Stimulus And Grant Payments: How We Are Changing Our Overdraft Process

We made the decision to amend our overdraft processes to provide you access to stimulus payments in their entirety for clients who deposit their Golden State Stimulus and/or Golden State Grant payment into a Union Bank deposit account via a check or direct deposit.

If at the time your stimulus/grant payment is deposited your account has a negative balance, we may apply a Temporary Credit to cover the negative balances in your account so that you may have full access to your stimulus payment. Clients who cash their check are not eligible to receive a Temporary Credit. The Temporary Credit will remain in your account for 90 days, after which it will be reversed, and the amount will become due.

Important information about your temporary credit:

The California Franchise Tax Board Is In The Middle Of Distributing The Direct Payments For Californians But Some Residents May Have Been Missed Out

Millions of California residents became eligible for a Golden State stimulus check earlier this year when Gov. Gavin Newsom signed the California Comeback Plan into law. The $100 billion package ensured that two-thirds of adult residents could get the direct payment, but not everyone has received one yet.

First and foremost, residents had to have submitted their 2020 tax return before 15 October 2021 to be eligible for a payment. Each individuals entitlement is based on information submitted in their latest filing.

REMINDER: The deadline for Californians to submit their 2020 tax returns and qualify for the Golden State Stimulus is tomorrow October 15th! Were putting money directly back into the pockets of those that need it most.

Office of the Governor of California

The initial rounds of payments were primarily comprised of direct deposits straight into the beneficiaries bank accounts because this was the faster payment method. However the California Franchise Tax Board have confirmed that the vast majority of these had been sent out by 15 November, meaning that anyone still waiting will likely get a paper stimulus check.

When will my physical Golden State stimulus check arrive?

Golden State Stimulus Payment: How Much Will You Get

$600 Golden State Stimulus check

According to the FTB, you will get a $600 one-time payment if:

– you receive the CalEITC- you do not receive the CalEITC but are an ITIN filer who earned $75,000 or less in 2020- you filed a joint tax return, you or your spouse is an ITIN filer and you earned $75,000 or less in 2020

$1,200 Golden State Stimulus check

According to the FTB, you will get a $1,200 one-time payment if:

– you receive the CalEITC, are an ITIN filer and earned $75,000 or less in 2020

– you filed a joint tax return, you receive the CalEITC, you or your spouse is an ITIN filer and you earned $75,000 or less in 2020

Through the Golden State Stimulus, we are already sending $1.6 billion to 2.5 million Californians who need it the most – and were just getting started. These $600 payments have put money back in the pockets of Californias families – helping them make ends meet.

Office of the Governor of California May 6, 2021

Read Also: How Heavy Is A Brick Of Gold

How Much Is The California Golden State Stimulus

This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit or file with an Individual Taxpayer Identification Number . The Golden State Stimulus aims to: Support low-income Californians Help those facing a hardship due to COVID-19

Recommended Reading: How Do You Apply For Stimulus Check

Why Have I Not Gotten My 2nd Stimulus Check

GetYourRefund is expected to be available in 2022. If you do not receive any stimulus checks, go to https://www.gov. To get the third stimulus check and the first two stimulus checks, you should complete your tax return for 2020. In order to get the Recovery Rebate Credit, you must file a tax return.

You May Like: War Thunder Unlock All Planes Hack

Your 2020 Tax Return Hasnt Been Processed Yet

Eligible individuals who submitted their 2020 taxes on time but whose returns have not yet been processed by the state yet should expect a delay in their payment, according to the Franchise Tax Board.

Taxpayers who filed after Sept. 1 and typically get their refund via direct deposit likely wont get the payment until up to 45 days after their return has been processed.

For those anticipating a payment by mail, expect a longer delay up to two months if the return hasnt been processed prior to their ZIP codes scheduled payment date.

On top of that, Some payments may need extra time to process for accuracy and completeness, the state notes.

Surprise Stimulus Checks Are Being Sent Out

Payments are due to be sent out across the state until the end of the year as the FTB will start processing outstanding tax returns.

Californians who earn less than $75,000 are eligible to claim a stimulus check but there are some conditions attached.

Read our stimulus checks live blog for the latest updates on Covid-19 reliefâ¦

âStill no California stimulus, I must make more money than I thought???â tweeted user ryanramoneda.

