. The majority of gold trading in the London OTC gold market is spot gold trading in large quantities, generally between quantities of 5,000 to 10,000 troy ounces of gold.

However, the unit of settlement in the London OTC gold market is not physical gold but unallocated gold. Unallocated gold is a form of synthetic gold which is fractionally-backed by bullion banks and where trades are predominantly cash-settled. Huge volumes of unallocated gold trades are executed on the London gold market each day that are many multiples of the amount of physical gold underlying these bilateral contracts. See BullionStar’s Infographic of the London Gold Market for more details.

Where Does Jm Bullion Store Their Gold

JM Bullion has partnered with Transcontinental Depository Services Vaults to ensure the safe storage of your precious metals if you should choose not to store it yourself.

TDS has locations in Las Vegas, Toronto, Zurich, and Singapore.

Simply open an account with TDS, select from one of their four available storage locations, and when you purchase precious metals from JM Bullion, you can have it stored safely in one of their vaults.

TDS has double insurance for your peace of mind. Metals stored with them are insured by the vault and as well as through a commercial “all risk” insurance policy.

How would you keep your precious metals safe?

Read Also: Is Gold Going Up In Value

How Is The Spot Price Of Gold Determined

Gold is traded worldwide across many different exchanges the most popular being Chicago, Hong Kong, London, New York and Zurich. The COMEX, part of the CME Group in Chicago, is the most important exchange for determining the price of Gold. The Gold spot price is computed using data from the futures contracts traded on the COMEX.

What Is The Difference Between An Ounce Of Gold And A Troy Ounce

A single standard ounce equates to approximately 28.349 grams. This is used as a measure for almost all common commodities. However, gold is not a common commodity! Therefore, we measure the price of gold and other precious metals in troy ounces. One single troy ounce weighs about 31.103 grams.

Approximately 31.1035 grams of 24 karat pure gold makes up one troy ounce. A kilogram consists of 32.15 troy ounces. France created this system of measuring precious metals during the Middle Ages, and the United States adopted this method of measurement for standard coinage in 1828.

Read Also: Does Amazon Sell Real Gold

How To Open An Account

To open an account, youll need to work with New Direction first.

Heres what that process looks like:

From there, New Direction will purchase the metals, and JM Bullion will ship them to the depository. Theyll be kept there safely until youre ready to withdraw funds from your account.

What Is The Gold Spot Price

The gold spot price is tightly aligned with investment demand for the yellow metal. Heres an overview of how its determined.

The gold spot price is used globally for trades in the precious metal. Constantly in a state of flux, the live gold price is driven by demand for safe haven assets and gold futures market speculation.

For much of human history, gold has been looked to as a symbol of wealth. Gold emerged as a desirable commodity as far back as 3,600 BCE in Egypt. In 2,600 BCE, Mesopotamian artisans began crafting gold jewelry to adorn royal elites. By 700 BCE, humans were using gold coins in the first monetary transactions.

In modern times, gold is not only recognized as a show of affluence or a safe haven for storing value, but has also become a popular investment vehicle for generating wealth.

Today, gold can be traded in physical forms such as gold bullion coins and bars, as well as via paper trades such as gold futures, gold exchange-traded funds and gold stocks.

Physical gold transactions are tied to the spot price for gold, while gold paper trades play a role in determining that price. Read on for more information on the gold spot price and why it’s important.

You May Like: What Is More Expensive Gold Or Platinum

Form Of Bullion For Sale

As a general rule, the larger the piece of bullion is, the less the premium costs are per oz.

It costs a mint far less to make one 100 oz silver bar, vs. 100 rounds of 1 oz each.

There is also typically a significant difference in premiums between government and private mints.

For example the most popular bullion coins in the world are American Silver and Gold Eagle coins. The U.S. Mint charges a minimum of $2 oz over spot for each Silver Eagle coin and +3% over spot for each Gold Eagle coin they strike and sell to the worlds bullion dealer network.

A private company like Sunshine Minting will sell their silver rounds and bars in bulk for less than ½ the premium most government mints will sell their products for.

Gold Price Factors Faq

The price of gold seems to move around quite a bit. What are some things that cause changes in the gold price?

Gold is a commodity that can have very rapid price changes during periods of high volatility and can also have very little price movement during quiet periods of low volatility. There are many different things that can potentially affect the price of gold. These issues include but are not limited to: supply and demand, currency fluctuations, inflation risks, geopolitical risks, and asset allocations.

Gold is viewed by some as a safe-haven asset for it is one of the only assets with virtually no counter-party risks . This is why golds value may potentially rise during times of economic instability or geopolitical uncertainty.

Isnt the price of gold too volatile for most investors?

Gold can, just like any other commodity, become volatile with rapid price changes and swings. The gold market can also, however, go through extended periods of quiet trading and price activity. Today many financial experts see gold as being in a long-term uptrend and that may potentially be one reason why investors are buying gold.

Why does gold trade essentially 24 hours per day?How often do gold prices change?

Recommended Reading: Is Platinum Worth More Than Gold

Futures Price For Gold

The Futures Price of Gold is a price at which delivery of gold could take place on a future delivery date based on a gold futures contract agreement between transacting parties. A gold futures contract is said to be in contango when the futures price is higher than the spot price. Conversely, a gold futures contract is in backwardation when the gold futures prices is below the spot price.

What Is The Ounce Of Gold Price

The gold spot price is typically reflecting a troy ounce of gold.

