Other Problems With Your Payment

If you received payment and have a problem, follow these steps:

Claim Your Golden State Stimulus

The COVID-19 pandemic created tough financial challenges for working families all across California.The Golden State Stimulus programs provides rapid cash support to millions low and middle income Californians.

There are two different Golden State Stimulus. You may qualify for one or both. Visit the page below for more on Golden State Stimulus I & II.

Do I Qualify for the Golden State Stimulus I?

You may qualify for the Golden State Stimulus I if you are a California resident, not claimed as a dependent, and either of the following apply:

-

Claim the CalEITC on your 2020 California tax return be October 15, 2021 to receive $600 or

-

File your 2020 tax return with an Individual Tax Identification Number and up to $75,000 to receive $1,200.

Do I Qualify for the Golden State Stimulus II?

You may qualify for the Golden State Stimulus II if you are a California resident, not claimed as a dependent, and all of the following apply:

-

File your 2020 California tax return by October 15, 2021 and

-

Have a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year

The Golden State Stimulus II provides $600 to taxpayers that did not qualify for GSS I and an

additional $500 – $1,000 if there is a child dependent and reported up to $75,000 for the 2020 tax year.

California Stimulus Checks: Nearly 800000 More Golden State Payments Going Out

California on Friday began issuing its latest round of Golden State Stimulus II checks of up to $1,100, officials said.

This round includes 784,000 payments with a total valuation of $555 million, according to the California Franchise Tax Board.

The vast majority in this batch 750,000 will be sent by mail, with checks scheduled to go out starting Monday.

According to the Tax Boards website, the new payments are scheduled to be mailed to recipients whose ZIP codes have the last three digits of 376 to 584. The money is also still going out qualifying taxpayers who have ZIP codes with the last three digits of 221 to 375.

Mailed checks will go out to the next group of ZIP codes 585 to 719 starting Nov. 29., the website shows.

The state also plans to directly deposit 34,000 payments into bank accounts beginning Friday.

Also Check: Banned For Buying Gold Wow Classic 2021

Irs Announces Tax Filing Start Date New Tax Day This Yearyour Browser Indicates If You’ve Visited This Link

The Internal Revenue Service has announced a start date for this year’s tax season. The nation’s tax agency will start accepting and processing 2021 returns on Monday, Jan. 24. You generally do not have to wait to file 2021 returns and can do so when ready but the IRS won’t start processing returns until Jan.

Cleveland.com

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income that’s on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Recommended Reading: How Much Is 1 Oz Of 24k Gold Worth

California Stimulus Check Summary

Heres the bottom line:

The state of California will provide the Golden Status Stimulus payment to families and people who qualify.

There is Golden State Stimulus I and Golden State Stimulus II.

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

To receive your payment, file your 2020 tax returns by October 15, 2021.

To Qualify For The Golden State Stimulus:

-

You earned less than $30,000 in 2020.

If you earned less than $30,000 in 2020, you may likely qualify for the Golden State Stimulus. Make sure to claim the CalEITC this tax season to be eligible to receive your GSS payment. Find out if you qualify for the CalEITC here.

-OR-

-

You file taxes with an ITIN and you earned $0 to $75,000 in 2020.

If you file your taxes using an ITIN and you earned $0 to $75,000 in 2020, you may be eligible to receive a $600 payment, even if you dont qualify for the CalEITC. If you file your taxes using an ITIN and you qualify for the CalEITC in 2020, you may be eligible to receive a one-time payment of $1,200. Learn more about claiming the CalEITC as an ITIN holder.

-

If you earned income in 2020, and you qualify for the CalEITC, you must file your 2020 tax returns by October 15, 2021 to ensure you receive your GSS payment.

-

Be a California resident on the date payment is issued.

-

Be 18 years or older as of December 31st, 2020.

-

Not be eligible to be claimed as a dependent on another tax return.

If you qualify for the CalEITC, you likely qualify for the Golden State Stimulus. Estimate your EITC credit here.