Taxpayers must also have a valid Social Security number to claim the cash and they must not have received the first payment, according to National Interest.

Americans who did not receive the first Golden State stimulus check and claimed a credit for at least one dependent are eligible for the $1,100 check.

Gov Gavin Newsom said the extra money should help residents of the state who suffered financial difficulties during the Covid-19 pandemic to get back on their feet, including low-income parents and self-employed workers.

Read Also: Safely Buy Wow Gold

How Do I Know If My Second Stimulus Was Sent

In order to trace a payment, you can contact the IRS at 800-919-9835 or mail or fax a completed Taxpayer Statement Regarding Refund PDF to them. Generally, the IRS will reply to your payment trace request 6 weeks after it is received, but in some cases, staffing constraints may prevent a response from being sent to your request.

More Than Half The Year

Just because someone lived with you for six months does not mean that the person lived with you for more than half the year. A year has 365 days, and more than half the year is 183 days.

To determine how many days your home was your qualifying personââ¬â¢s main home, follow these guidelines:

- If you were not married and not an RDP at any time during the year, count all of the days that your qualifying person lived with you in your home.

- If you were at any time during the year and received a final decree of divorce, legal separation, or your registered domestic partnership was legally terminated by the last day of the year, add together:

- Half the number of days that you, your spouse/RDP, and your qualifying person lived together in your home.

- All of the days that you and your qualifying person lived together in your home without your spouse/RDP .

You May Like: 400 Oz.gold Bar

Will I Get $600 Or $1200

Heres how you know whether you get the $600 or the $1,200 one-time payment:

| On your 2020 tax return | Stimulus amount |

|---|---|

| You are not a CalEITC recipient, but you:File with an ITIN andMade $75,000 or less | $600 |

| You file a joint return and:At least one of you files with an ITINMade $75,000 or less | $600 |

| You file a joint return and:You are a CalEITC recipientAt least one of you files with an ITINMade $75,000 or less | $1,200 |

As long as your 2020 taxes are filed and you claim either CalEITC or ITIN, youre good as gold for the Golden State Stimulus.

How Do I Find Out Where My Second Stimulus Is

On the Tax Records page, click on Economic Impact Payment Information), select your first, second and third Economic Impact Payment amounts. Log into your individual IRS account online to view them. EIP letters from the IRS to addresses on file: These were sent in writing to the addresses listed on file with us.

Recommended Reading: How To Buy Wow Gold Safely

When Can You Expect The Golden State Stimulus Checks To Arrive

The Franchise Tax Board has stated that the direct deposits would typically show up in your bank accounts within a few business days. A paper check could take up to three weeks to arrive.

The stimulus checks will not be scheduled until your tax return has been processed. You can review overall wait times for tax returns and refund processing timeframes here.

If you filed your tax return after September 1, expect up to 45 days after the return has been processed, the Franchise Tax Board says.

The paper checks are going out by the last 3 digits of the ZIP code on your 2020 tax return. You need to look at the when youll receive your payment section on the website, on paper check timeframes for more information.

If the last three digits of your ZIP code are 720-927, checks will be mailed from 12/13 through 12/31. If the last three digits of your ZIP code are 928-999, checks will be mailed from 12/27 through 1/11.

The schedule is based on the states ability to validate eligibility and protect against fraud.

How Long Does It Take To Receive Golden State Stimulus

What is the current payment deadline re Stimulus II payments? FTB said direct deposit can usually be accessed in bank accounts within a short amount of time. There could be delays of up to three weeks if you receive a paper check. Tax returns have not yet been processed, so payments wont be scheduled.

Don’t Miss: What Channel Does Gold Rush Come On

Irs Announces Tax Filing Start Date New Tax Day This Yearyour Browser Indicates If Youve Visited This Link

The Internal Revenue Service has announced a start date for this years tax season. The nations tax agency will start accepting and processing 2021 returns on Monday, Jan. 24. You generally do not have to wait to file 2021 returns and can do so when ready but the IRS wont start processing returns until Jan.