The spot price is the value of one troy ounce of gold on the over the counter market. However, understand that gold is not always sold by the ounce, although that is one of the most common methods. Gold can also be sold by the gram and by the kilo . So, by knowing the gold price per ounce, you know the baseline of what youll typically pay for one troy ounce of .999 fine gold from a bullion dealer .

You May Like: Where Can I Sell Gold Nuggets

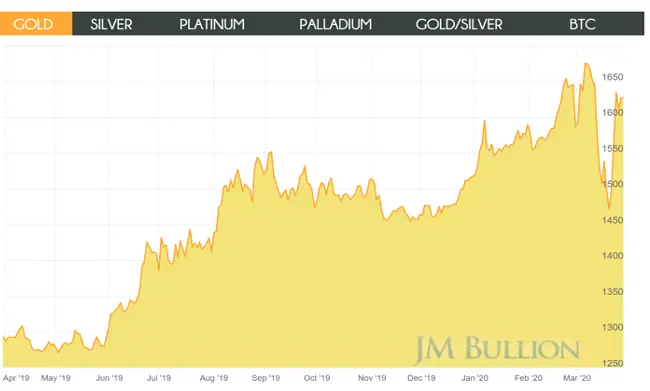

Gold Silver Platinum And Bitcoin Live Prices

Welcome to our precious metals charts page. Below you will have access to live gold, silver, platinum, and Bitcoin prices, as well as historical price charts. By clicking either the gold, silver, or platinum link below, you will see interactive charts that let you plug in custom date ranges and specifications for each metal. You will also have access to current spot prices on these pages. Be sure to check them out below, or read on as we explain more about how investors use these charts, and different strategies you can use while following gold price and silver price movements.

Gold Spreads On Gold Bullion Bars And Gold Bullion Coins

The Bid price for a gold bullion bar or gold bullion coin, also known as the buy price, is a price quote for an immediate purchase of that gold bar or gold coin. The Ask price for a gold bullion bar or gold bullion coin, also known as the offer price or sell price, is a price quote for an immediate sale of that gold bar or gold coin. The spread between ask and bid is usually expressed as a percentage. The more liquid the market for a particular gold bullion product, the lower the spread.

In the wholesale gold market, Bid – Ask prices will be influenced by quotes from market makers as well as from market orders and limit orders entered by transacting participants.

You May Like: How To Unlock Gold Saucer Ffxiv

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

Is The Gold Rate In The Us Different From The Gold Rate In Other Countries

Yes, the price of gold, specifically the spot gold price, will be different from one market to another, but only marginally so. Youll actually pay the same regardless of your market. While there is a 24-hour gold market, its closer to Forex than the stock market in terms of performance. However, with that being said, there is usually a very close correlation between the gold rate for one market and the gold rate for another.

This all said, since the year 2000 gold has performed better vs some fiat currencies like the Argentine peso vs other stronger less rapidly debasing fiat currencies like Swiss francs or New Zealand dollars for instance. See various annual price performances of Gold vs Fiat Currencies below.

GOLD vs FIAT CURRENCY KEY

Also Check: Where Is The Nearest Golden Corral

Factors Affecting The Gold Price

The gold price is influenced by a number of external factors. Over the long term, one of the key drivers of the gold price is the rate of inflation and inflation expectations. Over the shorter term, some of the demand drivers for gold include the level of real interest rates, the relative strength of the US dollar, financial market and political risk, growth or contraction in income levels, the influence of central bank gold sales and gold lending transactions. Inflation and inflation expectations will also affect the gold price over the short term.

Gold supply will have an influence on the gold price. but its important to appreciate that the potential supply includes the above ground stock of gold and not just the annual supply of gold . About 190,000 tonnes of gold are known to have been mined throughout history, and most of this above-ground stock can still be accounted for. For example, approximately 90,000 tonnes of gold is held in the form of jewelry, 33,000 tonnes of gold are claimed to be held by central banks, 40,000 tonnes are under the control of private gold holders, and the rest has gone into fabrication and industrial uses.

Annual gold supply comprises new gold mine supply, but also recycling of scrap gold, central bank net sales of gold, and at times the conversion of large wholesale gold bars into smaller gold bars such as kilo gold bars. Gold therefore has a very high stock-to-flow ratio, which is a factor to watch in terms of its impact on the gold price.

Know The Difference Between Bars And Coins

Though all forms of pure gold have significant monetary value, not all investment-quality gold is equal. From an investment perspective, investors who want to add the physical product that tracks the price of gold may wish to avoid gold coins. These coins often feature attractive designs, have historic value, and contain a lower quantity of gold but still cost more due to their numismatic value.

In addition to costing more, gold coins sometimes skew the value of an investors portfolio. For example, the highly regarded American Eagle coin produced by the U.S. Mint contains 91.67% gold but costs more than plain gold bars because of its value as a collectors piece. Some investors may want collector’s items, while others may want plain gold bars, which typically are the easiest to hold long term and convert to cash. For this reason, plain gold bars tend to be a popular choice among investors seeking gold as a safe haven investment.

You May Like: How To Clean Gold Vermeil

What Is The Price Of Gold Today

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by the weight of the pure metal content. Todays spot price of Gold, like all days, is constantly changing according to many variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day. APMEX lists live Gold prices as well as historical data related to Gold spot price. All prices are updated in real-time. View the bid, ask and spot price at any time, on any device on our website or by utilizing our mobile app.