Read Also: Free Tinder Plus Code

How To Track Your $600 California ‘golden State’ Stimulus Check

In February, Governor Gavin Newsom announced that qualifying Californian’s will receive a $600 Golden State stimulus check. The stimulus package was signed by Newsom on February 23, and a total of 5.7 million Californian’s will be eligible according to the governor’s office. $600 payments have started to go out to Californians on April 15th from The California Franchise Tax Board and will be received in the same way you received your tax return. For eligibility on the Golden State Stimulus click here! If eligible, the speed at which you will receive your payment depends on when you filed your taxes. The state must receive your 2020 taxes before the payment is sent and the deadline to send your taxes for the one-time payment is October 15, 2021. If your taxes were filed between January 1st and March 1st you can expect the Golden State Stimulus after April 15th. If you filed after March 2nd it can take up to 45 days to receive payment depending on the method of delivery.

The California Franchise Tax Board has a wait-time availability on their website for the Golden State Stimulus. Eligible residents can contact The California Franchise Tax Board by talking with a representative on their website or by calling 800-852-5711.

Golden State Stimulus Check #2

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

GSS I payments were a one-time check of either $600 or $1,200.

As mentioned above, it went out to those who typically earned less than $30,000 and received the California Earned Income Tax Credit, or CalEITC, or those who filed their taxes with an Individual Tax Identification Number, or ITIN.

However, GSS II has been expanded so that more Californians qualify.

Here are the eligibility requirements for GSS II:

Don’t Miss: One Brick Of Gold Worth

Received A Payment In Error

If you received the Golden State Stimulus payment and believe this is an error, please review the eligibility qualifications above to verify this is an erroneous payment. Once verified, follow the instructions that correspond to the payment received:

Direct deposits:

Paper checks that have not been cashed:

ATTN: Golden State Stimulus FundFranchise Tax Board

Did A Stimulus Check Miss You Here Are 7 Reasons You Can Still Be Owed A Paymentyour Browser Indicates If You’ve Visited This Link

Here are eight potential reasons for the long and frustrating delay. The IRS was in a colossal bit of multitasking last spring up to its eyeballs in both tax returns and the millions ofs. Rather than completely overwhelm itself and risk creating an ugly backlog of payments,

Yahoo Finance

Recommended Reading: How Pure Is 24k Gold

Where Are My California Stimulus Checks

Have you been wondering about the same question, where did all the stimulus checks go?We have an answer for you here.

The Golden State Stimulus II checks are going out to the residents of California, which is valued at around half a billion dollars. Some of the families are also receiving a holiday bonus as a part of the newest stimulus checks.

Around 9,000 payments are being made which are worth $6.1 billion and were issued on December 10. This was stated exclusively by the California Franchise Tax Board.

As part of the latest round, about 794,000 checks worth another $568 million were being mailed from December 13 through December 31.

This last year has been about helping our most vulnerable Californians, Controller Betty Yee said.

This last batch of stimulus payments will benefit people in the Sacramento area because the checks are sent out by ZIP code, she added. What this has meant is my team working around-the-clock days, evenings, weekends to be sure that this work doesnt stop.

The California state has either announced or issued around 8.1 million GSS II stimulus checks worth $5.8 billion in total, as reported by the Franchise Tax Board.

The bulk of the payments have been issued by now and the spokesperson Andrew LePage stated that he expects there will be 8.5 million total payments for the program when all is said and done.

Check If You Qualify For The Golden State Stimulus Ii

To qualify, you must have:

- Filed your 2020 taxes by October 15, 2021

- Had a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year. For this information refer to:

- Line 17 on Form 540

- Line 16 on Form 540 2EZ

- Had wages of $0 to $75,000 for the 2020 tax year

- Been a California resident for more than half of the 2020 tax year

- Been a California resident on the date payment is issued

- Not been claimed as a dependent by another taxpayer

- A dependent is a qualifying child or qualifying relative. Go to FTB Publication 1540 for more information about a qualifying child and qualifying relative

To receive your payment, you must have filed a complete 2020 tax return by .