Cleveland.com

When And How Will I Receive My Payment

Heres the timeline for when you can expect to receive the $600 Stimulus Check for Californians:

Once your 2020 tax returns are processed and it is determined that you are eligible for the Golden State Stimulus payment, then heres what will happen:

If you filed your tax return between January 1, 2021, and March 1, 2021:

You will receive your stimulus payment beginning after April 15, 2021.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you filed your tax return between March 2, 2021, and April 23, 2021:

You will receive your stimulus payment beginning after May 1.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you file your tax return after April 23, 2021:

- Direct deposits: Allow up to 45 days after your return has been processed

- Paper checks: Allow up to 60 days after your return has been processed

Some payments may need extra time to process for accuracy and completeness.

Recommended Reading: Can You Get Banned For Buying Gold Wow Classic

Why Have I Not Received My Second Stimulus Check

If you are eligible to receive three stimulus checks, including the first one, you will have to file a 2020 tax return, and the second one, such as the third one, will have to be filed in 2021, as well. In addition to the stimulus checks, you can still claim part of your tax refunds if you did not receive any or none of them.

Stimulus Checks Are Coming To California Residents

California lawmakers authorized a total of $12 billion in Golden State Stimulus Payments to be issued in two different programs.

The original Golden State Stimulus payment was intended for low-income residents. But the relief effort was expanded in July and now most residents of the state with incomes under $75,000 will be receiving payments. In fact, around 2 out of every 3 state residents should have already received stimulus funds or will be getting them in the future.

The expanded payments available to higher earners, called the Golden State Stimulus II checks, are valued at up to $600 per eligible adult and $500 per eligible dependent, with a maximum payment of $1,100. At the end of October, the California Franchise Tax Board released 400,000 of these payments via direct deposit. And another 750,000 checks were scheduled to go out as early as Monday Nov. 1.

If you already received a payment under the original Golden State Stimulus, you will not be getting another one from this batch of payments. But, if thatâs not the case and you otherwise meet the qualifications, you should watch your bank account or check the mail carefully for the money to arrive in the coming days.

If you filed your 2020 return already and you meet the requirements, then the money from the Golden State Stimulus should come via whatever method you used to obtain your tax refund. You can check your past return to see if your payment will likely come via mail or direct deposit.

You May Like: Does Kay Jewelers Sell Real Gold

Golden State Stimulus Check: Heres When These Zip Codes Will Receive Their Checks

- The Golden State Stimulus checks will arrive between Nov. 15 and Dec. 31

- The eligibility for the current payments depend on an individuals 2020 tax return

- The Tax Board is expected to send out a total of 9 million checks

Thousands of households in the state of California are set to receive their stimulus checks before the end of the year, with some families getting their payments as early as this week.

The California Franchise Tax Board on Monday sent out at least 750,000 paper checks as part of the Golden State Stimulus II program. The checks will arrive at different times, depending on the last three digits of the recipients zip code, the Tax Board told the SFGATE.

Families with zip codes ending in 376 to 584 will likely see the checks in their mail anytime between Nov. 15 and Dec. 3. Individuals living in areas with zip codes ending in 585 to 719 will receive their checks from Nov. 29 through Dec. 17, while those residing in places with zip codes ending in 720 to 927 are expected to see their payments from Dec. 13 through Dec. 31.

Households may receive their payments through paper checks or direct deposits, depending on what they selected on their tax return. The eligibility for the current payments is based on tax returns.

Most people who live in California are not required to do anything besides file their 2020 tax return to receive the payments. However, the filing of tax returns ended on Oct. 15.