If you dont qualify for GSS II, you may qualify for GSS I.

You May Like: Kay Jewelers Sale 19.99

Here Is The List Of Zip Codes With Delays

- 000-044: October 6 – October 27

- 045-220: October 18 – November 5

- 221-375: November 1 – November 19

- 376-584: November 15 – December 3

- 585-719: November 29 – December 17

- 720-927: December 13 – December 31

- 928-999: December 27 – January 11, 2022

If your ZIP code ends with the digits 585 and above, your paper check has not yet been mailed.

Those who qualify will receive payment through direct deposit or by mail.

The Tax Board notes that those who receive checks by mail should expect to wait up to three weeks to receive them once they are mailed.

On the other hand, most direct deposit stimulus payments were issued between .

Another $600 California ‘golden State’ Stimulus Check Headed Your Way

In February 2021, Governor Gavin Newsom announced that low-income Californians would receive a $600 ‘Golden State’ Stimulus Check. The first round of Golden State Stimulus Checks have already gone out to California residents, and if you haven’t received yours you are able to track it here! Another round of $600 Golden State Stimulus Checks has been approved by the California state legislature and are expected to be going out soon! To qualify for the first round of the Golden State Stimulus you had to earn LESS than $30,000 in the year of 2020, however this new round the requirements have changed. California residents who made $75,000 or less in 2020 will receive this second round of Golden State Stimulus Checks, to qualify for this check according to ‘The National Interest’:

The CFTB is basing eligibility for the checks on individuals 2019 and 2020 state income tax returns to ensure that all eligible Californians can receive their payment, the agency has recommended that people file tax returns, even if they nominally owe no taxes. The federal income tax deadline for 2020 was in May 2021, but California has extended its deadline to October 15 any returns received by that date will qualify the filer for a stimulus payment if he or she meets the income limit.

Read Also: 1 Oz 24 Karat Gold Price

When And How Will I Receive My Payment

Heres the timeline for when you can expect to receive the $600 Stimulus Check for Californians:

Once your 2020 tax returns are processed and it is determined that you are eligible for the Golden State Stimulus payment, then heres what will happen:

If you filed your tax return between January 1, 2021, and March 1, 2021:

You will receive your stimulus payment beginning after April 15, 2021.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you filed your tax return between March 2, 2021, and April 23, 2021:

You will receive your stimulus payment beginning after May 1.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you file your tax return after April 23, 2021:

- Direct deposits: Allow up to 45 days after your return has been processed

- Paper checks: Allow up to 60 days after your return has been processed

Some payments may need extra time to process for accuracy and completeness.

What To Do If Your Golden State Stimulus Check Hasnt Arrived

The news which has been the latest news in terms of the stimulus checks is that whosoever has not been receiving the Golden state stimulus checks of finding the ways to claim it so for them new updates and details have been framed in the following manner.

There have been millions of California residents according to updates via been becoming eligible for the Golden state stimulus check and that has been earlier this year.

To those residents who have been submitting their tax return which is of 2020 and their 2020 tax return they have been submitting in the year 2021 before the month of October they have been eligible for the payment.

The criteria for people to be eligible for the extra payment is that they need to submit the tax return in the year 2021 before the 15 October.

The most frequent update is that the individuals each entitlement has been on the basis of the information which has been in the latest filling of the submission.

Related Topics :

And the updates now is that the payments initial rounds have been the prime direct depositing and that is just straight into the bank accounts of the people who has been eligible and is going to receive the payment just because this method which has been the newest one has been the faster payment method.

Read Also: Does Kay Jewelers Sell Moissanite

Golden State Stimulus Check: Here’s When These Zip Codes Will Receive Their Checks

- The Golden State Stimulus checks will arrive between Nov. 15 and Dec. 31

- The eligibility for the current payments depend on an individual’s 2020 tax return

- The Tax Board is expected to send out a total of 9 million checks

Thousands of households in the state of California are set to receive their stimulus checks before the end of the year, with some families getting their payments as early as this week.

The California Franchise Tax Board on Monday sent out at least 750,000 paper checks as part of the Golden State Stimulus II program. The checks will arrive at different times, depending on the last three digits of the recipients zip code, the Tax Board told the SFGATE.

Families with zip codes ending in 376 to 584 will likely see the checks in their mail anytime between Nov. 15 and Dec. 3. Individuals living in areas with zip codes ending in 585 to 719 will receive their checks from Nov. 29 through Dec. 17, while those residing in places with zip codes ending in 720 to 927 are expected to see their payments from Dec. 13 through Dec. 31.

Households may receive their payments through paper checks or direct deposits, depending on what they selected on their tax return. The eligibility for the current payments is based on tax returns.

Most people who live in California are not required to do anything besides file their 2020 tax return to receive the payments. However, the filing of tax returns ended on Oct. 15.

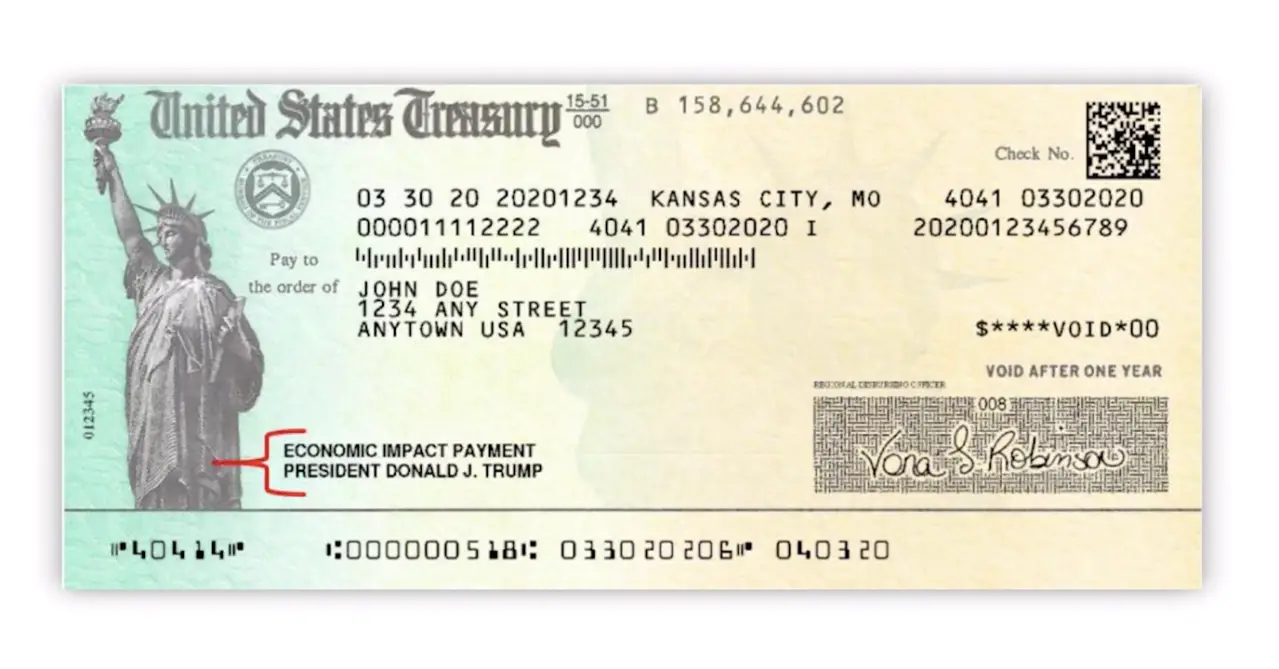

Representation. A COVID-19 stimulus check.Photo: Pixabay