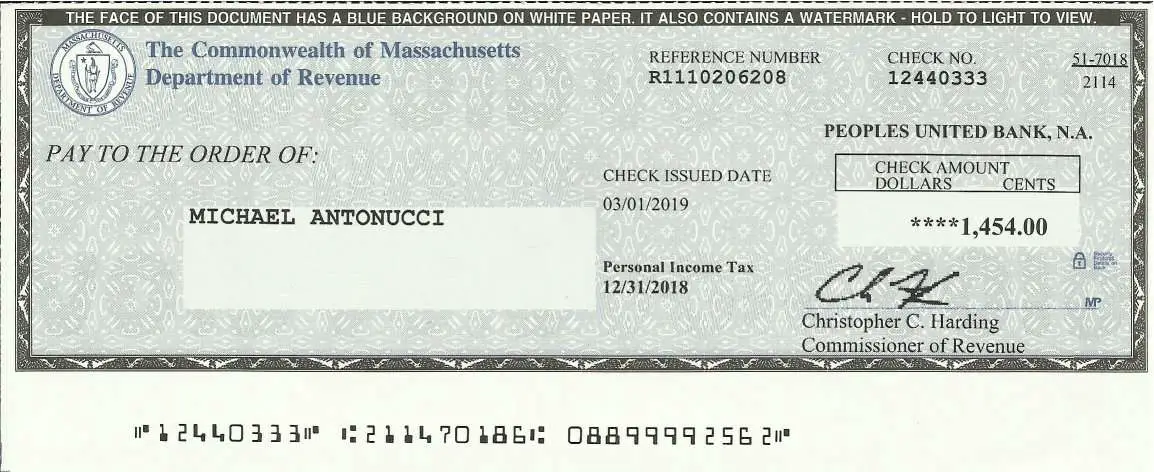

Representation. A COVID-19 stimulus check.Photo: Pixabay

How To Track Your $600 California ‘golden State’ Stimulus Check

In February, Governor Gavin Newsom announced that qualifying Californian’s will receive a $600 Golden State stimulus check. The stimulus package was signed by Newsom on February 23, and a total of 5.7 million Californian’s will be eligible according to the governor’s office. $600 payments have started to go out to Californians on April 15th from The California Franchise Tax Board and will be received in the same way you received your tax return. For eligibility on the Golden State Stimulus click here! If eligible, the speed at which you will receive your payment depends on when you filed your taxes. The state must receive your 2020 taxes before the payment is sent and the deadline to send your taxes for the one-time payment is October 15, 2021. If your taxes were filed between January 1st and March 1st you can expect the Golden State Stimulus after April 15th. If you filed after March 2nd it can take up to 45 days to receive payment depending on the method of delivery.

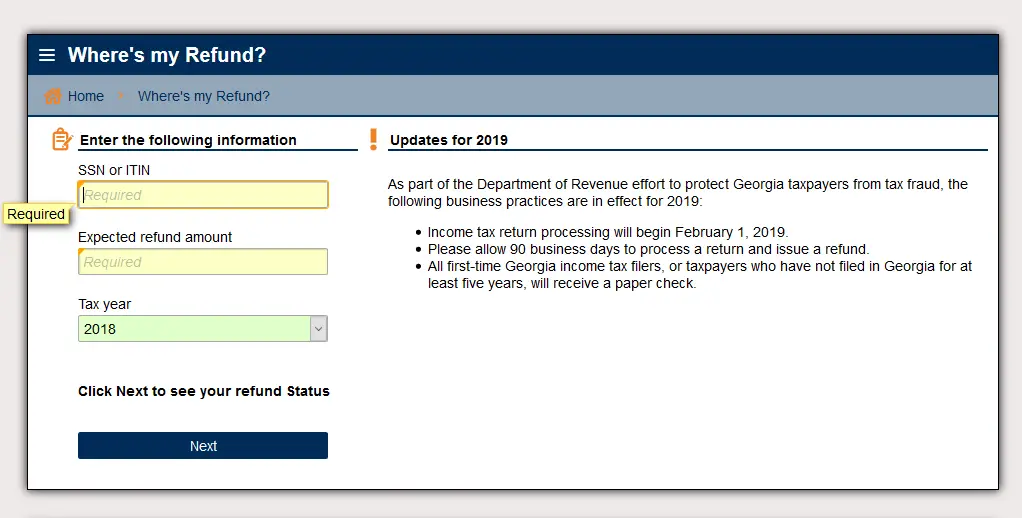

The California Franchise Tax Board has a wait-time availability on their website for the Golden State Stimulus. Eligible residents can contact The California Franchise Tax Board by talking with a representative on their website or by calling 800-852-5711.

Recommended Reading: What Is A 10k Gold Ring Worth

How Much Will I Get From The Golden State Stimulus Ii Checks

Parents who have a Social Security number and who got money from the first round of Golden State Stimulus will get another $500. Undocumented parents who have an ITIN number, which means they were left out of federal stimulus programs, get $1,000.

Adults earning between $30,000 and $75,000 will get $600 if they do not have children and $1,100 if they do.

Again, people without kids who received a check from the first Golden State Stimulus program will not receive another check.

If you are married filing separately, this is where you can find information on how much you can get.

If you are still confused, you can check the Golden State Stimulus II estimator online to help you see how much to expect.